Building on Part I, Part II, and Part III of this series, here’s a video debunking some online socialists who are inexplicably popular.

As you can see, the video cites real socialists – i.e., people who defend policies such as government ownership of the means of production.

What’s amusing – though predictable – is that none of those economic illiterates were willing to be interviewed by John Stossel.

I suspect their cowardice is mostly due to the fact that they are trying to defend the indefensible.

It’s easy to spout nonsense to a friendly audience of acolytes, but it’s entirely different to defend preposterous beliefs when being grilled by someone – like Stossel – who actually knows something.

As you can see in the video, all of the specific socialist talking points got debunked (such as socialists taking credit for advances in China and Vietnam that were only possible because of partial economic liberalization).

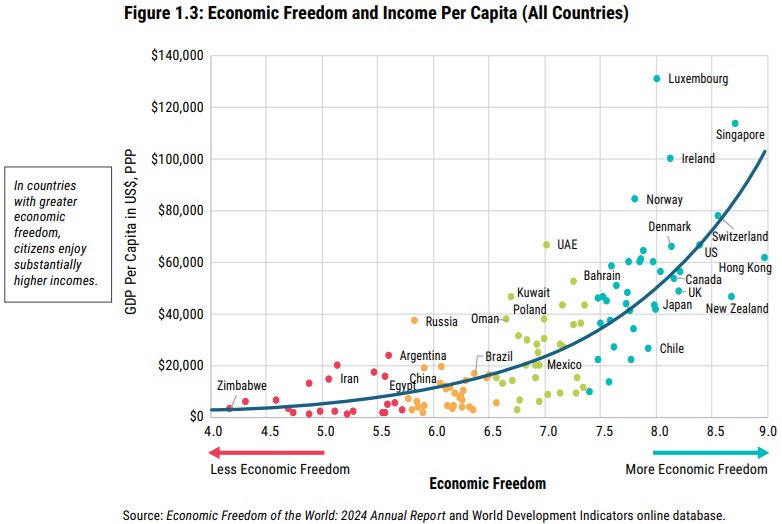

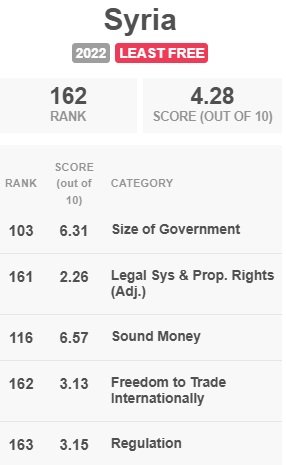

So my contribution to today’s discussion will be to cite data from the most-recent edition of Economic Freedom of the World.

I already wrote about that report, but primarily to bemoan the global decline in economic freedom and to highlight the world’s freest and more repressive economies.

