Summary: in this tutorial, you will learn how to use the SQL Server UPDATE statement to change existing data in a table.

Introduction to the SQL Server UPDATE statement #

To modify existing data in a table, you use the following UPDATE statement:

UPDATE

table_name

SET

c1 = v1,

c2 = v2,

...,

cn = vn

[WHERE condition]Code language: SQL (Structured Query Language) (sql)In this syntax:

- First, specify the name of the table you want to update data after the

UPDATEkeyword. - Second, specify a list of columns c1, c2, …, cn and new values v1, v2, … vn in the

SETclause. - Third, filter the rows to update by specifying a condition in the

WHEREclause. TheWHEREclause is optional. If you skip theWHEREclause, the statement will update all rows in the table.

SQL Server UPDATE examples #

First, create a new table named taxes for demonstration.

CREATE TABLE sales.taxes (

tax_id INT PRIMARY KEY IDENTITY (1, 1),

state VARCHAR (50) NOT NULL UNIQUE,

state_tax_rate DEC (3, 2),

avg_local_tax_rate DEC (3, 2),

combined_rate AS state_tax_rate + avg_local_tax_rate,

max_local_tax_rate DEC (3, 2),

updated_at datetime

);Code language: SQL (Structured Query Language) (sql)Second, execute the following statements to insert data into the taxes table:

Insert Statements

INSERT INTO sales.taxes(state,state_tax_rate,avg_local_tax_rate,max_local_tax_rate) VALUES('Alabama',0.04,0.05,0.07);

INSERT INTO sales.taxes(state,state_tax_rate,avg_local_tax_rate,max_local_tax_rate) VALUES('Alaska',0,0.01,0.07);

INSERT INTO sales.taxes(state,state_tax_rate,avg_local_tax_rate,max_local_tax_rate) VALUES('Arizona',0.05,0.02,0.05);

INSERT INTO sales.taxes(state,state_tax_rate,avg_local_tax_rate,max_local_tax_rate) VALUES('Arkansas',0.06,0.02,0.05);

INSERT INTO sales.taxes(state,state_tax_rate,avg_local_tax_rate,max_local_tax_rate) VALUES('California',0.07,0.01,0.02);

INSERT INTO sales.taxes(state,state_tax_rate,avg_local_tax_rate,max_local_tax_rate) VALUES('Colorado',0.02,0.04,0.08);

INSERT INTO sales.taxes(state,state_tax_rate,avg_local_tax_rate,max_local_tax_rate) VALUES('Connecticut',0.06,0,0);

INSERT INTO sales.taxes(state,state_tax_rate,avg_local_tax_rate,max_local_tax_rate) VALUES('Delaware',0,0,0);

INSERT INTO sales.taxes(state,state_tax_rate,avg_local_tax_rate,max_local_tax_rate) VALUES('Florida',0.06,0,0.02);

INSERT INTO sales.taxes(state,state_tax_rate,avg_local_tax_rate,max_local_tax_rate) VALUES('Georgia',0.04,0.03,0.04);

INSERT INTO sales.taxes(state,state_tax_rate,avg_local_tax_rate,max_local_tax_rate) VALUES('Hawaii',0.04,0,0);

INSERT INTO sales.taxes(state,state_tax_rate,avg_local_tax_rate,max_local_tax_rate) VALUES('Idaho',0.06,0,0.03);

INSERT INTO sales.taxes(state,state_tax_rate,avg_local_tax_rate,max_local_tax_rate) VALUES('Illinois',0.06,0.02,0.04);

INSERT INTO sales.taxes(state,state_tax_rate,avg_local_tax_rate,max_local_tax_rate) VALUES('Indiana',0.07,0,0);

INSERT INTO sales.taxes(state,state_tax_rate,avg_local_tax_rate,max_local_tax_rate) VALUES('Iowa',0.06,0,0.01);

INSERT INTO sales.taxes(state,state_tax_rate,avg_local_tax_rate,max_local_tax_rate) VALUES('Kansas',0.06,0.02,0.04);

