Tesla Stock Pops Despite Annual Sales Drop, Two Models CanceledTesla stock NASDAQ:TSLA managed a modest pop pre-market Thursday, rising about 3%, even as the company delivered a quarter that, on the surface, looked anything but celebratory.

Profits slid. Revenue dipped. Vehicle sales declined. Two iconic models were sent quietly into retirement. And yet, the

The best trades require research, then commitment.

Get started for free$0 forever, no credit card needed

Scott "Kidd" PoteetPolaris Dawn astronaut

Where the world does markets

Join 100 million traders and investors taking the future into their own hands.

EURUSDHello Traders! 👋

What are your thoughts on EURUSD?

EUR/USD has successfully broken above the descending trendline as well as a key resistance zone, confirming a bullish breakout on the daily timeframe.

At current levels, price is approaching a resistance area. Therefore, a short-term correction

Hellena | GOLD (4H): LONG to resistance 5200.Since the movement continues and clearly shows no signs of reversing, I had to slightly revise the wave count, and it looks as if the impulse has been extended.

This means that the higher-order wave “3” has just ended or will end soon.

This means that wave “5” is not over yet and we should expect a

Silver’s Generational Super Cycle: 31 Years of Waiting, 15 YearsWelcome to a special macro edition of the Mubite market analysis.

Today, we are zooming out to the 12-Month (Yearly) timeframe on Silver (XAG/USD).

In trading, patience is not just a virtue; it is a requirement for generational wealth. The chart we are looking at today tells a story of massive cyc

Silver at $110 in Fierce Rally, Gold Tops $5,100. What’s Behind?(What a chart.)

Silver OANDA:XAGUSD is on a tear. Actually, scratch that — silver is on a mission. Prices have surged more than 250% over the past year, including a blistering 50% jump in January alone, lifting the metal to around $109 an ounce and placing the $110 level firmly in sight .

That

XAUUSD Bullish Structure Intact - $5,040 AheadHello traders! Here’s my technical outlook on XAUUSD (2H) based on the current chart structure. Gold continues to trade within a broader bullish context, maintaining a sequence of higher highs and higher lows. Earlier in the move, price spent a significant amount of time consolidating inside multipl

Again C3.AI - 90 % potential profit - TARGET 24 USDOn the daily chart, the stock remains in a long-term downtrend; however, downward momentum has clearly weakened in recent weeks. Price has stabilized around the 12–13 USD area, which previously acted as a demand zone. This price behavior suggests a possible accumulation phase following a prolonged d

Only God or Nuclear War Can Break This Weekly Gold ResistanceA Resistance That Has Stopped Gold for 20 Years

On the weekly chart, gold has respected the same rising resistance line through every major global crisis:

May 2006 – ~$723

September 2011 – ~$1,900

Now / early 2026 projection – ~$5,000–$5,200

Each time price reached this zone, the world was u

UJ, Yen takes over, Weekly Overview and Upcoming week PlanThe week:

Exiting week for the pair, first signs of weakness in the trend confirmed both by the pattern and level where it happen. A text book evening star at the same level where the found resistance and reversed on the week of 13 January last year, so know we have 3 confirmations: Time, Pattern

BTC Is Not Weak — It’s Just Quiet Before the Next Big WaveIf I look at BTCUSDT right now through the lens of someone who has lived through multiple market cycles, what I see is a market that is calm rather than weak.

Recent news hasn’t delivered a major catalyst, and that is actually a positive sign. There is no new macro pressure, no unexpected bad ne

See all editors' picks ideas

Volume Cluster Profile [VCP] (Zeiierman)█ Overview

Volume Cluster Profile (Zeiierman) is a volume profile tool that builds cluster-enhanced volume-by-price maps for both the current market window and prior swing segments.

