Overview

As Washington’s spending binge pushes the national debt above $36 trillion, many state governments are showing there’s a better way. In 2023, Americans for Tax Reform (ATR) launched the Sustainable Budget Project (SBP) to monitor how state budgets align with a simple, taxpayer-focused standard: limiting spending growth to the rate of population growth plus inflation (pop+inf). This benchmark reflects the average taxpayer’s ability to pay for government without being taxed into poverty or priced out of prosperity.

We’ve updated SBP data for every state through FY 2024, provided new sustainable budget limits for FY 2026, and highlighted key economic and fiscal data and rankings.

The findings illustrate that overspending, rather than under-taxation, is the primary issue in most states.

The Past Decade: 2015–2024

Federal Government

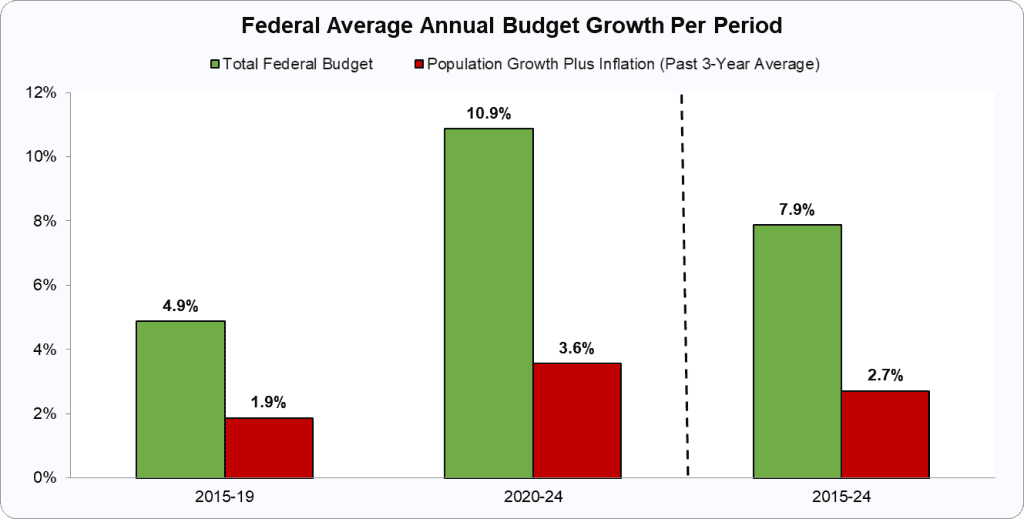

- Federal spending skyrocketed 88.0%—more than three times faster than the 27.6% increase in pop+inf.

- If Congress had simply restrained spending to this sustainable growth rate:

- The federal government would’ve spent $2.2 trillion less in 2024.

- The national debt would’ve fallen by $1.8 trillion instead of growing by $14.3 trillion.

- Cumulative debt since 2005 would have risen by $2.5 trillion, not $21.7 trillion.

- That’s trillions of dollars that could’ve stayed in people’s pockets or been invested in future prosperity, not siphoned off to fund bloated bureaucracies and waste.

State Government

- The story at the state level isn’t much better. From 2015-24, aggregate state spending by the 50 state governments, excluding funds received from the federal government, increased by 54.2% during that decade.

- Had their spending grown by the maximum rate of 27.6% in population growth plus inflation from 2015 to 2024:

- State governments would’ve spent $328 billion less than the $1.90 trillion in 2024.

- Cumulative spending across that decade would have been $1.3 trillion less than what was spent, resulting in more money in people’s pockets.

Results

When combining federal and state overspending, Americans lost over $2.5 trillion in 2024 and more than $13.4 trillion in excess taxes and debt across the decade.

State Rankings: Who Spends Smart and Who Splurges?

- Ten states kept their budgets below population growth plus inflation.

Four states kept both state funds and all funds budget growth below pop+inf over the last decade:

- Alaska

- Colorado

- North Dakota

- Wyoming

These states are the gold standard of sustainable budgeting—controlling both state funds and all funds spending, protecting taxpayers, and creating room for pro-growth tax reforms.

Six more states kept state funds growth below the benchmark:

- Louisiana

- Massachusetts

- Mississippi

- Montana

- Ohio

- Oklahoma

These states deserve credit for showing restraint with taxpayer-funded spending, even if their total spending (including federal funds) needs work.

No state kept total spending below pop+inf without also controlling state funds, which proves that sustainable budgeting begins with what states themselves control.

Standout States: Fiscal Champions in All Funds from 2015-24

Alaska (Red State Politically)

Cumulative Savings Per Family: -$103,049

Despite oil volatility, Alaska spent below sustainable levels for both state and all funds. However, the burden of paying for spending is pushed onto the oil and gas companies.

North Dakota (Red)

Cumulative Savings Per Family: -$76,458

Low taxes, low spending, big growth. South Dakota continues to shine.

Wyoming (Red)

Cumulative Savings Per Family: -$43,825

No income tax, shrinking budgets, and strong economic results. Enough said.

Colorado (Blue)

Cumulative Savings Per Family: -$25,750

Thanks to TABOR, Colorado remains a top fiscal performer—proof that constitutional spending limits work, even under Democratic control.

“Pro-Growth” States to Watch

Texas (Red)

Cumulative Cost Per Family: $750

Nearly sustainable, but state funds growth needs tighter reins.

Iowa (Red)

Cumulative Cost Per Family: $20,506

Tax reform is promising, but spending needs to be reined in to ensure its sustainability.

South Carolina (Red)

Cumulative Cost Per Family: $25,949

With 30.6% real GDP growth, the state must control spending to maintain competitiveness.

North Carolina (Red)

Cumulative Cost Per Family: $23,373

Strong growth, solid reforms. However, the budget is beginning to outpace the average taxpayer’s ability to afford it.

Tennessee (Red)

Cumulative Cost Per Family: $27,182

No income tax and strong growth mask an emerging spending issue. Lawmakers should course-correct before it grows even more out of balance.

Louisiana (Red)

Cumulative Cost Per Family: $37,347

A surprising bright spot, Louisiana’s state funds growth has stayed under control for state funds, but not for all funds.

Florida (Red)

Cumulative Cost Per Family: $42,872

With 47.5% real GDP growth over the last decade, Florida demonstrates economic growth, but it needs to spend less for sustainable growth.

Worst Offenders: The Big Spenders

California (Blue)

Cumulative Cost Per Family: $81,799

High taxes. High regulations. High departures from sustainable budgeting.

Illinois (Blue)

Cumulative Cost Per Family: $63,607

A poster child for failed fiscal policy—overspending, debt, and a shrinking population.

New York (Blue)

Cumulative Cost Per Family: $53,897

Bleeding people and capital thanks to decades of fiscal recklessness.

Minnesota (Blue)

Cumulative Cost Per Family: $42,635

Progressive budgets with regressive outcomes. Minnesotans deserve better.

New Jersey (Blue)

Cumulative Cost Per Family: $40,089

High spending. High taxes. High cost of living. Low accountability.

Conclusion: Let People Prosper, Not Government

When governments grow faster than the taxpayers who fund them, something has to give—usually household budgets, jobs, or future opportunities. The solution is clear: increase spending no more than population growth plus inflation at every level of government. States like Alaska, Colorado, North Dakota, and Wyoming prove this is possible. And if the federal government had followed suit, we’d have less debt, more growth, and stronger families. The path forward is simple—but it requires political courage. Enforce spending limits. Cut excessive budgets. Let people—not politicians—prosper.

Use the following map or dropdown menu to view detailed state-specific budget and economic information.