Yesterday’s column was about a new report from Olivier De Schutter, a bureaucrat at the United Nations who has the grandiose title of being the Special Rapporteur on extreme poverty and human rights.

Mr. De Schutter claims that the welfare state (he calls it “social protection”) has become “punitive,” in part because of policies such as work requirements and anti-fraud measures.

Mr. De Schutter claims that the welfare state (he calls it “social protection”) has become “punitive,” in part because of policies such as work requirements and anti-fraud measures.

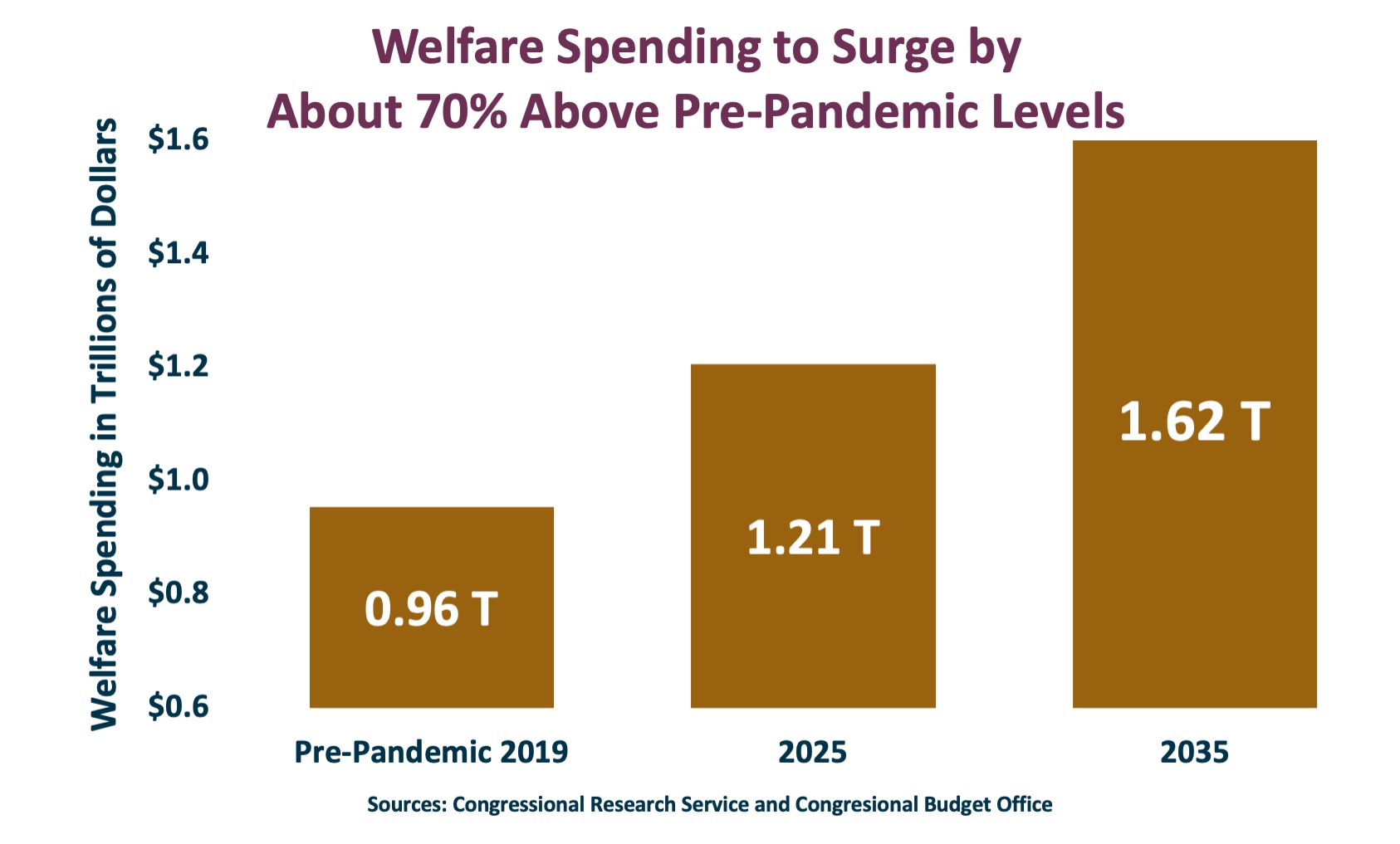

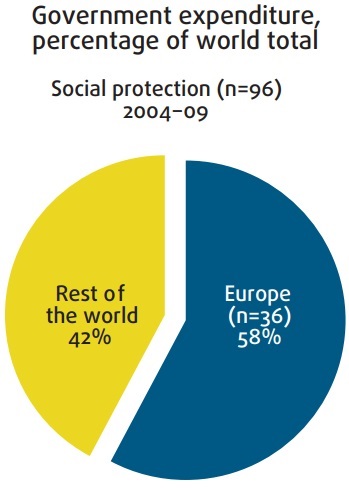

I responded by sharing a chart from Our World in Data, which shows that so-called social protection outlays have increased dramatically over time. And I also warned the burden of social spending is projected to increase even more in the future because of demographic change.

Looking at the issue from a macro perspective, the U.N. report was misleading and deceptive.

Today, let’s look at a specific example.

If you look at page 16 of the report (available here), you will find this dystopian analysis of what has happened in Argentina since the election of Javier Milei.

At the time of his election, 86 per cent of Argentines believed the economy was doing poorly, around a quarter of the population was affected by food insecurity and faith in democratic politics was dwindling (only 68 per cent of citizens expressed support for democracy by 2023, compared with 90 per cent in 2008).

Mr. Milei has since made deep cuts to public spending and social protection programmes, including vetoing pension increases and scaling back free medications for retirees. Minimum pensions are 5.3 per cent below the purchasing power they had in November 2023, and the amount barely covers 30 per cent of the basic food basket for senior