Our capital. Your skills. Shared profits.

27K +

Active traders

200+

Trading Instruments

$1 200 000

Max. Trader Capital

Grow with us

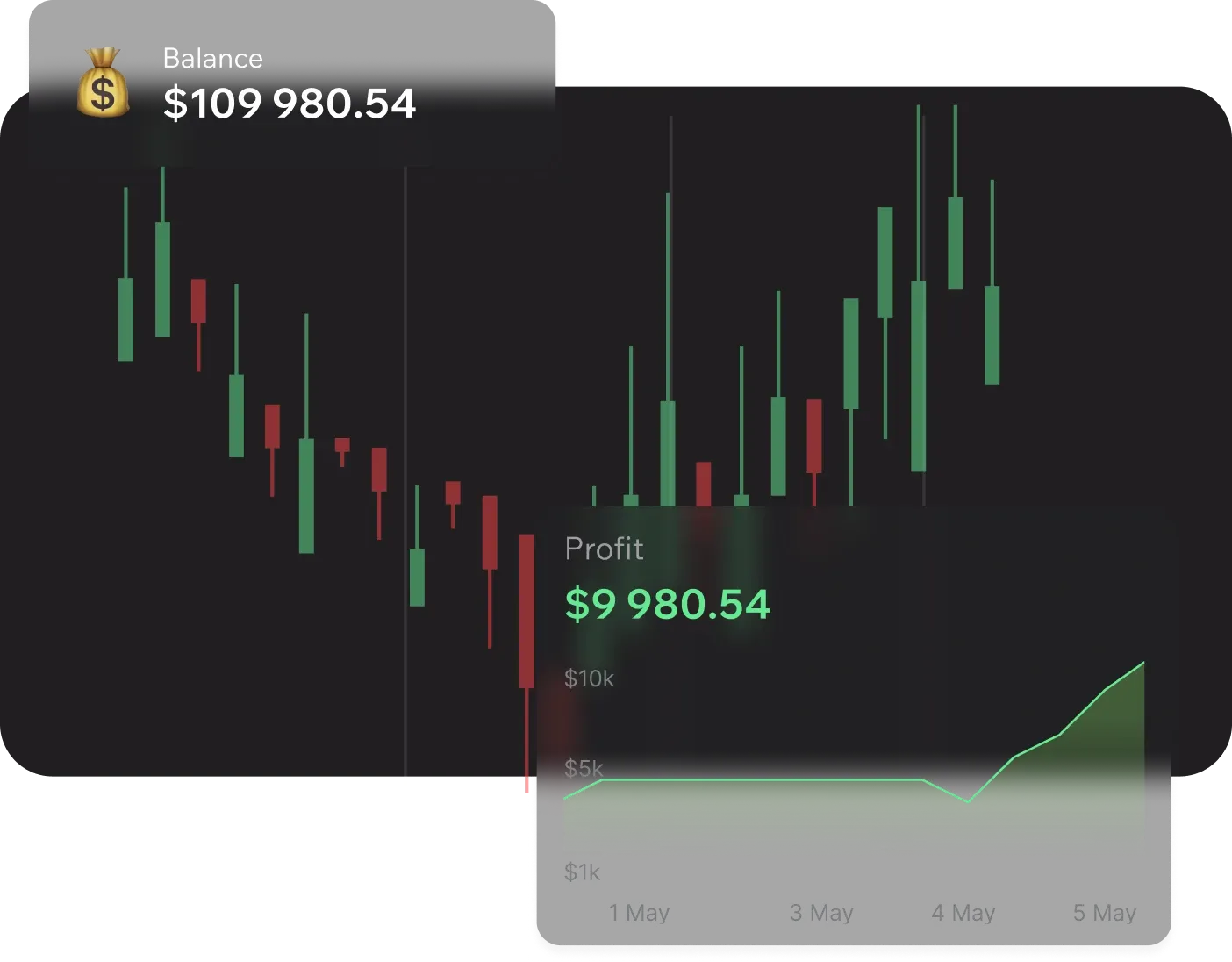

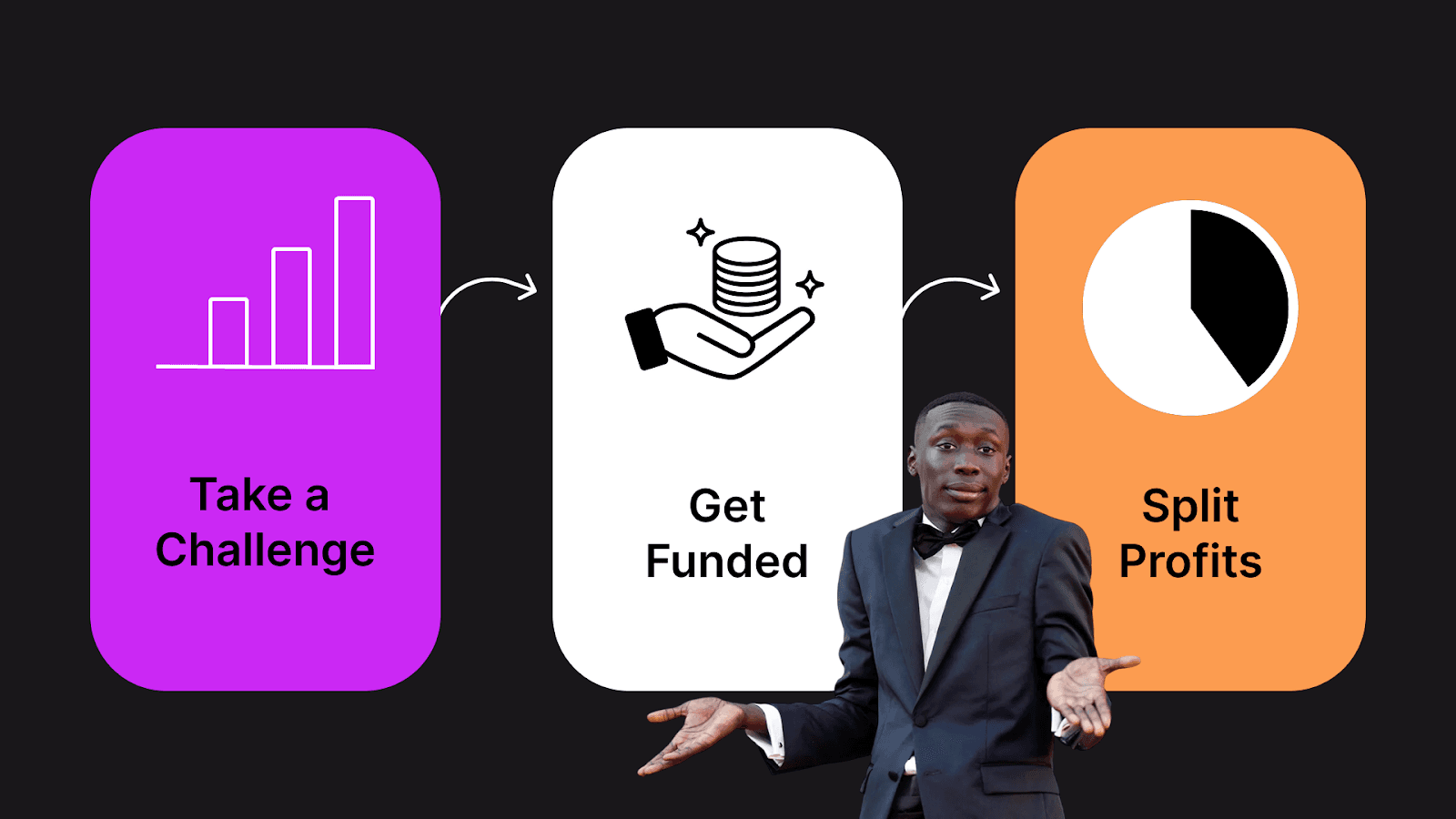

Pass the challenge, trade with funded capital, and withdraw profits - earning rewards for your trading success

