As explained in my four-part series (here, here, here, and here) and in this clip from a recent interview, Javier Milei’s first two years have been amazingly successful.

There are two points in the interview that deserve emphasis.

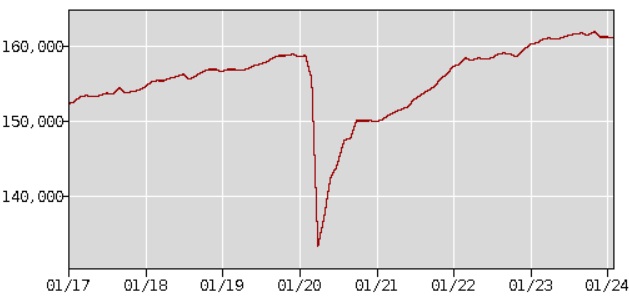

- First, Javier Milei’s libertarian policies already have been extremely beneficial for the Argentine economy. Inflation has dramatically declined. The burden of government spending has been reduced. The budget was balanced very rapidly.

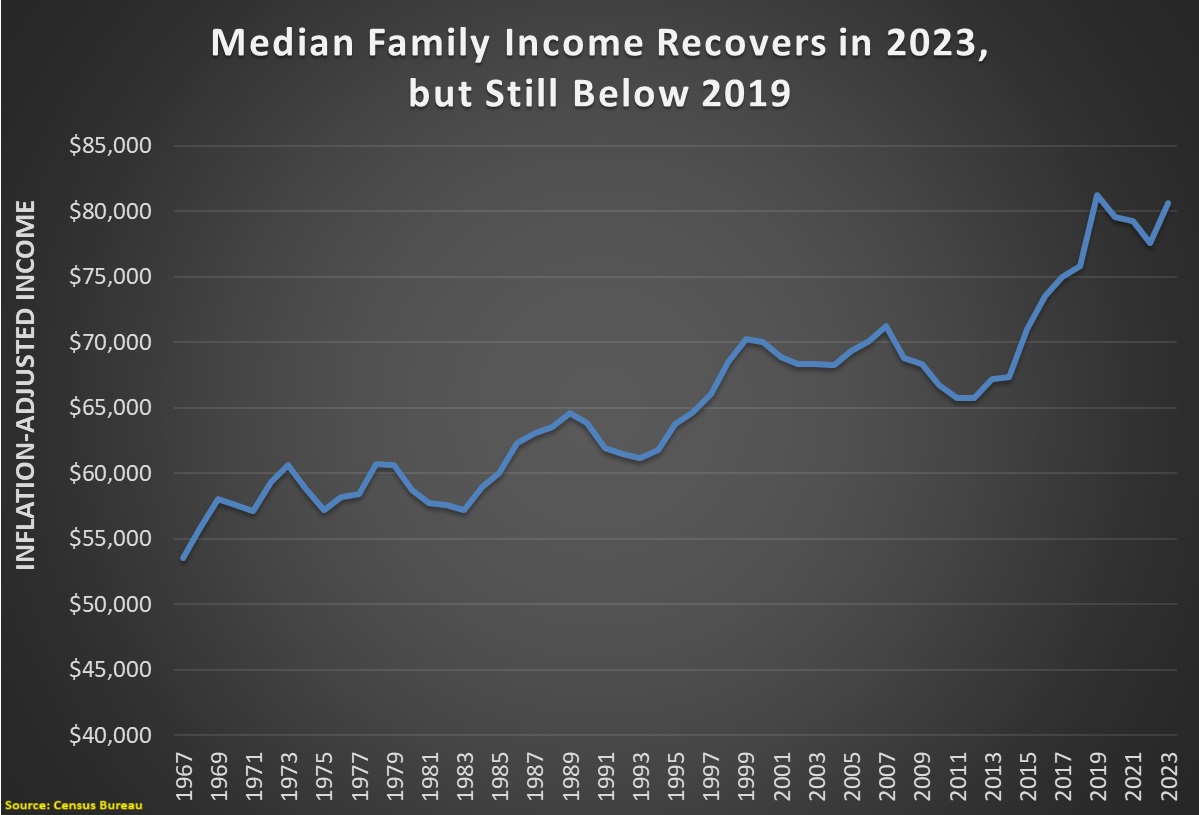

Red tape has been slashed. Incomes are rising. And, perhaps most important, the chart shows that poverty is plummeting.

