NVIDIA Huge Head & Shoulders forming. $127 technical Target.NVIDIA Corporation (NVDA) is in the process of completing the Right Shoulder of a Head and Shoulders (H&S) pattern, having turned sideways since the October 29 2025 High (ATH).

With the 1D RSI on Lower Highs, i.e. a Bearish Divergence since July 17 2025, it is possible that within a month's time ma

The best trades require research, then commitment.

Get started for free$0 forever, no credit card needed

Scott "Kidd" PoteetThe unlikely astronaut

Where the world does markets

Join 100 million traders and investors taking the future into their own hands.

AUDUSD Trend continuation pattern supported at 0.6637The AUDUSD remains in a bullish trend, with recent price action showing signs of a breakout within the broader uptrend.

Support Zone: 0.6637 – a key level from previous consolidation. Price is currently testing or approaching this level.

A bullish rebound from 0.6637 would confirm ongoing upside m

Bitcoin - 2026 roadmap, pump to 100k, then crash to 57k!Is it possible that Bitcoin will go above 100k or 103k in the next weeks/months? And is it possible that Bitcoin will later drop heavily to 57k? Altcoin season during the rise to 103k? I will answer these questions in this post. Write a comment with your altcoin, hit the like button, and I will make

Gold Strengthens as Geopolitical Risk IncreasesGold Strengthens as Geopolitical Risk Increases

Gold continues to respect a bullish market structure, with price developing a clear impulsive sequence followed by shallow corrective waves. The recent pullback found support near the 4,400 zone (wave iv), and price is now pushing higher again, confi

Stocks Shake as Prosecutors Go After Fed Boss Powell. Now What?Wall Street went into the weekend riding record highs — and came back to something that felt more like a political thriller than a macro update.

US stock futures slipped after news broke that the Department of Justice has opened a criminal investigation into Federal Reserve Chair Jerome Powell, sha

A letter to myself. (Buy the dip)This is phase one of a global technological financial system. If our parents even parked a fraction of their cash here 10–20 years ago the long-term payoff would have been nice, but they didn't and it's okay because they didn't know. We now have the privilege of choosing to contribute to our financi

Meta Is Down Nearly 20% Since August. Here's What Its Chart Says"Magnificent Seven" stock Meta Platforms NASDAQ:META has fallen nearly 20% since hitting an all-time high in August, and has also trailed the S&P 500 SP:SPX in various timeframes from three months to one year. Let's see what its chart and fundamental analysis can show us.

Meta's Fundamental An

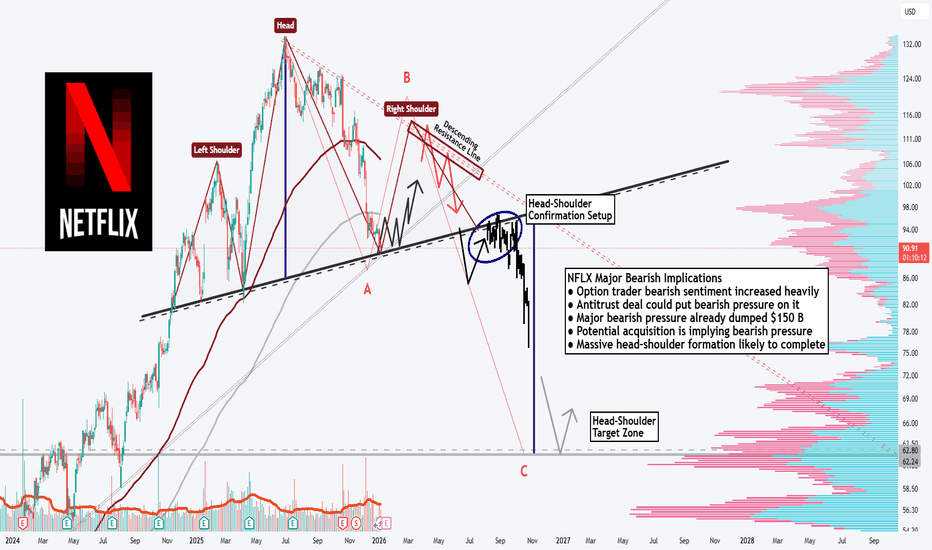

NFLX: Massive Head-Shoulder-Formation!Hello There,

welcome to my new analysis about the Netflix stock (NFLX). Recently, I spotted major underlying factors that will be highly determining for the whole upcoming price action. The stock already dumped heavily bearishly towards the downside, almost declining over $150 B in market cap. Such