About Upscale

We bring together capital, AI, and precision execution in one prop trading platform. You get a funded trading account, the tools to grow, and transparent terms. We succeed when you succeed.

| Profit | Daily Drawdown | Total Drawdown | Profit Days | |

| Phase 1 | +5% | +5% | +10% | 3 |

| Phase 2 | +8% | +5% | +10% | 5 |

| Trading | ∞ | +5% | +10% | 5in 14 days |

$200,000

Market Legend

Participation: $1,299

$1000 for $6.495

$100,000

Top Traders' Choice

Participation: $799

$1000 for $7.99

$50,000

Confident Entry

Participation: $399

$1000 for $7.98

$25,000

Optimal

Participation: $249

$1000 for $9.96

$10,000

Smooth Start

Participation: $119

$1000 for $11.9

$5,000

Minimal Risk

Participation: $69

$1000 for $13.8

New to trading?

We’ve got you covered!

Learn everything from scratch with Storm Academy — free, flexible, and built to help you grow. Level up your skills and earn rewards as you progress!

Start learning →New to trading?

We’ve got you covered!

Learn everything from scratch with Storm Academy — free, flexible, and built to help you grow. Level up your skills and earn rewards as you progress!

Blog

Real Prop Firm Payouts: 9 Funded Trader Success Stories 2025

Verified crypto prop trading results with payouts ranging from $91 to $30,000+

Looking for proof that crypto prop firms actually pay out? You're not alone. With only 5-10% of traders passing prop firm challenges and even fewer receiving consistent payouts, skepticism is warranted. That's why we've compiled real, verified success stories from Upscale traders — complete with actual payout amounts, trading strategies, and lessons learned.

What you'll learn in this article:

- 9 detailed case studies of funded traders with verified payouts from $91 to $30,000+

- Proven trading strategies: Price Action, Smart Money Concept, indicator-based trading, and news trading

- Common mistakes that cost traders their funded accounts — and how to avoid them

- Why trading psychology matters more than your entry point (the 70/20/10 rule)

- Practical risk management tips from traders who've passed prop firm challenges

📌 Pricing note: These success stories span summer 2024 through 2025. Early cases ($18 per challenge) reflect launch pricing. Current Upscale challenge prices start at $59 (Basic RWA $5,000 account).

Vladislav: $30,000+ in Payouts — 12 Years of Price Action Mastery

Funded account size: $100,000

Total payouts: $30,000+

Challenge cost: $899

ROI: 3,337%+

Strategy: Price Action + trend following

Vladislav represents what's possible with long-term dedication to prop trading. With 12 years of trading experience, he's developed a refined approach based on trend following and price action — almost entirely abandoning indicators.

How Vladislav's Trading Strategy Works

His primary timeframe is M30 for identifying market direction, with entries on M5 and occasionally M1 for intraday positions. Moving averages serve only as visual aids, not trading signals.

Core principles:

- Trade exclusively with the trend — "mathematically, this always beats catching reversals"

- Place stop-loss immediately after entry — non-negotiable

- Minimum risk-to-reward ratio of 1:2, typically 1:3, historically reaching 1:26

- Strict pre-trade checklist prohibiting trades during unsuitable conditions or major news events

Key Prop Trading Lessons from Vladislav

"I've made every possible mistake. Large financial losses taught me discipline — lose a five-figure sum in one day, and your brain rewires itself fast."

His most critical rule: place your stop-loss within seconds of entry. A single candle can destroy an entire funded account. Interestingly, he considers the "stop trading after three losses" rule counterproductive — sometimes the real signal appears only after several stop-outs.

His success formula: "A trading strategy is a future business, not improvisation. Stability beats speed — small risks and strict planning let you pass challenges and maintain profits for months."

speculator1337: How $540 Became $11,231 in One Month

Funded account size: $50,000

Challenge cost: $540

Payout: $11,231

ROI: 2,080%

Strategy: Trend trading on BTC and ETH

On June 12, trader @speculator1337 purchased a $50,000 prop challenge. By July 2 — just 20 days later — he'd passed all requirements and received his funded account.

Within 2 weeks of getting funded, trading primarily BTC, ETH, and WIF, he generated approximately $14,000 in profits. On July 17, he withdrew $11,231 — a 20x return on his initial investment.

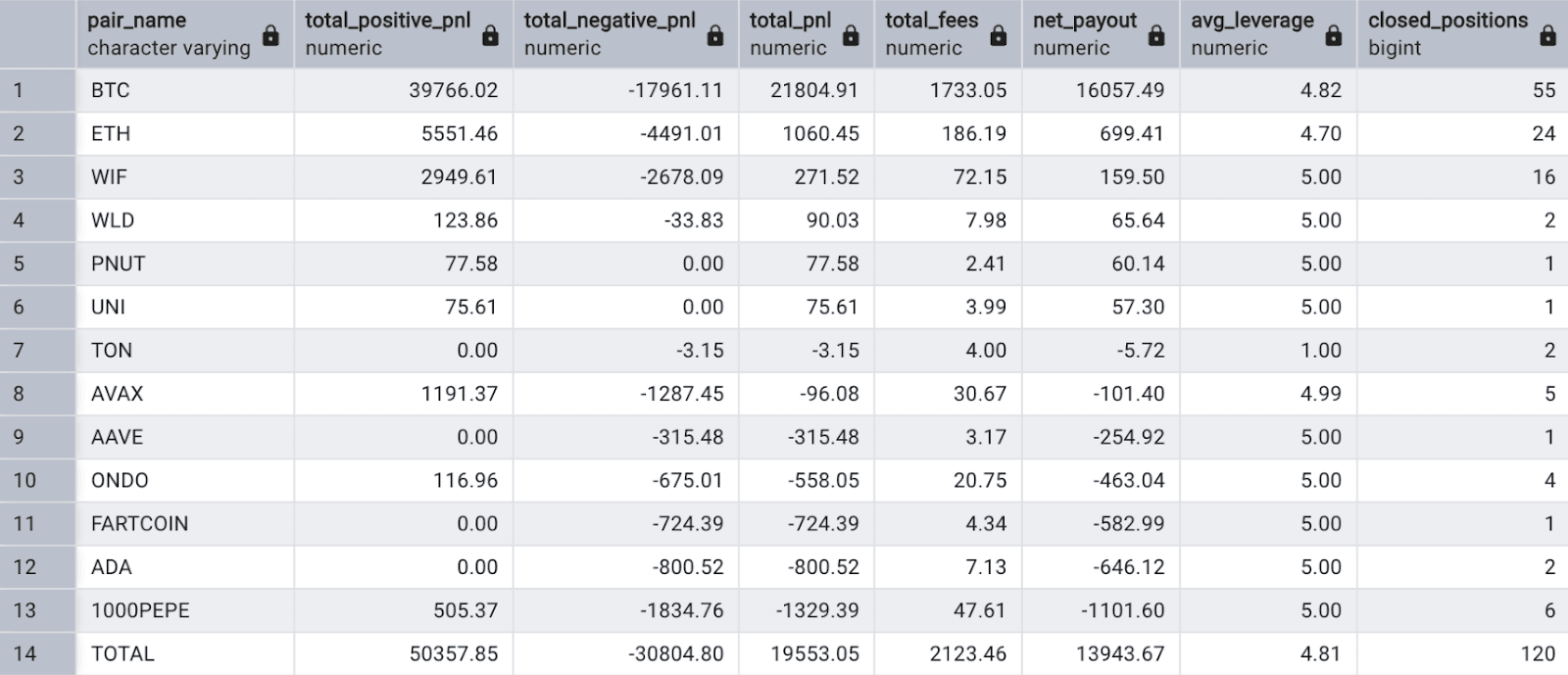

Trading Statistics

💡 Trading the same strategy with his own $540 would have yielded roughly $150. The prop trading model amplified his results by 75x.