Red tape has been slashed. Incomes are rising. And, perhaps most important, the chart shows that poverty is plummeting. - Second, we can expect even more success in the future because Javier Milei’s libertarian party (La Libertad Avanaza) won a landslide victory two months ago in Argentina’s midterm elections. As I noted in the video, the victory was especially shocking since most observers expected voters would revert to their post-WWII pattern of voting for leftism.

So the first two years of Milei-ism have been extraordinarily successful.

Now let’s hope there is additional progress the next two years.

According to a report in the U.K.-based Financial Times, that is likely to happen. Milei’s government is especially focused on labor law reform. Here are some excerpts.

Argentina’s government sees 2026 as its “golden opportunity” to pass major economic reform…according to the minister tasked with enacting President Javier Milei’s ‘chainsaw’ deregulation agenda. …having more than doubled its congressional bloc at those elections, the government believes it can now pass labour and tax overhauls, as well as a hardline new penal code. Such reforms have long been resisted by the country’s leftwing Peronist opposition… “There is a new political climate,” deregulation minister Federico Sturzenegger, who wrote many of the planned reforms, told the Financial Times.

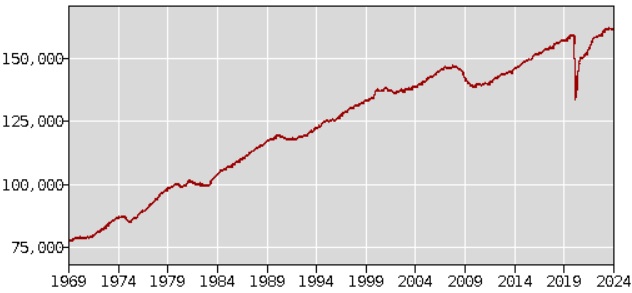

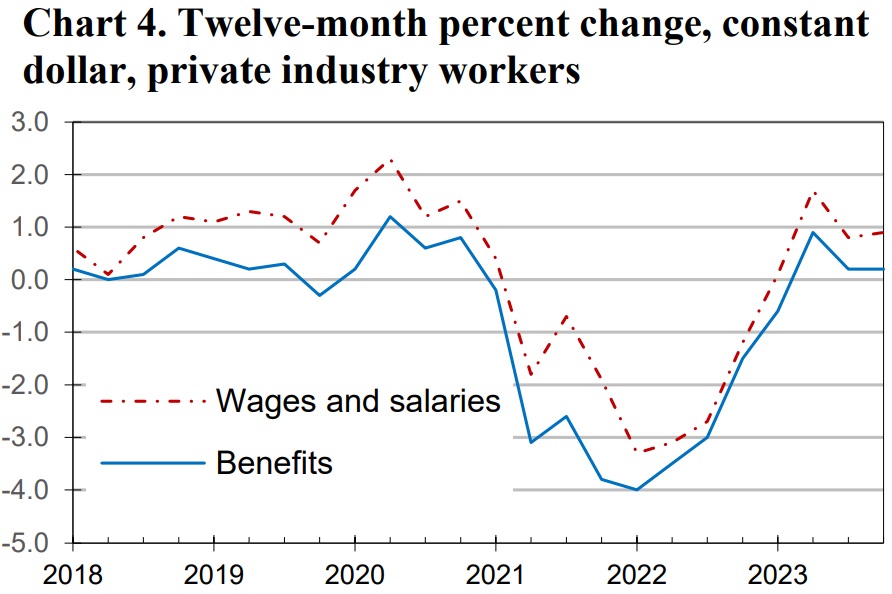

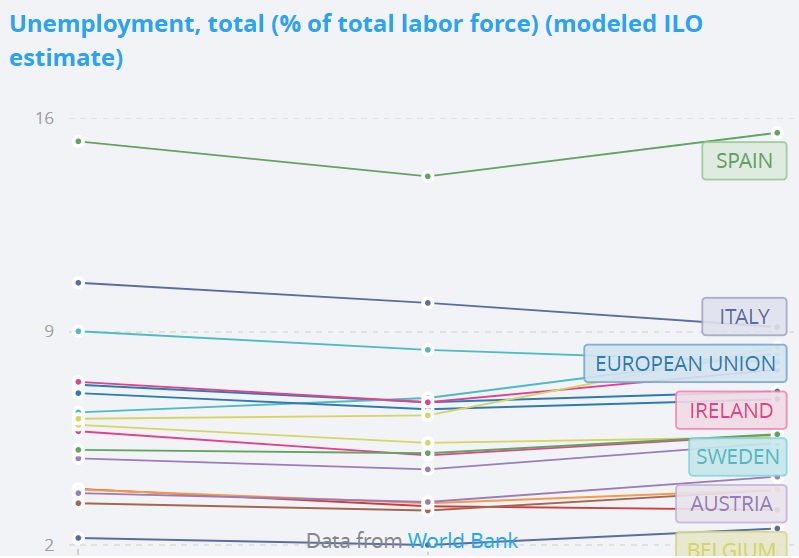

