In addition to my work on big-picture economic issues (tax reform, size of government, free trade, etc), I also have a few niche issues that have captured my attention.

- Tax havens and tax competition

- Spending caps and fiscal rules

- Argentina (for the obvious reason!)

Today, I’m going to pontificate on other niche issue. Like the ones above, I think this next issues is far more important than most people realize.

- Protecting the dollar as the world’s reserve currency.

I’ve already written about this under-appreciated issue a few times.

It involves the dollar’s role in the global economy and the benefits that America enjoys as a result.

But many countries – especially ones that could be considered potential adversaries – would like to weaken or dethrone the dollar. Indeed, they’ve already taken steps in some cases to make that happen.

That is not a good development.

This issue is probably best summarized by these passages from an article in the Cayman Financial Review that I shared back in 2018.

A reserve currency is a currency that governments hold in their foreign exchange reserves to settle international claims and intervene in foreign exchange markets. …Governments overwhelmingly choose one currency – the U.S. dollar… U.S. dollar-denominated assets comprised 63.79 percent of disclosed foreign exchange reserves… The Bank for International Settlements (BIS) reported that 88 percent of all foreign exchange transactions in 2016 involve the U.S. dollar on one side. …In 2014, 51.9 percent of international trade by value and 49.4 percent of international trade by volume of transactions were invoiced in U.S. dollars. …Major internationally traded commodities such as oil are priced in U.S. dollars. …The status of the U.S. dollar as the world’s reserve currency and the resulting foreign demand for U.S. dollars creates what French Finance Minister Valéry Giscard d’Estaing described in 1965 as an “exorbitant privilege” for the United States. …While difficult to measure, empirical studies suggest the privilege is worth about ½ percent of U.S. GDP (or roughly $100 billion) in a normal year.

The article is seven years ago, so some of the numbers need updating, but they key things to understand is that having the world’s currency is a huge boost to the United States, most notably lower interest rates and a bigger economy.

My interest in this issue is a big reason why I wrote a study, co-authored with Robert O’Quinn, about President Trump’s efforts to bring peace to Ukraine.

We explain many reasons why the U.S. would benefit (such as expanded exports and investment opportunities), but I think the most important issue is the role of the dollar.

Here are some excerpts from the executive summary of our report.

Russia’s aggression against Ukraine has led to reduced international trade and investment. In large part because of economic sanctions, American exports to Russia have declined, as have American imports from Russia. The same is true for Ukraine, but to a lesser extent and only because of regional conflict rather than restrictions by the U.S. government.

Even more important, at least from an economic perspective, is that the ongoing conflict is creating significant risks for the U.S. economy—everything from putting at risk the role of the dollar as the world’s reserve currency to significant potential losses for critical industries such as energy and aviation. Ongoing efforts by the Trump Administration and others to end the war without rewarding Russian aggression are very desirable, most notably because it would put a stop to the death and destruction. But an end to hostilities would be economically beneficial as well.

We elaborate later in the study.

The United States enormously benefits from the dollar being the world’s reserve currency. Nations such as Russia and China would like to end this “exorbitant privilege” and are using the war, as well as trade tensions, to undermine America’s position. This major macroeconomic risk will be much less likely to materialize if and when the war ends. …Russia and China already have been shifting away from using the dollar for international reserves and international transactions. …Today, there is even greater incentive for Russia and China to dethrone the dollar. And because of sanctions and secondary sanctions, many other nations are sympathetic to that outcome. It’s almost impossible to overstate the downside risk for America. Many countries hold U.S. Treasury bonds as part of their foreign exchange reserves because the dollar is the dominant reserve currency. If the dollar lost that role, foreign central banks and investors would hold fewer Treasuries. …With less foreign demand, U.S. Treasury prices would fall and interest rates would rise. Higher Treasury yields would cascade throughout the economy, raising:

- Mortgage rates

- Corporate borrowing costs

- Credit card and loan rates

This would make financing more expensive for consumers, businesses, and the government. With about $30 trillion of debt, even a modest 1-percentage point increase in interest rates would dramatically increase America’s fiscal problems.

The last sentence should be especially sobering since the U.S. faces a huge long-run fiscal challenge.

I’ll close by shifting away from the dollar and mentioning trade.

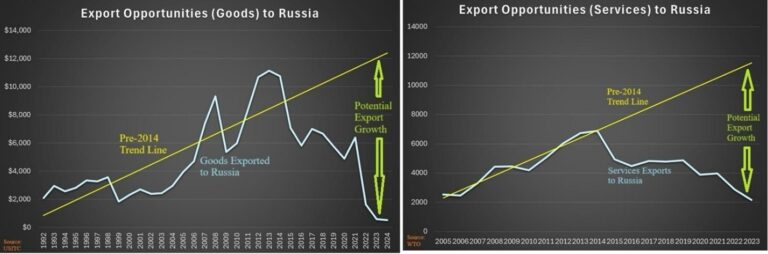

We did some calculations about the potential boost to U.S. exports if the war ends.

And the report also has lots of information about potential investment opportunities for American companies, which probably would be even more important than the potential for increased trade.

But my two cents is the benefits of increased trade and investment are not as important as the economic benefits of preserving the dollar’s role as the world’s reserve currency.

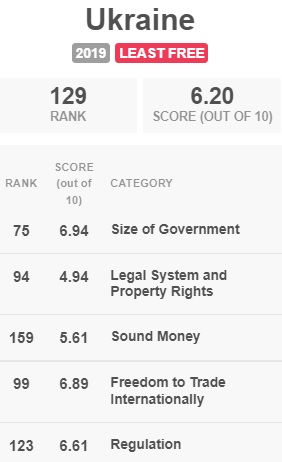

P.S. On a related topic, I hope the U.S. and other western nations use their influence after the war to press Ukraine to engage in sweeping (and much-needed) economic liberalization. Heck, we should encourage Russia to do likewise. I want people in all nations to become rich.