citizens. In the name of austerity, the Government of Argentina has also reduced medication coverage: 800,000 senior citizens no longer have their medications covered by public health insurance. And public investment has halted: Argentina stopped building schools, kindergartens, health centres, hospitals and housing. People in poverty are thus paying the highest price for the restoration of fiscal balance.

Sounds horrible, right?

But let’s look at some actual real-world data. We’ll start with the fact that the U.N. bureaucrat is correct about spending restraint in Argentina. President Milei achieved the world’s largest-ever peacetime reduction in the burden of government spending.

Did this mean, as Mr. De Schutter wrote, that “People in poverty are thus paying the highest price for the restoration of fiscal balance”?

Actually, poor people are among the biggest beneficiaries of Milei’s libertarian policies.

Actually, poor people are among the biggest beneficiaries of Milei’s libertarian policies.

The poverty rate has been dramatically reduced in a remarkably short period of time. Mr. De Schutter and the rest of his colleagues at the United Nations should be celebrating Milei’s accomplishments!

By the way, poverty is still falling. Here’s a tweet with the latest data. The numbers for both poverty and severe poverty are getting continually better.

Suffice to say the U.N. report did not include these numbers. At the very least, this is a huge lie of omission.

What really matters, though, is that Milei has shown that free enterprise is the right recipe for poverty reduction.

If U.N. bureaucrats actually cared about people escaping poverty, they would have their fingers crossed that Milei’s party does well in this Sunday’s mid-term elections. If that happens, Milei can adopt additional reforms to further reduce poverty and restore prosperity.

