Sticking with tradition (2023, 2022, 2021, 2020, 2019, etc), it’s time for my annual column summarizing the best and worst things that happened during the year.

Let’s start with the good developments. And it should be obvious what will be my first item.

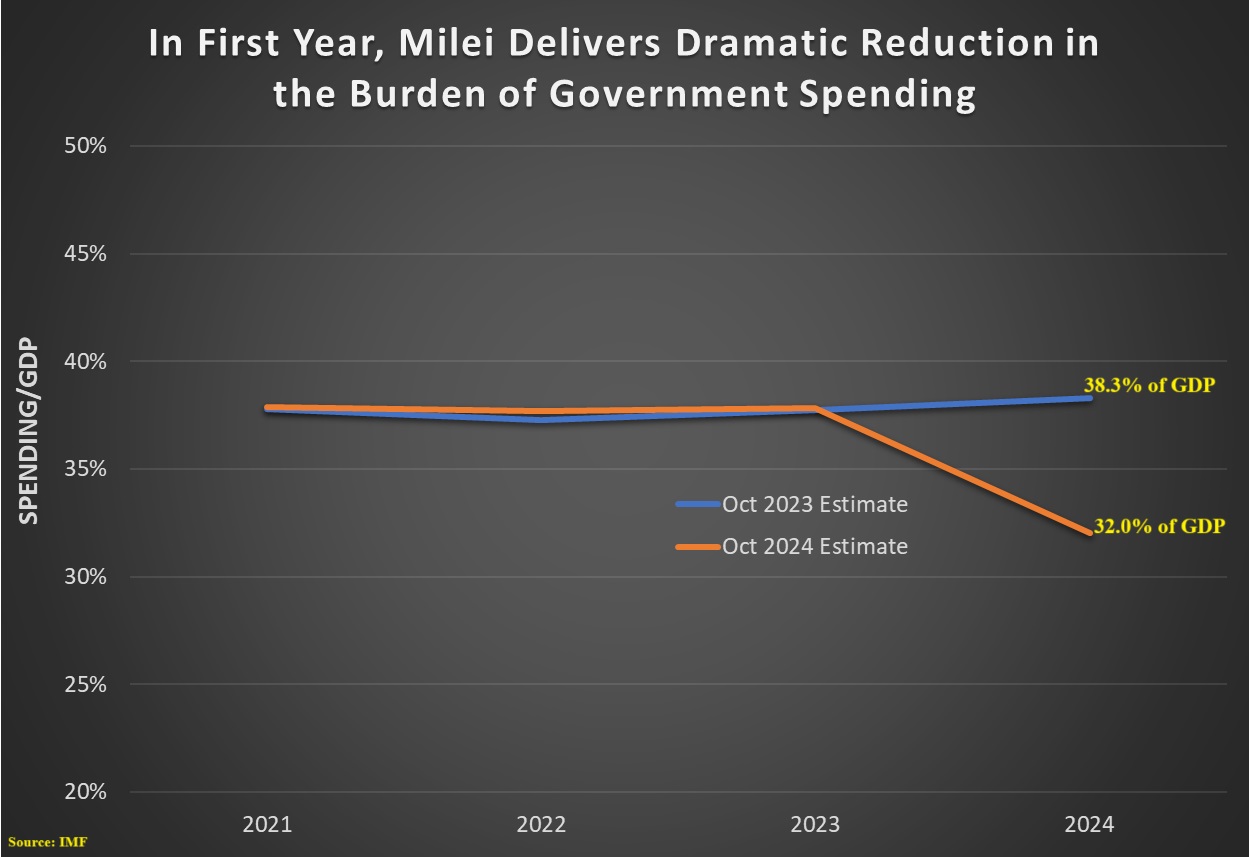

Milei’s policy and economic success – The election of Javier Milei as president of Argentina was shocking. Sort of like if New York elected Rand Paul as governor.

What’s not shocking, though, is that President Milei’s policies have been successful.

What’s not shocking, though, is that President Milei’s policies have been successful.

Thanks to radical reductions in the burden of government and other pro-market reforms, he has quickly balanced the budget, conquered inflation, restored growth, and lowered poverty.

The reason this is great news is that everyone (including me) surely thought a few years ago that Argentina was a hopeless case. After all, voters had been hopelessly corrupted by decades of statism, making the country an example of the 17th Theorem of Government.

Instead, Argentina is now going to be a role model for reformers in other nations.

Kamala Harris lost – I don’t know if the Vice President is actually a lightweight and I don’t care.

What I do know is that she is a doctrinaire statist with a terrible policy agenda. If she has won last month and Democrats won control of Congress, we may have been victimized by her version of Biden’s awful Build Back Better agenda.

Or worse, such as her absurd plan to tax unrealized capital gains.

The country was spared.