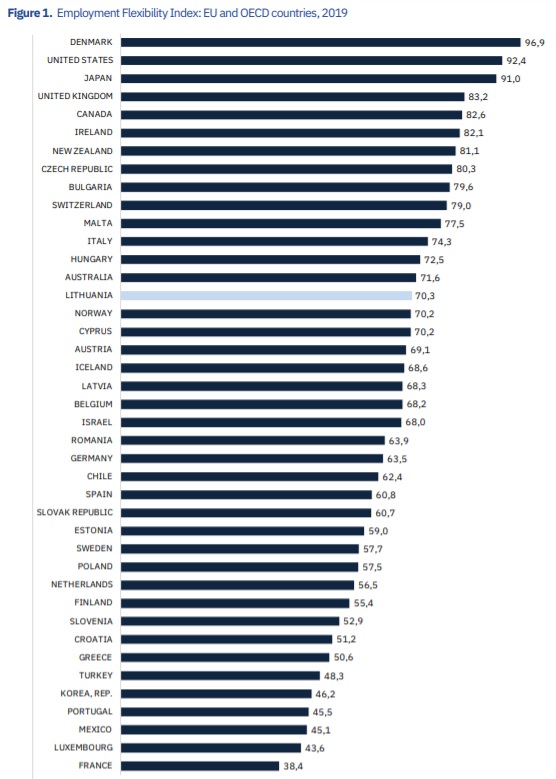

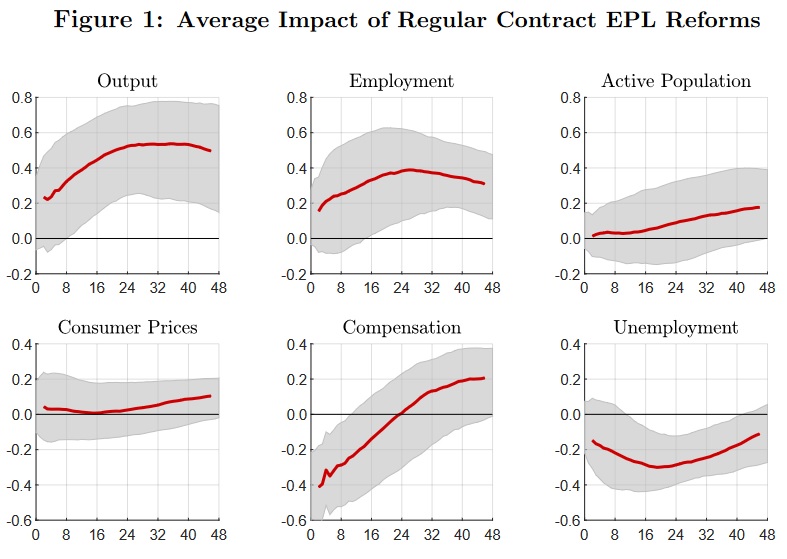

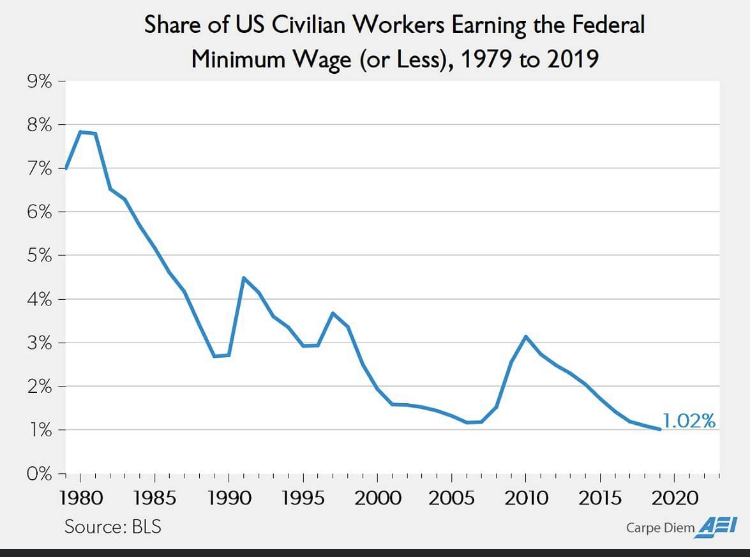

“The rest of the political system is looking to the party that won 40 per cent and that will make it easier to deal with congress.” …The first target is Argentina’s labour market, where the number of formal private sector jobs has been almost flat for 14 years. Roughly half of workers are employed off the books. Businesses blame high payroll taxes, sometimes outsized severance payments and national level wage agreements…that can override company-level talks. The proposed labour bill would reduce union dues paid by non-members, limit labour courts’ discretion on severance payments and make company wage negotiations supersede nation-level accords. It would also allow a working day of up to 12 hours and limit the right to strike by expanding the category of jobs deemed essential. Sturzenegger said the changes would “correct the rigidity that has expelled people from the formal labour market”. Greater flexibility in wage negotiations, he argued, would allow smaller companies and those in poorer regions to hire more and fuel a 15-20 per cent increase in formal jobs. …Sturzenegger has also led Milei’s efforts to slash Argentina’s labyrinthine regulations — and says he has cut or overhauled 13,500 articles using various executive powers.

To understand why it’s important to liberalize labor markets, here’s the one-minute video released by the Center for Freedom and Prosperity back in July.

