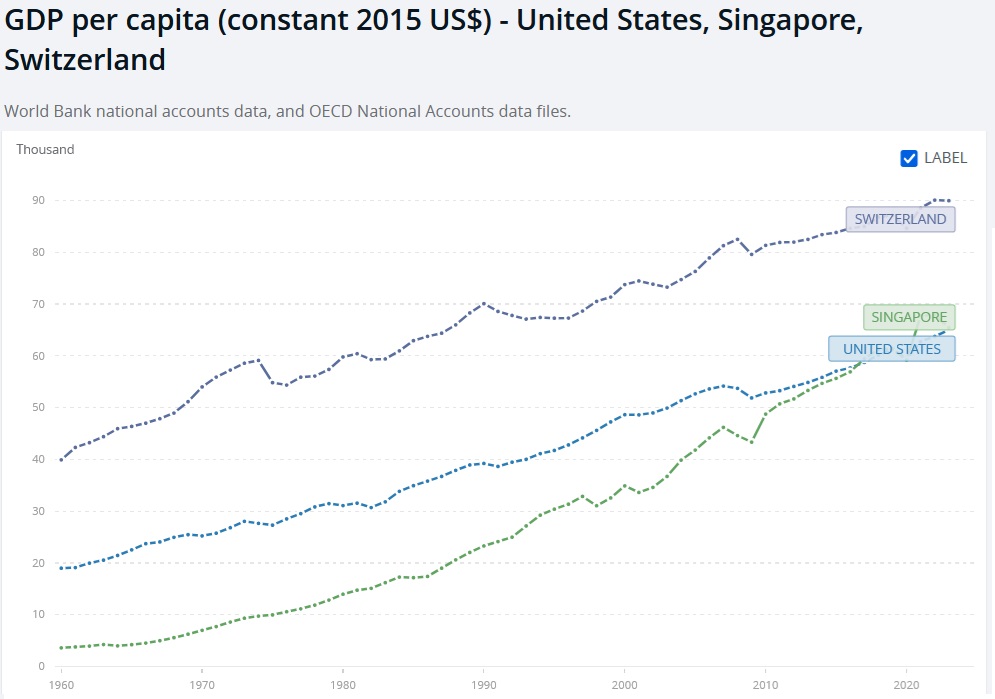

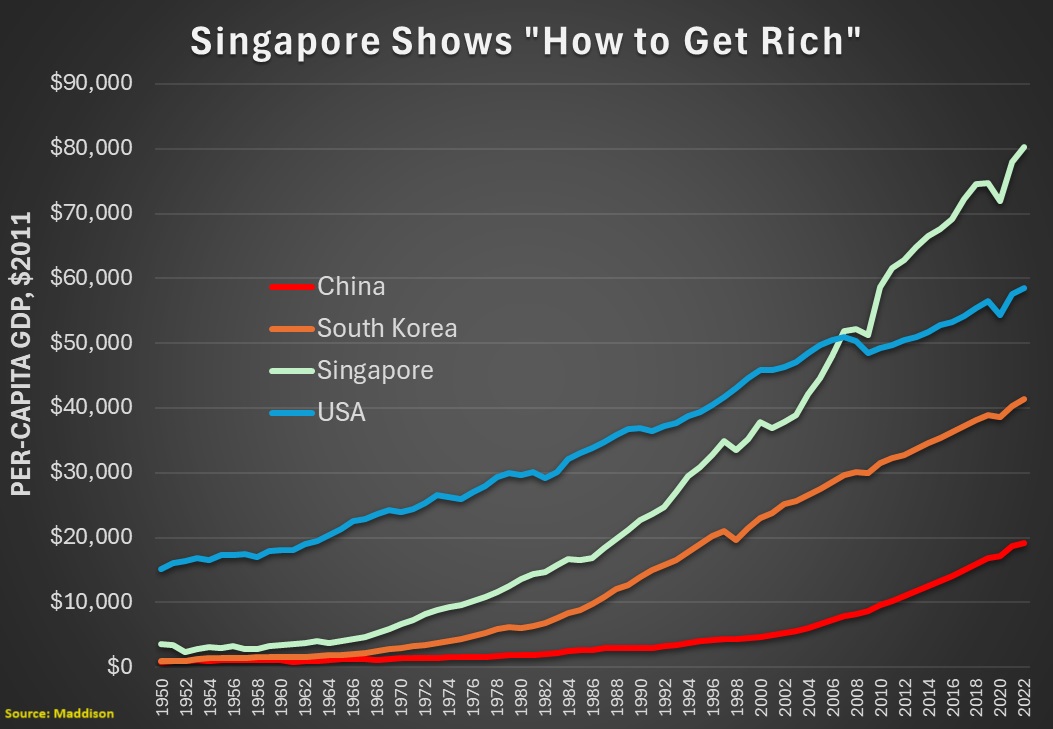

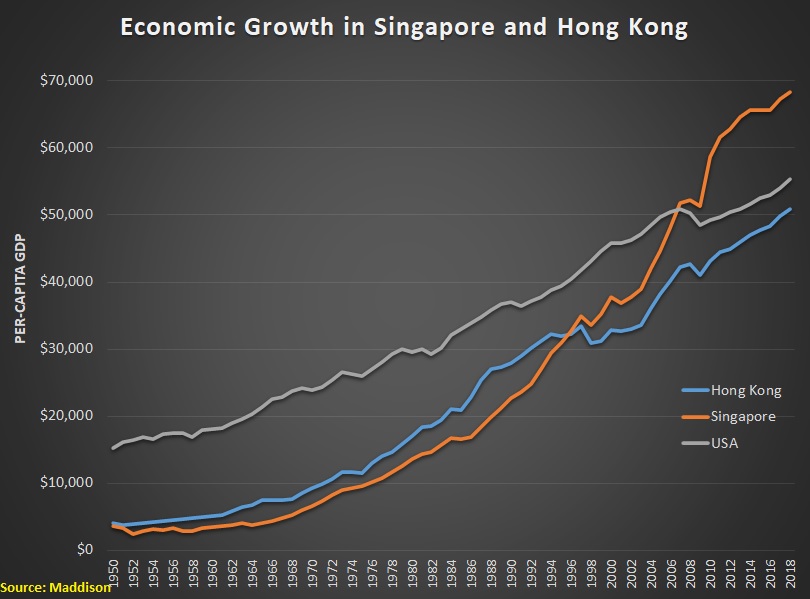

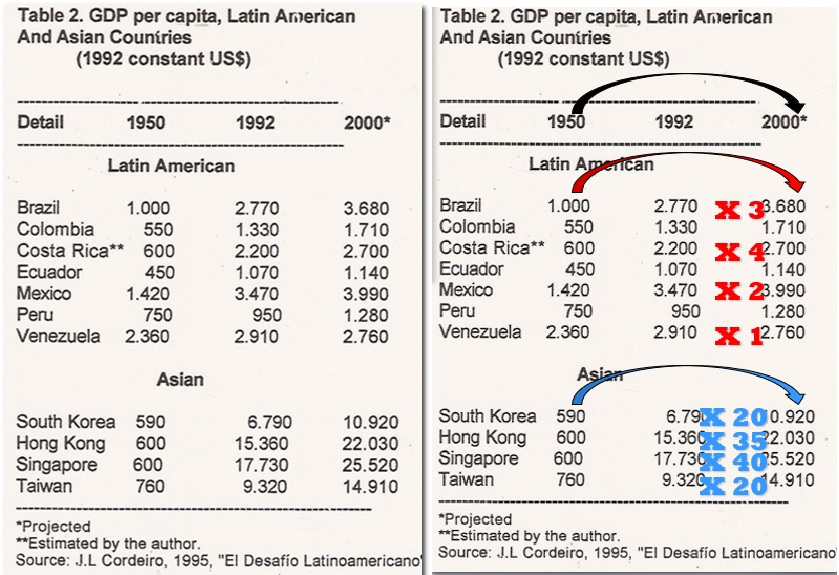