Where Is Oil Heading To ? - /CL Analysis 1) Technical Perspective: Support & Resistance

~$65 was a support zone earlier (2021–2024). In 2025–26, that $65 area now often acts as resistance. Prices have come down toward $55

2) Fundamental Drivers Behind the Downtrend

Oil has been in a multi-year decline from the highs seen in 2022 afte

Dollar Off to Weak Start After Worst Year Since 2017. Now What?The US dollar rang in 2026 without much enthusiasm. No fireworks. No flex. Just a quiet shuffle out of the gate that felt eerily familiar to anyone who shoved cash in FX markets last year.

After logging its worst annual performance since 2017, the greenback has started the new year on the back foot

See all editors' picks ideas

DeeptestDeeptest: Quantitative Backtesting Library for Pine Script

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

█ OVERVIEW

Deeptest is a Pine Script library that provides quantitative analysis tools for strategy backtesting. It calculates over 100 statistical metrics including risk-adjusted return ratios (Sharpe

Arbitrage Detector [LuxAlgo]The Arbitrage Detector unveils hidden spreads in the crypto and forex markets. It compares the same asset on the main crypto exchanges and forex brokers and displays both prices and volumes on a dashboard, as well as the maximum spread detected on a histogram divided by four user-selected percenti

Multi-Distribution Volume Profile (Zeiierman)█ Overview

Multi-Distribution Volume Profile (Zeiierman) is a flexible, structure-first volume profile tool that lets you reshape how volume is distributed across price, from classic uniform profiles to advanced statistical curves like Gaussian, Lognormal, Student-t, and more.

Instead of forcin

Multi-Ticker Anchored CandlesMulti-Ticker Anchored Candles (MTAC) is a simple tool for overlaying up to 3 tickers onto the same chart. This is achieved by interpreting each symbol's OHLC data as percentages, then plotting their candle points relative to the main chart's open. This allows for a simple comparison of tickers to tr

Vdubus Divergence Wave Pattern Generator V1The Vdubus Divergence Wave Theory

10 years in the making & now finally thanks to AI I have attempted to put my Trading strategy & logic into a visual representation of how I analyse and project market using Core price action & MacD. Enjoy :)

A Proprietary Structural & Momentum Confluence System

Per Bak Self-Organized CriticalityTL;DR: This indicator measures market fragility. It measures the system's vulnerability to cascade failures and phase transitions. I've added four independent stress vectors: tail risk, volatility regime, credit stress, and positioning extremes. This allows us to quantify how susceptible markets are

Volatility Risk PremiumTHE INSURANCE PREMIUM OF THE STOCK MARKET

Every day, millions of investors face a fundamental question that has puzzled economists for decades: how much should protection against market crashes cost? The answer lies in a phenomenon called the Volatility Risk Premium, and understanding it may fundam

Volume Gaps & Imbalances (Zeiierman)█ Overview

Volume Gaps & Imbalances (Zeiierman) is an advanced market-structure and order-flow visualizer that maps where the market traded, where it did not, and how buyer-vs-seller pressure accumulated across the entire price range.

The core of the indicator is a price-by-price volume prof

Match Finder [theUltimator5]Match Finder is the dating app of indicators. It takes your current ticker and finds the most compatible match over a recent time period. The match may not be Mr. right, but it is Mr. right now. It doesn't forecast future connection, but it tells you current compatibility for today.

Jokes aside,

Trend Line Methods (TLM)Trend Line Methods (TLM)

Overview

Trend Line Methods (TLM) is a visual study designed to help traders explore trend structure using two complementary, auto-drawn trend channels. The script focuses on how price interacts with rising or falling boundaries over time. It does not generate trade sign

See all indicators and strategies

Community trends

NVIDIA Huge Head & Shoulders forming. $127 technical Target.NVIDIA Corporation (NVDA) is in the process of completing the Right Shoulder of a Head and Shoulders (H&S) pattern, having turned sideways since the October 29 2025 High (ATH).