This success came from disciplined risk management, trend-following execution, and a clear trading plan — not luck or excessive risk-taking.

Vlad: $3,600 Payout Using Indicator-Based Trading

Funded account size: $10,000

Payout: $3,600

Challenge cost: ~$144

ROI: 2,500%

Strategy: Indicator trading (GoTrade system)

Vlad is an intraday trader whose entire approach is built on technical indicators — proof that indicator-based strategies work in crypto prop trading when executed with discipline.

Vlad's Technical Toolkit:

- Divergence indicator — identifying overheated zones and potential reversals

- Weekend range — classic consolidation patterns for breakout trading

- Monday range — forms by end of day, provides signals throughout the week

- Color-coded trend indicator — quick visual confirmation of market direction

- Additional scalping indicators

Entry criteria: Only at points confirmed by multiple indicators and market structure. He'll commit up to half the account with 5x leverage — but only when the setup is strong and stop-loss is immediately placed.

Trading Psychology Insights from Vlad

"The biggest mistake is revenge trading. After 2-3 consecutive losses — step away. The charts will still be there tomorrow."

Vlad came dangerously close to daily drawdown limits multiple times. The prop firm's risk limits actually saved him — forcing discipline when emotions pushed for more.

Why he chose prop trading: "Trading your own money creates fear. You close too early, enter too late, hesitate constantly. Prop trading provides structure — clear rules, daily drawdown limits — that protect you from yourself and revenge trading."

He calls his first payout "the moment I knew this works" and believes prop trading is ideal for beginners: low entry cost, real experience, minimal personal risk, and actual withdrawable profits.

zverskyzver: From $18 to $2,744 — The Power of Persistence

Funded account progression: $1,000 → $25,000

Initial challenge cost: $18

Total payouts: $2,744

ROI: 15,244%

Strategy: Altcoin trading with 4-5x leverage

Trader @zverskyzver started with just $18 — the cost of a $1,000 challenge during Upscale's launch period. His first account? Blown.

Instead of quitting, he analyzed his mistakes and tried again. This time, he focused on 1000PEPE, TON, and DOGE with 4-5x leverage while strictly respecting drawdown limits.

Payout Timeline:

- June 22: First payout — $744

- July 6: Second payout — $960

- July 20: Third payout — $1,040

Over his trading period, he executed nearly 5,000 positions. After proving himself, he reinvested profits into a $25,000 challenge, continuing to scale his prop trading career.

Ruslan: $1,057 from News Trading

Funded account size: $25,000

Payout: $1,057

Challenge cost: $315

ROI: 335%

Strategy: News trading + trend following

Ruslan doesn't consider himself a traditional trader — he's a crypto enthusiast and investor. His approach is unconventional: trading the news, based not on charts but on information flow.

How the News Trading Strategy Works:

Ruslan monitors Twitter, Telegram, and Discord communities 24/7, receiving news before most traders and entering positions early. He catches sudden announcements — partnerships, releases, protocol updates — such as Pavel Durov's TON news, ApeChain launch, or Mantle teasers.

He trades only major assets: ETH, TON, ARB, ApeCoin, Mantle — avoiding low-caps and meme coins where information advantage matters less.

Hard Lesson: Emotions Destroy Traders

"My most painful lesson was a series of shorts on the meme token PENGU. The market kept rising, but I kept shorting emotionally. Lost $1,100 in one day and nearly liquidated my account."

Ruslan calls this "kill tilt" — emotions kill traders, not strategies. He finds prop trading psychologically easier because clear boundaries, mandatory stops, and drawdown limits protect against impulsive decisions.

Maxim: $860 with Smart Money Concept (SMC)

Funded account size: $10,000

Payout: $860

Challenge cost: ~$144

ROI: 597%

Strategy: Smart Money Concept (SMC)

Maxim trades predominantly intraday with a clear philosophy: fewer trades, higher quality.

SMC Trading Tools:

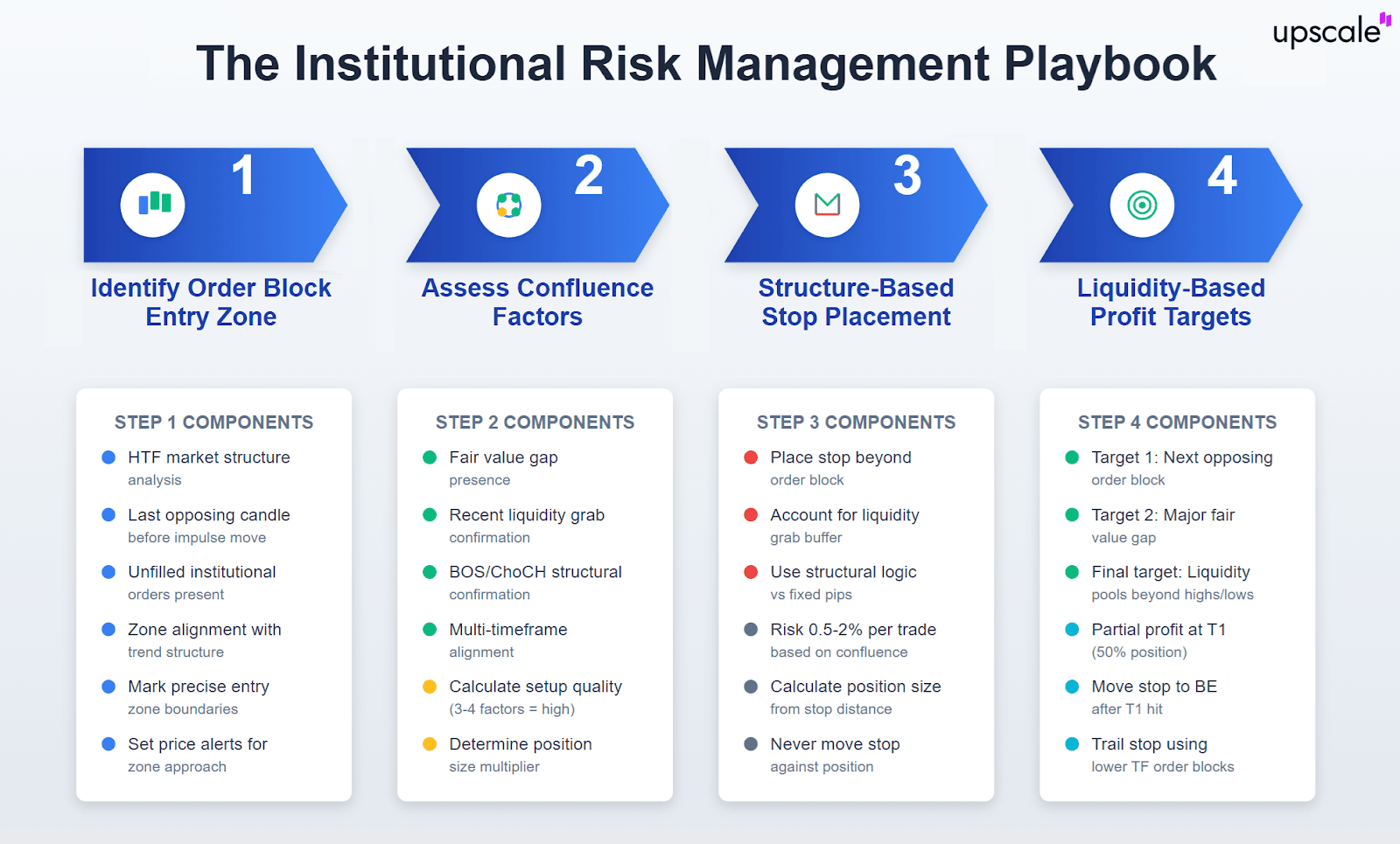

- Order blocks and liquidity zones

- Structure breaks (BOS/CHoCH)

- Volume Profile

- RSI, MACD, Stochastic, EMA (relied on for no more than 10% of decisions)

Risk management rules: Maximum 10% of account per position, stop-loss around 0.7-0.8% of account. On volatile coins, position size drops to 3-5%.

The Path Through Failed Challenges

"The journey was hard: multiple blown challenges, psychological breakdowns, attempts to go all-in. But each time I stopped trading, closed the charts, returned the next day, and recovered the drawdown strictly following my strategy."

Maxim emphasizes that discipline isn't theory — he quit smoking after 27 years, returned to fitness, started reading books. These lifestyle changes translated directly into trading stability.

His mindset: "If I lose this account, I'll buy another and continue." For Maxim, Upscale represents a path to financial independence.

Evgeny: $473 Trading Exclusively from Phone

Funded account size: $10,000

Payouts: $287 + $186 = $473

Challenge cost: ~$144

ROI: 328%

Strategy: Support/resistance levels

Evgeny trades 100% from his smartphone because his strategy requires no complex tools — just pure price levels and consolidation zones, no indicators.

Evgeny's Trading Approach:

- Analyze weekly BTC, ETH, and Solana charts for overall market context

- Solana matters because its ecosystem altcoins mirror SOL movements with amplified volatility

- Enter only based on price reaction at key levels

- Risk 0.3-1% per trade, daily drawdown limit 2%

- Minimum risk-to-reward ratio 1:2

The 70/20/10 Success Formula

"Psychology is the main success factor: 70% of results. Risk management accounts for 20%, and only 10% comes from the entry point itself."

On prop trading vs. personal capital: "Trading your own $10,000 makes no sense — invest that in spot and DeFi. Move trading to company capital where risks don't fall on you."

Daniil: $91 from a $1,000 Challenge — Everyone Starts Somewhere

Funded account size: $1,000

Challenge cost: $18

Payout: $91

ROI: 505%

Strategy: Technical analysis + Volume Profile

Daniil demonstrates that you don't need massive capital to start. His strategy relies on technical analysis without complex pattern recognition.

Core Trading Tools:

- Volume Profile — primary analytical tool

- Support/resistance levels and mirror zones

- First hours of New York session analysis

- SMC concepts: imbalances, order blocks, structure breaks

- Average RR of 1:2.5-1:3, sometimes reaching 1:5-1:6

Daniil's Core Trading Philosophy

"If you have a plan — follow it. Otherwise, it becomes gambling. Any strategy collapses when you increase risk. Your stop-loss belongs where the idea is invalidated, not where you feel comfortable."

Why prop trading works: "Invested $18, withdrew $91 — that's 5x. This is exactly why prop trading exists: small risk, real experience, consistent rules."

sciencebiotech: From Factory Shifts to $1,800 Payout

Funded account size: $10,000

Payout: $1,800

Challenge cost: $144

ROI: 1,250%

Strategy: RSI + EMA + price levels

Trader @sciencebiotech started on KuCoin, trading "by feel" and consistently blowing accounts.

After 4 failed attempts on $1,000 and $5,000 challenges, he learned the rules and passed his fifth challenge — a $10,000 account.

What Changed:

- Shifted from "button-clicking" to systematic analysis

- Learned proper stop-loss placement and stopped moving them

- Combined RSI and EMA with price levels

- Found an edge trading TON

- Trades from phone during commute and work breaks

"Trading larger challenges is actually easier — you develop respect for the money and naturally reduce risk-taking."

Upscale Trader Payout Summary Table

| Trader | Account | Cost | Payout | ROI | Strategy | |--------|---------|------|--------|-----|----------| | Vladislav | $100,000 | $899 | $30,000+ | 3,337%+ | Price Action | | speculator1337 | $50,000 | $540 | $11,231 | 2,080% | Trend Trading | | Vlad | $10,000 | ~$144 | $3,600 | 2,500% | Indicators | | zverskyzver | $1,000 | $18 | $2,744 | 15,244% | Altcoins | | sciencebiotech | $10,000 | $144 | $1,800 | 1,250% | RSI + EMA | | Ruslan | $25,000 | $315 | $1,057 | 335% | News Trading | | Maxim | $10,000 | ~$144 | $860 | 597% | SMC | | Evgeny | $10,000 | ~$144 | $473 | 328% | Price Levels | | Daniil | $1,000 | $18 | $91 | 505% | Volume Profile |

What Successful Prop Traders Have in Common

1. Non-Negotiable Stop-Loss Discipline

Every trader places a stop-loss immediately after entry — no exceptions. As Vladislav says: "Your stop should be set within seconds of entry — one candle can destroy your entire account."

2. Strict Risk Management Rules

- Risk per trade: 0.3-2% of account

- Risk/reward ratio: minimum 1:2, typically 1:3

- Daily drawdown limit: 2-4%

3. Psychology Over Strategy (The 70/20/10 Rule)

According to Evgeny's formula: 70% of success comes from psychology, 20% from risk management, and only 10% from entry points.

4. Prop Structure Removes Emotional Pressure

All traders report the same phenomenon: trading personal capital triggers fear, FOMO, and revenge trading urges. Prop trading's built-in rules and limits protect traders from their own worst impulses.

5. Strategy Diversity, Consistent Results

These traders use completely different approaches — pure price action, indicator stacking, news trading, Smart Money Concepts. The common thread isn't the strategy itself, but systematic execution and unwavering discipline.

FAQ

What's the best trading strategy for crypto prop firms?

There's no single "best" strategy. Successful Upscale traders use Price Action, indicator systems, SMC, news trading, and pure level-based approaches. Choose what you understand deeply and develop it into a repeatable system. Consistency matters more than the specific methodology.

How much can you realistically earn with a crypto prop firm?

Based on 2024-2025 Upscale data, verified payouts range from $91 to $30,000+. ROI relative to challenge cost ranges from 300% to over 15,000%. Results depend on account size, trading skill, and risk management discipline.

How many attempts does it take to pass a prop firm challenge?

It varies significantly. Some traders pass on their first attempt; others need five tries (@sciencebiotech). Industry data suggests only 5-10% of traders pass evaluations. The key is analyzing each failure, adjusting your approach, and persisting.