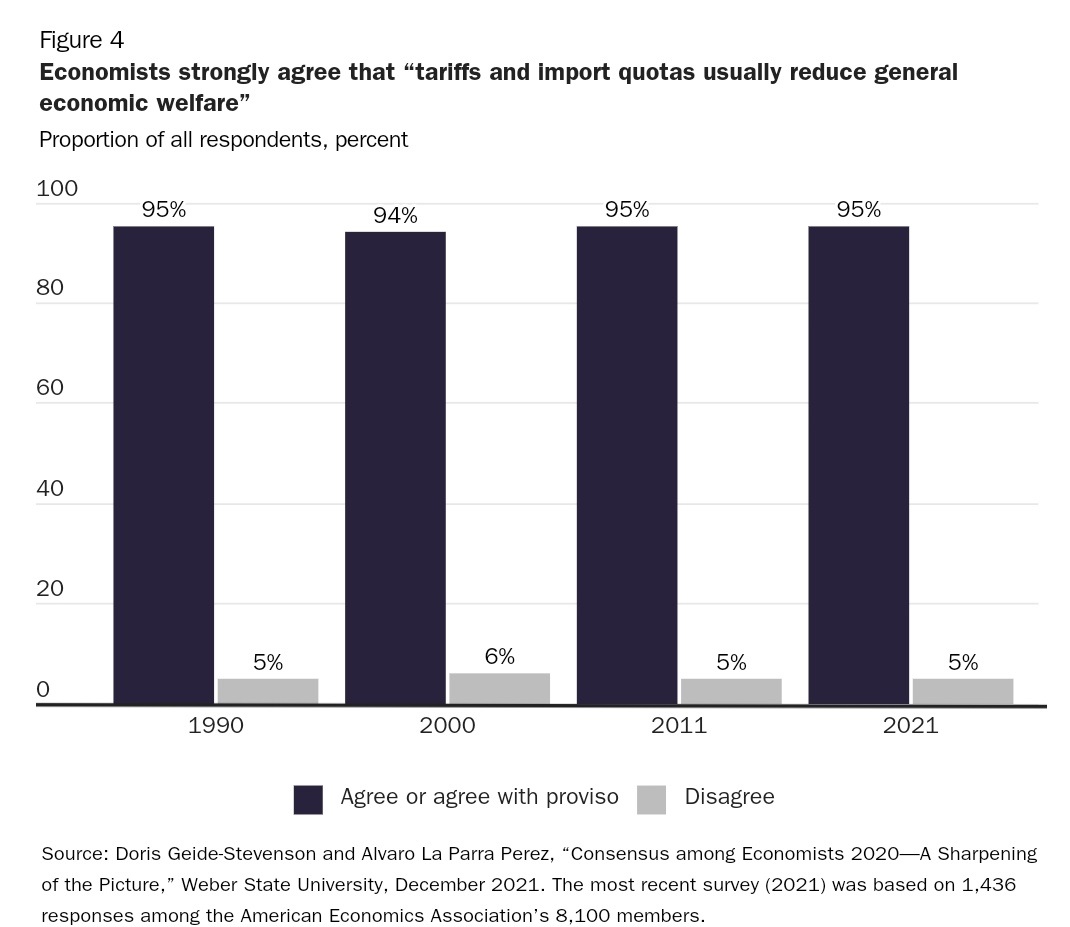

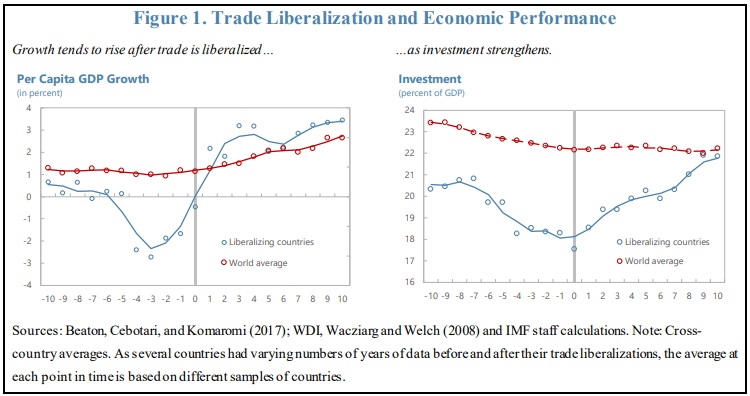

I’ll close by noting that Milei also needs to reform Argentina’s horrible tax code and get rid of protectionist trade barriers.

I’m optimistic.

Milei already has taken big steps toward his goal of making Argentina the world’s freest economy. Let’s hope 2026 sees even more economic liberty.

