Argentina is a sobering example of how statist policies can turn a rich nation into a poor nation.

I’m not exaggerating. After World War II, Argentina was one of the world’s 10-richest nations.

I’m not exaggerating. After World War II, Argentina was one of the world’s 10-richest nations.

But then Juan Peron took power and initiated Argentina’s slide toward big government, which eroded the nation’s competitiveness and hampered growth.

Even the Washington Post‘s Bureau Chief shares my assessment.

Perón’s rise marked the start of the country’s long, slow slide. …big-government populism squandered Argentine’s fortunes on nationalized railroads and ports. Perón’s pro-labor policies cultivated devout working-class followers but also laid the groundwork for the conversion of his party into an entity that would mirror a corrupt union. …The country battled bouts of damaging inflation in 1955, 1962, 1966 and 1974. …in the 1980s, Argentina saw a bonanza of public-sector hiring, bloated budgets… Cristina Fernández de Kirchner, the Perónist ex-president, took the helm a decade ago, ushering in a new era of fudged financial data and populism.

followers but also laid the groundwork for the conversion of his party into an entity that would mirror a corrupt union. …The country battled bouts of damaging inflation in 1955, 1962, 1966 and 1974. …in the 1980s, Argentina saw a bonanza of public-sector hiring, bloated budgets… Cristina Fernández de Kirchner, the Perónist ex-president, took the helm a decade ago, ushering in a new era of fudged financial data and populism.

Thanks to endless bouts of bad policy, the nation suffers from perpetual crisis.

…a country stuck in what has now become its natural state: crisis. As if living a deja vu, I flipped on the TV to once again hear Argentine newscasters fretting about bailouts, the diving peso and fears of default. Beggars — even more than before — panhandled on the same corner by an imposing church on Santa Fe Avenue. As others had done years before, stores advertised going-out-of-business sales. …Argentina is doomed to a repeating history of financial emergencies. You can almost set your watch to it, and, worryingly, the intervals between implosions are growing ever shorter.

If we focus on policy this century, there was plenty of bad policy under the previous Peronist-oriented Presidents.

And since government amassed so much power over the economy, nobody should be surprised by this BBC report about rampant corruption.

More than a dozen people have been arrested in Argentina after copies of notebooks were found detailing what seem to be illicit political payments. They were kept by Oscar Centeno,  who was employed as a driver by a public works official and describe delivering bags of cash. The notebooks cover from 2003 to 2015, when Cristina Fernández and her late husband Néstor Kirchner were president. …She has previously said she is being politically persecuted by the current government, who want to distract people from the country’s economic problems. …the payments total around US$56m (£43m), but Judge Claudio Bonadio says the corruption network could reached up to US$160m.

who was employed as a driver by a public works official and describe delivering bags of cash. The notebooks cover from 2003 to 2015, when Cristina Fernández and her late husband Néstor Kirchner were president. …She has previously said she is being politically persecuted by the current government, who want to distract people from the country’s economic problems. …the payments total around US$56m (£43m), but Judge Claudio Bonadio says the corruption network could reached up to US$160m.