Instead of treating the profile as a raw histogram only, VCP detects the dominant volume peaks (clusters) insid

DeeptestDeeptest: Quantitative Backtesting Library for Pine Script

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

█ OVERVIEW

Deeptest is a Pine Script library that provides quantitative analysis tools for strategy backtesting. It calculates over 100 statistical metrics including risk-adjusted return ratios (Sharpe

Arbitrage Detector [LuxAlgo]The Arbitrage Detector unveils hidden spreads in the crypto and forex markets. It compares the same asset on the main crypto exchanges and forex brokers and displays both prices and volumes on a dashboard, as well as the maximum spread detected on a histogram divided by four user-selected percenti

Multi-Distribution Volume Profile (Zeiierman)█ Overview

Multi-Distribution Volume Profile (Zeiierman) is a flexible, structure-first volume profile tool that lets you reshape how volume is distributed across price, from classic uniform profiles to advanced statistical curves like Gaussian, Lognormal, Student-t, and more.

Instead of forcin

Multi-Ticker Anchored CandlesMulti-Ticker Anchored Candles (MTAC) is a simple tool for overlaying up to 3 tickers onto the same chart. This is achieved by interpreting each symbol's OHLC data as percentages, then plotting their candle points relative to the main chart's open. This allows for a simple comparison of tickers to tr

Vdubus Divergence Wave Pattern Generator V1The Vdubus Divergence Wave Theory

10 years in the making & now finally thanks to AI I have attempted to put my Trading strategy & logic into a visual representation of how I analyse and project market using Core price action & MacD. Enjoy :)

A Proprietary Structural & Momentum Confluence System

Per Bak Self-Organized CriticalityTL;DR: This indicator measures market fragility. It measures the system's vulnerability to cascade failures and phase transitions. I've added four independent stress vectors: tail risk, volatility regime, credit stress, and positioning extremes. This allows us to quantify how susceptible markets are

Volatility Risk PremiumTHE INSURANCE PREMIUM OF THE STOCK MARKET

Every day, millions of investors face a fundamental question that has puzzled economists for decades: how much should protection against market crashes cost? The answer lies in a phenomenon called the Volatility Risk Premium, and understanding it may fundam

Volume Gaps & Imbalances (Zeiierman)█ Overview

Volume Gaps & Imbalances (Zeiierman) is an advanced market-structure and order-flow visualizer that maps where the market traded, where it did not, and how buyer-vs-seller pressure accumulated across the entire price range.

The core of the indicator is a price-by-price volume prof

Match Finder [theUltimator5]Match Finder is the dating app of indicators. It takes your current ticker and finds the most compatible match over a recent time period. The match may not be Mr. right, but it is Mr. right now. It doesn't forecast future connection, but it tells you current compatibility for today.

Jokes aside,

See all indicators and strategies

Community trends

TSLA Catalysts Ranking | Q1 2026 Update | by ProjectSyndicateTSLA: Updated Outlook Jan 2026 — Catalyst Memo

Updated Catalyst Scorecard Ranked by Impact

1 🤖 Autonomous and Robotaxi Execution — 9.4

2 🧱 Energy AI and Optimus Optionality — 9.0

3 🏭 EV Demand and Geographic Mix — 7.8

4 🧮 Battery Cost and Margin Levers — 7.6

5 🗃️ Affordable Model and Next Gen P

$XOM breaking ATHFor the past weeks, I been persistent in tracking NYSE:XOM forecast from different bank corporation and other firms. I have noticed it has been breaking the resistance level for the past weeks. Even if you look into the past month, the stock has increased approximately $18-$20. The way I view this

BA – Daily Technical AnalysisBoeing is testing a major long-term descending trendline, acting as a strong supply zone.

Price is reacting right at this resistance, making this a critical decision area.

Technical Structure

• Overall structure: Wide range with descending ceiling

• Price at dynamic resistance

• Moving average

Three Trades to Watch: 30 January 2026The final week of January has delivered the volatility traders were promised. We are witnessing a historic decoupling in precious metals and a rise in META and TSLA following better than expected earnings reports.

Here is the technical and fundamental alpha you need to capture the momentum.

1. Gol

TESLA New brutal Bear Cycle targets $270. 10 months ago (March 21 2025, see chart below) we made what many considered a bold buy call on Tesla (TSLA) amidst the Tariff war, which right on the market bottom. In September, our $450 long-term Target was hit:

The model was based on Tesla's previous Accumulation Phase of 2015 - 2019, which

Jan 28 : BE BuyJust bought Bloom Energy Corp. I see this has a massive Daily break potential that has been consolidating for the better part of January 2026.