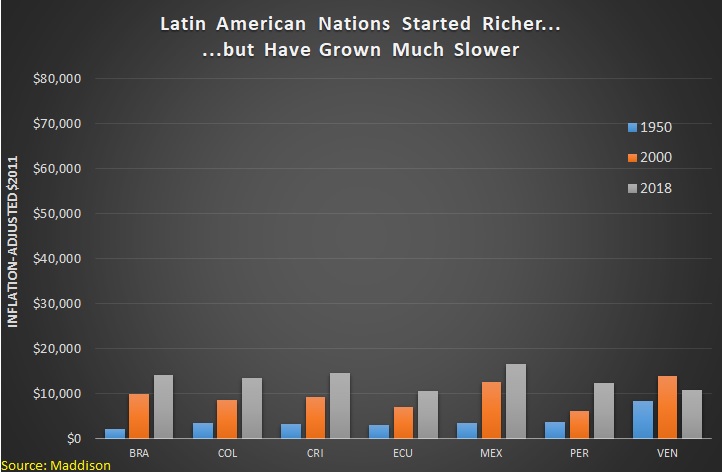

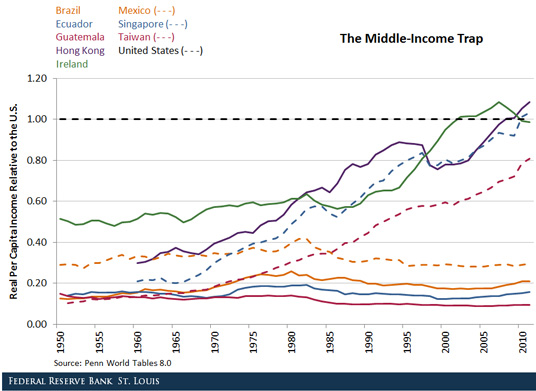

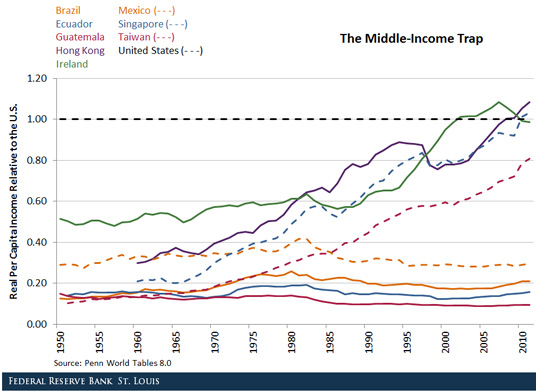

In Part I of this series, I explained that Singapore’s pro-market policies allowed it to catch up – and then surpass – the United States.

Let’s start Part II with a video explaining the country’s climb to prosperity.

