More than four years ago, I wrote about some very dubious leftist research that got lots of press attention.

It was, in my not-so-humble-opinion, a clear case of media bias and journalistic malpractice.

Let’s look at another example today.

Here’s a map from a report by Youyou Zhou in the Washington Post that supposedly shows the best places to raise children. You’ll notice that blue-leaning states such as Maine, New Jersey, Hawaii, Massachusetts, New York, Minnesota, and Virginia tend to have the highest scores (dark-colored counties are better, light-colored counties are worse).

Meanwhile, red-leaning states such as Louisiana, Arizona, West Virginia, and Montana are at or near the bottom.

This got me slightly suspicious, so I checked the methodology and found that the results are largely because a report on where to raise children is heavily distorted by a variable on where to avoid children.

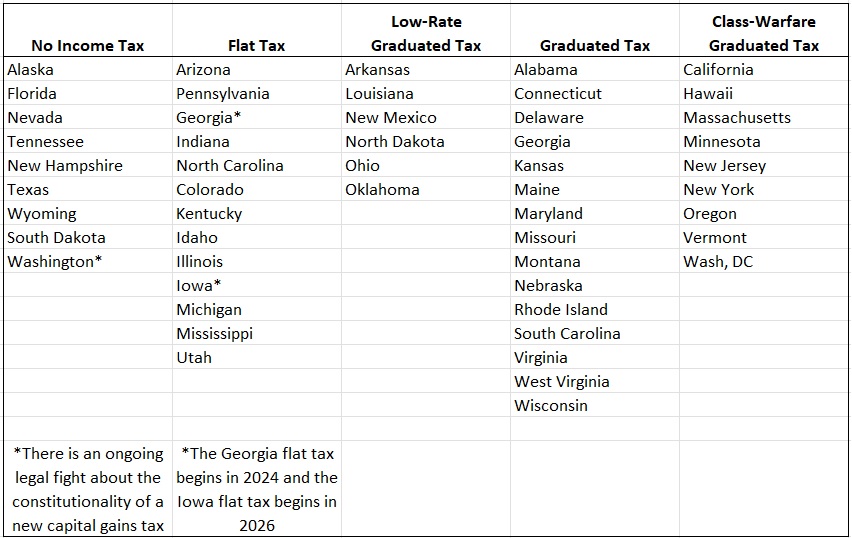

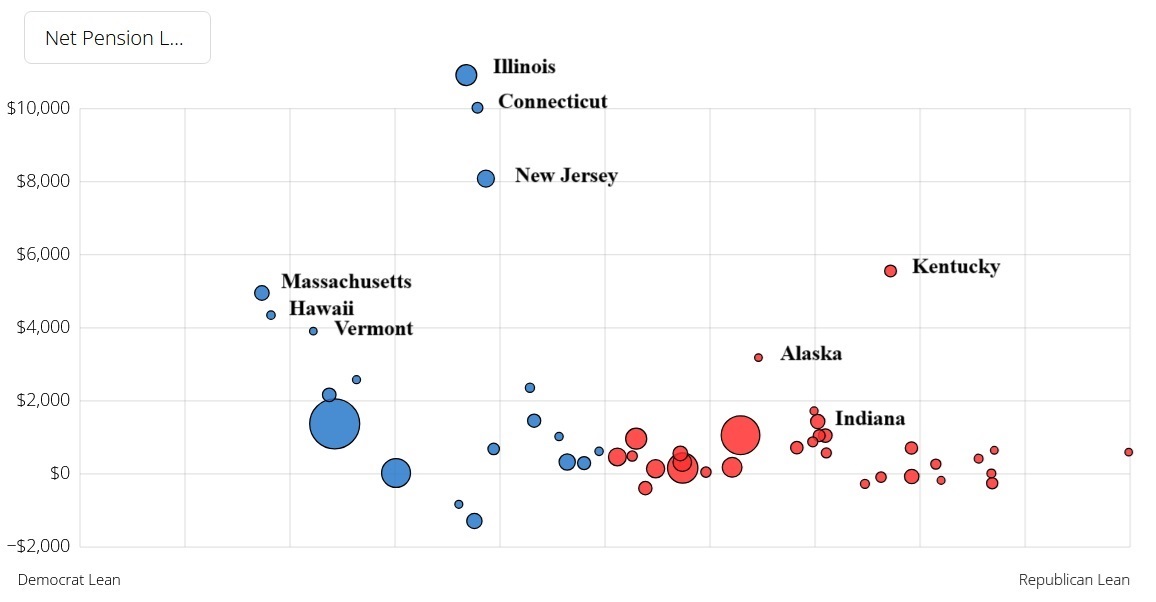

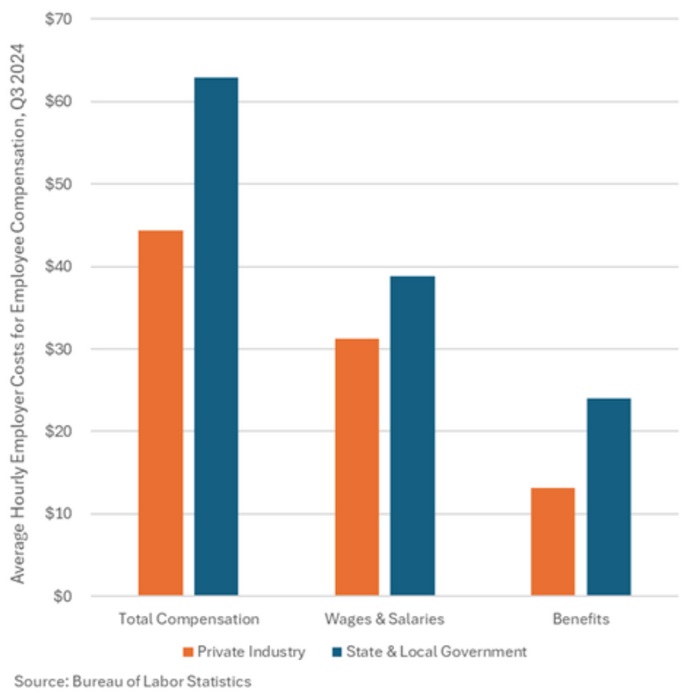

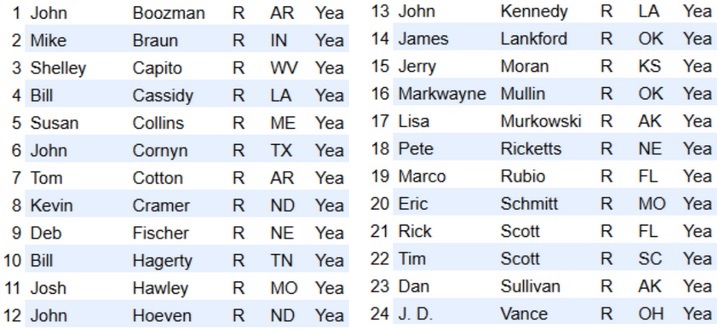