Momentum looks decent, CAD interest rate news has also just been released today. There should be enough activity to carry it through today and over the nex

$AMZN - Inverted Head and Shoulders Pattern Perfect Setup!Hello My Exit Liquidities!

The Head and Shoulders pattern is one of the most used and noticed patter in trading

In this case we have a inverted head and shoulders which is just a regular head and shoulders, but upside down

When seeing a regular head and shoulders people usually look to go short t

Meta Platforms Shares Rise Above $700 After Earnings ReleaseMeta Platforms (META) Shares Rise Above $700 After Earnings Release

Yesterday, Meta Platforms published its fourth-quarter 2025 earnings report, which made a strong impression. In after-hours trading, META shares surged by more than 10% at one point, reaching around $740.

Why META Shares Are Ris

See all stocks ideas

Today

GPIGroup 1 Automotive, Inc.

Actual

8.49

USD

Estimate

9.16

USD

Today

SBSISouthside Bancshares, Inc.

Actual

0.70

USD

Estimate

0.79

USD

Today

TMOThermo Fisher Scientific Inc

Actual

6.57

USD

Estimate

6.45

USD

Today

HONHoneywell International Inc.

Actual

2.59

USD

Estimate

2.54

USD

Today

DOWDow Inc.

Actual

−0.34

USD

Estimate

−0.46

USD

Today

XRXXerox Holdings Corporation

Actual

−0.10

USD

Estimate

0.10

USD

Today

VLOValero Energy Corporation

Actual

3.82

USD

Estimate

3.27

USD

Today

PHMPulteGroup, Inc.

Actual

2.56

USD

Estimate

2.81

USD

See more events

Today

E

EIKNEikon Therapeutics Inc.

Exchange

NASDAQ

Offer price

16.00 - 18.00

USD

Today

YSSYORK SPACE SYSTEMS INC

Exchange

NYSE

Offer price

30.00 - 34.00

USD

Today

P

PICSPICPAY HOLDINGS NETHERLANDS N.V.

Exchange

NASDAQ

Offer price

19.000

USD

Today

LIFEETHOS TECHNOLOGIES INC

Exchange

NASDAQ

Offer price

19.000

USD

Today

LCDCLorenzo Developments Inc.

Exchange

NASDAQ

Offer price

4.00 - 6.00

USD

Feb 2

HWEPHW ELECTRO Co. Ltd.

Exchange

NASDAQ

Offer price

—

Feb 3

J

JAGUJaguar Uranium Corp.

Exchange

AMEX

Offer price

4.00 - 6.00

USD

Feb 4

M

MANEVeradermics Inc.

Exchange

NYSE

Offer price

14.00 - 16.00

USD

Feb 5

B

BOBSBob’s Discount Furniture Inc.

Exchange

NYSE

Offer price

17.00 - 19.00

USD

Feb 5

F

FPSForgent Power Solutions Inc.

Exchange

NYSE

Offer price

25.00 - 29.00

USD

See more events

Community trends

Bitcoin - Must see, bear flag target 42k in 2026!Bitcoin is forming a huge bearish flag on the daily/weekly chart! This is an extremely good pattern for all bears around, but for the bulls, it's indeed not that good because the classic profit target of this pattern is 42k (by classical technical analysis of a bear flag pattern). How to measure the

BTCUSD – 30M – Bullish Continuation From SupportBITSTAMP:BTCUSD

After sweeping liquidity from the lower demand zone, BTC shifted momentum bullish and pushed toward the 90,700–91,000 resistance zone. Price is now retracing into prior support, suggesting a potential continuation if buyers defend the level.

Key Scenarios

✅ Bullish Case 🚀 → Hold ab

Bitcoin Descending Channel Signals Further Downside To $86,100Hello traders! Here’s my technical outlook on BTCUSD (4H) based on the current chart structure. BTCUSDT initially traded inside a well-defined range, reflecting a prolonged period of balance between buyers and sellers. This consolidation phase ended with a clean upside breakout, signaling a shift in

BTC Faces Major Resistance Before FOMC – Breakdown or Breakout?As I expected in the previous idea , Bitcoin( BINANCE:BTCUSDT ) has followed the anticipated bullish and bearish trends and has reached all of its targets (full target).