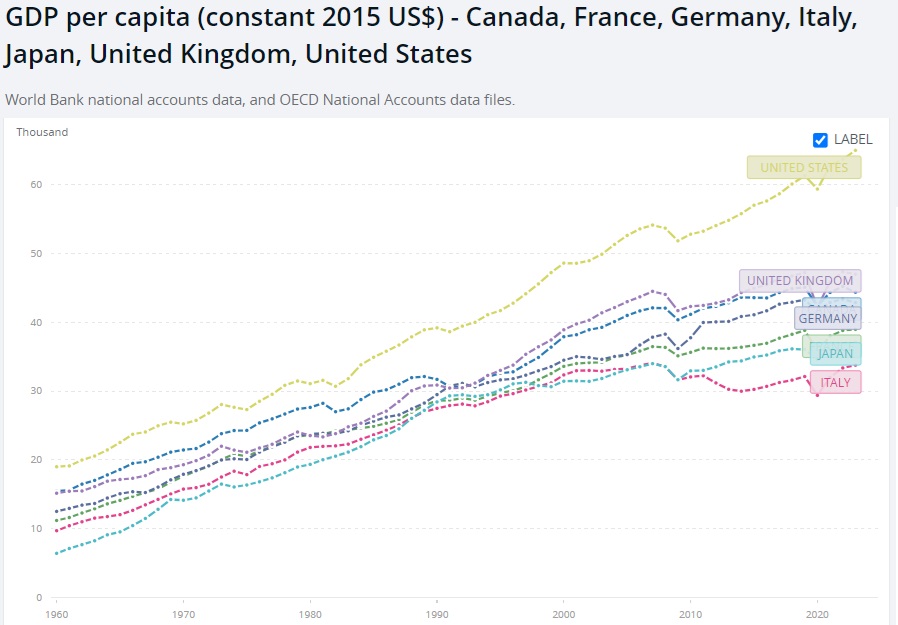

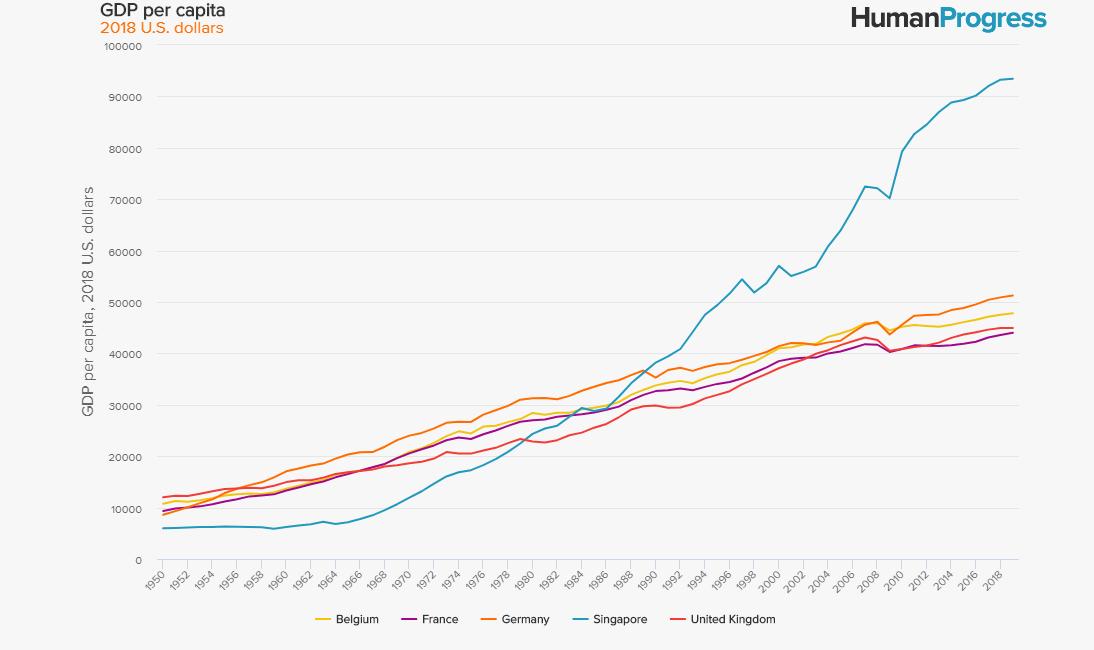

I’m motivated to write about Singapore today after seeing a chart showing how Singapore is doing dramatically better than its former colonial master, the United Kingdom.