With the 1D RSI on Lower Highs, i.e. a Bearish Divergence since July 17 2025, it is possible that within a month's time ma

When Will Tesla’s Pilot Take Off?Hello Traders 👋

Hope you all are doing well and trading with discipline. Let’s analyze Tesla from a pure technical perspective and see where the next major move could unfold.

Tesla is trading inside a well-defined rising channel, respecting both the rising support and the rising resistance, which c

Price is currently holding the lower boundary of the rising chanPrice is currently holding the lower boundary of the rising channel, which has acted as a strong dynamic support throughout the uptrend.

A controlled pullback into the 610–630 zone would be technically healthy and would allow the structure to reset without damaging the primary trend.

As long as pri

ABAT: Bouncing off Major Support, Eyeing $8.85 Target.ABAT (American Battery Technology Company) is showing signs of a bullish reversal on the Daily timeframe. After a period of consolidation, price has successfully tested and held the key support zone around $4.00 - $4.50.

Key Drivers:

Support Confirmation: Price is bouncing off the 50-period Moving

Meta - Preparing a major buying opportunity!🤩Meta ( NASDAQ:META ) is clearly heading higher:

🔎Analysis summary:

Just recently Meta once again retested the major resistance trendline. This retest was followed by a decent correction of about -25%, perfectly playing out. Now, Meta is retesting major support and is already setting up for a

$NSC | Quant Reversion Setup | Short Put StrategyInstitutional-Grade Mean Reversion Setup on $NSC.

My proprietary scanner flagged Norfolk Southern ( NYSE:NSC ) today as a high-probability reversal candidate based on volatility metrics.

The Technical Confluence:

Volatility Extension: Price pierced the Lower Bollinger Band (2.0 StdDev), indicatin

Long Momentum Day Trade on $TSLA If NASDAQ:TSLA crosses the $442.75 mark at the open then it can go above 445 and 448. Eventually can reach the 452.5 mark.

Looking for the price to stay below the entry line before the market open. If the can stay below and then break the entry line at the open then I will be looking to get long

See all stocks ideas

Jan 13

UNTYUnity Bancorp, Inc.

Actual

1.41

USD

Estimate

1.36

USD

Jan 13

DALDelta Air Lines, Inc.

Actual

1.55

USD

Estimate

1.53

USD

Jan 13

BKThe Bank of New York Mellon Corporation

Actual

2.02

USD

Estimate

1.91

USD

Jan 13

JPMJP Morgan Chase & Co.

Actual

4.63

USD

Estimate

4.85

USD

Jan 13

ATONAlphaTON Capital Corp.

Actual

—

Estimate

—

Jan 13

SOTKSono-Tek Corporation

Actual

0.02

USD

Estimate

0.03

USD

Jan 13

CNXCConcentrix Corporation

Actual

2.95

USD

Estimate

2.91

USD

Jan 13

VMARVision Marine Technologies Inc.

Actual

—

Estimate

−1.67

USD

See more events

Community trends

Bitcoin - Holding The Middle, Eyes On The EdgeBitcoin continues to trade within a clearly defined range, with price currently positioned in the upper half of that structure. After a strong move away from the lower boundary, the market has shown acceptance above the midpoint, suggesting buyers are still active but now approaching an area where r

BTCUSDT Long: Demand Holding at 90,100 - Eyes on 92,200 SupplyHello traders! Here’s a clear technical breakdown of BTCUSDT (4H) based on the current chart structure. After a strong bearish move, BTC formed a clear pivot low, from which price transitioned into a bullish recovery phase. From this pivot point, the market developed a well-defined ascending channel

Bitcoin - 2026 roadmap, pump to 100k, then crash to 57k!Is it possible that Bitcoin will go above 100k or 103k in the next weeks/months? And is it possible that Bitcoin will later drop heavily to 57k? Altcoin season during the rise to 103k? I will answer these questions in this post. Write a comment with your altcoin, hit the like button, and I will make

