Change the way you money

Home or away, local or global — move freely between countries and currencies. Sign up for free, in a tap.

Download the app

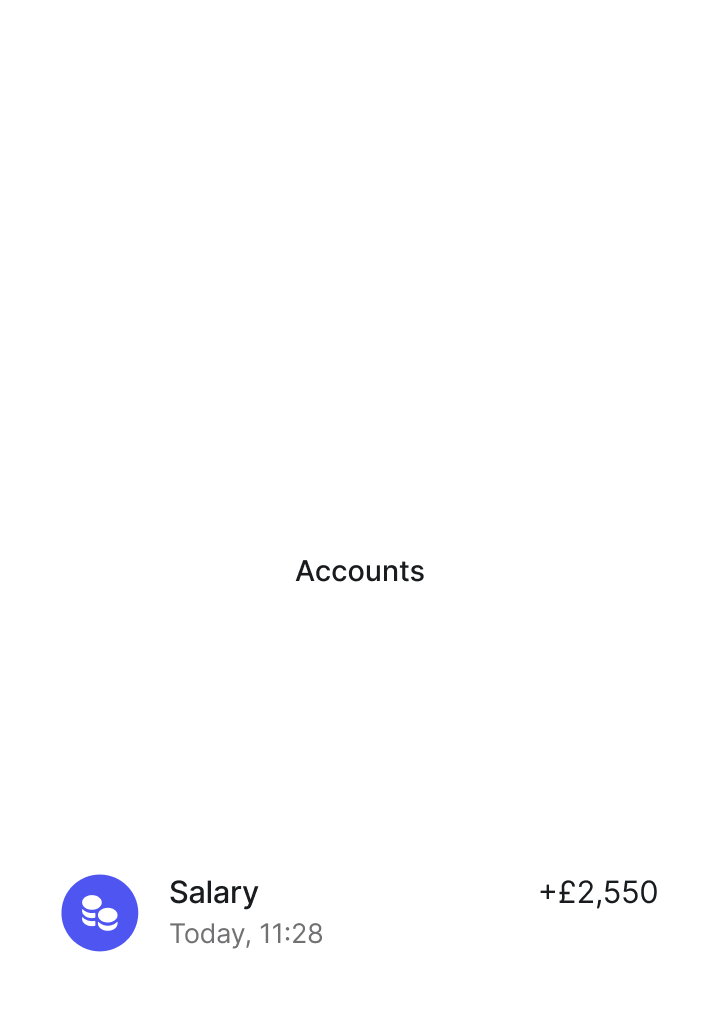

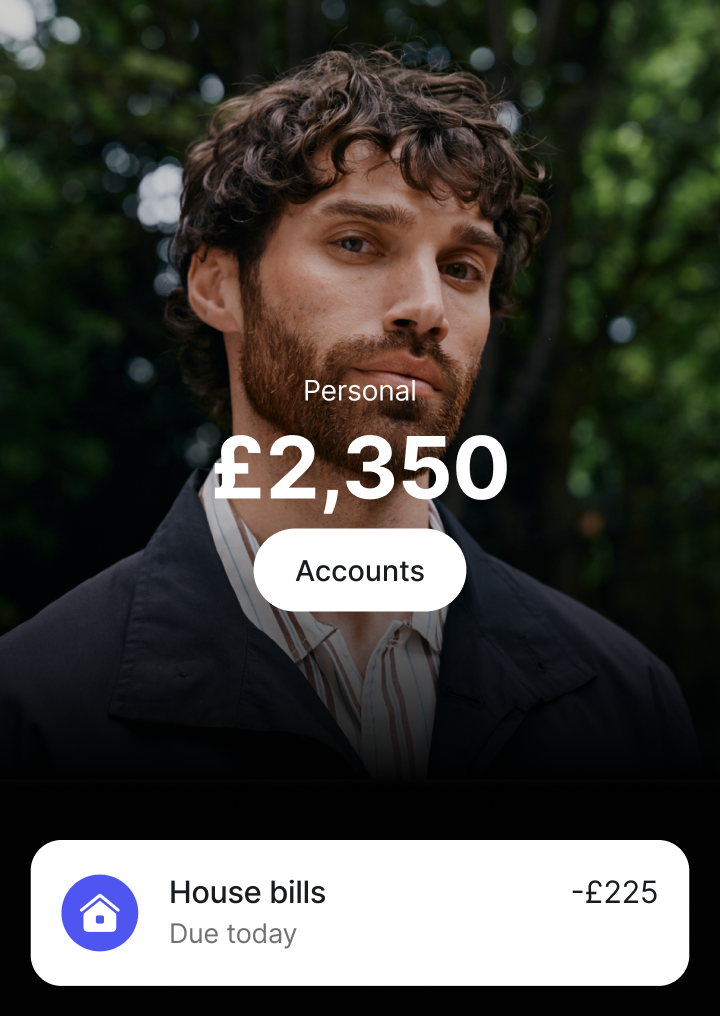

Your salary, reimagined

Spend smartly, send quickly, sort your salary automatically, and watch your savings grow — all with Revolut.