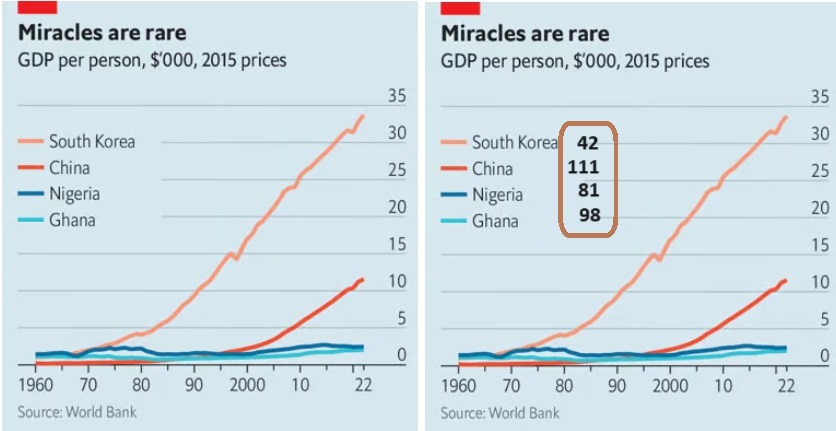

As you can see, we definitely have a new example for the Anti-Convergence Club.

So why has Singapore been so successful?

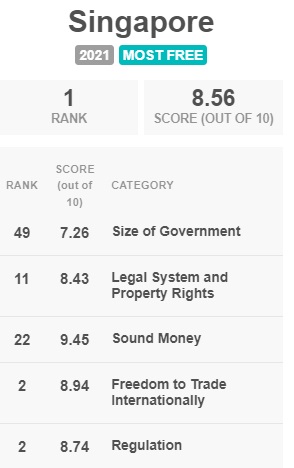

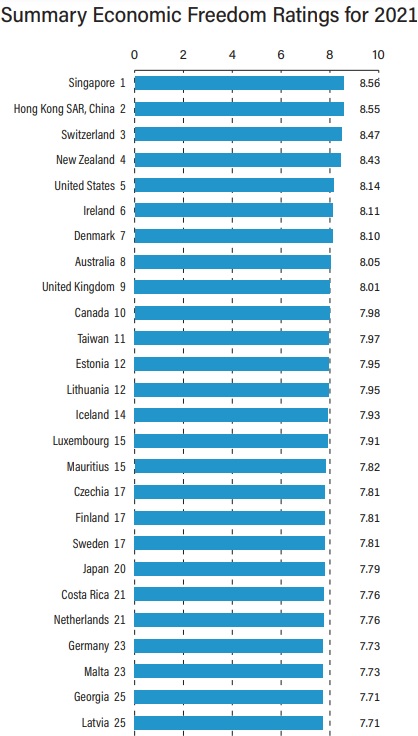

The answer is that the nation enjoys very high levels of economic liberty. It ranks #1 in the Index of Economic Freedom and ranks #2 in Economic Freedom of the World (and almost surely will be #1 when the new edition is released).