Elise | BTCUSD – 30M | Post-BOS Reaction from HTF DemandBITSTAMP:BTCUSD

After a sharp impulsive drop, BTC tapped into HTF demand and produced a short-term BOS, indicating a potential relief move. However, momentum remains corrective rather than impulsive. The current structure suggests a retracement-based bounce, not a confirmed trend reversal, unless

BTCUSD Consolidation Before the Next Big MoveHello traders! Here’s my technical outlook on BTCUSD (4H) based on the current chart structure. Bitcoin is trading within a broader bullish structure after reclaiming key levels and breaking above previous consolidation zones. Earlier on the chart, price respected a rising support line and formed a

Litecoin (LTC): One Way or Another - We Will Fill That CME GapLTC has been in an accumulation phase after forming a bullish CME gap and dumping during Monday. This is a simple setup but quite solid, since CME gaps tend to get filled over time. For that to happen, all we need is a proper BOS. Looking at the recent candlestick movement, the odds of a BOS are pre

BTC: Weekly DSS Bressert Reset in PlayPrice Structure

Bitcoin is in a weekly pullback after the run to the highs.

The down‑sloping blue trendline marks the corrective leg.

Price is now trying to base just under 92K, with upside space back to the 105K resistance zone.

Stochastic Signal: Momentum Is Turning

On the main stoch

Post-Rally Consolidation, Awaiting CatalystHello everyone,

Bitcoin is no longer in an expansion phase of the uptrend, but has shifted into a consolidation phase following the recent rally.

From a structural perspective, the medium-term uptrend remains intact. Bitcoin continues to print higher highs and higher lows, with price holding ab

Bitcoin Ranges as Middle East Tensions Raise Sell-Off RiskBitcoin( BINANCE:BTCUSDT ) has experienced both bullish and bearish moves over the past few days under the influence of various news events, resulting in a clear ranging structure.

One key factor that must be considered for Bitcoin and other risk assets is the escalation of tensions in the Middle E

BTCUSDT: Compression Before the Move (IH&S Inside Triangle)Hi!

Price is still moving inside a symmetrical triangle, showing clear compression and indecision. An inverse head & shoulders is visible, but the breakout so far is weak and needs confirmation.

Short-term expectation:

A push-up is likely toward the gray resistance zone around 91,330. From there

See all crypto ideas

XAUUSD: Critical Supply Zone - Reaction May Define Next MoveHello everyone, here is my breakdown of the current XAUUSD setup.

Market Analysis

Gold is trading within a broader bullish environment, but recent price action shows signs of exhaustion near key resistance. After a period of consolidation inside a clear range, XAUUSD broke to the upside and forme

GOLD - Consolidation ahead of news. Long squeeze?FX:XAUUSD is trading in the $4575-4600 range (consolidation) ahead of US inflation data (CPI) for December...

Inflation remains above the Fed's target (2%), making the data key to assessing the timing of rate cuts. XAU is consolidating below record highs. Profit-taking is observed ahead of the

Selena | XAUUSD – 30M – CPI-Driven Bullish StructureFOREXCOM:XAUUSD PEPPERSTONE:XAUUSD

Gold is consolidating after a strong impulsive bullish expansion, with price respecting the rising channel structure. The current pullback is corrective, occurring below HTF resistance and above channel support. With CPI Core news in play, volatility is expect

Gold Strengthens as Geopolitical Risk IncreasesGold Strengthens as Geopolitical Risk Increases

Gold continues to respect a bullish market structure, with price developing a clear impulsive sequence followed by shallow corrective waves. The recent pullback found support near the 4,400 zone (wave iv), and price is now pushing higher again, confi

#XAUUSD:+4000 Pips Swing Targeting $5000! Comment Your Views! Dear Traders,

Gold has been bullish since last week as the uncertainty rises across the globe. The fear is growing and which is the main reason why Gold has been bullish. In this market scenarios, we may not see a strong correction as momentum remain extremely bullish. Right now, if you are thinkin

THE KOG REPORT - UpdateEnd of day update from us here at KOG:

We could have got more!

