I supported Brexit for two reasons.

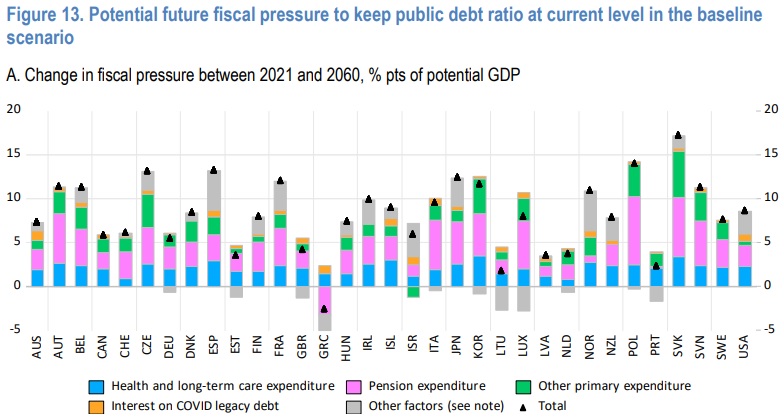

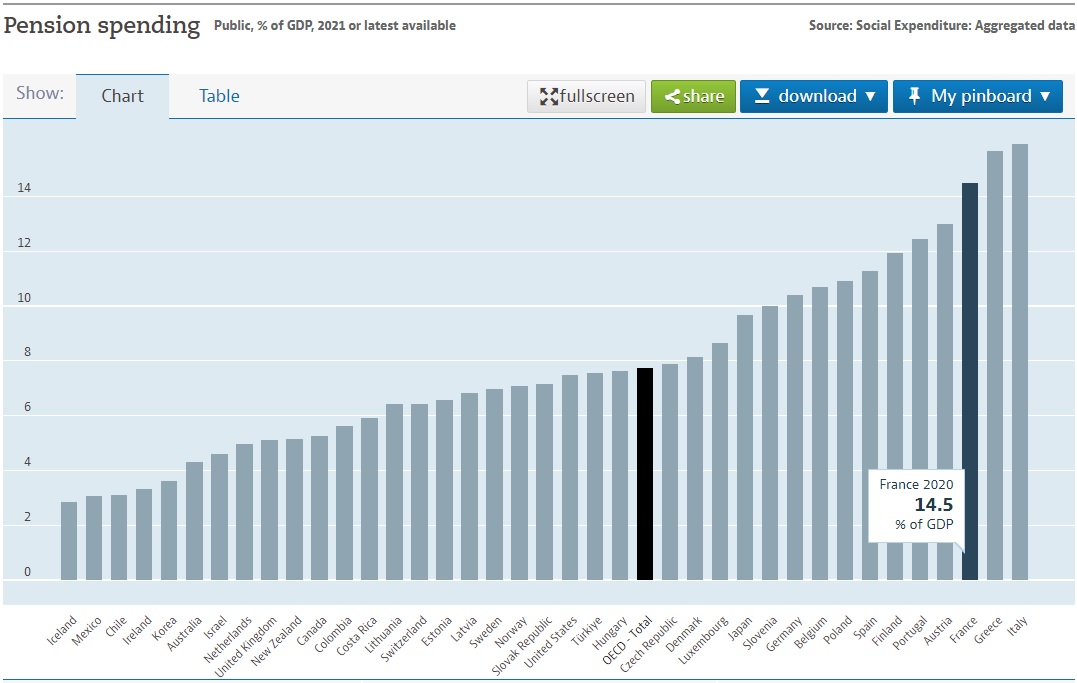

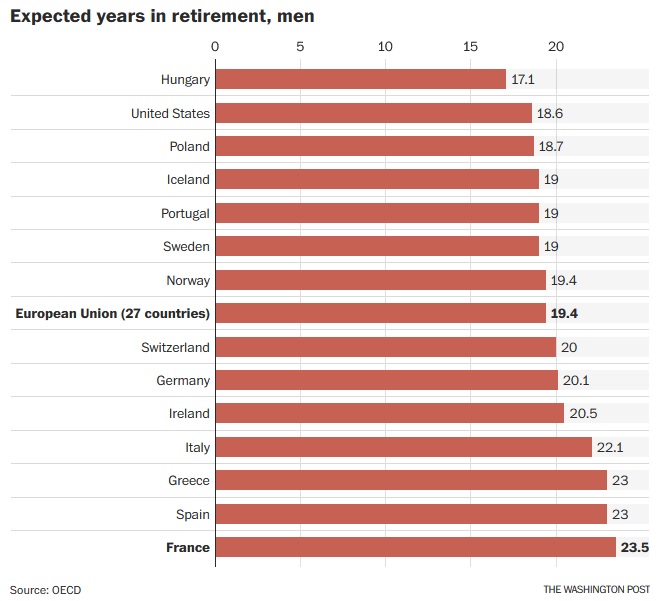

- The European Union is a sinking ship and a vote for Brexit spares British taxpayers from being on the hook when massive bailouts occur.

- Leaving the European Union would give the United Kingdom more leeway to choose a pro-market, Singapore-on-Thames policy agenda.