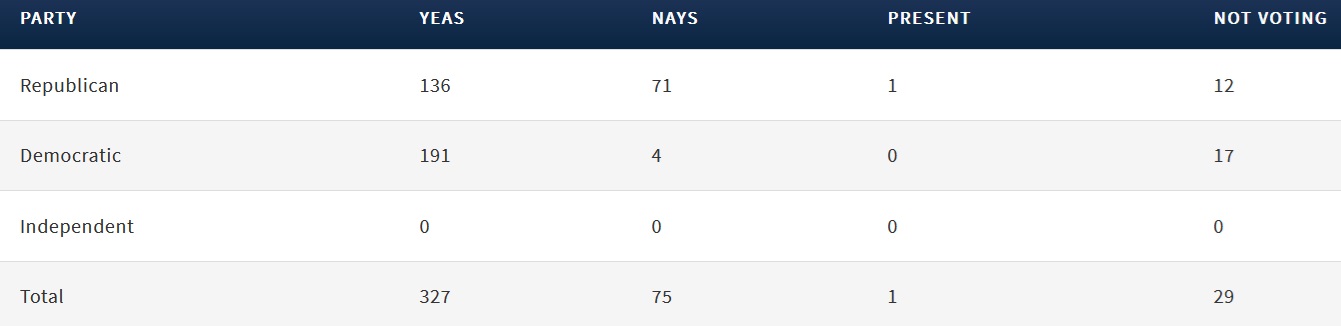

Here’s the methodology, which is based on some factors that are very appropriate (cost of living, education, and safety), but also includes abortion. Meanwhile, it leaves out some variables that presumably are very important.

I’ve added my commentary in red.

Fortunately, the report is interactive, so you can choose which categories are most important.

And if you simply set the “personal liberties and parental support” variable to zero, the map suddenly looks much different.

Red-leaning states such as Mississippi, South Dakota, Idaho, and Texas suddenly look good and blue-leaning states such as New York, Vermont, California, and Washington score very poorly.

Interestingly, Virginia does very well regardless of whether abortion is included, and North Carolina and Georgia also do well in both maps.

The report, to its credit, does include a graphic showing where people are actually having kids.

Lo and behold, fertility is highest in red-leaning states such as Utah, Texas, and Idaho.