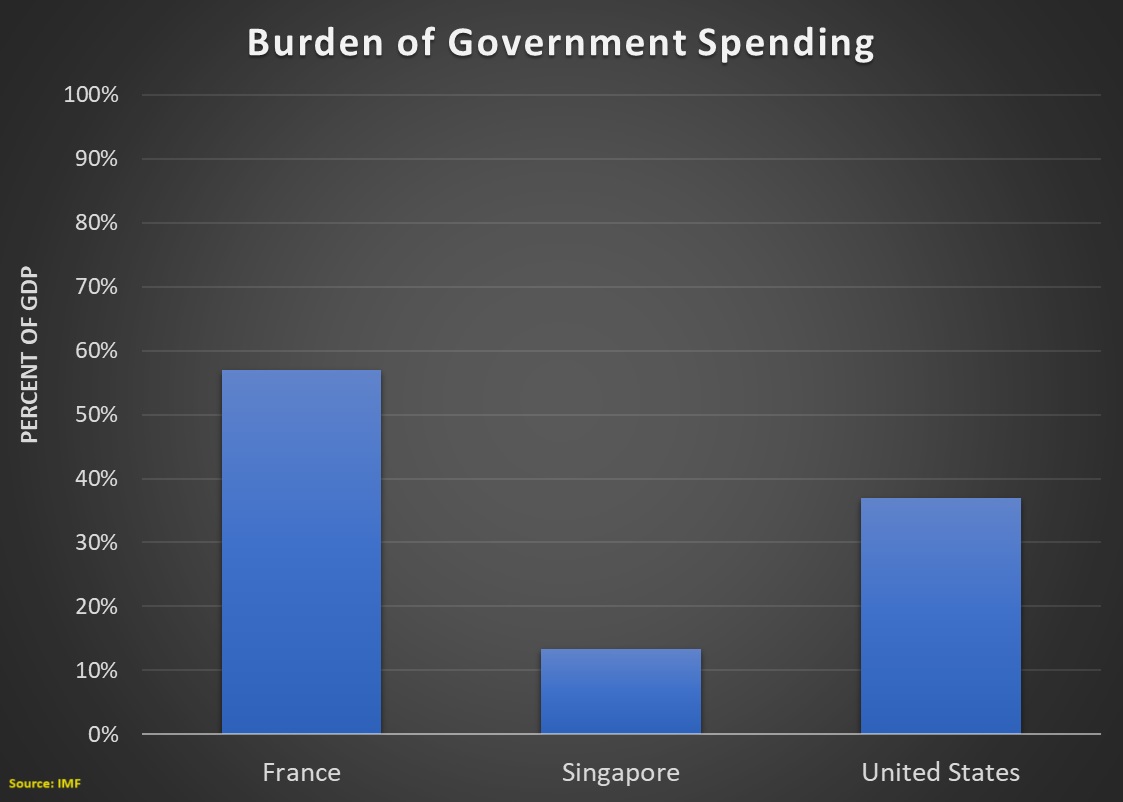

Given my background as a fiscal policy economist, I often cite Singapore’s fiscal policy when explaining why it is richer than the United States or United Kingdom

Simply stated, it has a small-sized public sector. Here’s a chart based on IMF data showing a much-lower burden of government spending in Singapore.

While Singapore’s economic policy is admirable, it is not perfect.

Indeed, it may even be exaggerated and not as good as conservatives and libertarians sometimes believe.

Here are some excerpts from an analysis by Pradyumna Prasad.

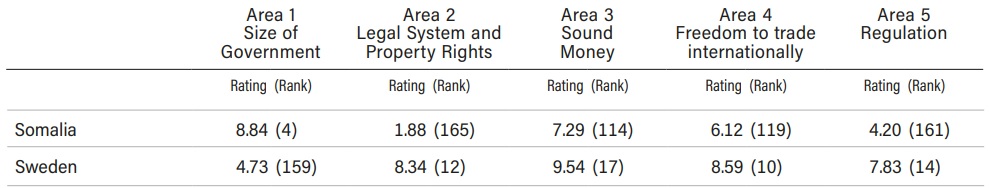

Singapore from the statistics looks as if it is one of the least interventionist states in the world. Tax rates are low, and it is extremely easy to set up a business in the city-state. …But this focus on taxes and government spending as the measure of the size of government obscures an important fact in understanding Singapore’s government:

it owns several companies… Out of the 25 largest companies listed on the Singapore Exchange (as of 26th June 2023, excluding real estate investment trusts) 9 companies were started by the government. It still maintains at least a minority stake in all of them and a majority stake in Singapore Airlines and ST Engineering. For most of them, it is still the largest shareholder. …Along with this, the government of Singapore owns the vast majority of land in Singapore… Nearly 80% of Singaporeans live in government built housing.

And even the good parts of Singapore’s fiscal policy data might not stay good forever.

I warned about slippage in 2019, and there was an unfortunate tax increase a couple of years ago.

Here are some excerpts from a report by Kok Xinghui in the South China Morning Post.

Singapore will roll out its long-delayed 2 percentage point increase in sales tax next year. …the goods and services tax (GST) hike would take place in two steps – with an increase

from the current 7 percent to 8 percent on 1 January 2023, and subsequently to 9 percent on 1 January 2024. Alongside this rate hike, Wong also announced plans to increase personal income, property and vehicle taxes – measures aimed at the ultra-wealthy. …The country’s current S$% per tonne carbon tax also will rise fivefold in 2024, and subsequently be increase until in reaches S$80 per tonne by 2030.