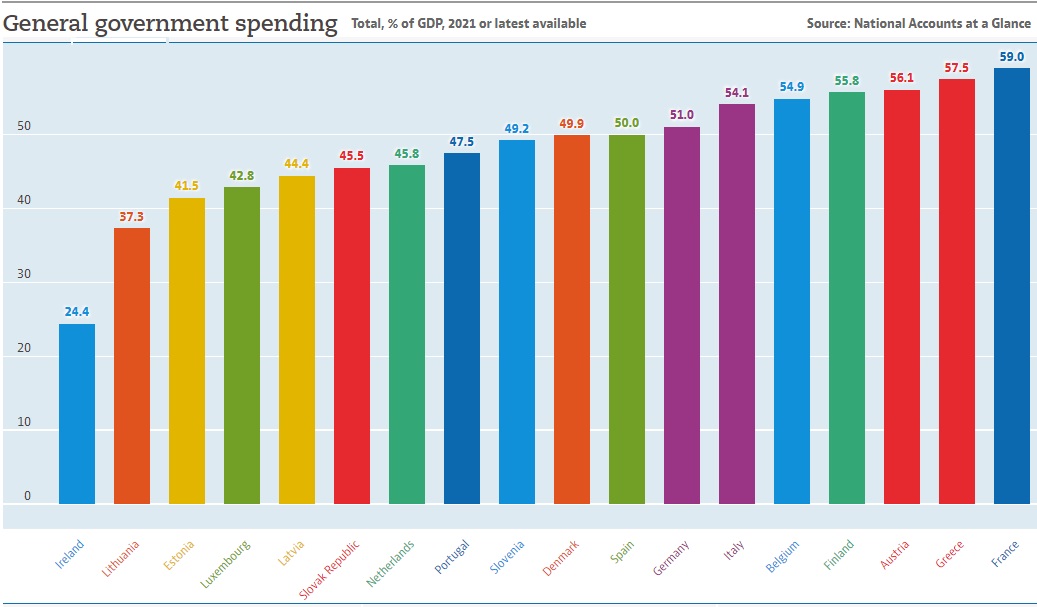

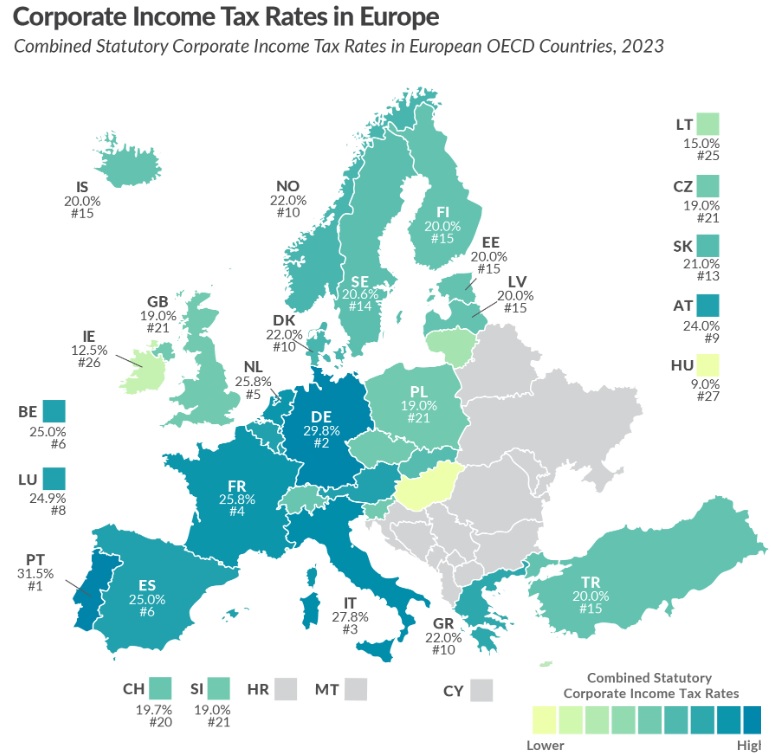

The good news is that Point #1 is still completely relevant. In the long run (which may be short run), I fear the European Union will will turn into the Welfare State Transfer Union.

The not-so-good news is that Point #2 is still relevant, but British politicians have moved policy in the wrong direction ever since Brexit. I’m tempted to joke that they are bad at geography and opted for Caracas-on-Thames by mistake.

All things considered, I think Brexit was the right choice, but I’m very disappointed that British politicians have not taken advantage of their nation’s independence from Brussels.

But what if I’m wrong? That heretical thought crossed my mind when I saw these estimates showing that Brexit has produced all sorts of negative outcomes.

The charts all come from a new study published by the National Bureau of Economic Research, authored by

Here are the key findings from the abstract.

This paper examines the impact of the UK’s decision to leave the European Union (Brexit) in 2016. Using almost a decade of data since the referendum, we combine simulations based on macro data with estimates derived from micro data collected through our Decision Maker Panel survey.

These estimates suggest that by 2025, Brexit had reduced UK GDP by 6% to 8%, with the impact accumulating gradually over time. We estimate that investment was reduced by between 12% and 18%, employment by 3% to 4% and productivity by 3% to 4%. These large negative impacts reflect a combination of elevated uncertainty, reduced demand, diverted management time, and increased misallocation of resources from a protracted Brexit process.

This seems like bad news, and I instinctively agree that “the protracted Brexit process” was not helpful for the U.K. economy.

But what about the study’s main findings? Did Brexit actually reduce GDP, investment, employment, and productivity?