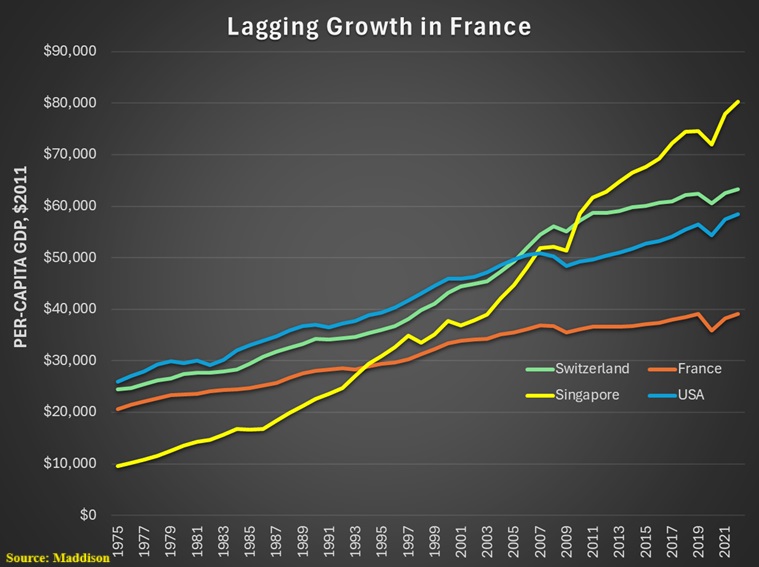

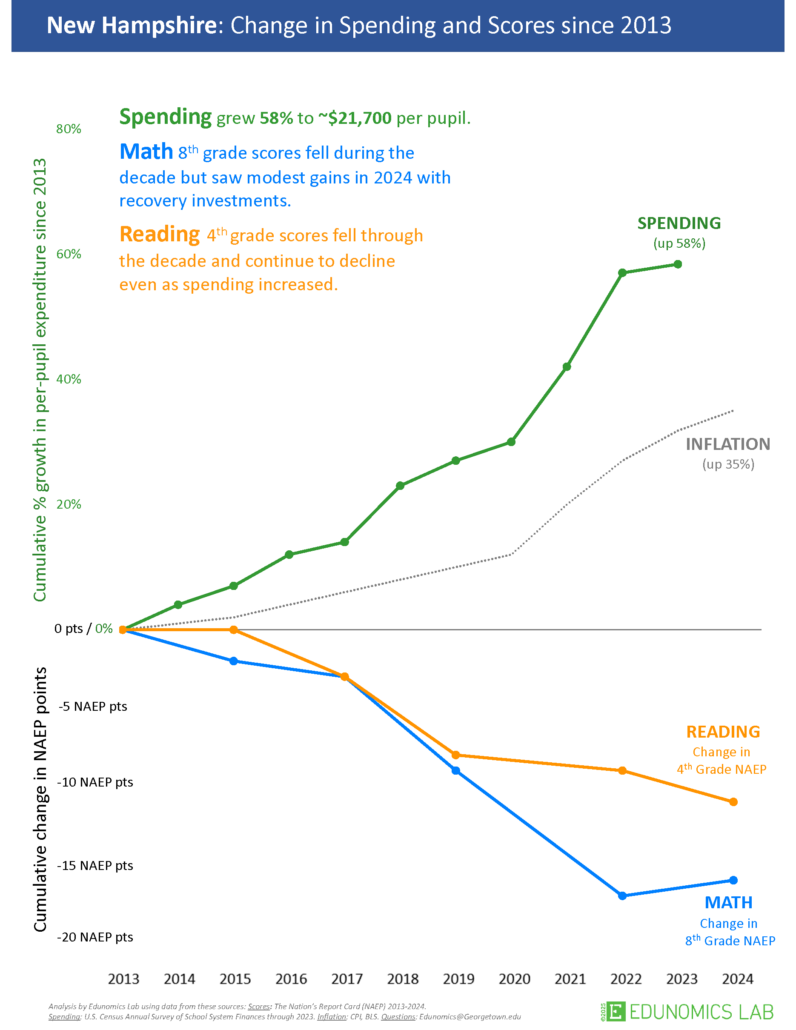

But I did include this graph, which is (or at least should be) a slam-dunk argument for more economic liberty and less socialism.

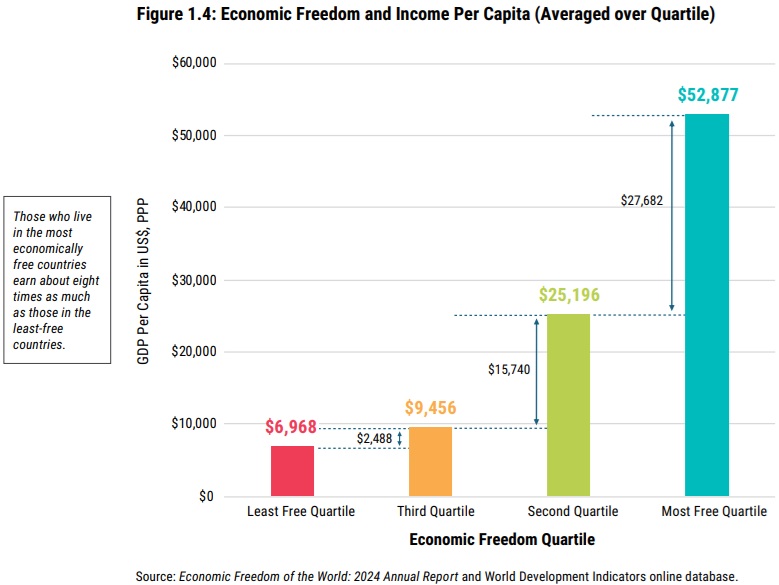

And here are two more graphs from EFW that are worth sharing.

Figure 1.4 looks at average per-capita economic output by quartile. As you can see, the world’s freest economies have more than seven times as much per-capita GDP.

Socialists claim to be concerned about the poor.

Many of them, I’m sure, are very sincere.

But they also are very wrong about their preferred economic system. That’s because Figure 1.9 reveals that material deprivation is almost non-existent if free economies, but is very common in statist economies.

I’ll close by noting that there are different strains of statism, so not every lowly ranked country is socialist. But the flip side of that statement is that every socialist country is lowly ranked. Which is a statement that belongs in the not-surprising file.