Can you trade crypto prop accounts from your phone?

Yes. Evgeny trades exclusively via smartphone using Upscale's Telegram bot. His level-based strategy doesn't require desktop-only tools. Mobile trading works well for strategies that don't depend on complex charting software.

Why is prop trading better than trading your own money?

Psychological advantage is the primary benefit. With prop trading, you risk only the challenge fee — not your entire savings. Built-in rules (daily drawdown limits, max loss thresholds) enforce discipline and protect against emotional trading and revenge trading spirals.

What's the typical profit split at crypto prop firms?

Most crypto prop firms offer 70-90% profit splits to traders. Some firms increase the split based on consistent performance. Always verify the exact terms before purchasing a challenge.

How fast are prop firm payouts processed?

Processing times vary by firm. Upscale processes payouts within a competitive timeframe. Industry leaders typically process within 24-48 hours, with some offering same-day withdrawals in cryptocurrency (USDT/USDC).

Conclusion: Real Traders, Real Payouts, Real Proof

These 2024-2025 success stories from Upscale demonstrate a clear truth: the path from minimal investment to substantial payouts is real and achievable. From $18 to $30,000+ isn't marketing — it's verified results from real traders with different experience levels and trading strategies.

The pattern is consistent: don't quit after initial failures, learn from every mistake, maintain strict risk management, and develop a systematic approach to cryptocurrency trading.

The pattern is consistent: don't quit after initial failures, learn from every mistake, maintain strict risk management, and develop a systematic approach to cryptocurrency trading.

If you're looking to scale your crypto trading skills and access significant capital without risking your personal savings, these trader stories prove it's possible.

👉 |

What Is Prop Trading? How to Get a Funded Account in 2026

💡 Want to earn from trading without risking all your savings? Heard about prop trading but not sure what it is or how to start trading with a firm's capital? Let's break it down in simple terms!

🔎 In this article, you'll learn:

- What prop trading (proprietary trading) is and how it works.

- How prop trading differs from trading with your own money.

- The pros and cons of prop trading for beginners and experienced traders.

- Why more and more traders are choosing prop firms to earn in financial markets.

- Tips and life hacks to help beginners successfully pass a prop trading challenge.

What Is Prop Trading?

Prop trading (proprietary trading) is professional trading in financial markets using a prop firm's capital. Unlike traditional trading, where a trader risks all their personal funds and starting capital, here you trade with the firm's money and receive a share of the profits earned through a profit split arrangement.

For example:

Imagine you only have $1,000 and want to earn from trading. With your own money, you can only afford to open small positions, and even a minor loss would significantly impact your trading account.

If you pass a prop trading challenge (evaluation) at a prop firm, they can allocate capital for you to manage — for example, $50,000 for trading. Now you're working with a much larger volume and trading account, while only risking the challenge fee (e.g., $100–$200).

If you demonstrate profitable trading over a month and earn 5% profit, that's $2,500. Your share (for example, 80% according to the profit split) would be $2,000 — many times more than you could earn trading only with your own money without funding.

How Does a Prop Firm Work?

Trader evaluation (prop trading challenge): To gain access to the firm's capital and funding, you need to pass a prop trading challenge or evaluation, proving your risk management skills and ability to trade profitably on a demo account.

Trader evaluation (prop trading challenge): To gain access to the firm's capital and funding, you need to pass a prop trading challenge or evaluation, proving your risk management skills and ability to trade profitably on a demo account.

Trading with prop firm capital: After successfully passing the evaluation, the trader receives a funded account and capital to manage — from $5,000 to $200,000 or more. In case of failure, the trader only loses the challenge fee, not their entire starting capital.

Profit sharing (profit split): Typically, the trader receives 70–90% of the earned profits, with the remaining portion going to the prop firm. Profit payouts occur regularly: monthly or at the end of a trading period.

Why Are More Traders Choosing Prop Trading?

Minimal Personal Risk and Loss Control

You don't risk all your starting capital and personal savings — only the cost of participating in the prop trading challenge. This is a key advantage for beginner traders.

For example:

Imagine you paid $100 to participate in a prop trading challenge. If something went wrong and you didn't pass the evaluation — exceeded the drawdown limit or violated risk management rules — you only lose that $100, not your entire deposit as happens when trading independently with your own money. Even if the funded account had trades worth tens of thousands of dollars, your real losses are limited to the participation fee.

Access to Large Trading Capital

You can work with substantial amounts and a larger trading account, which significantly increases potential profits and earnings from trading, even for a beginner trader.

For example:

Let's say you only have $500 of your own funds, but after passing the prop trading challenge, the prop firm gives you a funded account of $50,000 to manage. If you demonstrate profitable trading and earn 5% profit in a month, that's $2,500. Even after the profit split with the company, your share will be many times greater than if you were trading only with your own money and starting capital.

Clear Risk Management Rules and Trading Discipline

Prop firms require strict adherence to risk management and risk control, which helps prevent completely blowing your account on emotions. This builds trading discipline — a key skill for any professional trader.

For example:

If you start trading too aggressively or violate established loss limits and daily drawdown rules, the system will automatically stop your trading. This protects you from impulsive decisions and teaches emotional control and trading discipline — even if you decide to "chase losses," the risk management rules won't let you blow the entire trading account in one bad session.

Partnership with a Prop Firm and Support

The prop firm is directly interested in your success and profitable trading, as their income directly depends on your profits through the profit split arrangement.

For example:

Projects like want you to trade profitably and show consistent returns, which is why they offer free trading education to continuously improve your trading level and risk management skills!

Prop Trading vs Trading with Your Own Money

| Parameter | Prop Trading | Trading with Your Own Money | |-----------|--------------|----------------------------| | Trading Capital | Large sums from the prop firm, trader funding | Only personal funds and starting capital | | Risks | Limited to the prop trading challenge fee | You risk your entire deposit and savings | | Profits | 70–90% to the trader via profit split | 100% yours, but from smaller capital | | Discipline & Risk Management | Strict rules, risk and drawdown control | Self-control only | | Support & Education | Trading education, prop firm support | Everything on your own |

FAQ

1. What's the minimum deposit needed for prop trading?

Usually, you just need to pay the prop trading challenge fee (from $50 to $500 depending on the account size) to gain access to a funded account and the prop firm's capital. You don't need substantial starting capital of your own.

2. Can I lose my money in prop trading?

You only risk the amount paid for the prop trading challenge (evaluation), not your entire deposit and personal savings. This is the key difference from independent exchange trading.

3. What requirements do prop firms have for traders?

You need to follow risk management rules, stay within drawdown limits (daily and overall), and prove your qualifications through profitable trading during the prop trading challenge.

4. What instruments and assets can I trade at a prop firm?

The list of available trading assets and financial instruments (forex, cryptocurrencies, futures, stocks) depends on the specific prop firm and funding conditions.

5. How are profits paid out to traders?

Most commonly, profit payouts occur monthly or at the end of a specific trading period. The trader's share is typically 70% to 90% of earned profits according to the profit split arrangement, with the rest going to the prop firm.

6. What happens if I violate prop firm rules?

If you violate risk management rules (for example, exceed loss limits or allowable drawdown), trading on the funded account may be temporarily blocked or the account closed. This is done to protect both the prop firm's capital and the trader from significant losses. In some cases, you can pay for a reset and start the prop trading challenge again.