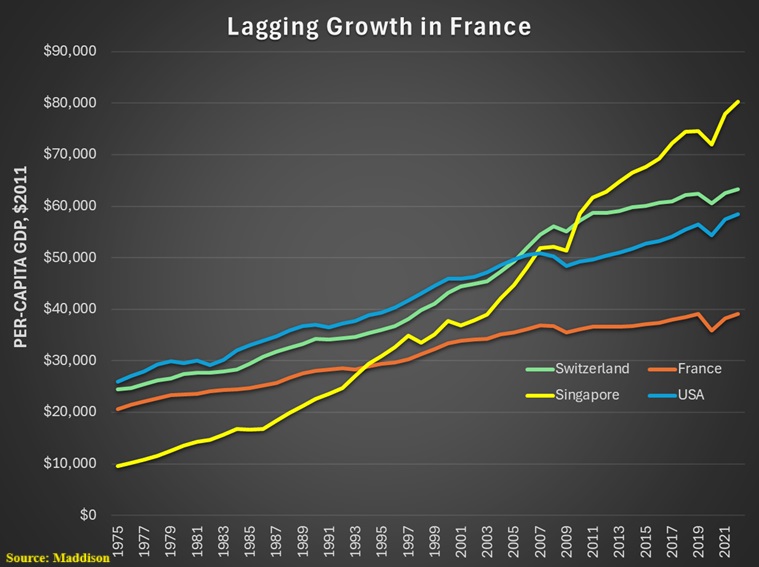

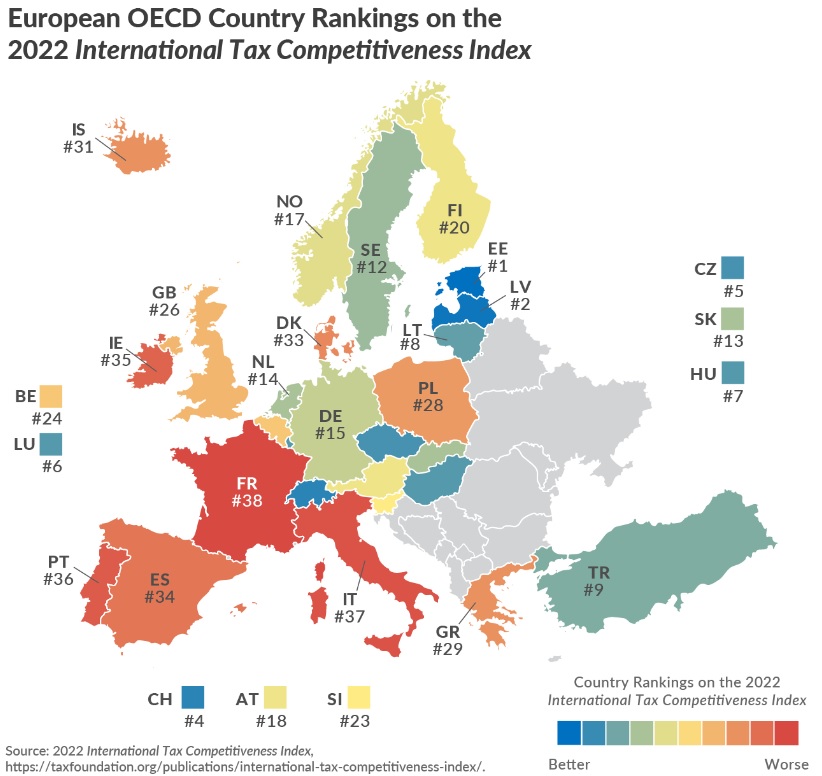

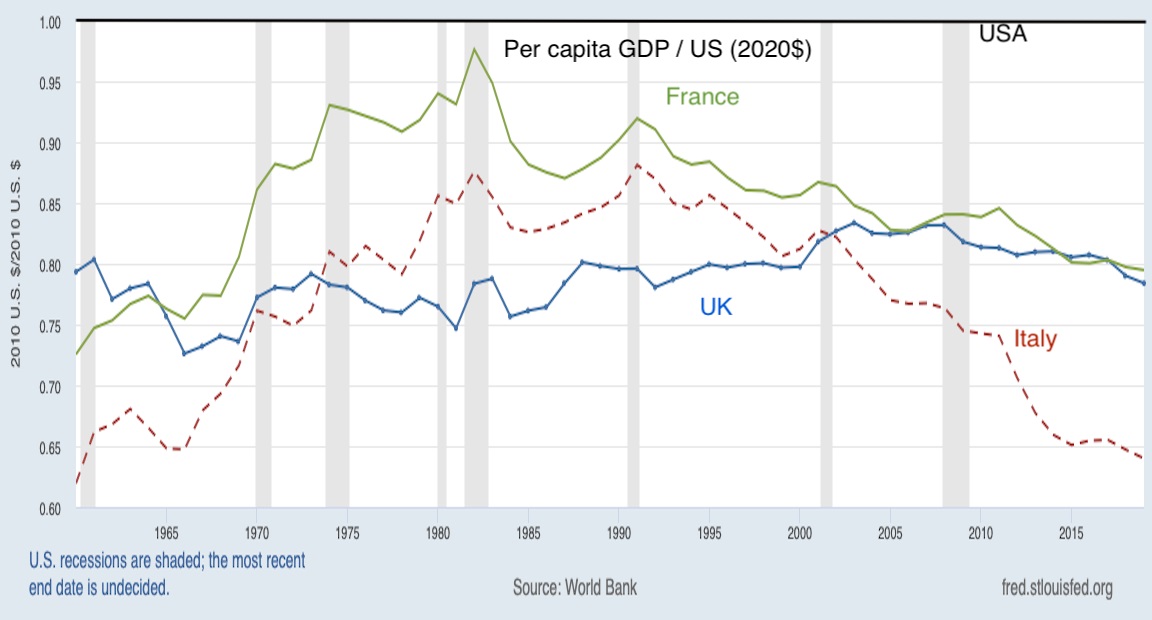

The study is based on data from 33 nations (North America, Japan, and Europe), which is certainly a reasonable approach. But I wondered what the data would show if we just compared the United Kingdom to the other two major European economies?

