My views on the European Union are summarized in my three–part series entitled “Yes to Globalization, No to Global Governance.”

In other words, I liked the European Union in the past when it was basically a free-trade pact among European nations – based on the vital principle of mutual recognition.

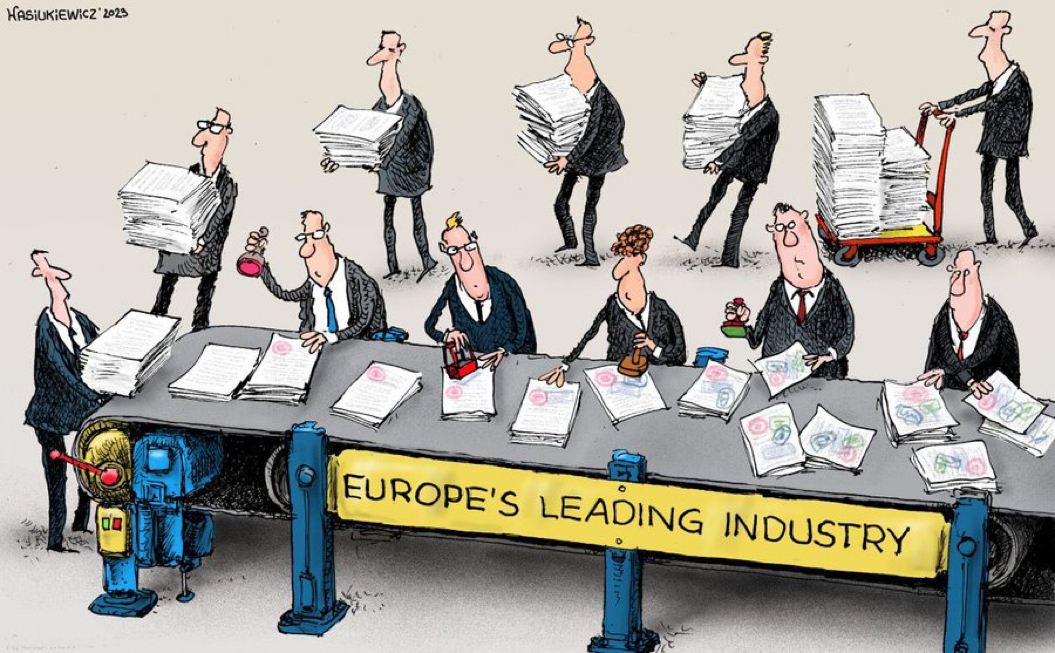

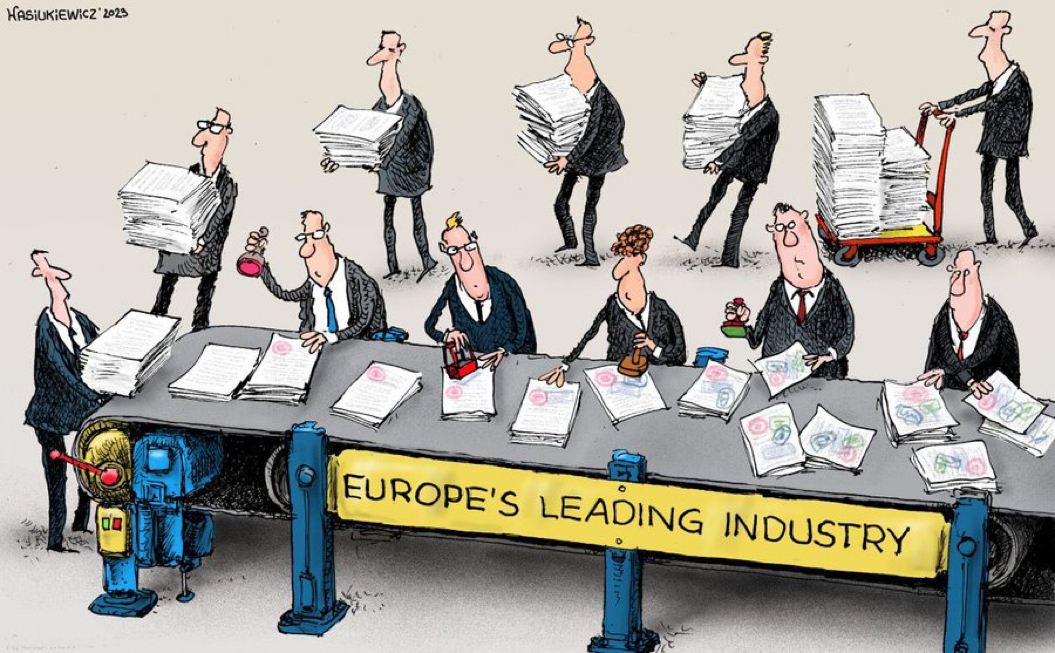

But I’m now hostile because it has morphed into a Brussels-based bureaucracy that promotes higher taxes, more spending, increased red tape, and global protectionism – based on the statist principle of harmonization (i.e., government cartels).

So it’s noteworthy that the Trump Administration, in its recently published National Security Strategy, warns that Europe faces “civilizational erasure.”

The section on Europe is only three pages (25-27) and is worth reading. But it also can be summarized by this excerpt.

The larger issues facing Europe include activities of the European Union and other transnational bodies that undermine political liberty and sovereignty, migration policies that are transforming the continent and creating strife, censorship of free speech and suppression of political opposition, cratering birthrates, and loss of national identities and self-confidence.

migration policies that are transforming the continent and creating strife, censorship of free speech and suppression of political opposition, cratering birthrates, and loss of national identities and self-confidence.

The document in in part a criticism of the European Union, but also very critical of some of the choices made by various national governments in Europe. And it’s obvious that the Trump Administration thinks that large-scale immigration is a threat to Europe.

The Wall Street Journal editorialized about the report, largely to say that there should have been more focus on bad economic policy. Here are some excerpts.