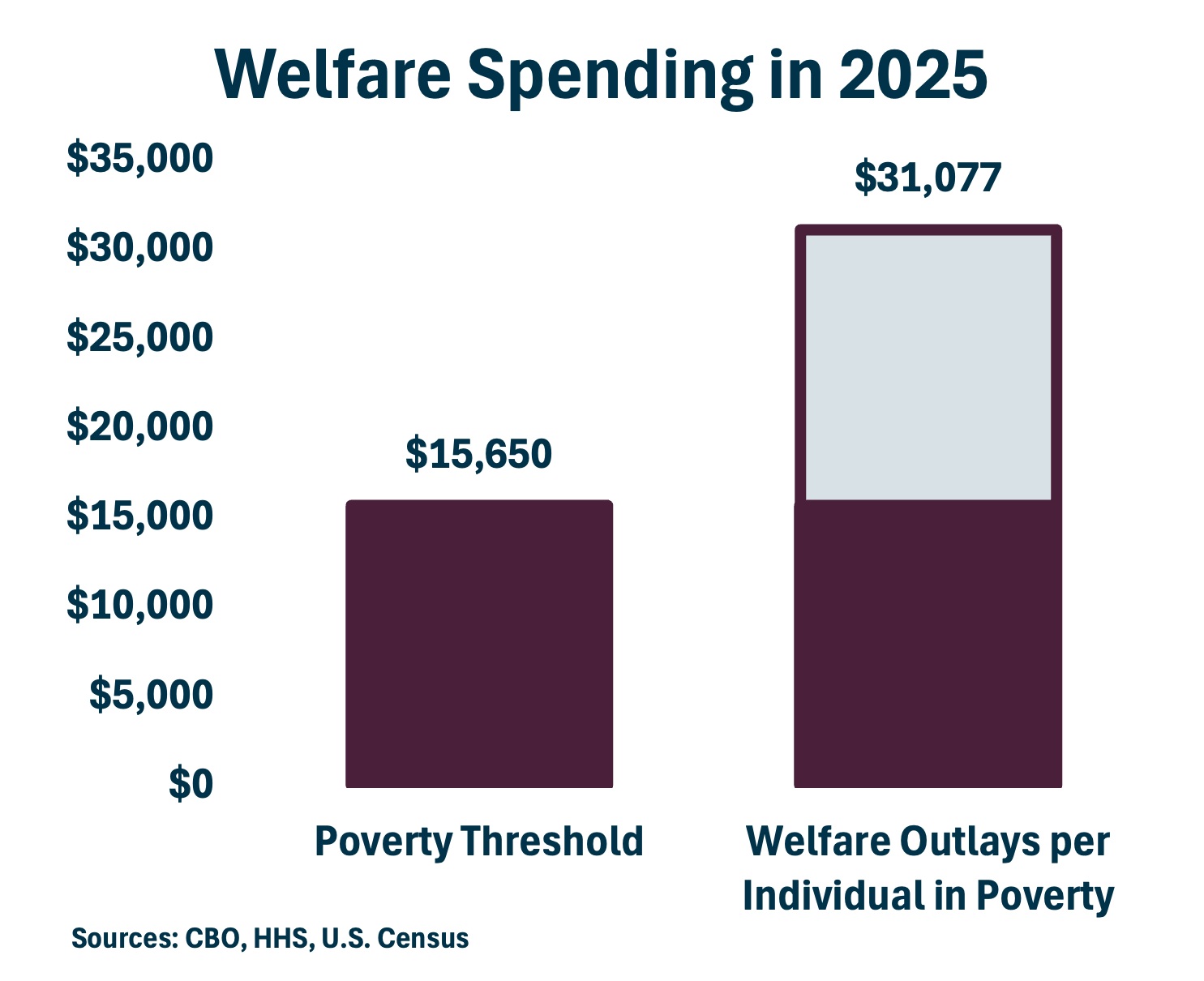

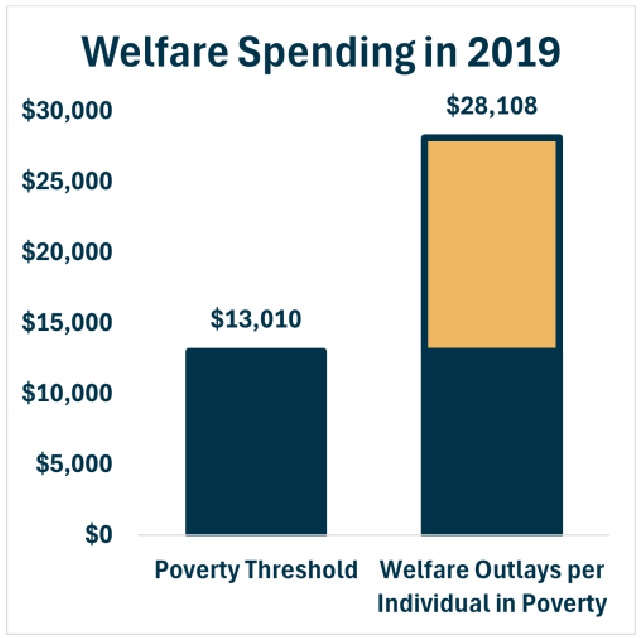

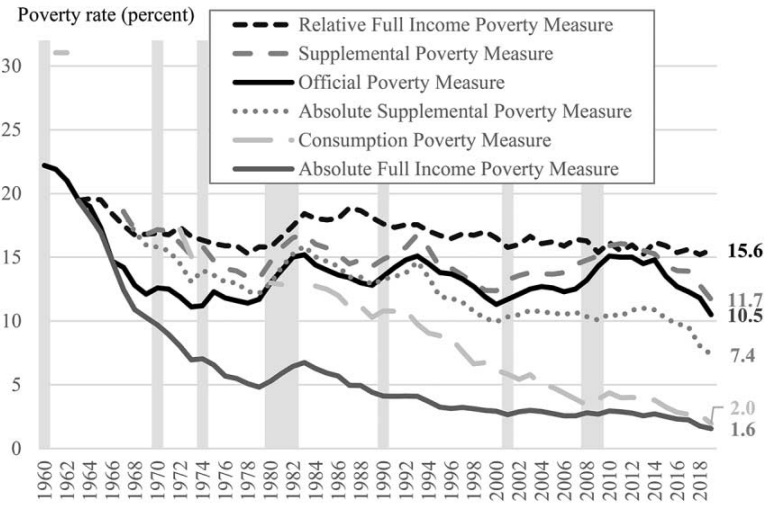