So I crunched some numbers from the IMF’s big database and found that France, Germany, and the United Kingdom have all suffered from anemic economic performance, with the U.K. being in the middle of the pack.

I then contemplated why these major economies have all averaged less than 1 percent growth over the past 10 years.

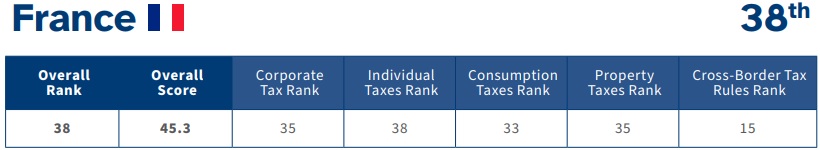

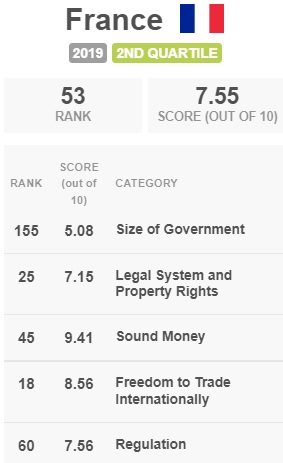

So I went to Economic Freedom of the World and found a possible answer. They’ve all suffered a loss of economic freedom since 2015.

And the United Kingdom, for what it’s worth, has been the worst of the worst.