Yes, we could have ran more on that trade idea but the move worked well and all of our red box targets were completed and exceeded. We got to a point where it was a little too stretched to attempt going long again and due to the brea

Lingrid | GOLD Key Level Breakout Triggers Bullish ContinuationOANDA:XAUUSD perfectly played out my weekly trading idea . Price has confirmed a clean breakout above the former consolidation ceiling, shifting market structure firmly back in favor of buyers. Price compressed inside the triangle before expanding with strong momentum, suggesting accumulation rath

XAUUSD Short: Fails at Supply Zone, Sellers Regain ControlHello traders! Here’s a clear technical breakdown of XAUUSD (1H) based on the current chart structure. XAUUSD recently completed a strong bullish leg within a well-defined ascending channel, but momentum started to fade as price reached the major Supply Zone around 4,620–4,630. This area acted as a

SILVER (XAGUSD): Confirmed Breakout

As I predicted yesterday, Silver successfully violated a key

horizontal resistance cluster.

It turned into a support now.

I will expect a bullish continuation from that.

Next resistance - 88.0

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program a

Gold Uptrend Strengthens, New Expansion Phase BeginsOver the past week, gold has continued to advance in a very “textbook” manner. What stands out is not how far price has moved, but how it has moved: steady, controlled, and consistently supported by both technical structure and the macro backdrop. On the H4 chart, this is the type of bullish behav

See all futures ideas

Hellena | EUR/USD (4H): LONG to resistance area 1.17420.Colleagues, the price has either completed or is completing a corrective movement in wave “2,” and I expect an upward movement to begin, which has either already started or will start soon.

I believe there is a possibility of the local minimum of 1.16180 being updated to the 1.16036 area, but the ma

EURUSD Price Action - Support Holds at 1.1670, TP Near 1.1720Hello traders! Here’s my technical outlook on EURUSD (1H) based on the current chart structure. After trading inside a clearly defined range, EURUSD broke to the upside, showing initial buyer strength. However, this bullish move failed to sustain, and price turned around, transitioning into a descen

EURUSD Reaction Zone After Downtrend RespectQuick Summary

EURUSD respected the bearish trend, Price is expected to target the low at 1.16530

A potential reaction zone sits at the demand area around 1.16332

This zone could support a bounce and a break of the bearish trend, However confirmation through strong rejection is required before any e

GBPJPY: Structure Break Signals Further Upside PotentialGBPJPY Structural Break Signals Further Upside Potential

GBPJPY broke out of a strong structural area near 212.10 also creating a new all-time high.

The JPY has been very weak lately. This weakness can only be attributed to the chaos that the new Prime Minister is already creating. Since Takaichi

EURUSD – Bearish Continuation from Seller ZoneEURUSD is currently reacting from a strong seller zone after a corrective pullback. Price previously formed a range, followed by a strong impulsive move to the upside, but momentum is now weakening inside a descending channel, indicating potential bearish continuation.

🔴 Sell Zone: Previous supply

Selena | USDJPY–4H|Bullish Channel, Compression Before ExpansionFX:USDJPY

USDJPY remains in a strong bullish market structure with higher highs and higher lows. The recent consolidation below resistance suggests liquidity build-up, not weakness. As long as price holds above the internal demand zone and channel support, upside continuation remains the higher-pr

Elite | GBPUSD – 4H | Bullish Structure in Corrective PhaseFPMARKETS:GBPUSD

GBPUSD pushed impulsively higher, then entered a corrective phase while respecting the ascending structure. Price is now reacting near a mid-channel demand area, where buyers previously stepped in. However, this is a reaction zone, not confirmation — continuation requires bullish

AUDCHF - Pullback Into Structure, Watching the ReactionAUDCHF remains overall bullish, trading cleanly inside the rising blue channel. After the recent push higher, price is now pulling back into a very interesting area.

We’re approaching the intersection of the demand zone and the lower blue trendline. This is exactly the kind of confluence I like

See all forex ideas

| - | - | - | - | - | - | - | ||

| - | - | - | - | - | - | - | ||

| - | - | - | - | - | - | - | ||

| - | - | - | - | - | - | - | ||

| - | - | - | - | - | - | - | ||

| - | - | - | - | - | - | - | ||

| - | - | - | - | - | - | - | ||

| - | - | - | - | - | - | - |

Trade directly on Supercharts through our supported, fully-verified, and user-reviewed brokers.