Now, the question is whether Bitcoin can sustain above the $90,000 level. Stay tuned!

At the moment, Bitcoin is moving near the

BITCOIN isn't diverging from 2022 at all!Bitcoin (BTCUSD) continues to replicate the 2022 Bear Cycle almost in the exact same fashion. This is of course a concept we introduced back in October for the first time and so far it has fulfilled all conditions set in its way.

The most recent is the 1D MA100 (green trend-line) rejection, which i

BTCUSDT: Recovery From Support Within a Uptrend Toward $92,300Hello everyone, here is my breakdown of the current BTCUSDT setup.

Market Analysis

BTCUSDT is trading within a broader bullish market structure, previously supported by a well-defined upward channel. Inside this channel, price consistently printed higher highs and higher lows, confirming strong b

XRP Dips UNDER $2 - Are we Heading BACK TO $1 ??Have you been watching XRP lately?

I was quite surprised that it held above the $2 as long as it did, to be honest.

But now, as the entire market dips, XRP drops... and it is notoriously know to dump and lose all bullish season gains.

Apart from all the controversy, if and I say IF you managed t

ETHUSDT ASAP will hit the first target 3700$As observed on the chart, Ethereum has demonstrated resilience at the key $2,700 daily support level. This constructive price action suggests a potential bullish reversal, with the initial technical target projected toward the $3,700 resistance zone .

A decisive breakout above $3,700—particularly

ETH : Bulls Regaining Control?ETH : Bulls Regaining Control?

Ethereum experienced a strong bullish impulse, followed by a small correction.

This structure looks like a classic bullish reversal pattern, and ETH is likely to resume the bullish trend again.

Price has now broken above the pattern, which is an important bullish s

Bitcoin — Bearish Bigger Picture, But a Short-Term Reversal?When it comes to the overall outlook for BTC, I remain far from optimistic and continue to hold a bearish bias on the medium to longer term.

That said, markets move in waves — and based on last week’s price action, I’m now expecting a short-term upside reversal.

🔎 What Changed on the Chart

Afte

See all crypto ideas

Hellena | GOLD (4H): LONG to resistance 5200.Since the movement continues and clearly shows no signs of reversing, I had to slightly revise the wave count, and it looks as if the impulse has been extended.

This means that the higher-order wave “3” has just ended or will end soon.

This means that wave “5” is not over yet and we should expect a

GOLD - Correction ahead of the Fed meeting. What next?FX:XAUUSD hit a new high of 5311 and entered a correction phase (profit-taking) ahead of the Fed's interest rate meeting...

Fundamental situation

Tensions between the US and NATO over plans for Greenland. Trump's threats to impose 100% tariffs on goods from Canada. Fruitless negotiations bet

GOLD: Detailed View, Is Price Heading Towards $5500?Gold overview!

After the price built up, we're seeing a strong bullish move. Our earlier analysis today didn't quite work out, but this one points to two key areas where the price might turn around. The first zone is probably the better entry, since the market will open with a gap up and fill it b

Gold Compressing Near Resistance Ahead of Potential BreakoutHello traders! Here’s my technical outlook on XAUUSD (3H) based on the current chart structure. Gold has been trading in a strong bullish trend, clearly defined by a rising structure that started after a prolonged consolidation phase. Initially, price moved sideways within a well-marked range, signa

Gold will experience a significant correction.

Gold experienced its largest single-month increase in history this month.

In the long run, gold will certainly rise, but in the near future, there will definitely be a significant downward correction. The recent gold market has been extremely volatile, but we must remain calm when trading. Maintai

Gold Price Intraday Analysis – Key Resistance and Support LevelsThis chart provides an intraday analysis of gold prices, highlighting critical levels for potential price action. Key zones include Trendline Resistance at 5,108.974, a Minor Resistance at 5,077.929, and a Support Zone at 5,040.216, where price could potentially bounce. The Key Support Level at 4,98

XAUUSD: at Key Resistance - Pullback Scenario in Focus To $5,400Hello everyone, here is my breakdown of the current XAUUSD setup.