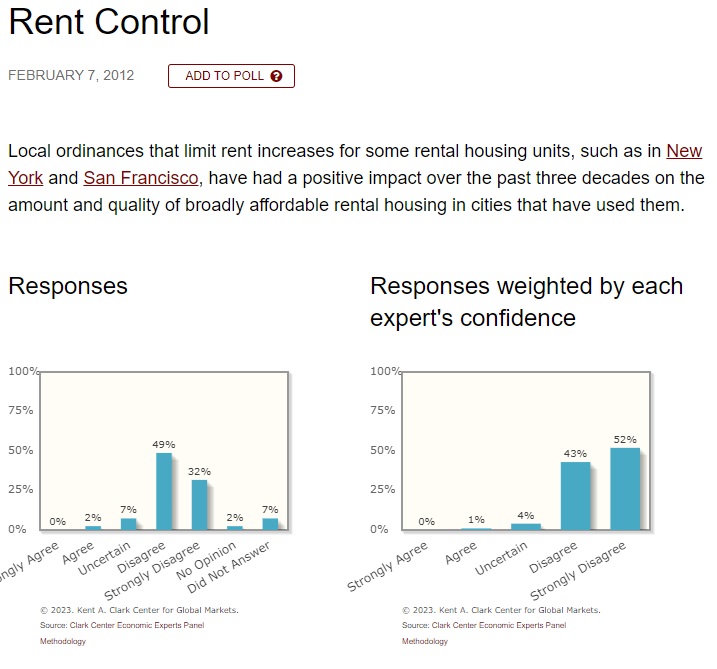

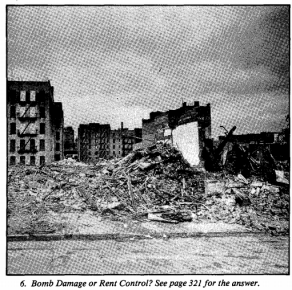

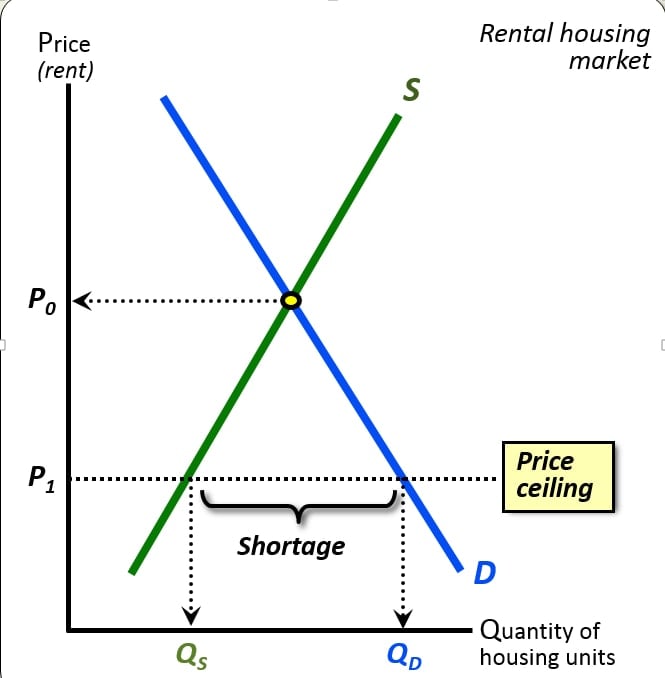

The Economist reports that the current president, Mauricio Macri, is imposing his share of bad policies, including price controls.

The measures are a change of course for a president who sought to undo the effects of more than a decade of populist government. The most important one is a…revival of a price-control mechanism in force under the two Peronist presidents who preceded him, Néstor Kirchner and his wife, Cristina Fernández de Kirchner. In Mr Macri’s version, which he, like the Kirchners, calls “precios cuidados” (“curated prices”), the price of 64 consumer items, from milk to jam, will be frozen for six months (ie, until the eve of the election). An “army” of inspectors, under the direction of the production ministry, will enforce supermarkets’ adherence to the freeze.

of a price-control mechanism in force under the two Peronist presidents who preceded him, Néstor Kirchner and his wife, Cristina Fernández de Kirchner. In Mr Macri’s version, which he, like the Kirchners, calls “precios cuidados” (“curated prices”), the price of 64 consumer items, from milk to jam, will be frozen for six months (ie, until the eve of the election). An “army” of inspectors, under the direction of the production ministry, will enforce supermarkets’ adherence to the freeze.

Price controls are spectacularly misguided.