Move your salary

Join 65+ million customers worldwide and 12 million in the UK

#3 most downloaded finance app

4.6 out of 5 on Trustpilot

Best International Payments Provider 2025

Best Consumer Banking Mobile App 2025

Customer Satisfaction — Gold

Consumer Guardian Badge 2025

Elevate your spend

Earn points on your purchases with one of our debit cards. Then redeem them for Airline Miles and more. RevPoints T&Cs apply.Some cards available on paid plans only. Fees may apply.Start earning

Life, meet savings

Grow your money with up to 4.50% AER (variable)¹ interest rate on Savings, paid every day.AER stands for Annual Equivalent Rate and illustrates what the interest rate would be if interest was paid and compounded once each year. The interest rate is variable and subject to your selected plan. T&Cs apply.Explore Savings

Your money’s safe space

With Revolut Secure, you’re entering a new era of money security — where our proactive, purpose-built defences and team of fraud specialists help protect every account, 24/7.

Learn moreExplore 2,500+ stocks

From Apple to Zoom, invest in some of the biggest and most influential companies in the world, commission-free within your monthly allowance.² Other fees may apply. Capital at risk.Try it outJoin the 65+ million using Revolut

¹The Annual Equivalent Rate (AER) shows the interest you can earn over 1 year. AER is compounded, so you’ll earn interest on interest already earned.

The 4.50% AER (variable) boosted rate is a limited-time offer available to eligible new and existing Revolut UK customers who have not previously opened a Savings account before 10 December 2025. The promotion will run from 10 December 2025 to 22 January 2026. Eligible customers who set up a personal Instant Access Savings account during this period will benefit from a boosted 4.50% AER (variable) until 31 July 2026. This rate will apply up to £20,000. For any amount over that, a blended rate will apply between the boosted rate and the applicable plan rate. After 31 July 2026, your Instant Access Savings rate will revert to the rate determined by your plan. For more information see Summary Box - Revolut Promo Rate Instant Access Savings (powered by ClearBank).

²FOR STOCK TRADING: Capital at risk.

Revolut Trading Ltd provides a non-advised execution-only service in shares. Revolut Trading Ltd does not provide investment advice or personal recommendations. You, as an individual investor, must make your own decisions, seeking independent professional advice if you are unsure as to the suitability or appropriateness of any investment for your individual circumstances or needs.

The value of investments can go up as well as down and you may receive less than your original investment or lose the value of your entire initial investment. Past performance and forecasts are not reliable indicators of future results. Currency rate fluctuations can adversely impact the overall returns on your original investment. Any trades outside of your monthly allowance are charged at 0.25% of the order amount if you are a Standard, Plus, Premium, or Metal customer, or at 0.12% of the order amount if you are an Ultra/Trading Pro customer. Read more on these fees. Further information about the investment service provided by Revolut Trading Ltd can be found in the Terms of Business, Risk Disclosure, and Invest FAQs.

Revolut Trading Ltd (No. 11567840) is a firm authorised and regulated by the Financial Conduct Authority (FRN: 933846). The registered address of Revolut Trading Ltd is at 30 South Colonnade, London, United Kingdom, E14 5HX.

³FOR COMMODITIES: Capital at risk.

Revolut Ltd commodities service is not regulated by the FCA and it is not protected or covered by the Financial Ombudsman Service, or the Financial Services Compensation Scheme.

Revolut Ltd (No. 08804411) is also authorised by the FCA under the Electronic Money Regulations 2011 (Firm Reference 900562). Insurance related-products are arranged by Revolut Travel Ltd which is authorised by the FCA to undertake insurance distribution activities (FCA No: 780586) and by Revolut Ltd, an Appointed Representative of Revolut Travel Ltd in relation to insurance distribution activities.

If you would like to find out more about which Revolut entity you receive services from, or if you have any other questions, please reach out to us via the in-app chat in the Revolut app.