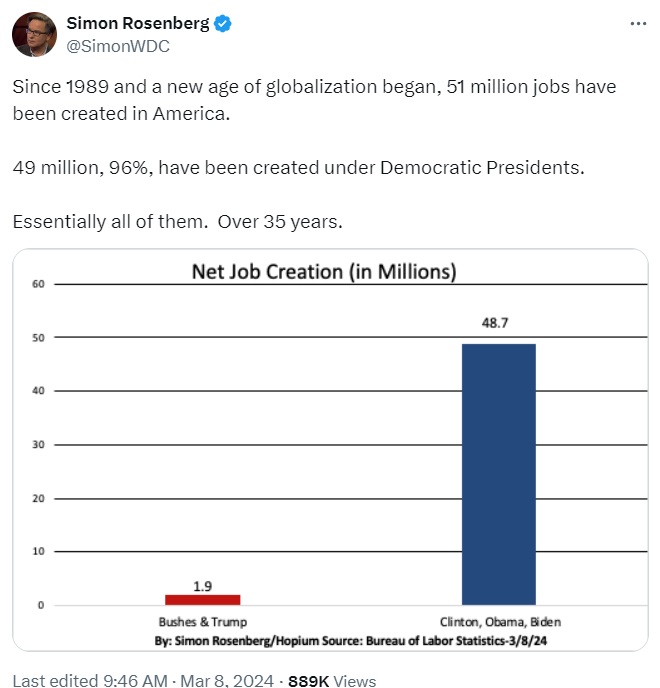

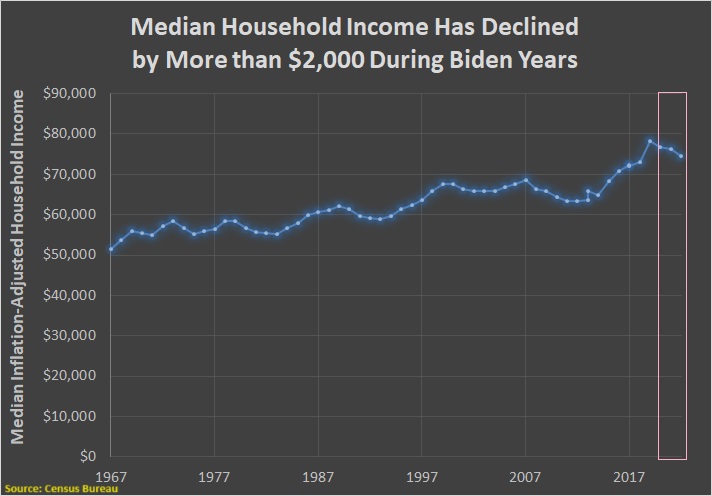

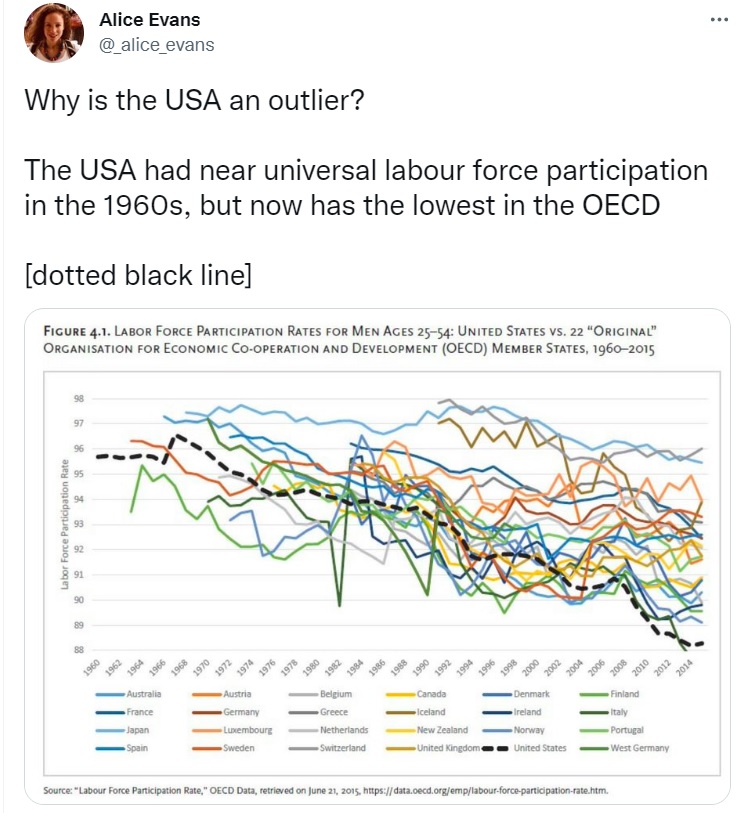

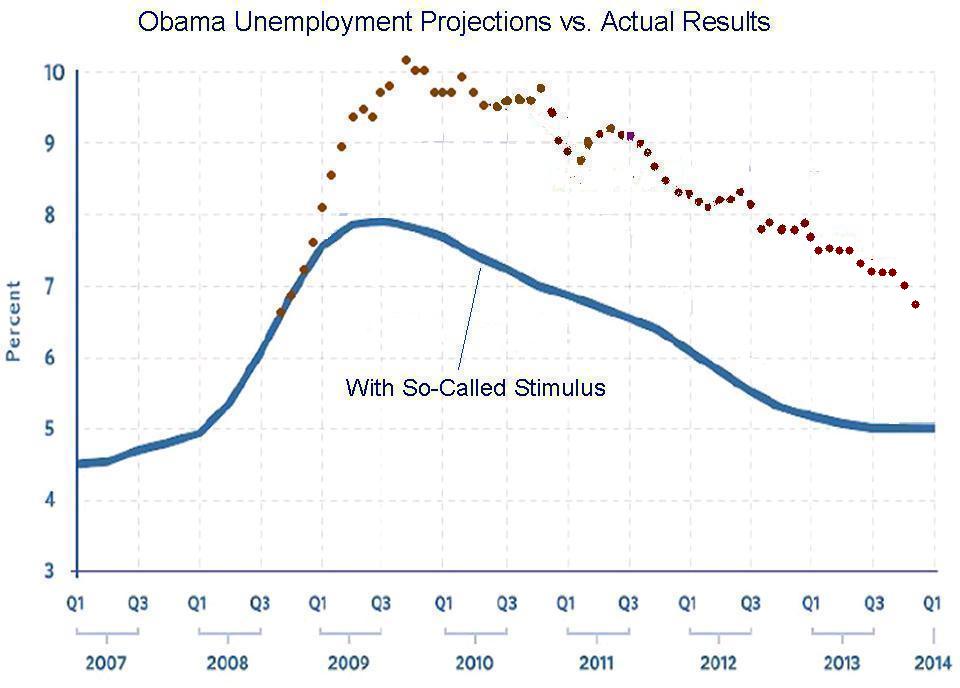

P.S. What makes Argentina’s success even more enjoyable is that 108 left-wing economist signed a letter back in 2023 warning that Milei’s agenda would “cause more devastation.” I wish we could have similar “devastation” in the United States!