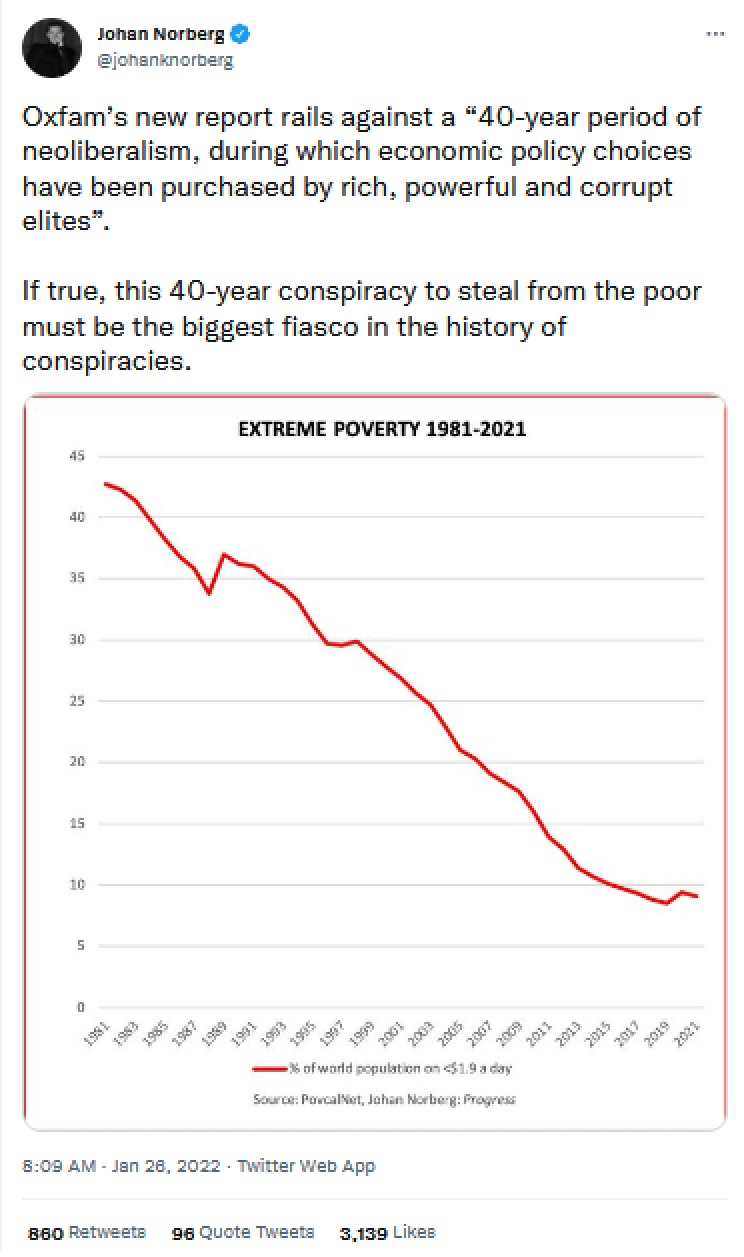

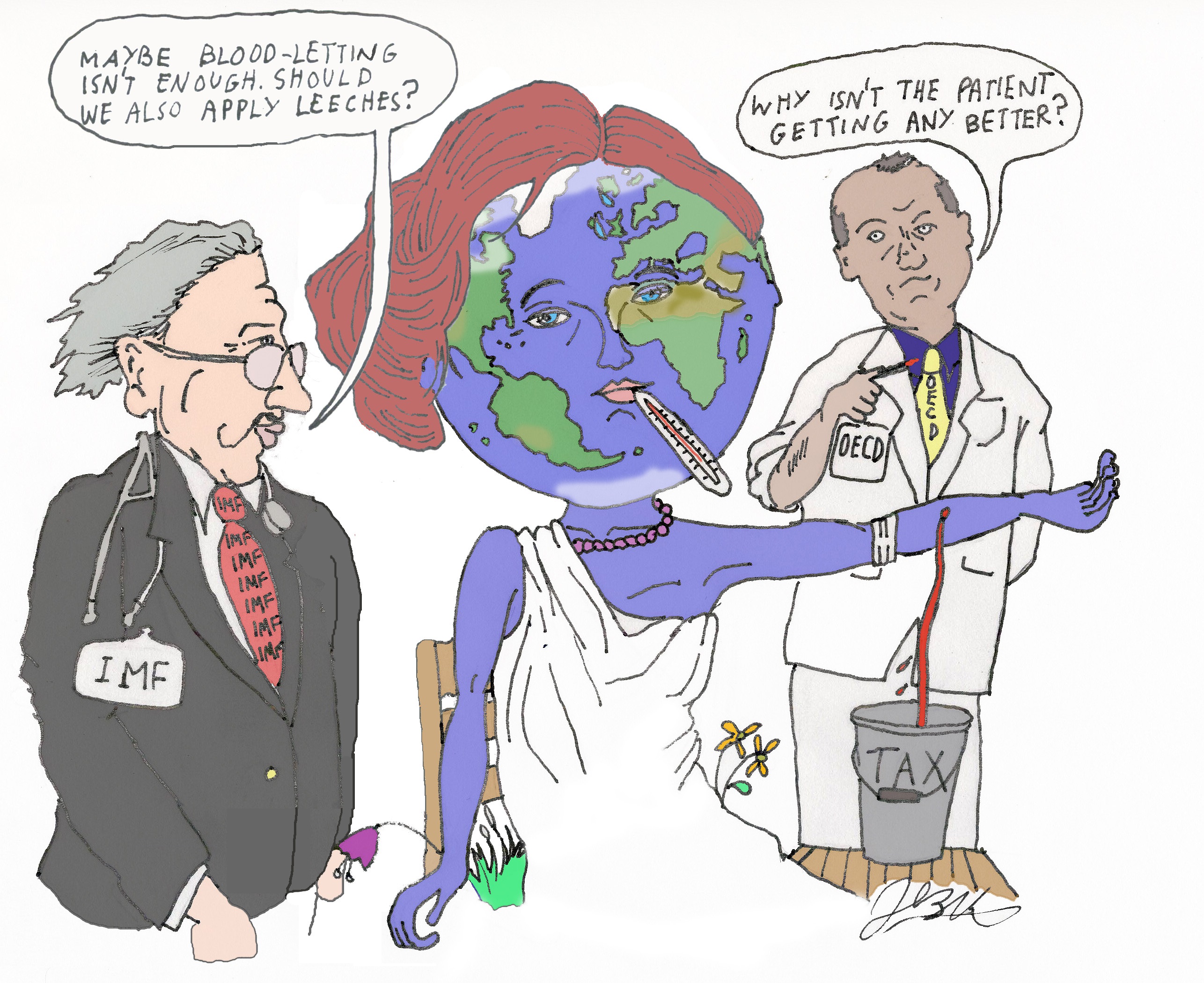

The Administration’s National Security Strategy last week stirred outrage by warning that America’s European allies face “civilizational erasure.” Mr. Trump’s foreign-policy panjandrums mean primarily that mass immigration and deepening political illegitimacy are sapping Europe’s vim and vigor. …Messrs. Trump and Vance have a point. The European Union does too many things (foreign policy, environmental regulation and the like) badly that it shouldn’t do at all. What it’s supposed to do, such as creating a Continent-wide free-trade bloc, it does poorly. …But the Trump diagnosis ignores the biggest threat to Europe’s well-being. That is Europe’s generous social-welfare states and the cascading fiscal, economic and social ills they create. Government social expenditure in…France the figure was 30.6%, in Germany 27.9%, and in Italy 27.6%. This share will rise as populations age. …This fact explains much of what ails Europe. Large welfare states require large tax bills to fund them… That level of taxation saps incentives for innovation and entrepreneurship. Generous welfare states also discourage work, which partly explains why Europe’s labor markets are so sclerotic. …The question is why Messrs. Trump and Vance stress migration and culture more than these fiscal and economic facts. Perhaps because Mr. Trump doesn’t want to reform America’s own entitlement state. Mr. Vance often speaks as if he wants to expand the government’s role, as if welfare checks and bureaucracy can restore national elan and social unity.