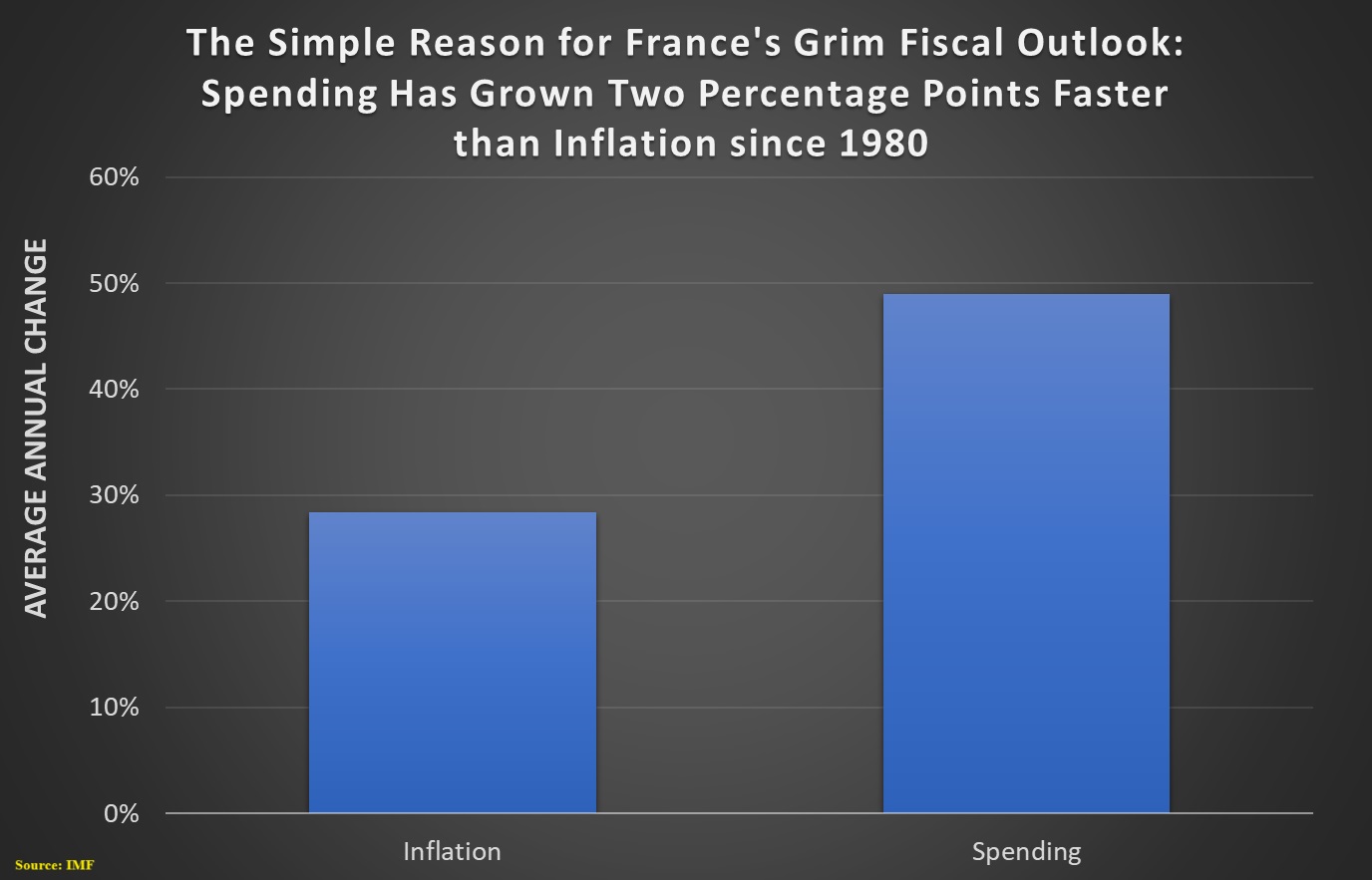

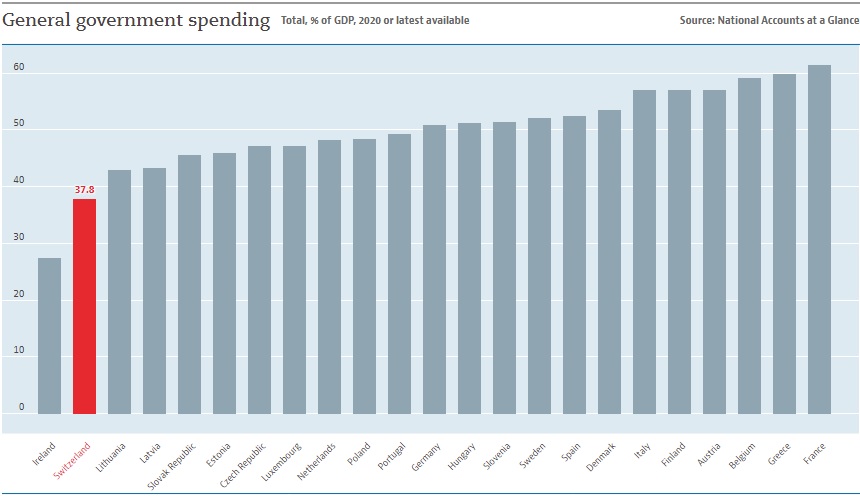

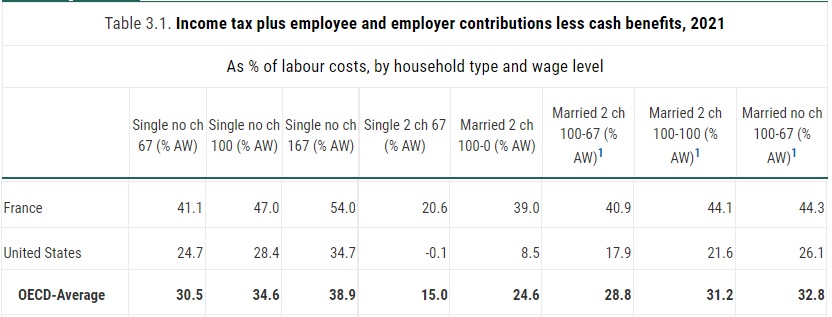

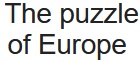

Since I’m a fiscal wonk, I also went to the IMF database to specifically see what has happened to the burden of taxes and spending in Europe’s Big-3 economies.