Since the top income tax rate is now 24 percent, it would be wrong to call Singapore a class-warfare jurisdiction.

But it’s still bad news that taxes are trending in the wrong direction.

In a 2022 column for National Review, Jacob Hjortsberg wrote about Singapore’s imperfect capitalism.

There are three main elements of the Singaporean system that…demonstrate that the country is far from a free-market paradise. Element 1: …a National Wages Council was…founded — a tripartite organization consisting of labor representatives, employer representatives, and representatives from the government, tasked with formulating central wage guidelines for the Singaporean labor market.

…Element 2: …the second element of Singapore’s social democracy was in place: a corporatist class compromise according to which zero-sum class struggle was exchanged for positive-sum cooperation, with the one-party state taking it upon itself to subordinate the interests of capital and labor to the unified “national interest.” …Element 3: …we get to the heart of Singaporean social democracy. Rather than being based on taxation, Singaporean social democracy is based on getting the citizens invested as shareholders in the state as a profitable corporation, with each citizen gaining access to the welfare services provided by the state based on their individually accumulated savings.

For what it’s worth, I think the above article mostly shows paternalism rather than statism.

Though it certainly is true that Singapore is not a libertarian society.

Speaking of which, let’s close with some passages from Mike Rigg’s 2021 article for Reason.

Singapore has combined classical liberal policies such as free trade, an open port, and low taxes with an authoritarian single-party government that centrally plans large swaths of the island’s economy and infrastructure, plays the role of censor in practically every media sector, canes petty criminals, and executes drug offenders. …Are there practical policies that Americans broadly and libertarians specifically can adopt from a country that combines free markets with forced collectivism?

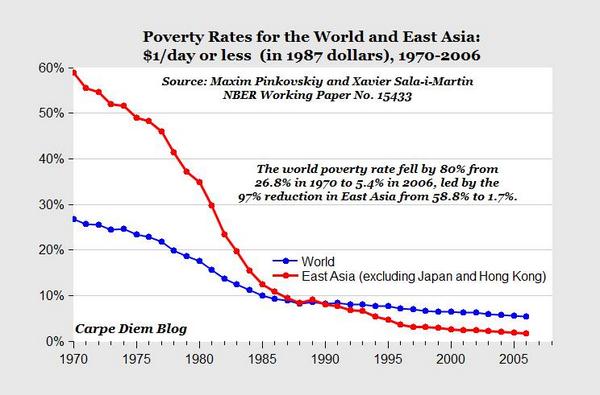

…Singapore is complex, but its core tension comes from the pairing of highly effective public and private institutions that take into account how people respond to incentives while engaging in shocking incursions on personal liberty… George Mason’s Garett Jones…asks readers whether they would “be willing to support longer terms for politicians, tightened voter eligibility, and a single, hegemonic political party in exchange for a 300% raise.” Jones later points out that a majority of Singaporeans have done just that. They’re 23 times richer per person today than they were six decades ago; the country’s GDP exploded from just under $1 billion in 1960 to $372 billion in 2019. “It’s worthy to discuss how to get to Denmark,” Jones writes of the Nordic nation, which funds a massive welfare state with high taxes and a market economy, “but it’s wise to discuss how to get to Singapore.”

For those who read my column last December about the Human Freedom Index, it’s hardly a surprise to see that Singapore is not a libertarian paradise.

The purpose of today’s column is to observe that it’s not a free-market paradise either.

But it’s still very good by global standards.

My final two cents is that Singapore’s biggest strength is low tax rates and the absence of a western-style welfare state. Those are the policies that other nations should be emulating.

P.S. Singapore’s retirement system is better than the U.S. Social Security system, but it would be better to copy the approach used by nations such as Australia and Chile.