…But the Trump diagnosis ignores the biggest threat to Europe’s well-being. That is Europe’s generous social-welfare states and the cascading fiscal, economic and social ills they create. Government social expenditure in…France the figure was 30.6%, in Germany 27.9%, and in Italy 27.6%. This share will rise as populations age. …This fact explains much of what ails Europe. Large welfare states require large tax bills to fund them… That level of taxation saps incentives for innovation and entrepreneurship. Generous welfare states also discourage work, which partly explains why Europe’s labor markets are so sclerotic. …The question is why Messrs. Trump and Vance stress migration and culture more than these fiscal and economic facts. Perhaps because Mr. Trump doesn’t want to reform America’s own entitlement state. Mr. Vance often speaks as if he wants to expand the government’s role, as if welfare checks and bureaucracy can restore national elan and social unity.

I agree with the WSJ, at least with regards to European statism being a major problem. Especially when you look at demographic trends.

And the editorial correctly notes that the Trump Administration is very weak on the issue of entitlements, which may explain why the report downplays that issue.

For what it’s worth, I think it is reasonable to be concerned about both issues – mass migration and bad economic policy.

And the European Union makes both problems worse. Indeed, Nile Gardiner of the Heritage Foundation thinks the E.U. is hopeless. Here are some passages from his recent column in the U.K.-based Telegraph.

Increasingly, the EU stands for despotism, socialism, mass migration, the suppression of free speech and the destruction of national sovereignty. Many senior US officials and Members of Congress rightly view the European Union as fundamentally undemocratic, run by power-hungry unelected bureaucrats with practically zero accountability.  …The EU is a real problem for the United States and for the transatlantic alliance. It is dominated by big government, Left-wing ideology, and is sinking under the weight of decades of open-borders policies, threatening the very future of Western civilisation. …the United States cannot unilaterally abolish the EU… But it can actively back the cause of national sovereignty and self-determination across Europe, challenging the power of Brussels, and stand with European movements that seek to throw off the shackles of the EU machine. To his great credit, Trump has been a huge supporter of Brexit… And just as the United States stood with the brave and fearless dissidents of the Soviet Union who fought against the tyranny of Moscow, the world’s superpower should back those in Europe who wish to see democracy and sovereignty restored across the continent and power taken away from Brussels. …The days of the US supporting the European Project are over, and the transatlantic alliance will be far better off when the EU is consigned to the dustbin of history.