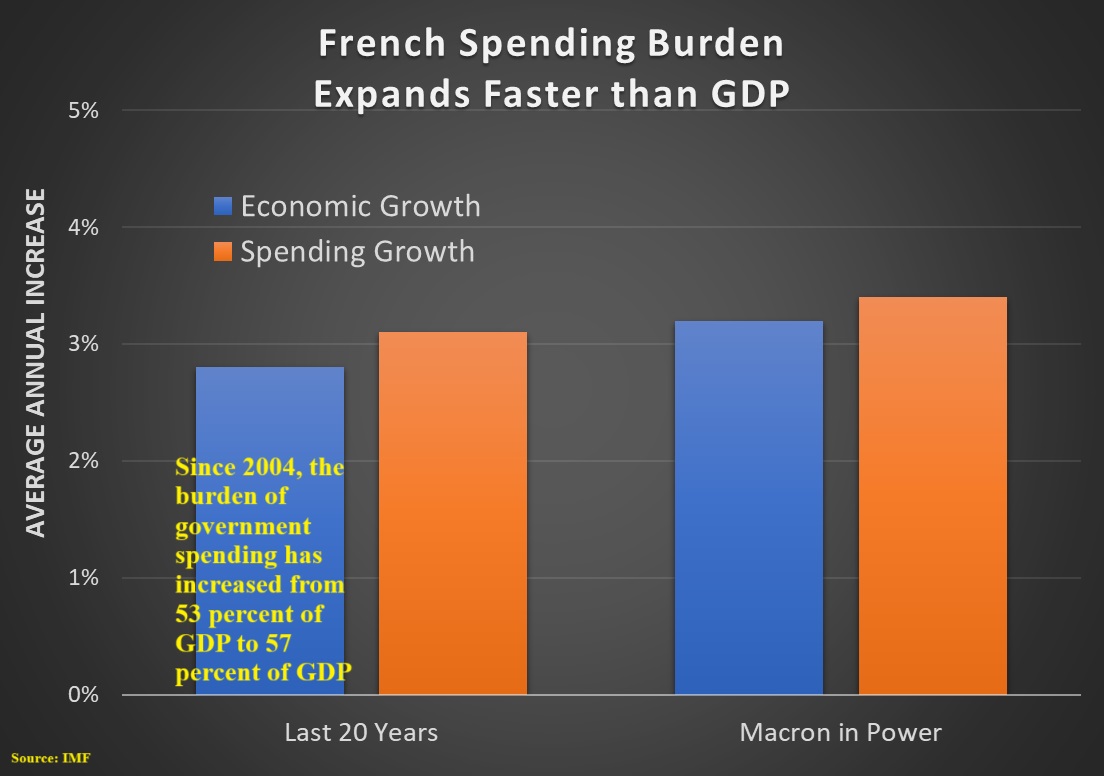

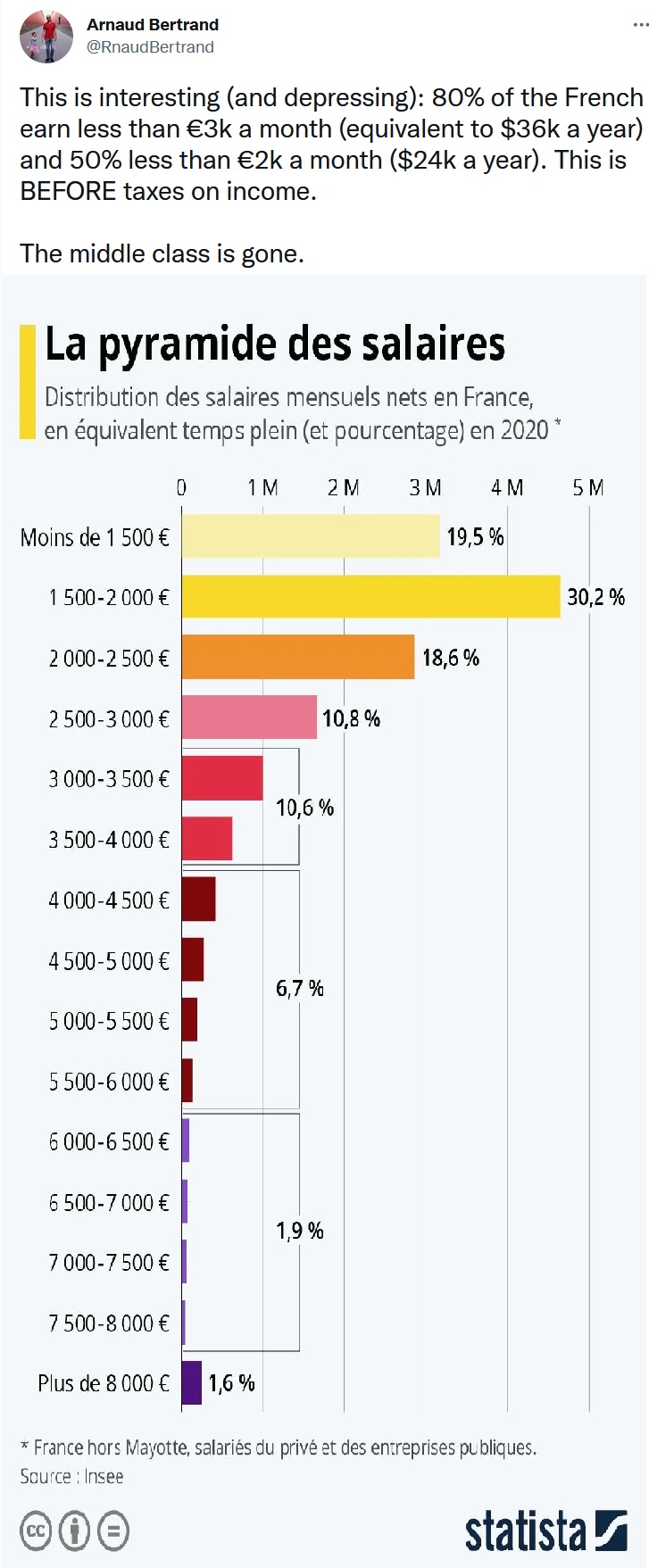

Interestingly, France has moved slightly in the right direction since 2015 (when you’re at the bottom of the barrel, it’s hard to get worse).

Germany and the United Kingdom, however, have both substantially deteriorated, with Germany being especially bad on spending and the U.K. doing a bad job across the board.

Looking at all this data, and thinking about the results of the aforementioned study, leads me to ask a few questions.

- If Brexit was so terrible for the United Kingdom, why have France and Germany endured similar economic weakness?

- Is it possible that the weakness of the United Kingdom has been caused by statist domestic policy instead of Brexit?

- Why is it better to compare the U.K. to 33 rather different nations rather than the two nations that are most similar?

I’m open to there being good answers to these questions, but suffice the say the study doesn’t provide them.

Since today’s column is a defense of Brexit, I’ll also address an article last year for the Institute of Economic Affairs. Emmanual Comte made a libertarian argument against Brexit.

Here are some of his claims.

Many libertarians supported Brexit, believing it would reduce governmental layers… They saw it as an opportunity to escape the control of Brussels’ technocracy, expecting increased autonomy and economic freedom. …They imagined a country liberated from Brussels… The critique of the EU often portrays it as an overreaching superstate…This interpretation overlooks the true nature and purpose of the EU. Contrary to being an emerging superstate, the EU essentially operates as a collection of