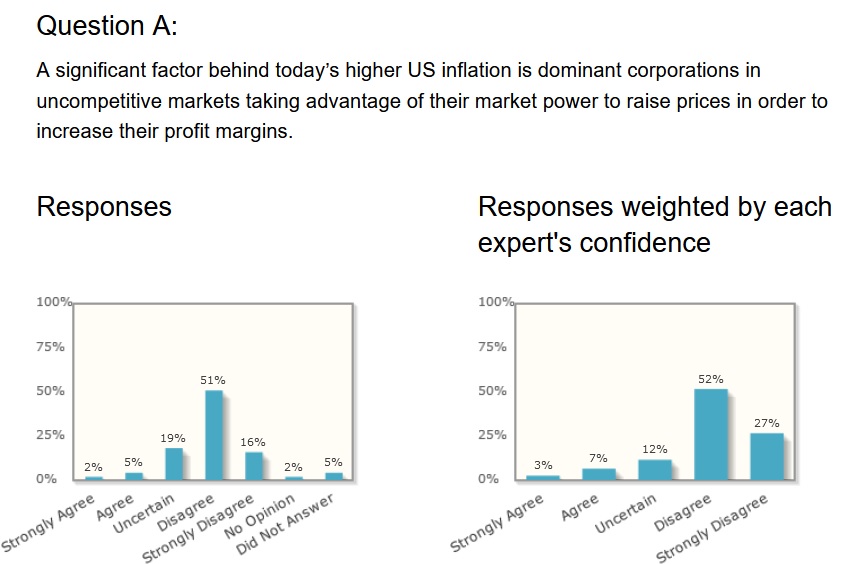

Politicians cause inflation by having the central bank create too much money. They then act as if the result rise in prices is the fault of “greedy businesses” and impose controls.

All of which never ends well (see Venezuela, for instance).

But Macri is also adopting other bad policies.

The government has also opened new credit lines for pensioners and families with children and expanded a plan to build new homes with state financing.

He obviously hopes his short-sighted policies will enable him to prevail in the upcoming elections.

And maybe he will if his main opponent is similarly bad.

But at least one candidate supports pro-market reforms.

Argentine economist José Luis Espert once described President Mauricio Macri’s political movement as “kirchnerism with good manners,”… Now a presidential candidate himself, Espert wants to make government a lot less polite. “We need to lay off approximately 1.5 million public employees,” Espert, the head of the newly-formed Libertarian party, told AQ in an exclusive interview. “What I propose is a complete U-turn.” …The economist claims that he is the only candidate who can actually turn around what he describes as “Argentina’s century-long failure, marked by economic populism.” …“We need to abandon our model of import substitution and of running budget deficits, and revise our labor laws, which are similar to those during Italian fascism. We need to have free trade and a state that can pay for itself through reasonable taxes,” added Espert, who on Feb. 2 released a book called The Complicit Society, in which he describes “the economic myths that led Argentina to decadency.”

“What I propose is a complete U-turn.” …The economist claims that he is the only candidate who can actually turn around what he describes as “Argentina’s century-long failure, marked by economic populism.” …“We need to abandon our model of import substitution and of running budget deficits, and revise our labor laws, which are similar to those during Italian fascism. We need to have free trade and a state that can pay for itself through reasonable taxes,” added Espert, who on Feb. 2 released a book called The Complicit Society, in which he describes “the economic myths that led Argentina to decadency.”

Wouldn’t it be a great ending to the story if Argentina become another Chile?

My fingers certainly will be crossed (as they are currently for Brazil).

Ironically, even though the International Monetary Fund has subsidized bad policy in Argentina with periodic bailouts, some of the economists who work at the IMF actually understand what’s plaguing the country.

Here are some excerpts from their study, starting with a description of how big government is stifling prosperity.

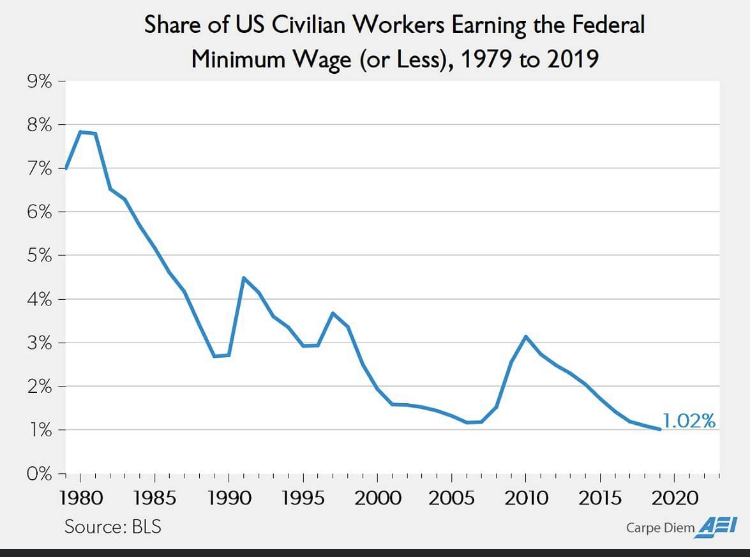

Argentina’s economic fortune has been on a declining path for a long time. Argentina’s per capita output relative to that of advanced economies nearly halved over the past 50 years. …yearly labor productivity growth has been close to zero on average since 1980… Argentina’s regulatory and administrative burden on businesses is one of the heaviest among EMs… Argentina has the worst overall PMR index among 42 OECD and non-OECD countries, owing to high barriers to entrepreneurship (including complex regulatory procedures which impede firm entry/expansion, and barriers in network sectors), …high trade and other external barriers, and a significant involvement of the state in the economy, both through state-owned enterprises and price controls. …Stringent labor market regulations, such as high firing costs and restrictions on temporary employment, hamper efficient allocation of resources in the economy, discourage investment, and lead to labor underutilization and informality… High tax burden, especially on labor, have similar adverse effects on investment, labor utilization (particularly formal employment), and overall competitiveness of the economy.