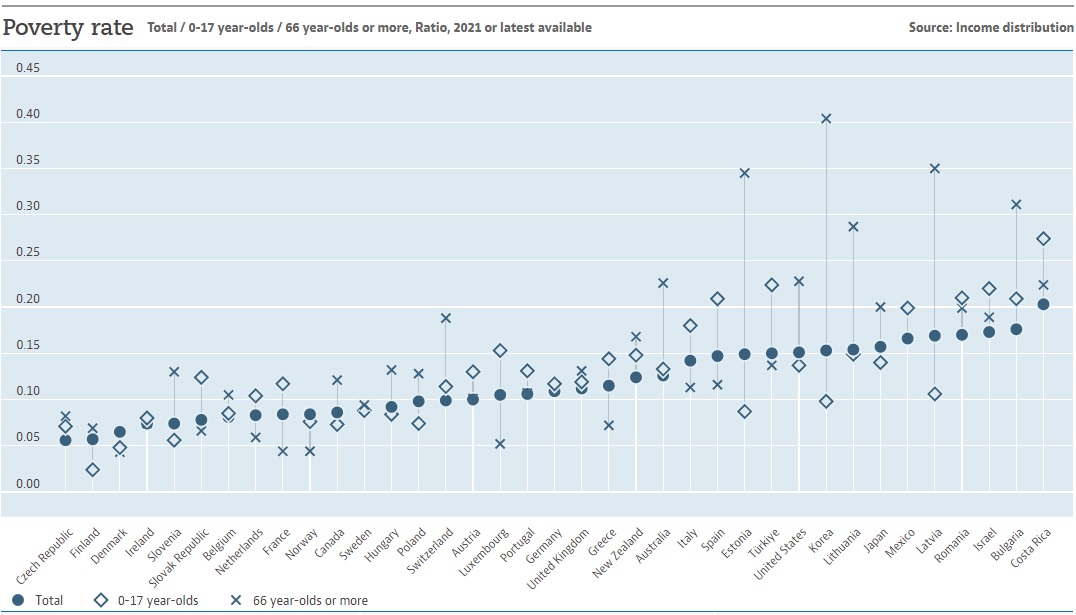

P.S. The United Nations also has a track record of lying about poverty in the United States.