7. Can I combine prop trading with a full-time job?

Yes, many prop firms operate entirely online, don't require physical office presence, and allow remote trading at your convenience. For example, allows you to take the prop trading challenge and trade both in the web platform version and within Telegram via @Upscalebot — convenient for earning from trading without leaving your main job.

8. How do I choose a reliable prop firm for trading?

Pay attention to the prop firm's reputation, challenge and evaluation conditions, payout transparency, availability of trader support and educational materials on trading and risk management. Study reviews from other traders on independent platforms and make sure the company doesn't promise "guaranteed profits" — this is the main sign of fraud in the prop trading market.

Conclusion

⚡ Prop trading (proprietary trading) is a modern and effective way to earn in financial markets without risking all your starting capital and personal savings. If you're looking for a better way to trade — with your own money or with a prop firm's capital — try prop trading and discover new opportunities for professional growth, consistent income, and trading earnings with minimal personal risk.

Pass a prop trading challenge, get funded and receive capital to manage, follow risk management rules — and start your trading journey today!

👉

Crypto Bull Run Guide: Timing, Indicators & Winning Strategies

Crypto Bull Run Guide: Timing, Indicators & Winning Strategies

Understanding crypto bull runs transforms chaos into opportunity. These periods create life-changing wealth for prepared investors. This guide reveals how to identify, navigate, and profit from the next major market surge.

⚠️ Important Disclaimer: This article analyzes historical cryptocurrency market patterns and cycles. While these patterns provide valuable frameworks for understanding market behavior, past performance never guarantees future results. Cryptocurrency markets remain highly volatile, unpredictable, and subject to regulatory changes. Each bull run cycle brings unique characteristics, external factors, and market conditions. The information presented here is educational and should not be considered financial advice. Always conduct your own research and consult with financial professionals before making investment decisions.

What is a Crypto Bull Run Meaning?

A crypto bull run represents sustained upward price momentum across digital assets. Markets rally for months. Optimism spreads like wildfire through trading communities.

The bull run meaning extends beyond simple price increases. Bitcoin often gains over 1,000% during these periods. The entire market capitalization can grow five to ten times. Volume builds gradually throughout the cycle.

True bull markets last between 12 and 18 months typically. They differ fundamentally from temporary price spikes. Market sentiment indicators like the Fear and Greed Index consistently read above 70. Capital flows steadily into crypto assets.

Key Takeaways:

- Definition: Sustained period of rising cryptocurrency prices with widespread market optimism

- Duration: Typically 12-18 months from accumulation to peak

- Bitcoin Performance: Historical gains exceeding 1,000% per cycle

- Market Growth: 5-10x increase in total market capitalization

- Sentiment: Fear and Greed Index readings consistently above 70

Market cycles follow predictable patterns. Smart money accumulates during bear markets. Retail investors enter during markup phases. Understanding these phases separates successful traders from the crowd.

Bull runs create opportunities across all market participants. Experienced traders scale positions strategically. Newcomers often chase momentum late in cycles. The difference between these approaches determines long-term success.

The Psychology Behind Bull Markets

Market psychology drives bull run dynamics more than fundamentals alone. The Fear and Greed Index measures collective emotions on a 0-100 scale. Bull markets typically show readings between 70 and 100.

During 2017's peak, the index hit extreme greed levels. Social media amplified every gain. New investors entered daily. FOMO (fear of missing out) dominated decision-making across retail traders.

The same pattern repeated in 2021. Bitcoin reached new all-time highs. Altcoins surged exponentially. Everyone became a crypto expert overnight.

These emotional shifts create both opportunity and danger. Disciplined traders recognize when euphoria reaches unsustainable levels. They protect gains while others chase tops.

Bull vs Bear Markets in Crypto

Bull and bear markets represent opposite sides of market cycles. Each phase exhibits distinct characteristics. Recognizing these differences protects capital and maximizes gains.

Bull Market Characteristics:

- Sustained uptrend lasting 12-18 months

- Gradually increasing volume with peaks at cycle tops

- Fear and Greed Index above 70 consistently

- Positive news dominates headlines

- New projects launch successfully

- Retail participation increases steadily

Bear Market Characteristics:

- Extended downtrend spanning 12-24 months

- Declining volume throughout the cycle

- Fear and Greed Index below 30

- Negative sentiment prevails

- Project failures make headlines

- Retail investors exit markets

The accumulation phase marks bear market endings. Smart money recognizes value before crowds. Prices consolidate near cycle lows. Volume remains relatively low.

Markup phases define bull markets. Public awareness grows. FOMO intensifies. Prices accelerate dramatically. This phase generates the largest gains.