…The EU is a real problem for the United States and for the transatlantic alliance. It is dominated by big government, Left-wing ideology, and is sinking under the weight of decades of open-borders policies, threatening the very future of Western civilisation. …the United States cannot unilaterally abolish the EU… But it can actively back the cause of national sovereignty and self-determination across Europe, challenging the power of Brussels, and stand with European movements that seek to throw off the shackles of the EU machine. To his great credit, Trump has been a huge supporter of Brexit… And just as the United States stood with the brave and fearless dissidents of the Soviet Union who fought against the tyranny of Moscow, the world’s superpower should back those in Europe who wish to see democracy and sovereignty restored across the continent and power taken away from Brussels. …The days of the US supporting the European Project are over, and the transatlantic alliance will be far better off when the EU is consigned to the dustbin of history.

I largely agree with Nile, especially about Brexit (even if British politicians haven’t take advantage of their newfound independence).

But I worry that the anti-E.U. movement in the rest of Europe is less worthy of support. Anti-E.U. politicians in places like Germany, France, and Hungary seem primarily concerned about mass migration.

I think that concern is legitimate, but I hardly view such people as allies when they support big welfare states so long as benefit payments are limited to native-born residents.

And many of these politicians are hypocrites in that they complain about Brussels yet they anxiously gobble up the various handouts distributed by the European Union.

Last but not least, here are some excerpts from Christopher Caldwell’s column in the New York Times. He argues that Trump is defending Europe and that the report is pushing European politicians to do likewise.

The president’s 2025 National Security Strategy, released last week, sent a message to the continent that shocked the world. Drowning under mass migration, mismanaged and bullied by the European Union’s leaders, increasingly incapable of producing children, Europe’s ancient nations, the document argues, face not just economic decline but also the prospect of imminent “civilizational erasure.”  …President Trump’s detractors on both sides of the Atlantic blamed him for rupturing the NATO alliance and for straying into matters far removed from national defense — such as migration, culture and demography — that are the province of racists and xenophobes. That is the wrong way to understand the document. Read carefully, in fact, the passages about Europe sound more like a defense of the continent. …Few of those outraged by the document have bothered to distinguish between Europe…and the European Union, a 33-year-old experiment that aims to replace the continent’s nation-states with a novel form of transnational governance based in Brussels. In certain quarters the European Union has become synonymous with a postdemocratic permanent ruling class of regulators and bureaucrats. …the Trump administration sees…the European Union as a danger to the United States — albeit for its incompetence rather than its antipathy.

…President Trump’s detractors on both sides of the Atlantic blamed him for rupturing the NATO alliance and for straying into matters far removed from national defense — such as migration, culture and demography — that are the province of racists and xenophobes. That is the wrong way to understand the document. Read carefully, in fact, the passages about Europe sound more like a defense of the continent. …Few of those outraged by the document have bothered to distinguish between Europe…and the European Union, a 33-year-old experiment that aims to replace the continent’s nation-states with a novel form of transnational governance based in Brussels. In certain quarters the European Union has become synonymous with a postdemocratic permanent ruling class of regulators and bureaucrats. …the Trump administration sees…the European Union as a danger to the United States — albeit for its incompetence rather than its antipathy.

For what it’s worth, Europe is the birthplace of the classical liberal principles that make Western Civilization superior. That should be celebrated.

Unfortunately, the European Union definitely does not defend those values. As such, I won’t lose sleep if it eventually collapses (and I definitely don’t think more nations should join).

However, I’m not optimistic that a post-E.U. Europe would be any better.

How do you convince European nations to copy Switzerland? To embrace jurisdictional competition? Or to remember the events of 1356?

Maybe they’ll be a rebirth of liberty after the upcoming fiscal crisis, but I fear Robert Higgs is right rather than Naomi Klein.

P.S. You can click here, here, and here for research on the European Union and economic freedom.

Read Full Post »

Though if you don’t have 24 spare minutes, you can simply compare the market for bread in socialist countries and capitalist countries.

Though if you don’t have 24 spare minutes, you can simply compare the market for bread in socialist countries and capitalist countries.