New

We are excited to announce our new Guest Invoicing feature, fully compliant with Spain's Verifactu anti-fraud regulation. This integration is designed to help property managers in Spain automate the generation and submission of electronic invoices, ensuring you meet all legal requirements effortlessly.

How it Works:

Our new feature integrates directly with the Spanish Tax Agency (Agencia Tributaria) to streamline your invoicing process. This eliminates the need for manual data entry and ensures that your invoices are always accurate and traceable.

Key Benefits:

- Automate Compliance: Generate sequential, unalterable invoices that meet all Verifactu requirements, including the necessary digital integrity safeguards.

- Save Time: Automate the entire invoicing process, from creation to submission, reducing manual work and minimizing the risk of errors.

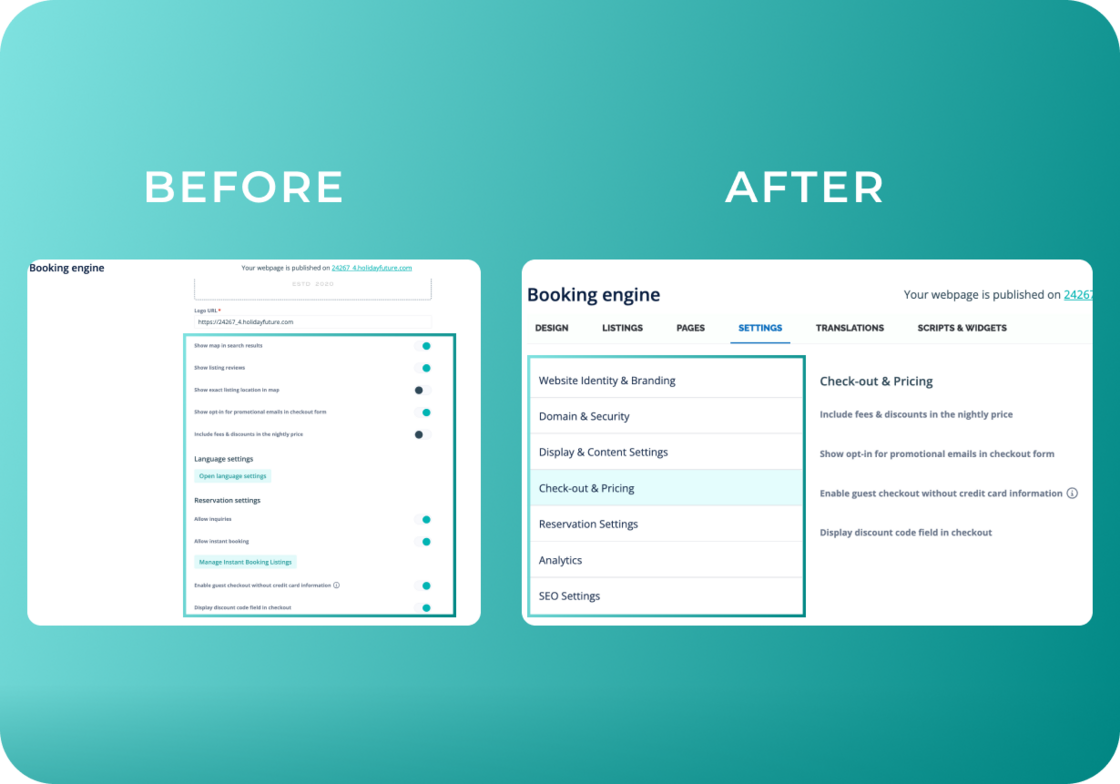

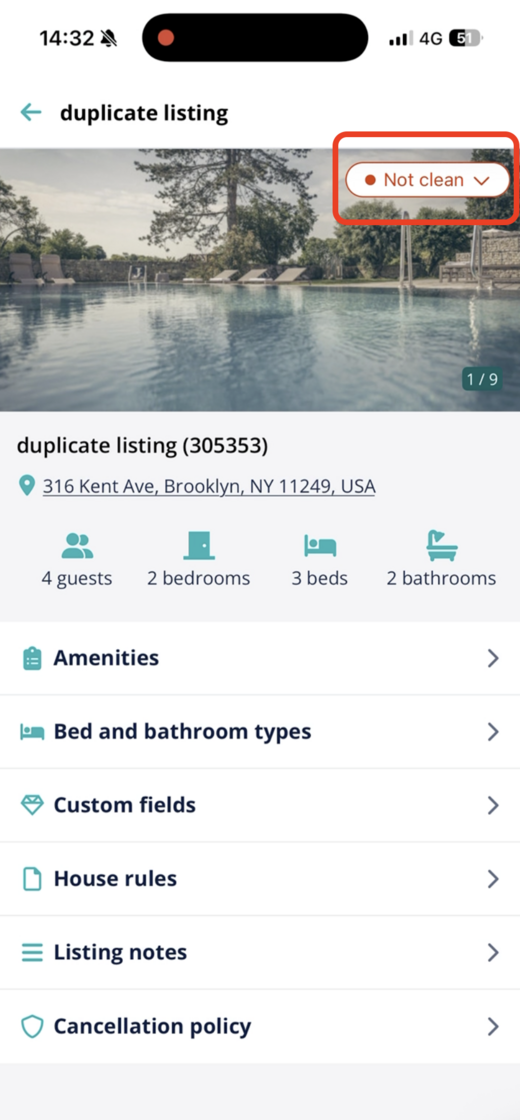

- Centralized Management: Manage all your guest invoices directly within your Hostaway dashboard, with clear visibility into the status of each invoice.

Getting Started:

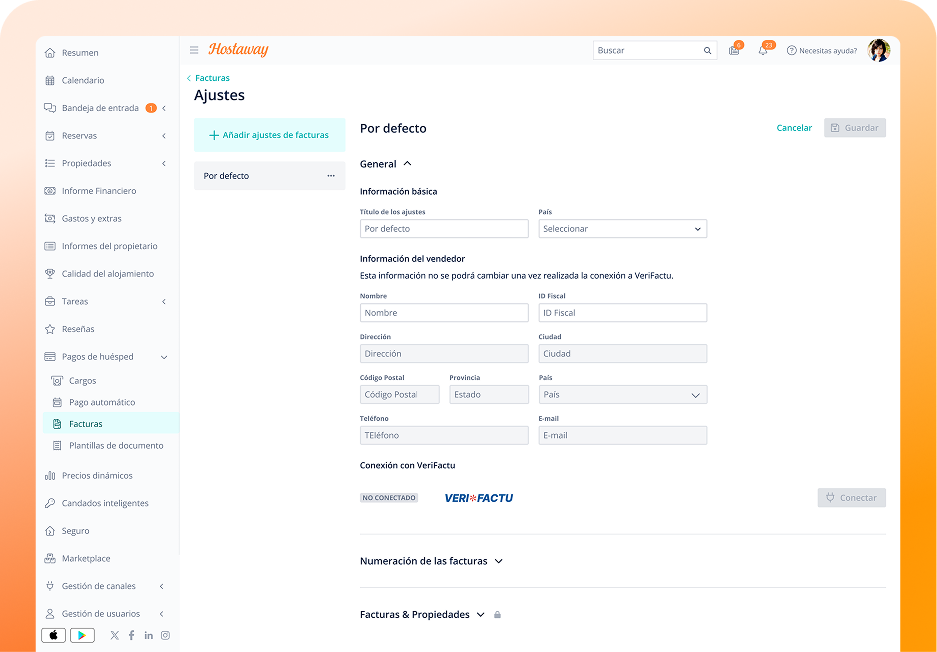

- Prerequisites: You will need an active Hostaway account and a Spanish tax ID (NIF/CIF). You must also submit an authorization document to the Spanish Tax Authority, allowing Hostaway to issue invoices on your behalf.