is one of the heaviest among EMs… Argentina has the worst overall PMR index among 42 OECD and non-OECD countries, owing to high barriers to entrepreneurship (including complex regulatory procedures which impede firm entry/expansion, and barriers in network sectors), …high trade and other external barriers, and a significant involvement of the state in the economy, both through state-owned enterprises and price controls. …Stringent labor market regulations, such as high firing costs and restrictions on temporary employment, hamper efficient allocation of resources in the economy, discourage investment, and lead to labor underutilization and informality… High tax burden, especially on labor, have similar adverse effects on investment, labor utilization (particularly formal employment), and overall competitiveness of the economy.

Here’s a chart showing how Argentina is de-converging, which is remarkably depressing since conventional theory tells us that poor nations should be catching up with rich nations.

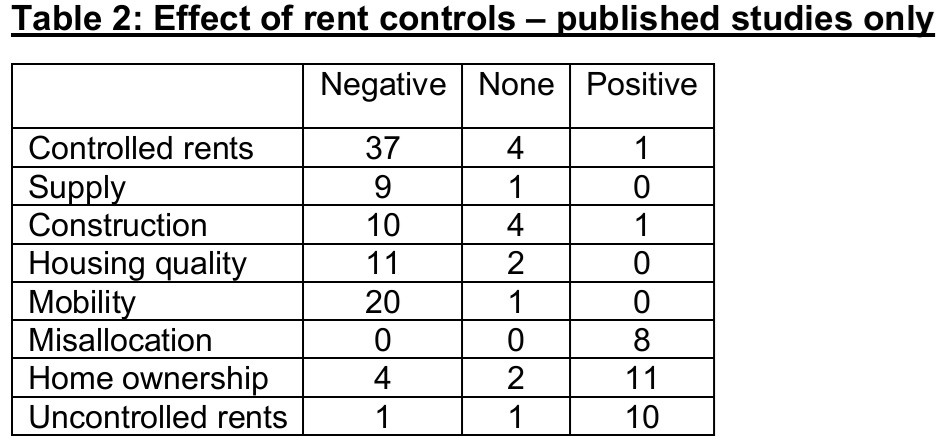

Here are the main findings from the study.

The main objective of this paper is to…assess the role of the reforms in boosting long-term GDP growth through their impact on (i) capital accumulation, (ii) labor utilization, and (iii) total factor productivity or efficiency. …The paper finds that structural reforms can have significant impact on long-term GDP growth through all three supply-side channels. …An ambitious reform effort, which were to improve business regulatory environment (closing half the gap with Australia and New Zealand over two decades), would add 1–1½ percent to average annual growth of GDP. Reducing trade tariffs and payroll taxes (closing half the gap with Australia and New Zealand) could each boost average annual real GDP growth by about 0.1 percent.

Keep in mind, by the way, that even small increments of sustained growth make a huge difference to a nation’s long-run prosperity.

Here’s a table showing the IMF’s suggested reforms.

I actually agree with almost everything on the list.

The only mistake is calling for aggressive anti-trust laws. Yet history teaches us that such laws wind up being tools to protect incumbent companies.

Moreover, the best way to fight monopolies is to have completely open entry to the marketplace.

But I don’t want to quibble. By IMF standards, that list of proposed policies is excellent.

P.S. Pope Francis inexplicably wants to export the failed Argentine model to the rest of the world. Not surprisingly, I think Thomas Sowell and Walter Williams have a better approach.

Read Full Post »

Nixon was worse, in my not-so-humble opinion, and LBJ, Obama, and Biden also were bad, as were both Bush presidencies.

Nixon was worse, in my not-so-humble opinion, and LBJ, Obama, and Biden also were bad, as were both Bush presidencies.