Liner shipping entered 2025 in a flat funk. CEOs warned of “challenging circumstances” and “a new normal” of trade tariffs and oversupply. Even though the Houthi militia generously offered in January to stop attacking commercial shipping sailing under most flags, the majority of owners continued to consider that the Red Sea was a no-go area and to take the longer, more expensive route round Africa, which coincidentally soaked up about 10% of Asia-Europe fleet capacity. Shipping entered the EU’s emission trading scheme while the far more complex and potentially far more expensive Fuel EU Maritime regulations lurked in the near future. Maersk and Hapag-Lloyd began their Gemini Alliance in January, shaking up the coordination of the top 10 liner companies handling 80% of container lifts, but none of them could force demand to move upwards.

In February, University College London climate boffins reported that every ship built from then on must operate on “clean” fuels (which do not yet exist in sufficient quantities) and that every ship built since 2016 would either have to be retrofitted for clean fuels or scrapped. Liner companies did their best to oblige by ordering almost 500 new vessels this year, the biggest order being ten 24,000 teu behemoths that Evergreen ordered from Hanwha Ocean and Guangzhou in February, for delivery from 2027 to 2029.

The new US administration baulked at China’s dominance of shipbuilding and threatened a new port charges regime for Chinese-owned, built or operated ships, only to back down at the eleventh hour after a Trump-Xi summit in November. The US, aided by Saudi Arabia, did manage to shoot down the IMO’s latest path to net zero in October, putting global decarbonisation plans on hold. With over 70% of containership orders featuring low-emission fuel capability, will the liners be shipping air in their methanol and ammonia tanks?

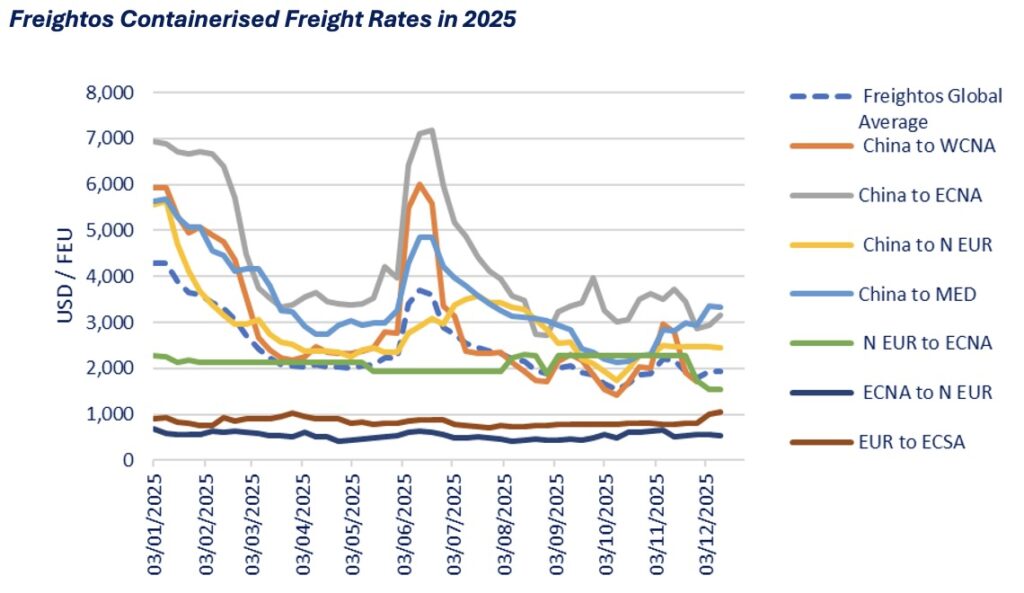

Even before Mr Trump appeared in the Rose Garden with his bizarre board of tariffs, liner trades were struggling. Freight rates plunged in Q1, with the Freightos global average rate for a 40 foot box falling from a nicely profitable $4,290 in early January to a half-as-good $2,049 in the last week of March, led by a slump in transpacific freight rates.

Mr Trump kept everyone guessing on what the final outcome of tariffs would be, as he followed an ambitious agenda of securing 100 new trade agreements in 100 days. The China tariff shot up from 55% to 140%, then down to 30%, taking the 40’ box rate from Shanghai to the US west coast on a roller coaster ride from $5,929 as 2025 opened, to a low of $2,321 in early May, back up to a peak of $5,488 in early June as shippers tried to beat a nominal August tariff deadline, then back to a low of $1,431 in early October as an early peak season petered out, before rising again to a peak of $2,958 in early November as Trump and Xi met.

Liners stripped capacity from transpacific services from August as the port of Los Angeles reported an all time peak in throughput of 1.02m teu in July but a fall to 0.85m teu in October. The port director, Gene Seroka, told media in July that China was 80% of throughput in 2018 but only 45% by mid-2025: “Hard policy goes in, we take a nose dive on cargo volume. When those goalposts shift, cargo picks up trying to race to the next deadline.”

As tariffs brought an early peak season and chaos to economic prediction, liners warned of harder times in H2. Mid-year results calls warned equity and credit analysts of uncertainty and an outlook that could be less robust than anticipated. Liner companies have been forced to move from business planning to risk management. Yet as Hapag-Lloyd reported in August, “Despite various disruptions in the past, global trade has proven to be resilient and is expected to continue growing.”

In December, UNCTAD has reported that global trade will exceed $35trn this year, a rise of 7% over 2024, and that trade volumes are also up. It points to 8% stronger south-south trade this year, to 9% growth east Asian exports and 10% growth in Asian regional trade as global supply chains are broken apart and reconfigured. Imports to Africa are up 10% over the last four quarters, while exports are up 6%. Even moribund Europe grew exports by 6% over the last four quarters, though the trade gap grew as imports expanded by 8%. US tariff policy has narrowed the US trade deficit and introduced more friendshoring and nearshoring, but liner shipping demand remains positive.

The problem remains the containership orderbook. In addition to the nearly 500 orders this year, 242 new containerships delivered 2.04m teu into the fleet, which now exceeds 6,100 ships of 31m teu. Liners have stripped capacity, enforced slow steaming, blanked sailings, rescheduled services and rerouted vessels to try to manage the tsunami of capacity. That has resulted in a Freightos global average of $1,934 by mid-December, a 55% fall over the year. The box rate from Shanghai to Los Angeles is down 67% this year at $1,964. On the Shanghai to Rotterdam voyage, rates are down 56% to $2,449 and on Shanghai to the Med, they are down 41% to 3,342. As tariffs bite, the 40’ box rate from Europe to North America is down 32% to $1,537 with the reverse rate down 20% to $549.

The container shipping outlook remains fragile: the global economic system that underpinned it for 70 years is collapsing. The energy transition looms expensively in the regulatory future. A mixture of confused policies could lead to profitable trade inefficiencies but costly capital investments. Liner executives are working harder than ever for their shareholders.