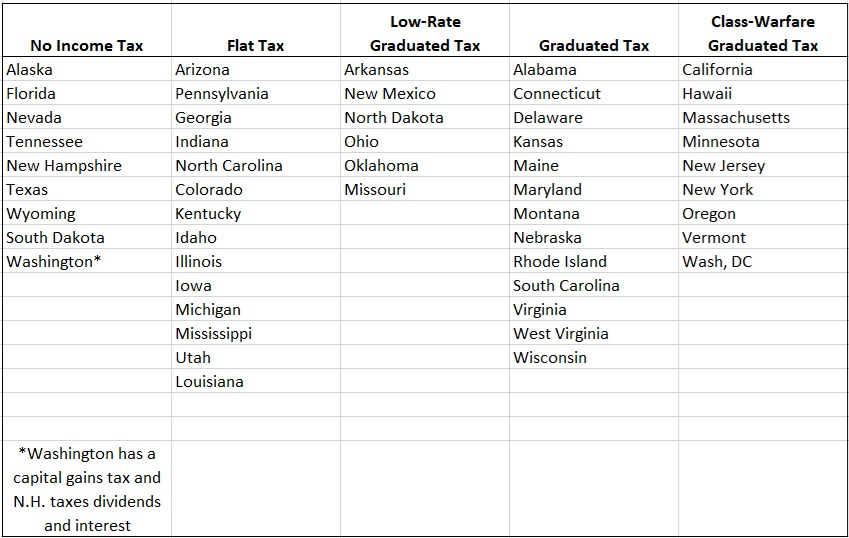

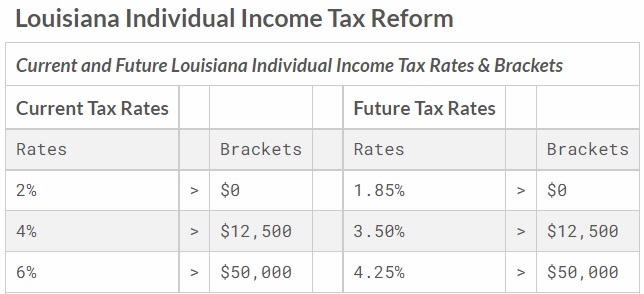

Louisiana flat tax – In recent years, we’ve had very good news at the state level with regards to school choice.

We’ve also had good news regarding lower tax rates and tax reform at the state level.

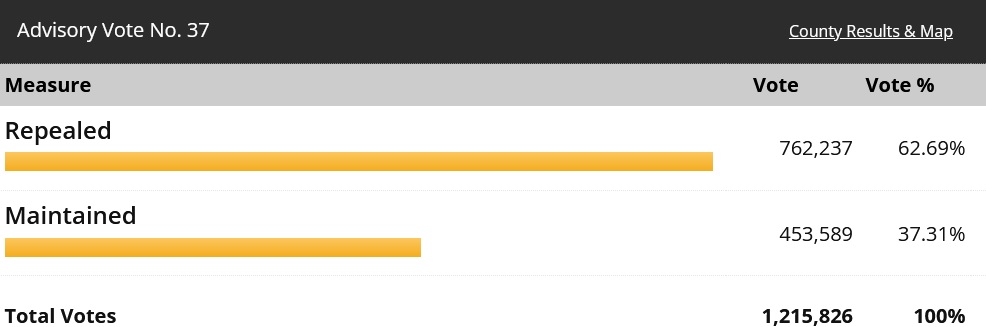

Regarding tax policy, we can celebrate that Louisiana is now part of the flat tax club. Hopefully just a first step.

Now let’s shift to the bad things that happened in 2024.

Social Security expansion – Given America’s horrible fiscal outlook, which is driven by poorly designed entitlement programs, you might think that politicians in Washington would at least understand that it’s not a good idea to make those programs even bigger.

But you would be wrong. The clowns on Capitol Hill recently voted to expand Social Security benefits for state and local bureaucrats, thus allowing that group to have a special ability to double-dip at taxpayer expense.

Sadly, plenty of callow Republicans joined Democrats in hastening America’s fiscal decline.

Many countries are moving in the right direction on this issue. In America, we’re digging the hole deeper.

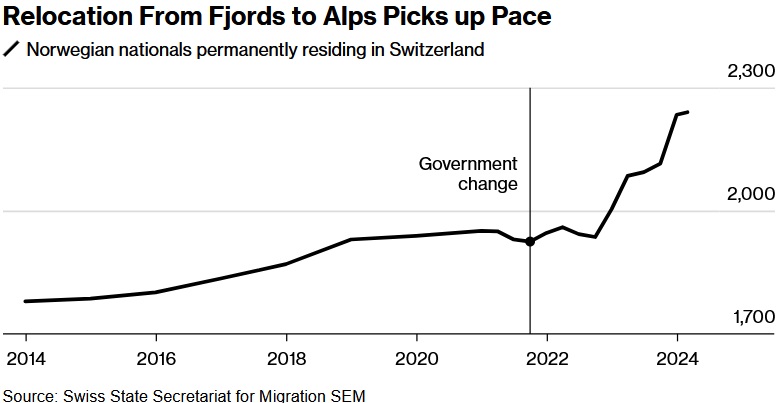

Norway’s wealth tax – I’ve explained repeatedly that wealth taxation is a very foolish and self-destructive idea.

So I suppose I should be grateful that Norway’s politicians are helping to confirm my arguments. They imposed a big increase in their wealth tax that is backfiring in a spectacular fashion.

So I suppose I should be grateful that Norway’s politicians are helping to confirm my arguments. They imposed a big increase in their wealth tax that is backfiring in a spectacular fashion.

I’m sort of cheating with this item. The wealth tax increase was not enacted this year. Instead, what we’ve seen is the disastrous impact of that change.

The terrible policy even led to an entertaining song.

Donald Trump won – While I’m glad Kamala Harris lost (see above), I’m not happy that Donald Trump won.

His fiscal profligacy and self-destructive protectionism hurt America before and those policies will hurt America again.

But what really irks me is that he opposes entitlement reform, which means massive future tax increases are almost certain to happen.

Moreover, his chaotic (but admittedly somewhat entertaining) governing style may lead to big Democratic gains in 2026 and a Democratic sweep in 2028.

But even if that doesn’t happen, that probably means J.D. Vance will be president. And he seems to share Trump’s big-government views.

Not exactly encouraging news for libertarians, classical liberals, and small-government conservatives. But maybe, just maybe, there’s another Reagan in our future (or a Javier Milei).