By contrast, Maine (which was supposedly one of the best states based on the report’s dodgy methodology) is the state with the lowest fertility.

Maybe, just maybe, Ms. Zhou should have considered whether the states with the highest fertility might actually be the ones with the best policies?

P.S.While I think the education methodology is reasonable, I wonder what would happen if the results were adjusted for demographics, as captured by this debunking of Paul Krugman.

White students in Texas perform better than white students in Wisconsin, black students in Texas perform better than black students in Wisconsin, Hispanic students in Texas perform better than Hispanic students in Wisconsin. In 18 separate ethnicity-controlled comparisons, the only one where Wisconsin students performed better than their peers in Texas was 4th grade science for Hispanic students (statistically insignificant), and this was reversed by 8th grade. Further, Texas students exceeded the national average for their ethnic cohort in all 18 comparisons; Wisconsinites were below the national average in 8, above average in 8.

Almost surely, red-leaning states would score even better.

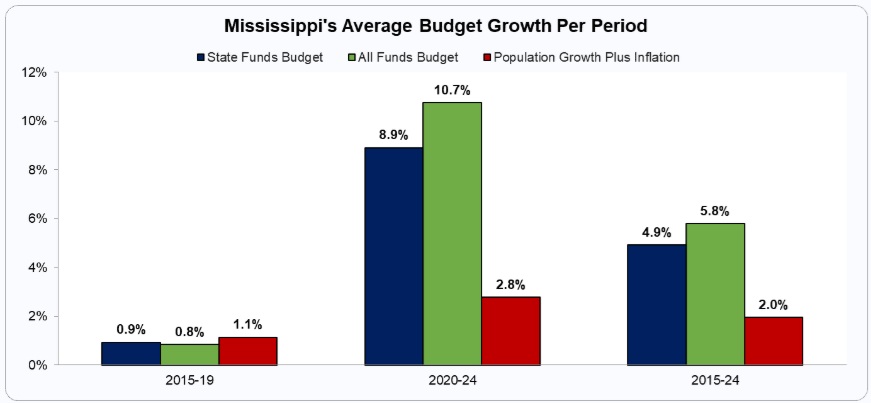

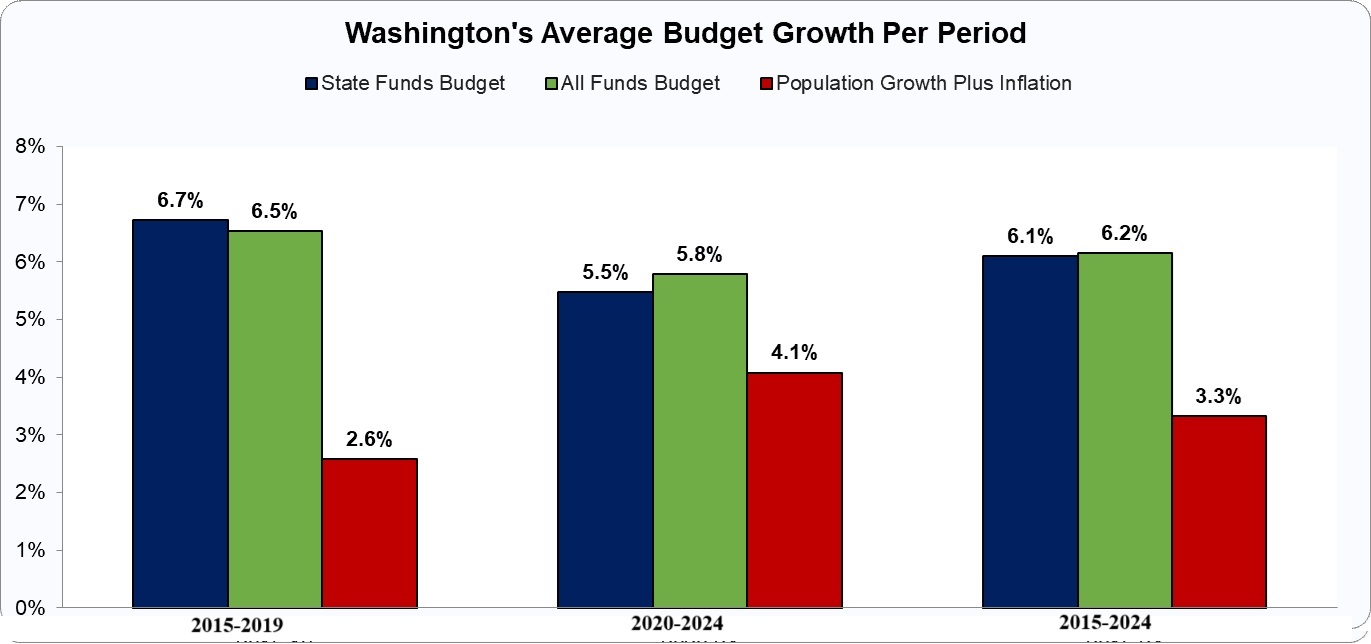

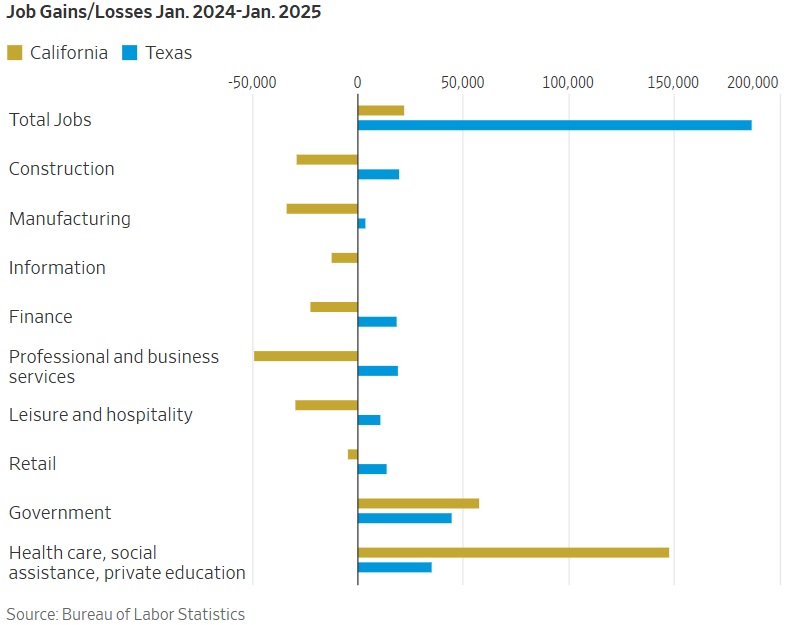

