A lot has happened if you look at the past 100 years of German economic policy.

- Hyperinflation leading to Hitler’s National Socialists taking power.

An impressive free-market revival after World War II.

An impressive free-market revival after World War II.- A growing welfare state after the imposition of a value-added tax in the 1960s.

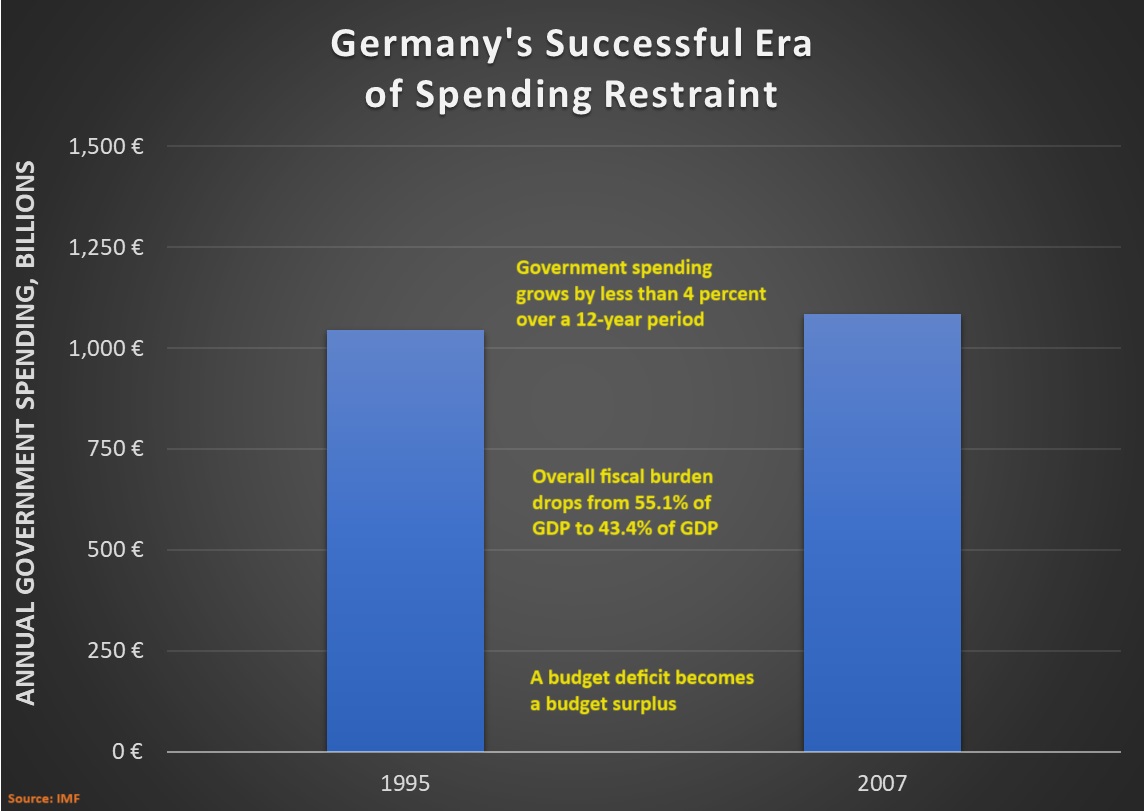

- Some semi-impressive spending restraint starting in the mid-1990s.

- Very disappointing fiscal policy starting about 10 years ago.

Unfortunately, bad fiscal policy has become worse fiscal policy.

First, some background from an editorial in the Wall Street Journal.

The backdrop is Germany’s long-brewing retirement crisis. A rapidly aging population means the “statutory pension” costs some €360 billion per year, or 8% of GDP. Payroll tax revenue is insufficient to fund benefits, forcing Berlin to tap into general tax revenue to fill a gap of €96 billion for the social-insurance system as a whole last year.

Left unchecked, this single entitlement will require escalating tax increases to fund… The legislation up for a vote this week doesn’t fix this. The main provision guarantees that the pension payout will be maintained at 48% of the average wage until 2031, meaning benefits will increase automatically as wages grow. When it was first introduced a few years ago, this “stabilization” provision overruled a prior formula that increased benefits more slowly. Extending the higher benefit level is a costly concession to the center-left Social Democratic Party (SPD)… lawmakers associated with the CDU’s youth wing…demanding bigger reforms as the price for their votes. Mr. Merz and the SPD need that support to pass anything through the Bundestag with the coalition’s 12-seat majority.

For more background, here are some passages from a report in the U.K.-based Telegraph.

…the so-called “young rebels”…are fighting tooth and nail against proposed changes to Germany’s pension system. They say the cost of these changes will put a €200bn (£175bn) burden on the taxpayers of their generation, funding the generous pensions of German baby boomers.

…These changes will cumulatively add to government spending, heading north of €15bn a year. By 2040, the extra spending is expected to total €200bn, which a shrinking pool of working-age taxpayers must bear. Germany’s fertility rate of 1.39 is one of the lowest in Europe. …“Merz’s pension package would add 0.2pc of GDP to German pension spending by 2028. In 2035, pension spending would be 0.4pc of GDP higher than in a constant policy scenario.”

Here’s a chart from the article, showing the increased burden of government spending.

So what happened?

Did the rebels block the additional spending?

Nope. Merz and his socialist friends got their way. Here’s some of what ABC reported.

Germany’s parliament on Friday approved a pension reform package that had prompted a rebellion in the ranks of Chancellor Friedrich Merz’s party… A group of 18 young lawmakers in Merz’s center-right Union bloc — a larger number than his coalition’s parliamentary majority — had balked for weeks at a provision that said after 2031,

the pension level would be slightly higher than under current law. They argued that that would cost up to 15 billion euros ($17.5 billion) per year, and that this would come at the expense of young people. Merz’s junior coalition partners, the center-left Social Democrats, were adamant that the package be approved unchanged. Merz backed that. …Friday’s result saved him from the potential embarrassment of getting the measures passed thanks only to abstentions by the opposition Left Party.

The final sentence in the excerpt deserves more attention.

Merz’s Christian Democrat Party is in a coalition with the Social Democrat Party. The Left Party is basically former communists, even more statist than the Social Democrats.

So the bottom line is that Merz was able to increase spending by cooperating officially with the socialists and unofficially with the communists.

Ludwig Erhard is rolling in his grave.

P.S. Predictably, the IMF is encouraging Germany’s fiscal decay.