In Part I of this series last year, we started with a table looking at the degree to which successful people were leaving some countries and moving to others.

Let’s start Part II with a look at a map showing how much money they are taking with them when they cross national borders.

Needless to say, it is good to be a country that attracts successful people and their money.

And it’s bad to be on the losing end of the equation.

Historically, nations such as China and Russia lose the most rich people, presumably because property rights are not very secure in nations where dictators and their henchmen can arbitrarily seize your wealth.

What’s stunning about the current map, however, is that the United Kingdom is suffering the largest exodus.

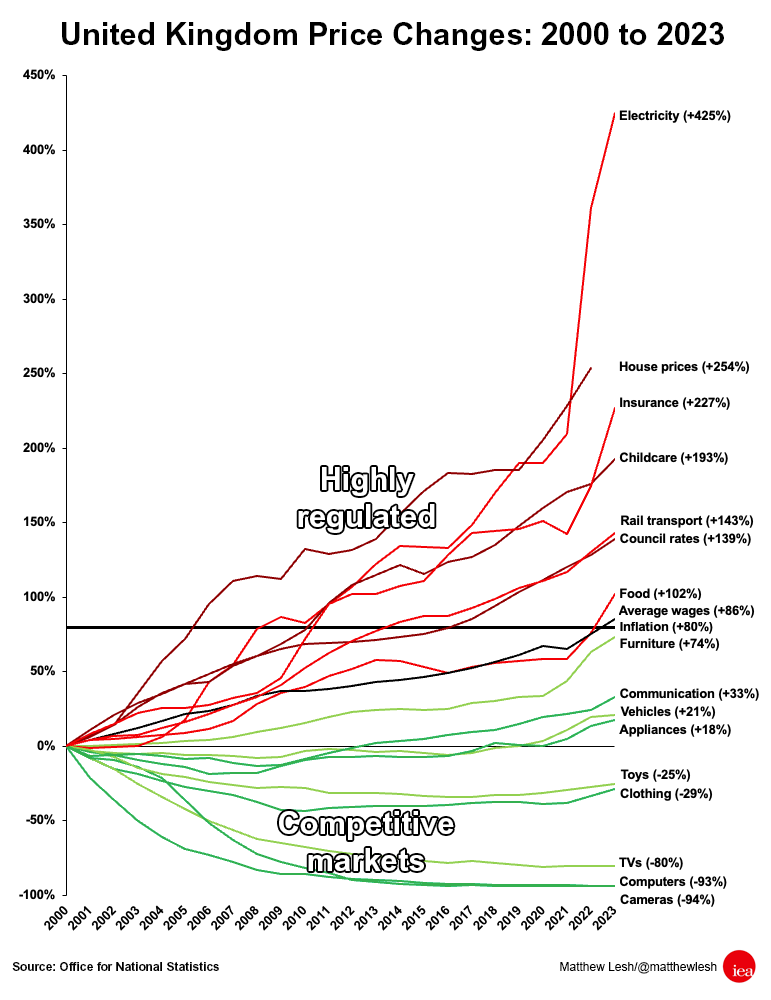

I’ve written already about some of the class-warfare policies that are driving away successful people.

Today, let’s dig deeper into why upper-income taxpayers want to escape some democratic nations.

We’ll start with some passages from Matthew Lynn’s column in the Washington Post.

…almost a fifth of last year’s graduates of the École Polytechnique have left France. Likewise, British entrepreneurs are fleeing the country’s rising tax burden by heading for the Gulf, while well-educated Germans are swapping stagnant Munich and Stuttgart for Switzerland. High-tax, big-state Europe is starting to suffer an accelerating brain drain.

…With its government in permanent crisis and with one of the highest tax burdens in the world, it is hardly surprising that many of France’s most talented young people are deciding to make their careers elsewhere. …not exactly a vote of confidence in the country. Wherever they go, these French graduates are likely to have plenty of British for company. As many as 250,000 of them are estimated to be living in Dubai, in the United Arab Emirates, including Alasdair Haynes, founder of Britain’s Aquis stock exchange. More than 1.1 million others have moved to Australia. At a granular level, almost 2,000 U.K.-trained doctors relocated to Australia in 2023, a 67 percent increase on a year earlier. And about a quarter-million Germans are reported to be moving out of the country every year, the largest number of them to Switzerland. …there is a huge opportunity in offering a haven for Europe’s overtaxed, underpaid professional and entrepreneurial classes.