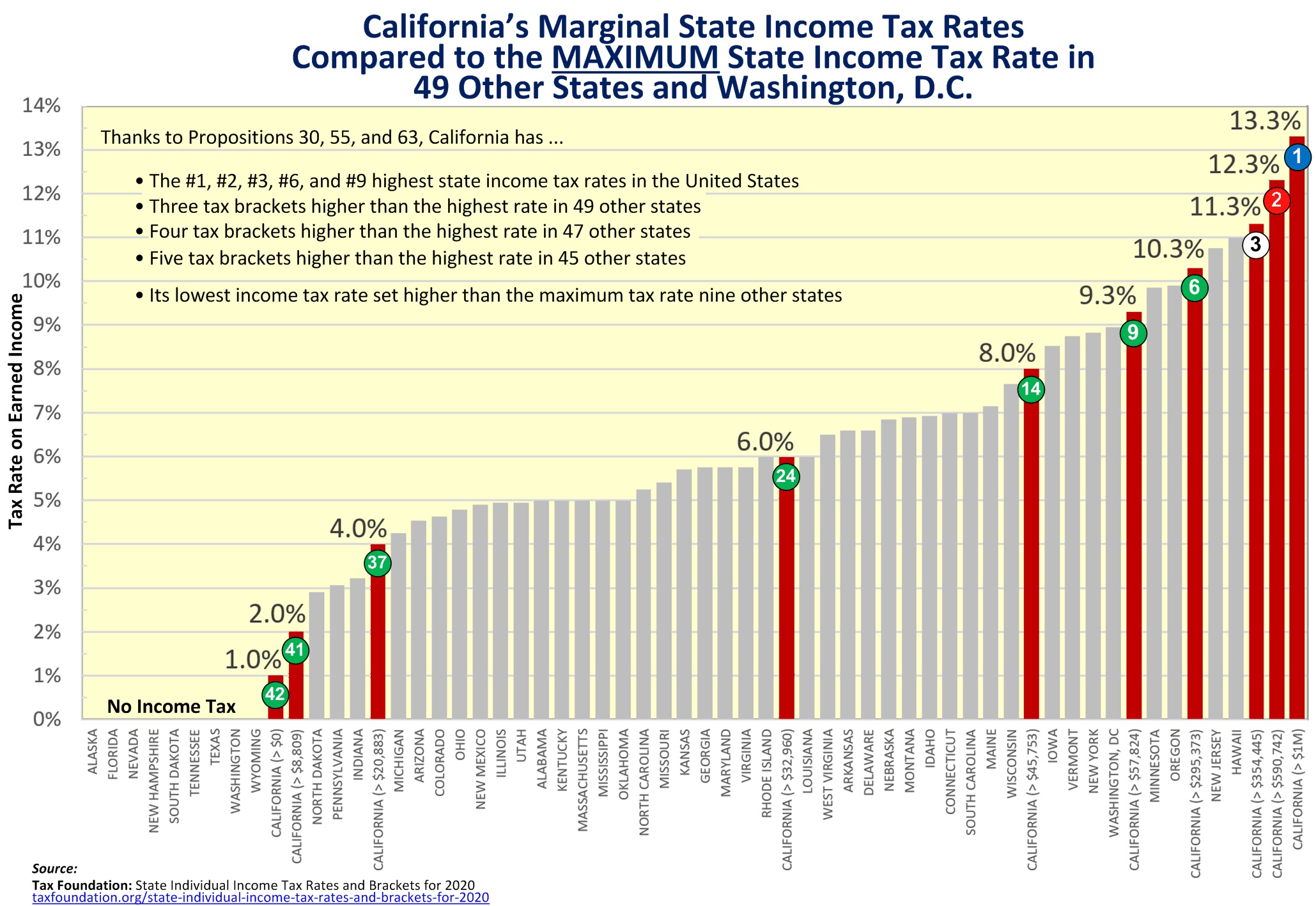

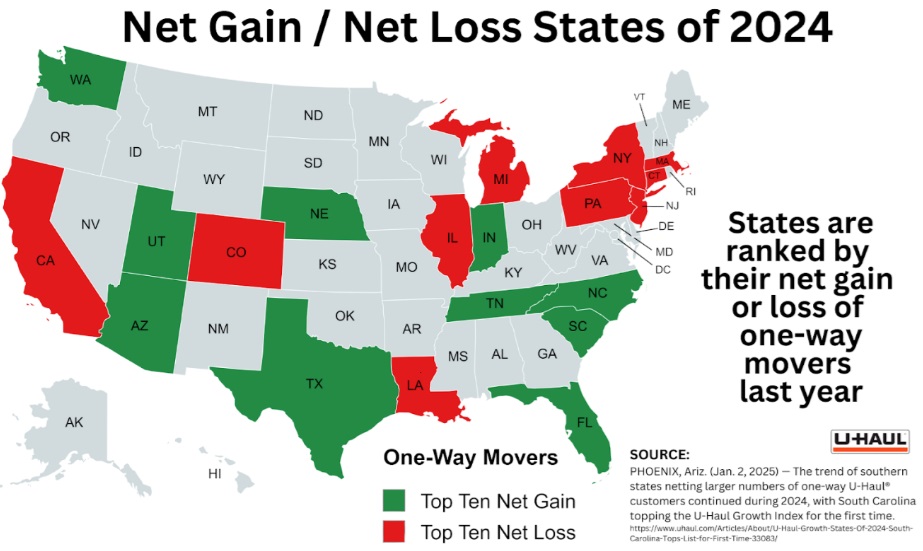

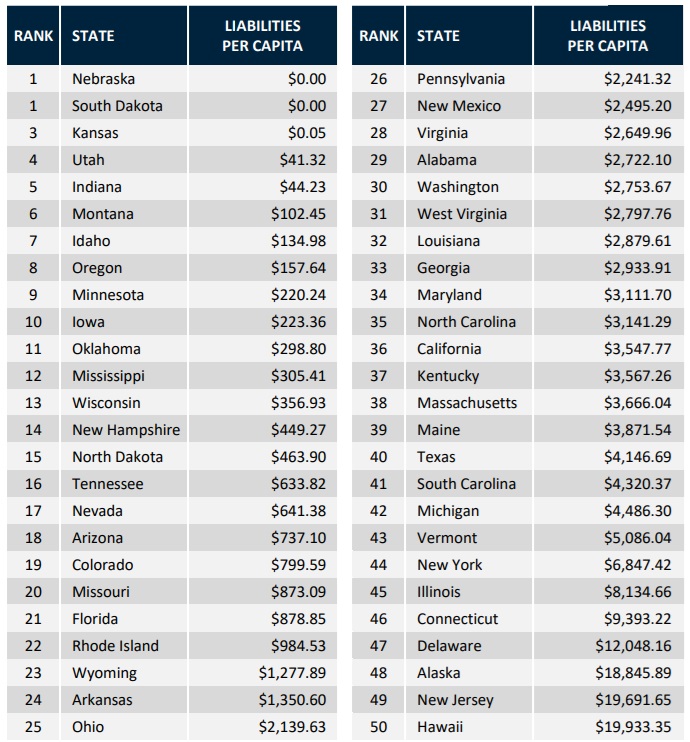

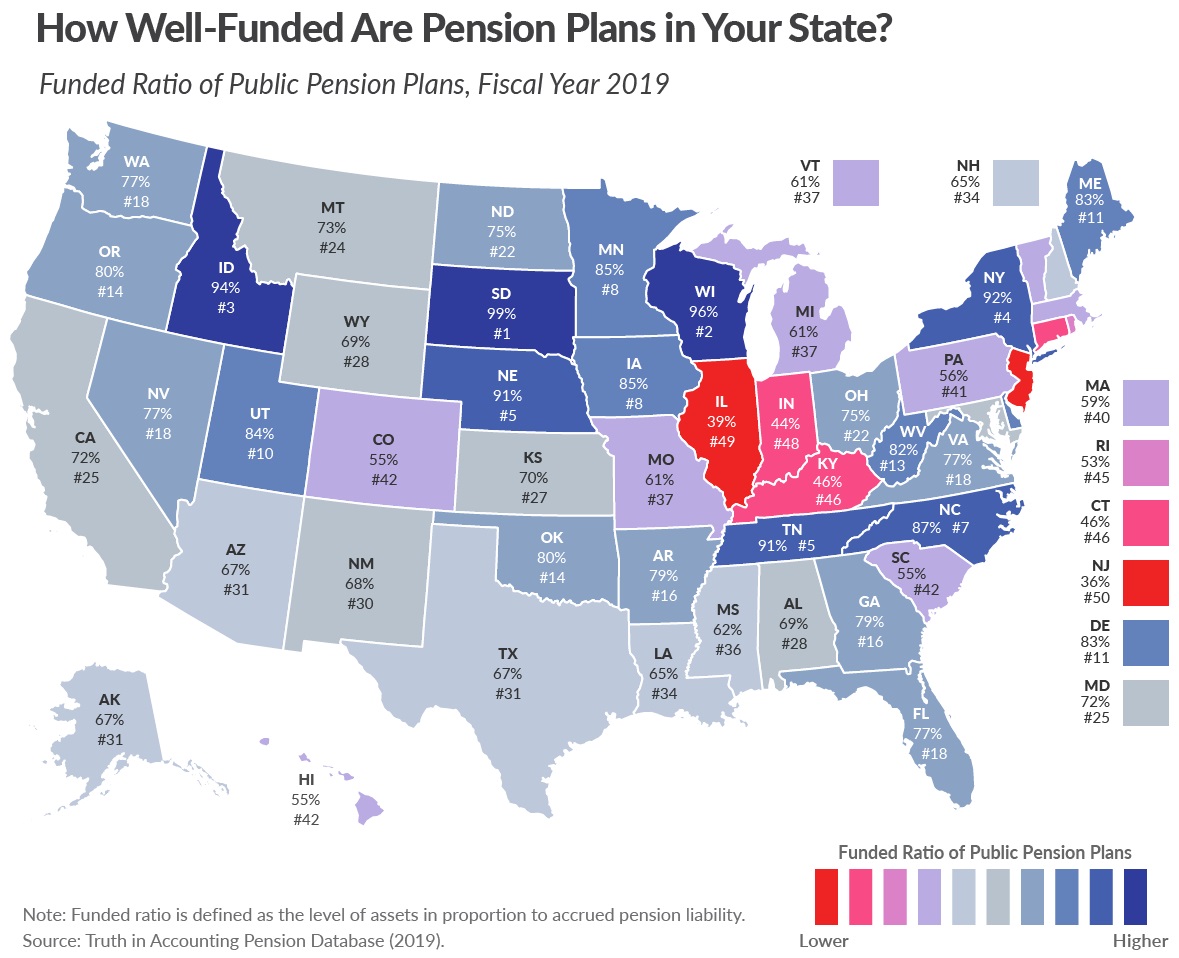

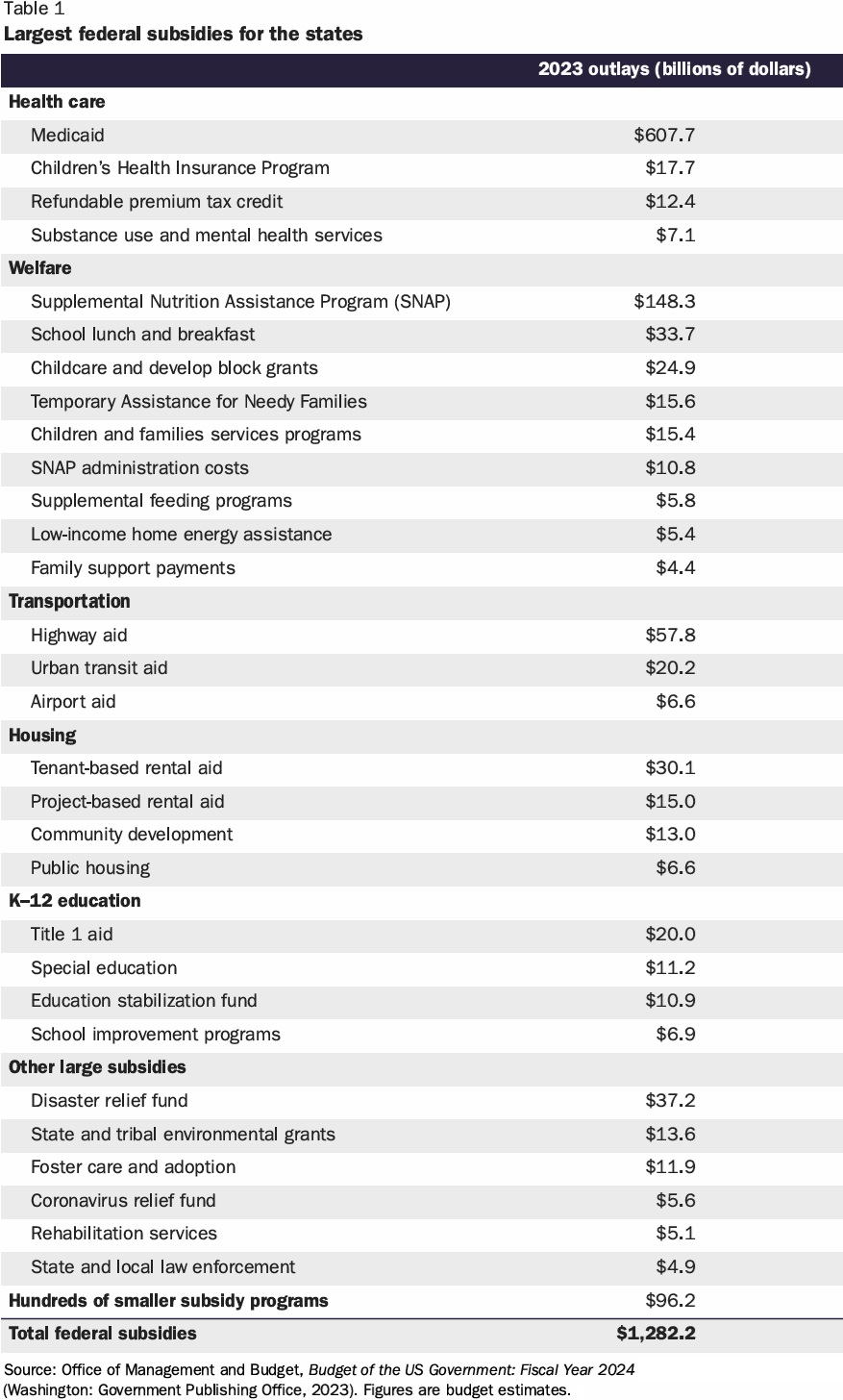

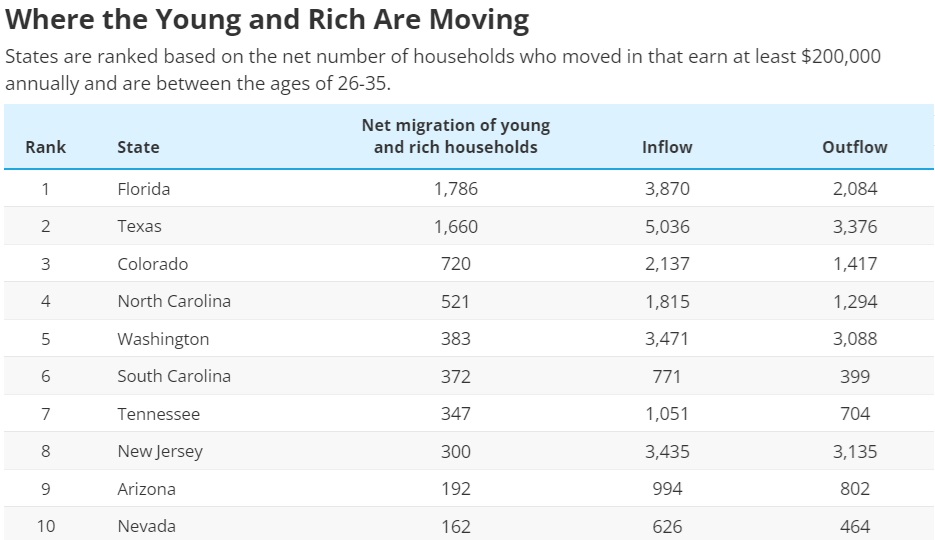

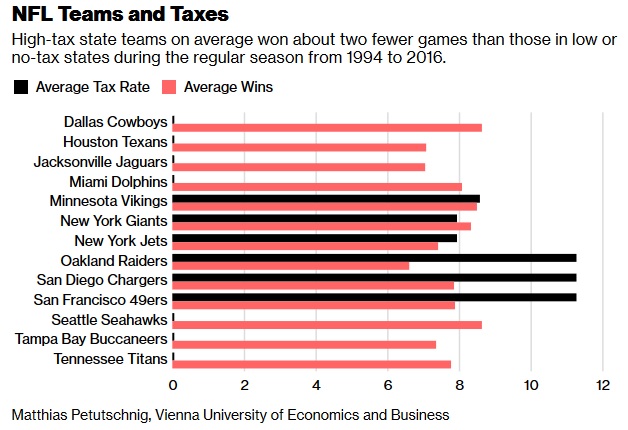

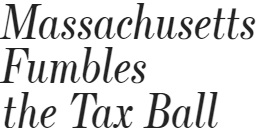