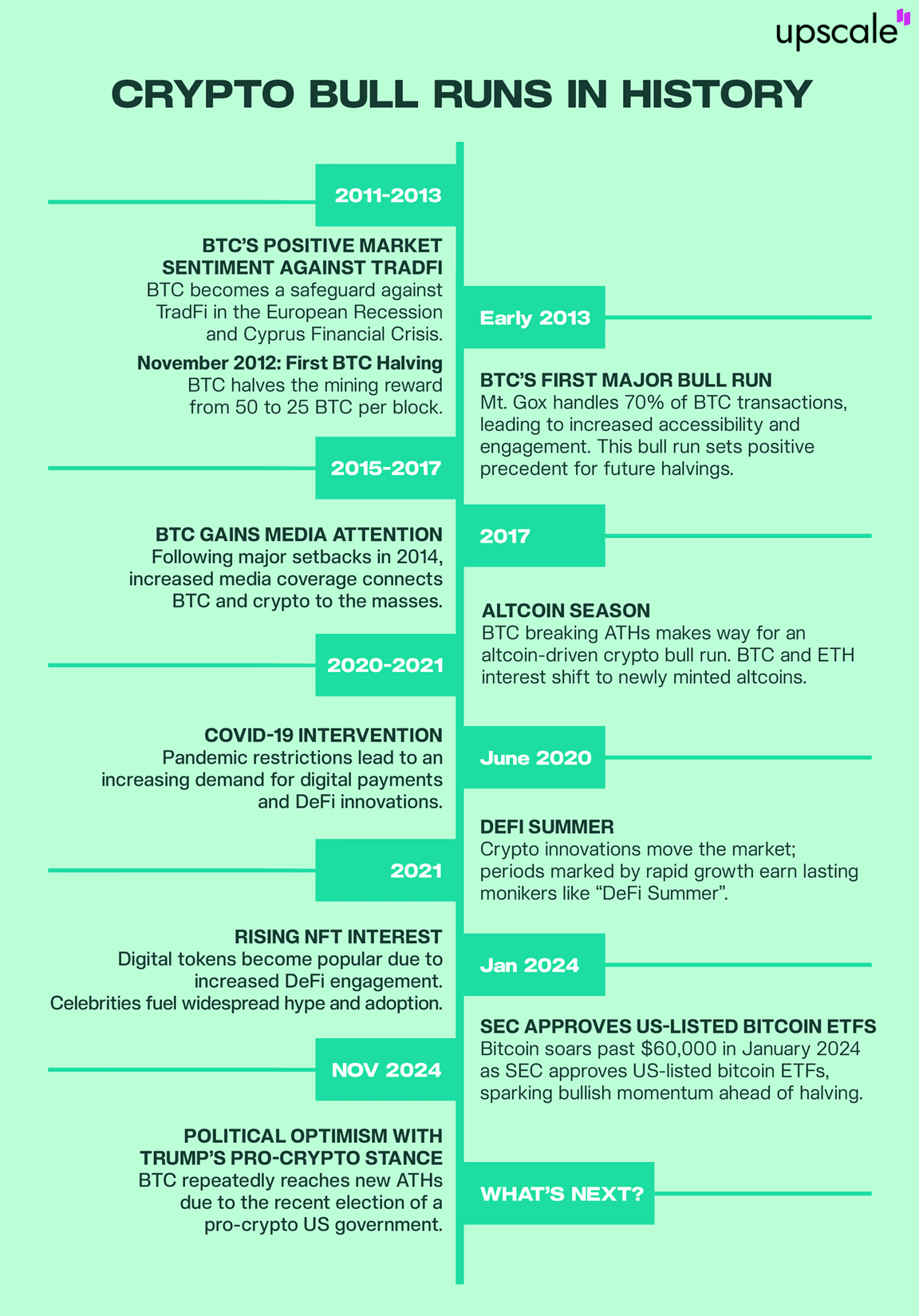

Historical Crypto Bull Run History

Cryptocurrency markets have experienced three major bull runs since Bitcoin's creation. Each cycle followed similar patterns. Each exceeded previous peaks dramatically. Studying crypto bull run history reveals consistent patterns.

The 2013 bull run saw Bitcoin surge from $13 to $1,100. The Cyprus banking crisis drove adoption. Media coverage intensified. Retail interest exploded. This early crypto bull run history established foundational patterns.

The 2013 bull run saw Bitcoin surge from $13 to $1,100. The Cyprus banking crisis drove adoption. Media coverage intensified. Retail interest exploded. This early crypto bull run history established foundational patterns.

2017's cycle proved even more spectacular. Bitcoin climbed from $1,000 to $20,000. ICOs (initial coin offerings) raised billions. Ethereum enabled smart contract platforms. Altcoins delivered life-changing returns.

The 2021 bull run marked institutional arrival. Bitcoin reached $69,000. Ethereum hit $4,800. The total crypto market cap exceeded $3 trillion. DeFi and NFTs captured mainstream attention.

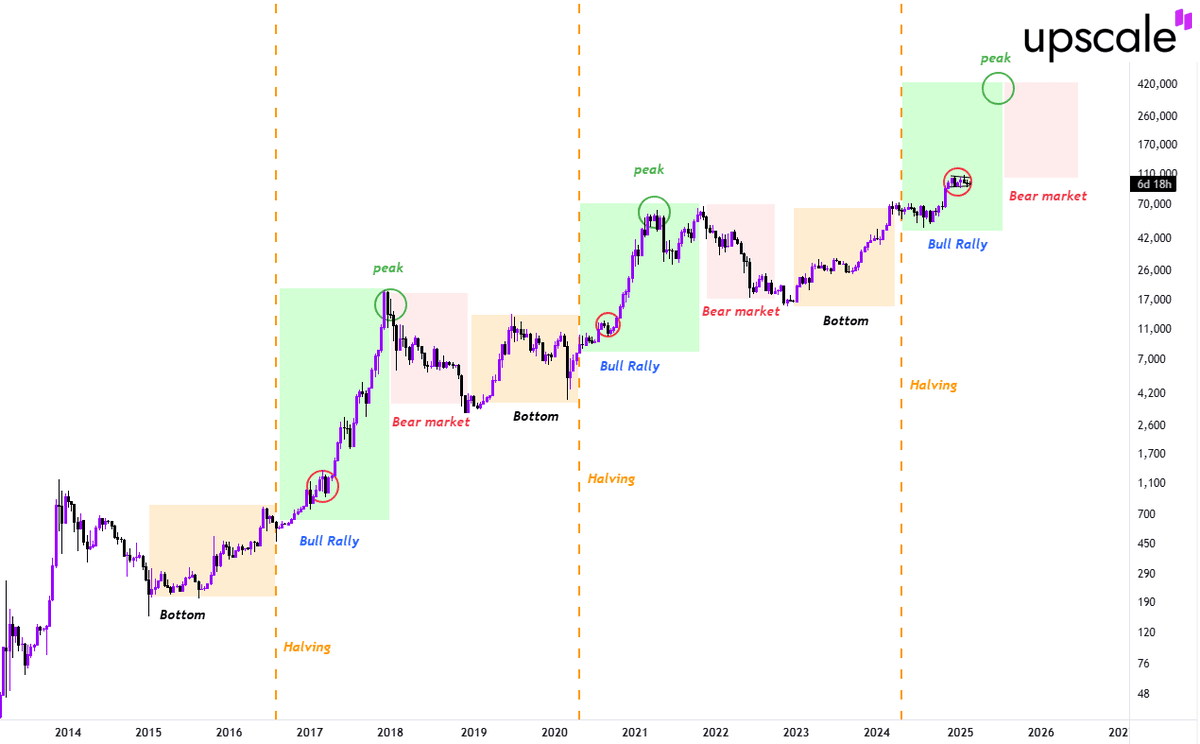

Bitcoin halving events preceded each major bull run. These programmed supply reductions occur every four years. They cut new Bitcoin issuance by 50%. Supply shock dynamics then drive price appreciation.

The 2012 halving preceded the 2013 bull run. The 2016 halving led into 2017's surge. The 2020 halving sparked 2021's rally. This pattern creates predictable timing frameworks.

However, correlation does not guarantee causation. While historical patterns show consistent relationships between halvings and bull runs, numerous other factors influence market outcomes. Economic conditions, regulatory developments, technological changes, and global events all play crucial roles. Future cycles may deviate from historical norms.

Each cycle attracted larger participant bases. 2013 drew tech enthusiasts. 2017 brought retail traders. 2021 welcomed institutions. The next cycle promises even broader adoption.

Learning from past cycles improves future positioning. Early accumulation during bear markets yields maximum returns. Patient holding through volatility preserves gains. Strategic exits near cycle peaks protect capital.

Learning from past cycles improves future positioning. Early accumulation during bear markets yields maximum returns. Patient holding through volatility preserves gains. Strategic exits near cycle peaks protect capital.

The 2021 Bull Run Case Study

The 2021 bull run demonstrated crypto's maturation. Institutional adoption reached critical mass. MicroStrategy accumulated over 100,000 Bitcoin. Tesla added Bitcoin to the corporate treasury. Square (now Block) made significant purchases.

These corporate moves validated cryptocurrency as legitimate assets. Traditional finance could no longer ignore digital currencies. Bitcoin ETF applications multiplied. Regulatory frameworks began taking shape.

Ethereum's ecosystem exploded during this cycle. DeFi protocols locked billions in value. NFT marketplaces processed record volumes. Layer-2 solutions addressed scalability challenges. The entire blockchain infrastructure evolved rapidly.

The cycle peaked in November 2021. Bitcoin reached $69,000. Market sentiment hit extreme greed. Leverage ratios climbed dangerously high. Warning signs accumulated for observant traders.

When Do Bull Runs End?

Recognizing bull market endings preserves hard-earned gains. Several reliable indicators signal approaching tops. Smart money begins exiting positions. Retail enthusiasm reaches fever pitch.

The Fear and Greed Index typically peaks between 90 and 100. Extreme greed readings warn of reversals. Historical data confirms this pattern across all major cycles.

Trading volume characteristics shift noticeably. Climax volume occurs at tops. Buying exhaustion follows. Subsequent rallies show declining participation. These technical signals provide actionable warnings.

