Speak with the only EOS Licensed Exit Readiness Solution Now: 833-366-2982 | Dataroom Login

The EOS-Licensed Exit Readiness System

Build Value. Eliminate Regret. Create Freedom.

EOS-run companies boost value up to 50%+ with Step-By-Step Exit.

Get a free, no-commitment business valuation using our Health & Value Assessment - it only takes 5 minutes.

Step by Step Exit

The Right Team + The Entrepreneurial Operating System

= The Right Exit

The Entrepreneurial Operating System® has gotten you this far - you've gotten Traction with your people, your data, your vision, and your processes. Now, applying the same revolutionary framework, the SxSE System turns your well-run business into an exit-ready asset - so you’re always ready to sell, scale, or step back on your terms.

Our Exit-Ready System extends EOS with:

The SxSE Model – a complete framework for transferability, valuation growth, and owner independence

The Six1 Team – Six coordinated advisors + One integrated operating system (EOS)

An Integrated Insights Platform – Live dashboards, scorecards, and business valuation tracking

The Exit-Ready Mindset – Support for the emotional and identity shifts every owner faces

EOS helps you build a great business.

We help you build one that’s ready for anything.

TAKE THE FIRST STEPS

How It Works

Take the Assessment

It all starts with the free Health & Value Assessment. This tool will estimate your current business valuation and overall readiness for exit.

Book Your Review Call

After getting your results, book your 30-minute review call with our team to get deeper insights, and roadmap your Step by Step exit ahead.

Onboard with Your Facilitator

Once you choose to commit to our system, we will get you in touch with your dedicated facilitator and establish a regular coaching cadence and start your journey.

