compliance for lenders, lawyers, fintechs, & More

Winnow is a powerful, automated compliance change management platform that empowers you to build accurate state and federal law surveys.

Automate Your Workflow

Winnow saves you time managing and keeping up with regulatory changes by delivering accurate results tailored to your business so you can lend and service with ease.

We Have Your Compliance Needs Covered

Why Winnow?

Custom Surveys in Minutes

Build targeted compliance surveys focused on your unique business needs, products, and areas of operation from Winnow’s extensive database of ~ 60,000 state and federal regulatory requirements.

Automated Change Management

Receive weekly notifications in your inbox about pending regulatory changes. Winnow only tells you about changes that apply to your business, making it easier to prepare in advance.

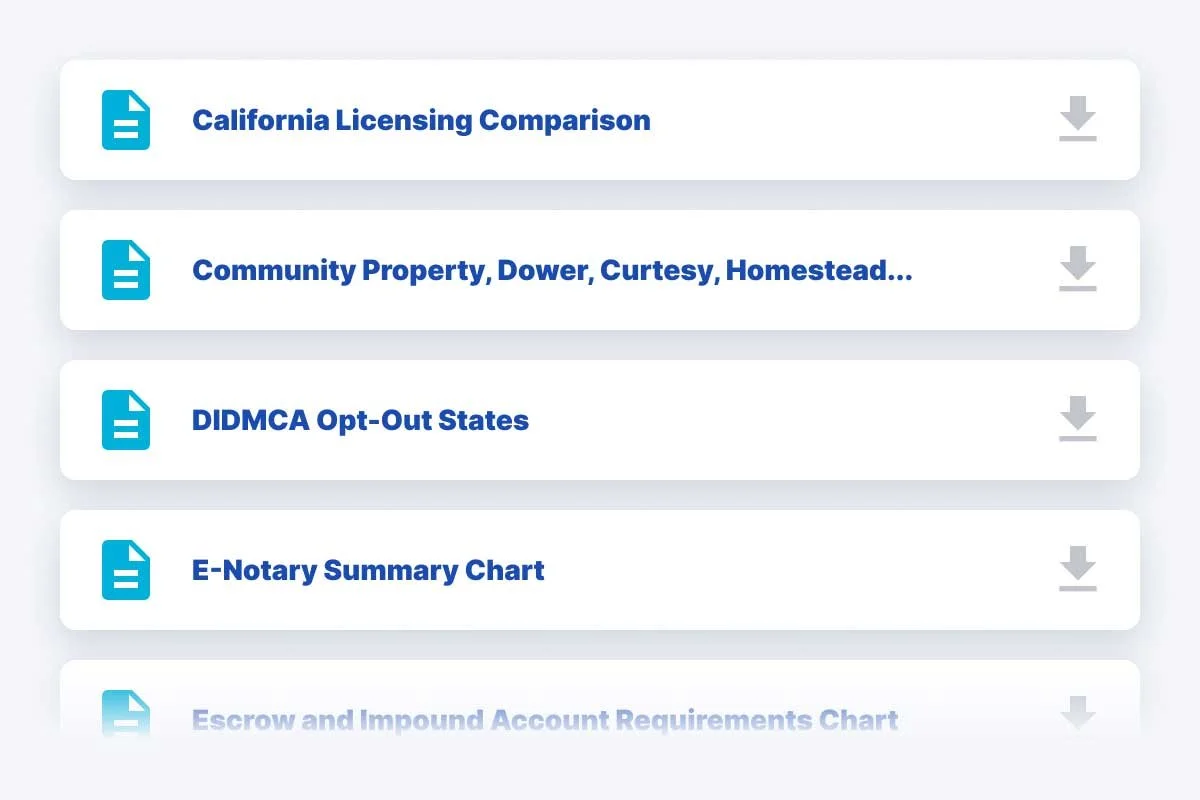

Packed With Resources

View and download helpful reference charts and agency guides. Quickly access federal citation language within Winnow to further enhance your survey results.

Backed by Experience

Winnow is built and maintained by a skilled team of engineers, product designers, and attorneys, with every single requirement undergoing multiple rounds of review before being published. We use attorney intelligence, not artificial intelligence.