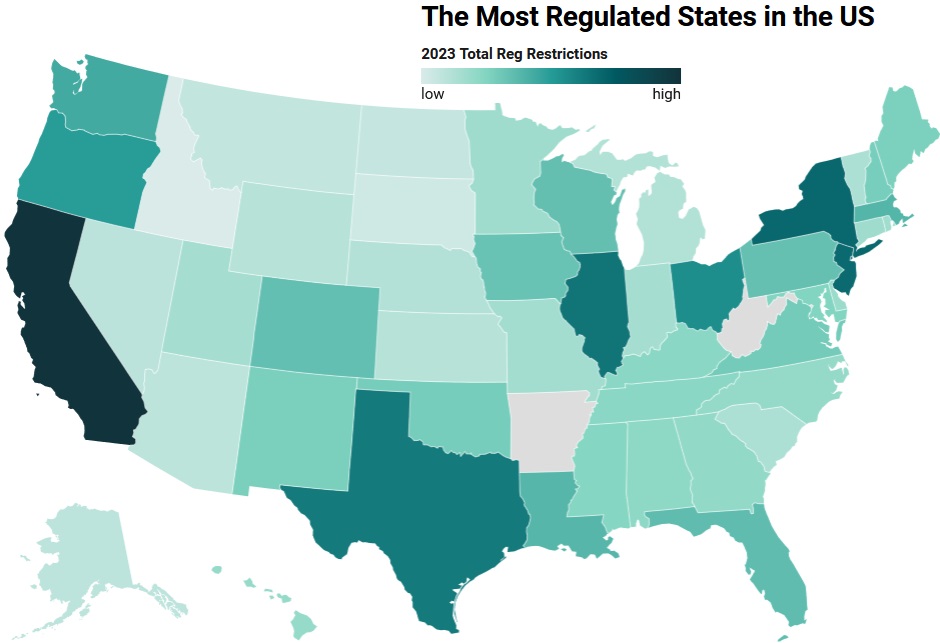

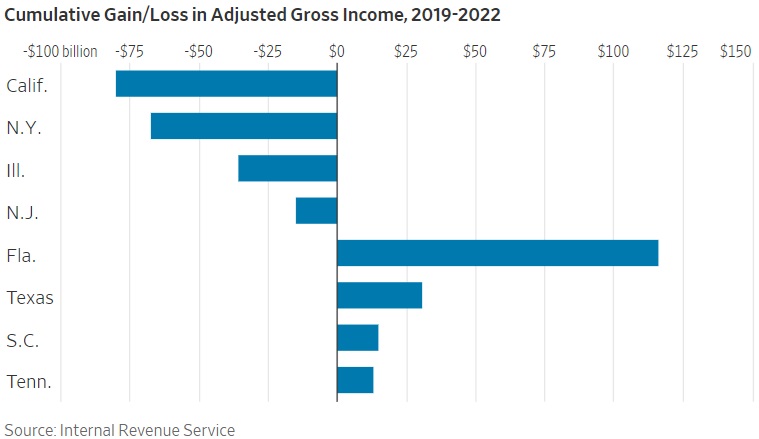

P.P.S. Given the way red states economically out-perform blue states (see here, here, here, here, and here), including measures of prosperity other than affordability presumably also would generate different results.

Read Full Post »