regimes designed to check excessive state power. …Membership in the EU involves states mutually restricting their arbitrary power – for example, of limiting international trade or controlling the movement of people. …This approach is evident in the EU’s efforts to curtail excessive state intervention in trade, capital movement, and the flow of people. In monetary matters, the creation of an independent European Central Bank (ECB) following the Maastricht Treaty was aimed at imposing restraint on monetary debasement – a common strategy of overreaching states. …In retrospect, the libertarian argument supporting Brexit appears to have been fundamentally flawed in its understanding of the European Union’s nature and functions.

I agree with Mr. Comte that the European Union has some positive features.

I’m even open to the idea that it is a net plus for poorer nations from Southern and Eastern Europe to join (though it’s definitely not a slam-dunk case).

But as I wrote recently about Iceland, I think richer nations lose by being part of the Brussels-based bureaucracy. Especially if they have a history of being more market-friendly.

P.S. I definitely agree with Mr. Comte’s analysis of the U.K.’s misguided post-Brexit approach to policy.

After Brexit, the United Kingdom’s policy direction did not follow the libertarian ideal of limited state intervention. …Libertarians had hoped for a reduction in state involvement, greater economic freedom, and a move towards decentralised power. However, the reality has been quite different.

Bad policy from the Conservative Party and bad policy from the Labour Party. Maybe the British people need a Brexit from their own government?