Now let’s take a closer look at people escaping the United Kingdom.

Here are some excerpts from an article by Louis Goss in the U.K.-based Telegraph.

One of Britain’s richest men has quit the UK after three decades as Rachel Reeves prepares a fresh tax raid at her Budget this week. Lakshmi Mittal, the billionaire steel magnate who is worth more than £15bn according to the Sunday Times Rich List, is said to have moved his tax residence from the UK to Switzerland and will spend most of his time in Dubai.

The Indian-born tycoon is the latest high-profile entrepreneur to abandon Britain in response to Labour’s tax treatment of the super-rich. …Mr Mittal is also a former Labour donor, having given the party more than £5m when it was under the leadership of Tony Blair and Gordon Brown. He also owns a stake in London football club Queen’s Park Rangers, and his family has donated millions of pounds to good causes. …His departure will be embarrassing for the Government on the eve of the Chancellor’s Budget. …Mr Mittal’s exit is the latest in a string of high-profile departures that have included Nik Storonsky, the founder of Revolut, and Herman Narula, the £2.5bn tech chief executive.

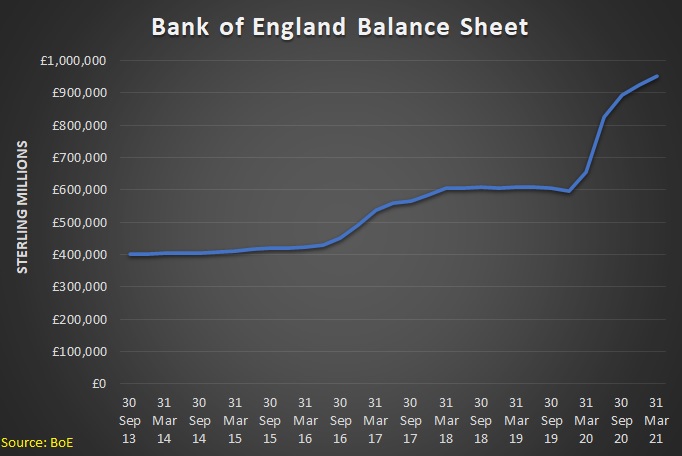

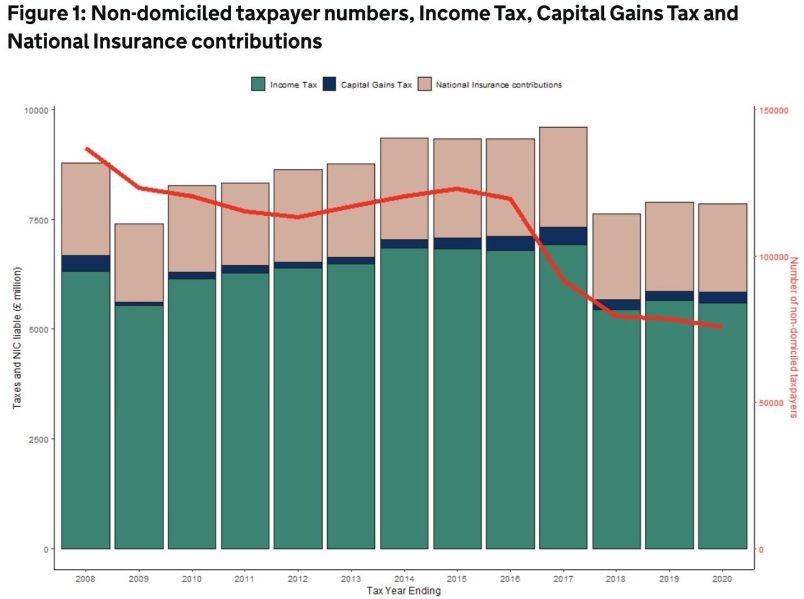