Market Analysis

XAUUSD is trading within a broader bullish structure that previously developed inside a well-defined upward channel. After a prolonged consolidation phase marked by a clear range, price broke to the upside, confirmi

XAUUSD (Gold) – 30M Trendline Support & Breakout ContinuationPrice is holding above the rising trendline and support zone, forming a bullish continuation structure. A successful hold or breakout above the range opens the path toward higher targets.

Immediate Support: 4960 – 4975

Range High / Resistance: 4985 – 4990

First Target: 5025 – 5045

Extended Targe

Gold - Preparing the final blow off top!💰Gold ( OANDA:XAUUSD ) will rally a final +20%:

🔎Analysis summary:

Just in January alone, Gold is up another +25% so far. Looking at this very bullish parabolic rally, Gold remains super strong and is still not done with the bullrun. Until Gold retests the ultimate resistance trendline, it ca

Lingrid | GOLD Temporary Pullback May Be AheadOANDA:XAUUSD perfectly played out my previous trading idea . Yesterday, the market accelerated sharply into the 5,600 resistance level following a news-driven impulse, stretching price far above the rising trendline and short-term value. The vertical push created a visible gap and spike into the n

See all futures ideas

EURUSD: Corrective Pullback After Strong Bullish ImpulseHello everyone, here is my breakdown of the current EURUSD setup.

Market Analysis

EURUSD has been trading within a well-defined upward channel, which reflects a strong bullish structure over the higher timeframe. Price has consistently respected the channel boundaries, forming higher highs and hi

EURUSD 3M CLS range - I Potential high of the yearWe have seen last six months of consolidation, recently in the COT data we could see 10 years extreme long positions and since then the longs been closed and shorts are growing which suggest that market makers has been preparing for this manipulation. As predicted in this previous idea. Now above

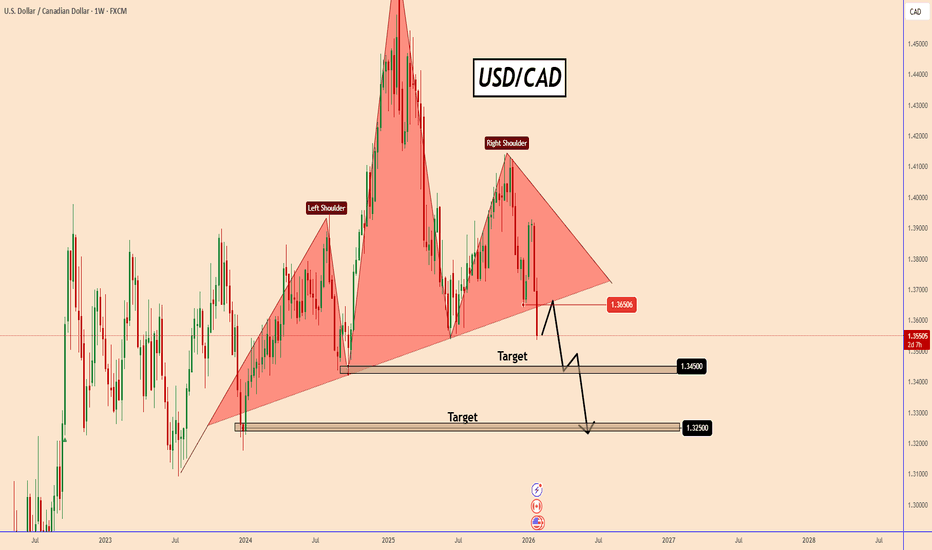

USDCAD Weekly Reversal Confirmed as Key Structure BreaksUSDCAD Weekly Reversal Confirmed as Key Structure Breaks

USDCAD broke out of a weekly Head and Shoulders pattern. Overall it is a very ugly reversal pattern. However, the most interesting area here is the weekly structure that was broken out.