INSERT INTO sales.taxes(state,state_tax_rate,avg_local_tax_rate,max_local_tax_rate) VALUES('Kentucky',0.06,0,0);

INSERT INTO sales.taxes(state,state_tax_rate,avg_local_tax_rate,max_local_tax_rate) VALUES('Louisiana',0.05,0.04,0.07);

INSERT INTO sales.taxes(state,state_tax_rate,avg_local_tax_rate,max_local_tax_rate) VALUES('Maine',0.05,0,0);

INSERT INTO sales.taxes(state,state_tax_rate,avg_local_tax_rate,max_local_tax_rate) VALUES('Maryland',0.06,0,0);

INSERT INTO sales.taxes(state,state_tax_rate,avg_local_tax_rate,max_local_tax_rate) VALUES('Massachusetts',0.06,0,0);

INSERT INTO sales.taxes(state,state_tax_rate,avg_local_tax_rate,max_local_tax_rate) VALUES('Michigan',0.06,0,0);

INSERT INTO sales.taxes(state,state_tax_rate,avg_local_tax_rate,max_local_tax_rate) VALUES('Minnesota',0.06,0,0.01);

INSERT INTO sales.taxes(state,state_tax_rate,avg_local_tax_rate,max_local_tax_rate) VALUES('Mississippi',0.07,0,0.01);

INSERT INTO sales.taxes(state,state_tax_rate,avg_local_tax_rate,max_local_tax_rate) VALUES('Missouri',0.04,0.03,0.05);

INSERT INTO sales.taxes(state,state_tax_rate,avg_local_tax_rate,max_local_tax_rate) VALUES('Montana',0,0,0);

INSERT INTO sales.taxes(state,state_tax_rate,avg_local_tax_rate,max_local_tax_rate) VALUES('Nebraska',0.05,0.01,0.02);

INSERT INTO sales.taxes(state,state_tax_rate,avg_local_tax_rate,max_local_tax_rate) VALUES('Nevada',0.06,0.01,0.01);

INSERT INTO sales.taxes(state,state_tax_rate,avg_local_tax_rate,max_local_tax_rate) VALUES('New Hampshire',0,0,0);

INSERT INTO sales.taxes(state,state_tax_rate,avg_local_tax_rate,max_local_tax_rate) VALUES('New Jersey',0.06,0,0);

INSERT INTO sales.taxes(state,state_tax_rate,avg_local_tax_rate,max_local_tax_rate) VALUES('New Mexico',0.05,0.02,0.03);

INSERT INTO sales.taxes(state,state_tax_rate,avg_local_tax_rate,max_local_tax_rate) VALUES('New York',0.04,0.04,0.04);

INSERT INTO sales.taxes(state,state_tax_rate,avg_local_tax_rate,max_local_tax_rate) VALUES('North Carolina',0.04,0.02,0.02);

INSERT INTO sales.taxes(state,state_tax_rate,avg_local_tax_rate,max_local_tax_rate) VALUES('North Dakota',0.05,0.01,0.03);

INSERT INTO sales.taxes(state,state_tax_rate,avg_local_tax_rate,max_local_tax_rate) VALUES('Ohio',0.05,0.01,0.02);

INSERT INTO sales.taxes(state,state_tax_rate,avg_local_tax_rate,max_local_tax_rate) VALUES('Oklahoma',0.04,0.04,0.06);

INSERT INTO sales.taxes(state,state_tax_rate,avg_local_tax_rate,max_local_tax_rate) VALUES('Oregon',0,0,0);

INSERT INTO sales.taxes(state,state_tax_rate,avg_local_tax_rate,max_local_tax_rate) VALUES('Pennsylvania',0.06,0,0.02);

INSERT INTO sales.taxes(state,state_tax_rate,avg_local_tax_rate,max_local_tax_rate) VALUES('Rhode Island',0.07,0,0);