YOUR JOURNEY

Exit-Ready Process

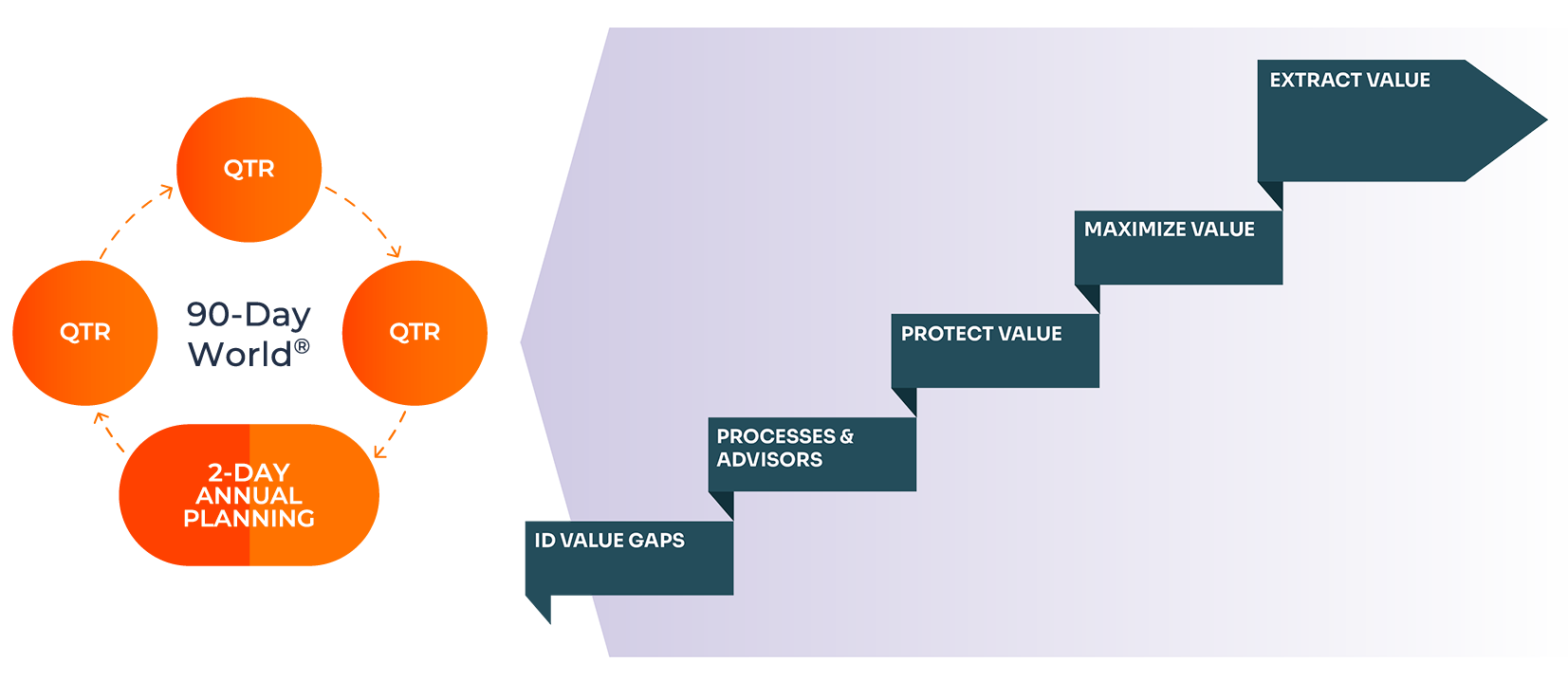

While running your business in the 90-Day World, SxSE feeds potential Rocks to your EOS Session for consideration and prioritization to get you Exit-Ready.

Identify Value Gaps

A deep dive into 153 key data points to uncover growth potential.

Implement Strategic Processes & Advisors

Gain expert guidance to optimize financials, operations, and market positioning.

Protect Value

De-risk your business by reducing owner dependence, enhancing governance, and preparing for unforeseen events.

Maximize Value

Develop a strategic plan for increasing profitability, efficiency, and attractiveness to buyers.

Extract Value

Prepare all necessary documentation for a smooth transaction.

Manage Value Post-Exit

Ensure financial security through ongoing investment and asset protection.

Who is this for?

We work exclusively with EOS-run companies that:

Have 10–250+ employees

Have used EOS for 2+ years & are running in the 90-day world

Are growth-minded and ready for structured guidance

Want to exit, scale, or step back without chaos

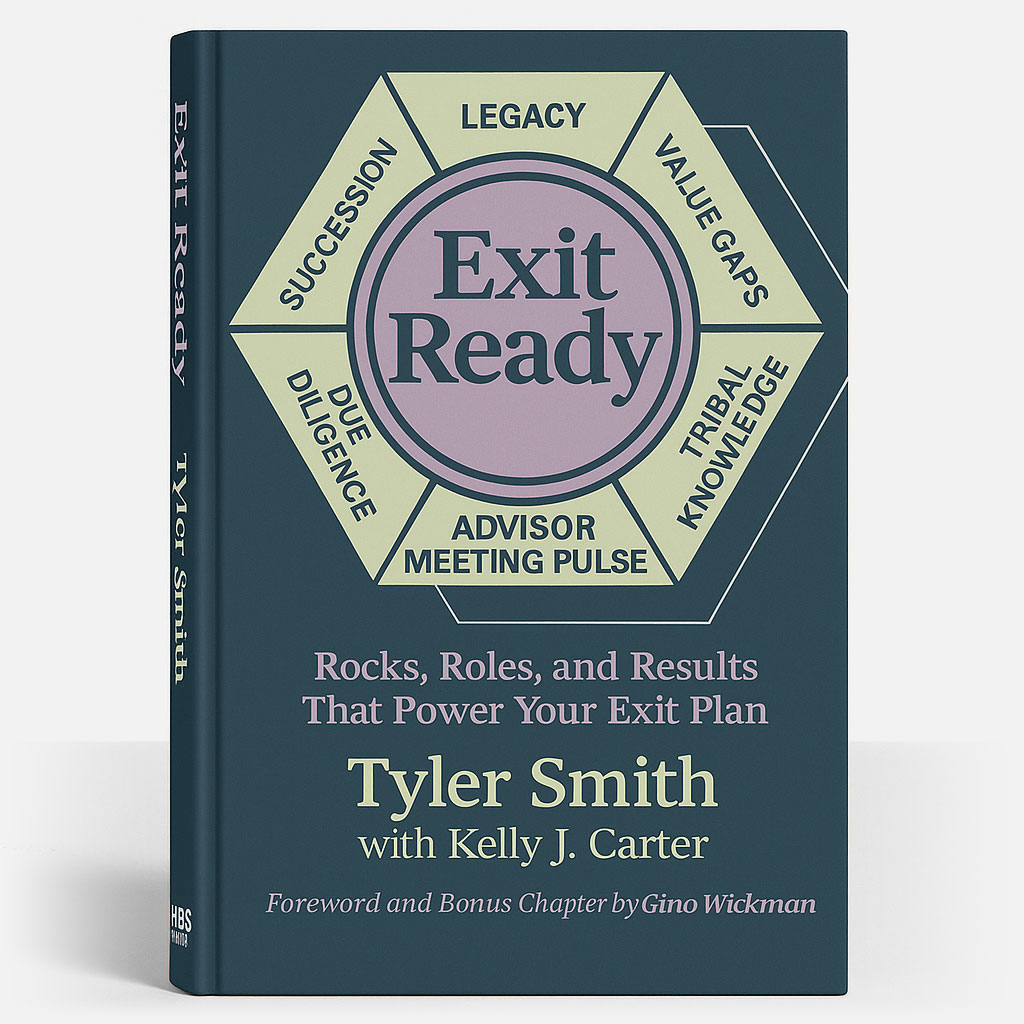

GET THE BOOK

Exit For EOS

on Amazon

Authored by the experts behind Step by Step Exit, Exit Ready shows you how to elevate your already well-run EOSⓇ company into an organization that's primed for a smooth, successful, and highly profitable transition, whenever that time may come.

In Exit Ready, you’ll discover how to:

Implement the Step-by-Step Model so you can layer exit-focused thinking onto each of the Six Key ComponentsⓇ of EOS.

Utilize the Six1 Framework to coordinate your EOS efforts with your six trusted advisors.

Follow the Exit-Ready Process to systematically assess your current state of readiness, identify gaps, and implement necessary changes to become Exit-Ready.

Use the SxSE Exercises to implement every aspect of SxSE effectively and efficiently.

"Exit Ready is the exact process I wish I had when I sold…Exit Ready takes out the guesswork. It gives you the structure, tools and guidance to make one of the biggest decisions of your life without losing yourself in the process."

Gino Wickman

Author of Traction & Shine

Creator of EOS

Why Most Businesses Fail to Sell

Only 20% of businesses successfully sell because most are not positioned properly.

What It Means to Be Exit-Ready

Many business owners underestimate what it takes to sell successfully. Our structured Exit-Ready Process ensures you maximize business value long before negotiations begin.

Most Businesses Wait Too Long

Only 20% of businesses that go to market actually sell.

Even EOS-run companies often fail to command full value—because buyers need more than clean ops.

They need proof the business can thrive without you.

That’s where we come in.

We extend your EOS foundation to help you become Exit-Ready: transferable, de-risked, and positioned for a premium valuation—whether you plan to sell now or never.

What it means to be Exit-Ready

You could sell tomorrow and command a premium

Your business runs smoothly without you

Your leadership team is empowered

Your systems, financials, and brand are buttoned up

You have leverage - whether you sell or not

Not sure where to start?

Take the Health & Value Assessment for Free...

Our Health & Value Assessment (HVA) is the first step in our comprehensive process. It identifies gaps between your current business performance and your desired exit value. By analyzing key operational, financial, and market factors, we provide you with a clear roadmap to bridge these gaps and enhance your business’s market value.

Meet Your Six1 Team

Legal Advisor

An M&A (mergers and acquisitions) attorney plays a crucial role when it comes to the merger and acquisition of privately held companies

M&A / Transaction Advisor

Mergers and Acquisitions (M&A) advisory firms provide specialized expertise and services that can be invaluable to business owners seeking to sell their privately held businesses.

Financial Advisor

By determining what comes after the sale -whether it's retirement, a new venture, philanthropy, travel, or other pursuits - a financial advisor helps in making the transition smoother and less disorienting.

Tax Advisor

A Tax Advisor plays a critical role in mergers and acquisitions (M&A) for privately held companies. The role of the CPA is multifaceted, encompassing financial due diligence, valuation, tax planning, integration planning, and post-acquisition financial management.

Wealth Management Advisor

An wealth management advisor may not be the primary professional one thinks of in the context of mergers and acquisitions (M&A) for privately held companies. However, they can play a significant role, especially when the business owners have significant estate planning concerns.

Personal Coach

A Personal Coach plays a critical role in exit planning for privately held companies. The coach’s role is multifaceted, encompassing mindset preparation, decision clarity, leadership alignment, emotional readiness, and post-exit life planning to ensure the owner exits confidently and on their terms.

FOR BUSINESS COACHES

Want to Become a Facilitator?

Get in touch with us to learn how you can provide value as a Step-by-Step Exit Facilitator for your clients and other businesses.

Overview of the VGA (Value Gap Assessment)

Call to Action: Take the Value Gap Assessment

Ready to discover how much your business is truly worth? Start with our Value Gap Assessment today to get a detailed analysis and actionable insights. [Take the Value Gap Assessment]

Testimonials or Success Stories

Discover how our clients have successfully enhanced their business value and achieved their exit goals with our guidance. [Read Success Stories]

Contact Information or Form

Have questions? Get in touch with us for more information. [Contact Us]

Our Process

Get started

Information

© 2026 StepByStepExit.com | Privacy Policy