Today we have the FOMC and Bank of Canada Interest rat

CADJPY: Swing Sell at the liquidity void area! Target 105! Dear traders,

I hope you’re doing well. We have a fantastic selling opportunity with the CADJPY pair. The price is approaching the liquidity gap and is likely to fill it. Once filled, we could see a reversal from that point. Our target is set at 105, but feel free to adjust your take profit based

AUD/USD: 90% of Traders Are Short… and Price Keeps RallyingAUD/USD has completed a clean and impulsive breakout above a major daily supply zone, which is now acting as structural support. This move marks a clear regime shift from the previous consolidation phase into a trend continuation environment.

From a price action perspective, the daily chart shows a

EURUSD Reclaims Key Structure - Upside Toward 1.2050Hello traders! Here’s my technical outlook on EURUSD (2H) based on the current chart structure. After an extended consolidation phase, EURUSD initially traded within a clearly defined range, reflecting market indecision and balance between buyers and sellers. This ranging behavior laid the groundwor

AUDNZD is Nearing a Strong Support AreaHey Traders, in today's trading session we are monitoring AUDNZD for a buying opportunity around 1.15900 zone, AUDNZD is trading in an uptrend and currently is in a correction phase in which it is approaching the trend at 1.15900 support and resistance area.

Trade safe, Joe.

USDCAD Price Update – Clean & Clear ExplanationUSDCAD Price is currently trading inside a descending channel, showing an overall short-term bearish structure. The market recently bounced from a lower demand zone (~1.3550–1.3560) and pushed back toward the mid / upper channel resistance around 1.3585–1.3600.

A clean breakout and hold above the d

EURUSD Short: Fake Breakout at Supply, Pullback to 1.1850Hello traders! Here’s a clear technical breakdown of EURUSD (4H) based on the current chart structure. EURUSD initially traded within a well-defined ascending channel, confirming a strong bullish environment with consistent higher highs and higher lows. This phase reflected clear buyer control and h

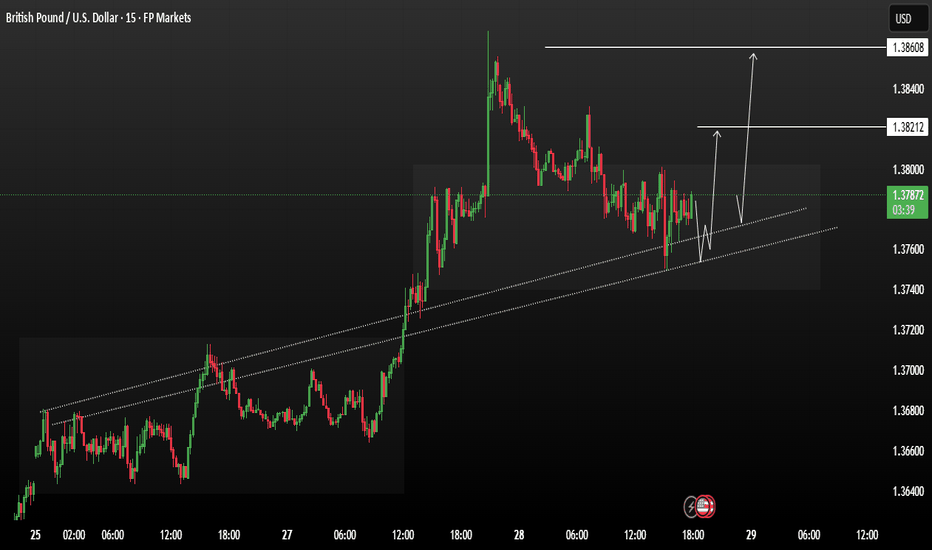

GBPUSD Consolidation Bullish remains validGBPUSD is moving in a clear bullish trend. Price has been respecting an ascending trendline, which indicates strong buying interest from lower levels. After a strong impulsive move upward, the market entered a consolidation phase, forming higher lows while staying above trend support — a healthy sig

See all forex ideas

| - | - | - | - | - | - | - | ||

| - | - | - | - | - | - | - | ||

| - | - | - | - | - | - | - | ||

| - | - | - | - | - | - | - | ||

| - | - | - | - | - | - | - | ||

| - | - | - | - | - | - | - | ||

| - | - | - | - | - | - | - | ||

| - | - | - | - | - | - | - |

Trade directly on Supercharts through our supported, fully-verified, and user-reviewed brokers.