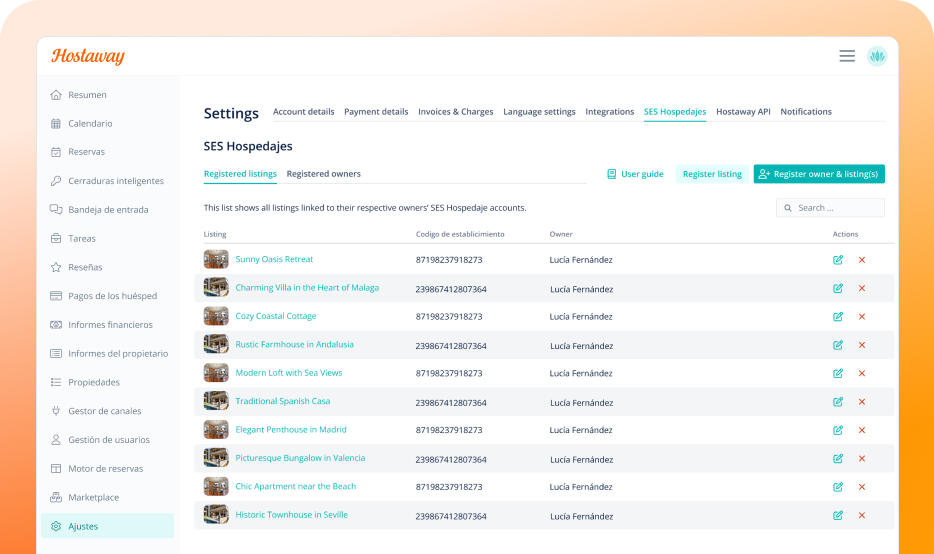

- Configuration: In your Hostaway dashboard, navigate to Guest Payments > Invoices > Settings to connect your account to Verifactu and configure your invoice numbering and closing settings.

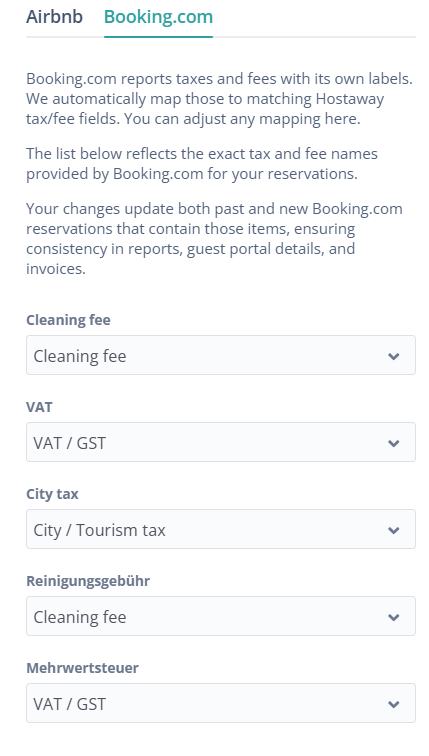

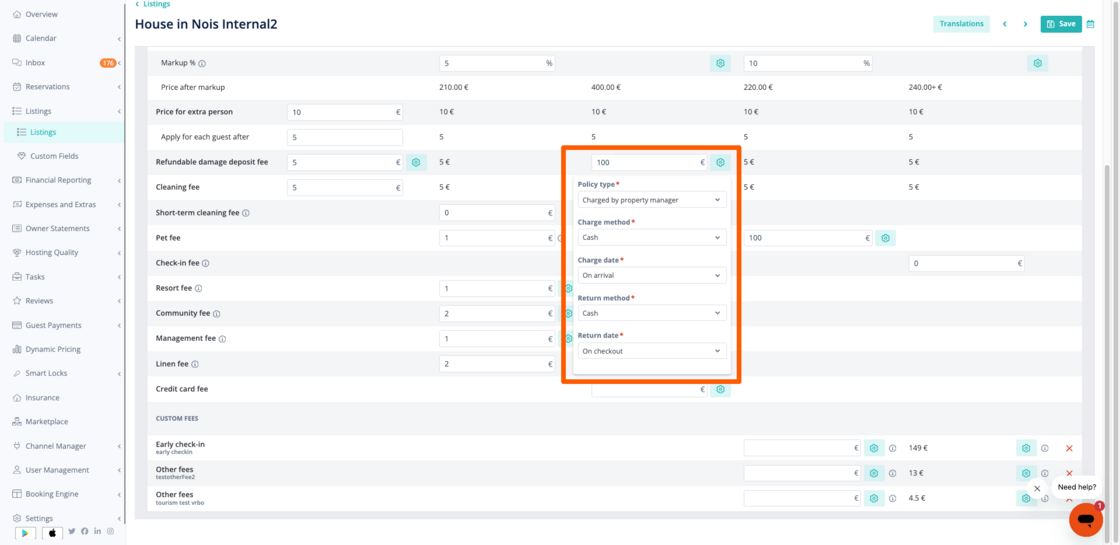

- VAT Setup: Ensure your VAT calculations are correctly configured in both your OTA channels and within Hostaway’s financial settings to guarantee accurate tax calculations on your invoices.

Please Note: Hostaway will not generate Verifactu invoices for bookings where the OTA is the Merchant of Record (e.g., Airbnb), as the OTA is responsible for invoicing in these cases.

For a detailed setup guide, please visit our Help Center or contact our support team at support@hostaway.com.