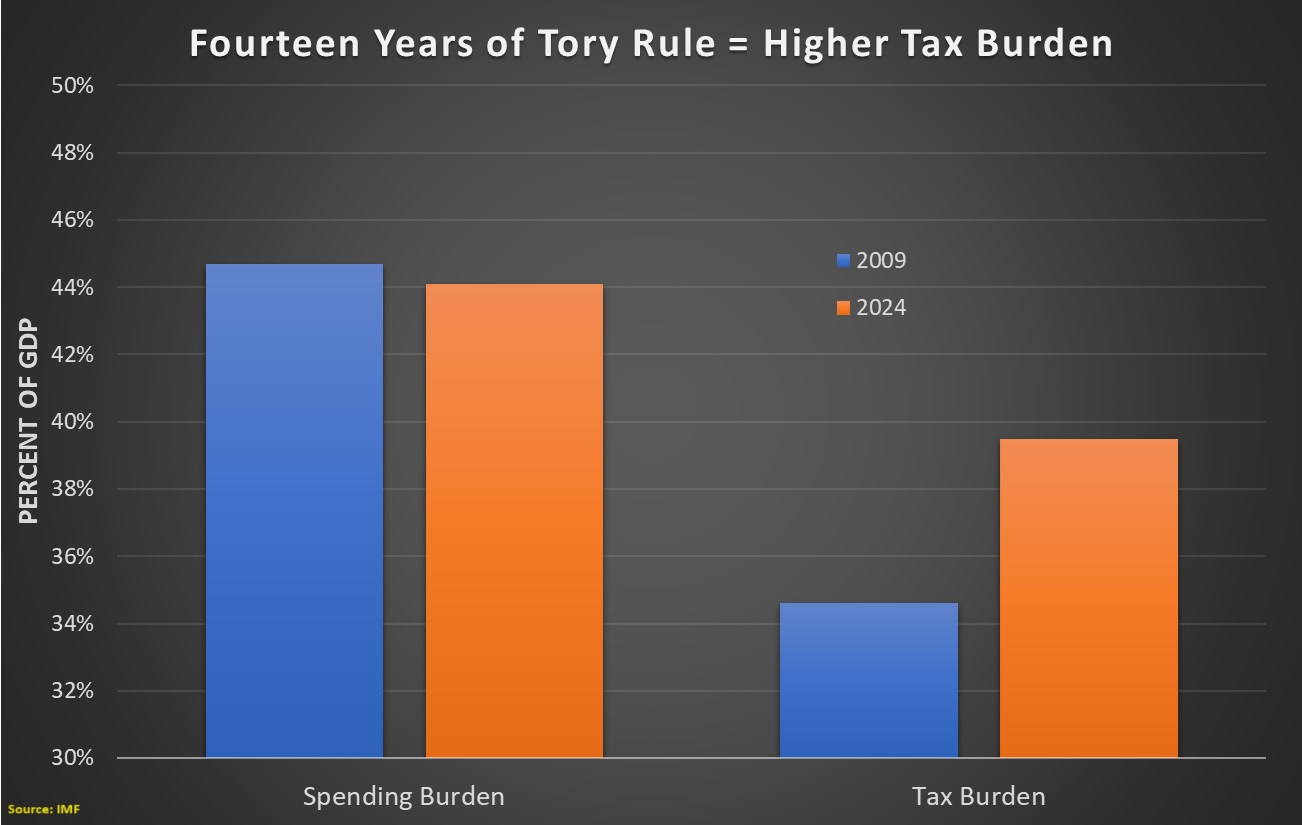

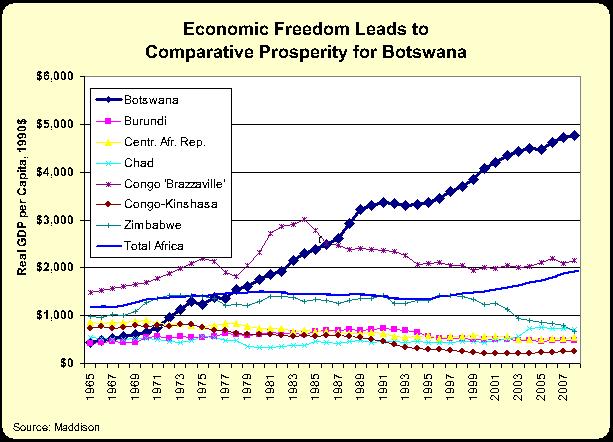

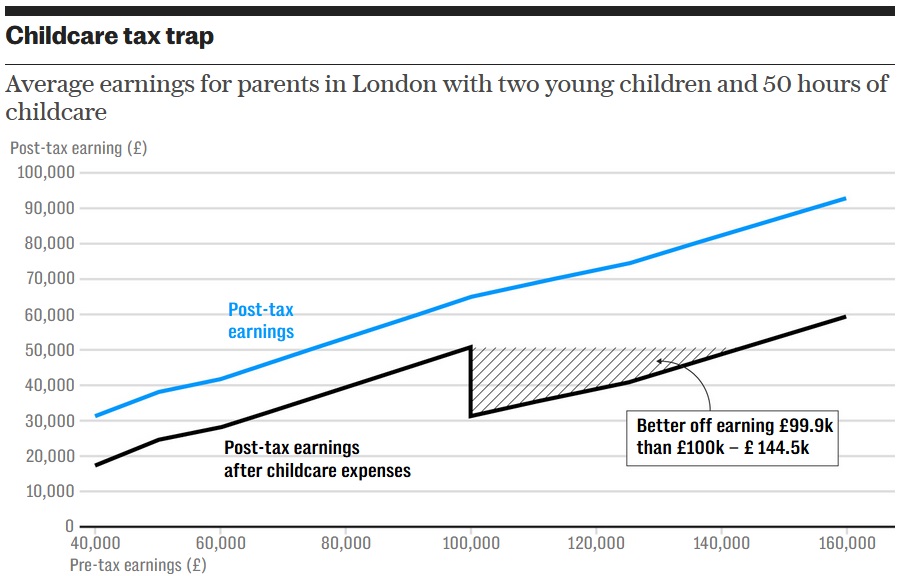

Here’s a visual from the article.

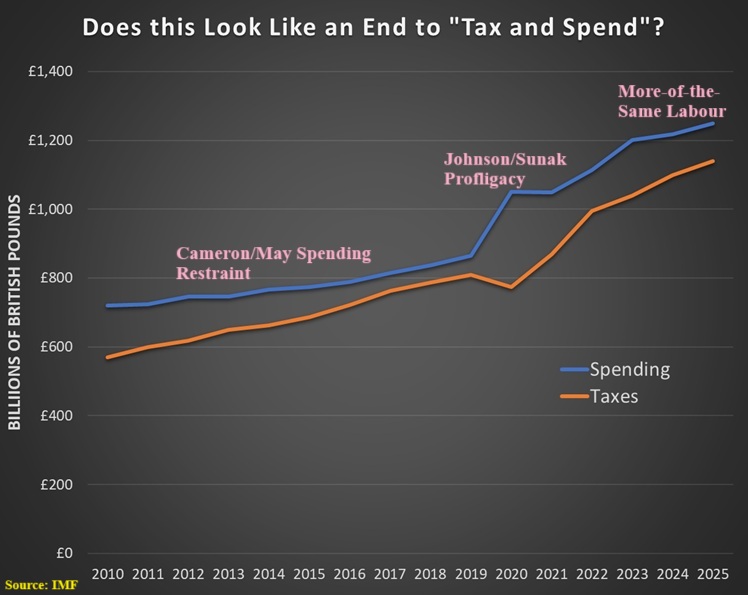

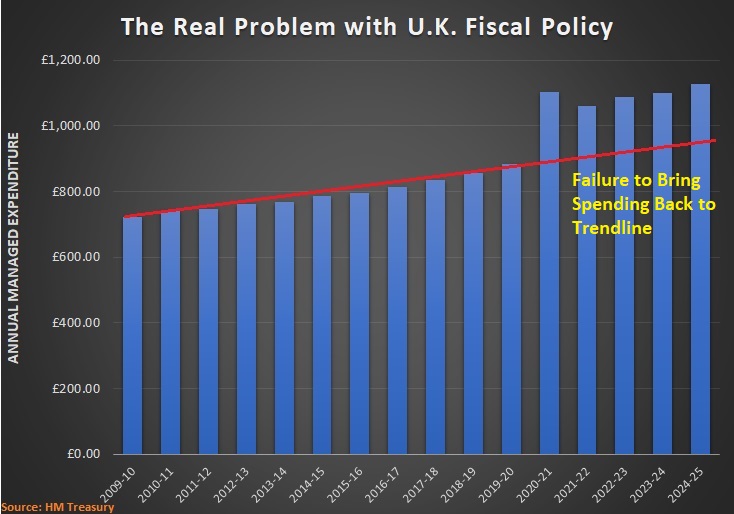

You can see that the outflow started under the big-government Tories and has recently become a torrent.

Needless to say, these escapees will not be paying the tax increases that have been imposed (and will be imposed) by U.K. politicians.

Let’s call that another victory for the Laffer Curve. Though that may not matter since I fear those politicians are not primarily motivated by a desire for more revenue.