INSERT INTO sales.taxes(state,state_tax_rate,avg_local_tax_rate,max_local_tax_rate) VALUES('South Carolina',0.06,0.01,0.02);

INSERT INTO sales.taxes(state,state_tax_rate,avg_local_tax_rate,max_local_tax_rate) VALUES('South Dakota',0.04,0.01,0.04);

INSERT INTO sales.taxes(state,state_tax_rate,avg_local_tax_rate,max_local_tax_rate) VALUES('Tennessee',0.07,0.02,0.02);

INSERT INTO sales.taxes(state,state_tax_rate,avg_local_tax_rate,max_local_tax_rate) VALUES('Texas',0.06,0.01,0.02);

INSERT INTO sales.taxes(state,state_tax_rate,avg_local_tax_rate,max_local_tax_rate) VALUES('Utah',0.05,0,0.02);

INSERT INTO sales.taxes(state,state_tax_rate,avg_local_tax_rate,max_local_tax_rate) VALUES('Vermont',0.06,0,0.01);

INSERT INTO sales.taxes(state,state_tax_rate,avg_local_tax_rate,max_local_tax_rate) VALUES('Virginia',0.05,0,0);

INSERT INTO sales.taxes(state,state_tax_rate,avg_local_tax_rate,max_local_tax_rate) VALUES('Washington',0.06,0.02,0.03);

INSERT INTO sales.taxes(state,state_tax_rate,avg_local_tax_rate,max_local_tax_rate) VALUES('West Virginia',0.06,0,0.01);

INSERT INTO sales.taxes(state,state_tax_rate,avg_local_tax_rate,max_local_tax_rate) VALUES('Wisconsin',0.05,0,0.01);

INSERT INTO sales.taxes(state,state_tax_rate,avg_local_tax_rate,max_local_tax_rate) VALUES('Wyoming',0.04,0.01,0.02);

INSERT INTO sales.taxes(state,state_tax_rate,avg_local_tax_rate,max_local_tax_rate) VALUES('D.C.',0.05,0,0);Code language: SQL (Structured Query Language) (sql)1) Update a single column in all rows of a table #

The following statement uses the UPDATE statement to change the values of the updated_at column in the taxes table to the system date time:

UPDATE sales.taxes

SET updated_at = GETDATE();Code language: SQL (Structured Query Language) (sql)Output:

(51 rows affected)Code language: SQL (Structured Query Language) (sql)The output shows that 51 rows have been updated successfully.

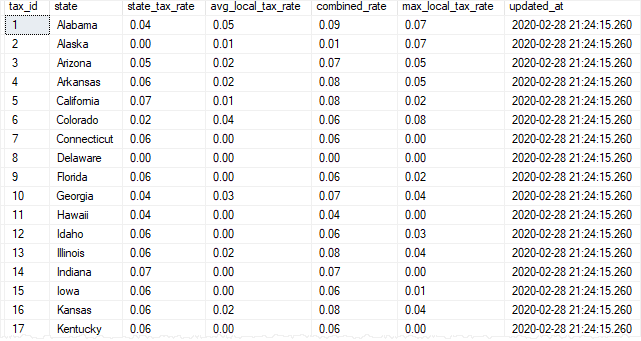

Let’s verify the update:

SELECT * FROM sales.taxes;Code language: SQL (Structured Query Language) (sql)Here is the partial output:

The output shows that the updated_at column has been updated with the date and time when we ran the statement.

2) Update multiple columns #

The following statement increases the max local tax rate by 2% and the average local tax rate by 1% in the states that have a max local tax rate of 1%.

UPDATE sales.taxes

SET max_local_tax_rate += 0.02,

avg_local_tax_rate += 0.01

WHERE

max_local_tax_rate = 0.01;Code language: SQL (Structured Query Language) (sql)Output:

(7 rows affected)Code language: SQL (Structured Query Language) (sql)The output shows that the taxes of 7 states have been updated.

Summary #

- Use the SQL Server

UPDATEstatement to modify data in the existing table.