Distribution phases unfold gradually at first. Smart money sells into strength. Prices continue rising temporarily. Eventually momentum fails. Sharp corrections begin.

Market cycle phases provide strategic frameworks. Accumulation occurs at bottoms. Markup defines bull markets. Distribution marks tops. Markdown completes the cycle. Understanding current phase positioning improves decision-making dramatically.

On-chain metrics reveal institutional behavior. Large transactions increase during distribution. Exchange inflows surge. Realized profits hit extremes. These data points confirm cycle positioning.

Successful traders prepare exit strategies long before tops. They scale out systematically. They avoid timing exact peaks. They preserve capital for next cycle accumulation.

Key Indicators of an Approaching Bull Run

Identifying early bull market signals creates significant advantages. Multiple indicators confirm emerging trends. Combining signals improves accuracy substantially.

Bitcoin halving events provide primary timing catalysts. The next halving occurred in April 2024. Historical patterns suggest bull markets begin 12-18 months post-halving. This framework guides strategic positioning.

Accumulation phase characteristics signal bull run approaches. Smart money enters quietly. Prices consolidate near cycle lows. Volume remains subdued. Retail interest stays minimal.

Fear and Greed Index readings offer sentiment insights. Extended periods below 20 indicate extreme fear. These zones historically mark excellent entry points. Transitioning from fear toward neutral suggests cycles turning.

On-chain metrics validate emerging trends. Bitcoin accumulation by long-term holders increases. Exchange balances decline as coins move to cold storage. Network fundamentals strengthen progressively.

Technical Signals to Watch For

Technical analysis provides concrete, observable signals. Chart patterns reveal market psychology. Price action reflects all available information.

Golden crosses mark powerful bullish signals. This occurs when the 50-day moving average crosses above the 200-day. Historical data confirms reliability across crypto markets.

Higher lows on weekly and monthly charts demonstrate strengthening momentum. Each correction finds support at elevated levels. This pattern validates underlying demand.

Volume analysis confirms price movements. Genuine bull runs show gradually increasing volume. Explosive volume spikes mark acceleration phases. Declining volume during rallies signals false moves.

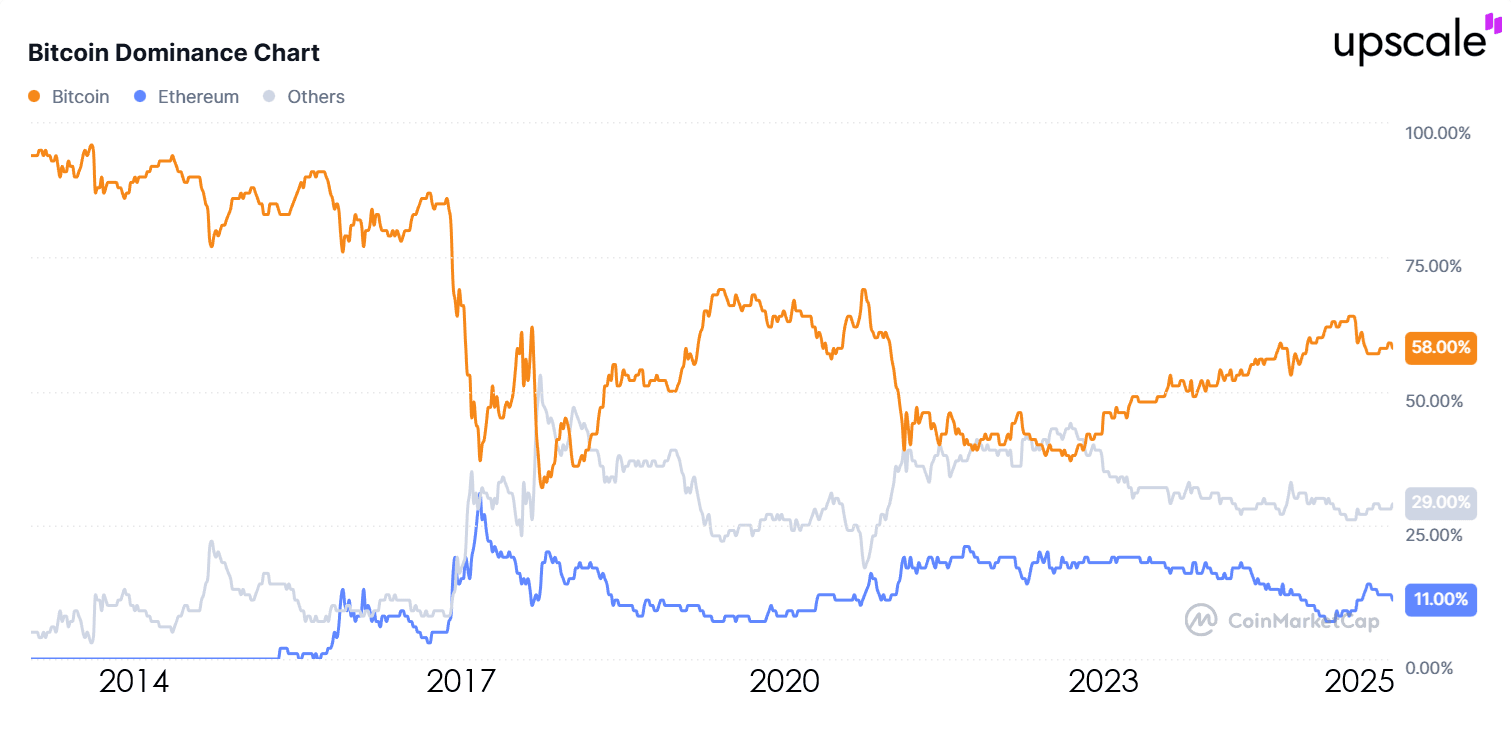

The Connection Between Bitcoin Bull Run and Altcoin Performance

Bitcoin dominates cryptocurrency markets fundamentally. Its price movements influence all digital assets. Understanding this relationship optimizes portfolio allocation. Every bitcoin bull run creates predictable patterns.

Bitcoin typically leads bull market rallies initially. Capital flows into the most established cryptocurrency first. Risk-averse investors seek relative safety. Bitcoin's liquidity and recognition attract initial attention. The bitcoin bull run momentum then spreads to altcoins.

As Bitcoin rallies extend, profits rotate into altcoins. Traders seek higher percentage gains. Ethereum often benefits next as the second-largest cryptocurrency. Then capital spreads across smaller market cap projects.

This rotation pattern creates altcoin season. Smaller cryptocurrencies outperform Bitcoin dramatically. 3-5x multipliers above Bitcoin's gains become common. High-risk, high-reward opportunities multiply.

Understanding Altcoin Season

The altcoin season represents the most explosive bull market phase. Bitcoin's initial rally attracts attention. Profits then chase higher percentage gains elsewhere.

Timing altcoin season entries proves crucial. Too early means underperforming Bitcoin. Too late means buying near cycle peaks. Monitoring Bitcoin dominance charts helps identify transitions.

Performance multipliers during altcoin seasons exceed normal market behavior. 10x, 50x, even 100x gains occur regularly. Smaller market caps allow parabolic moves. This creates both opportunity and danger.

Performance multipliers during altcoin seasons exceed normal market behavior. 10x, 50x, even 100x gains occur regularly. Smaller market caps allow parabolic moves. This creates both opportunity and danger.

Strategies to Capitalize During the Next Bull Run Crypto

Successful bull market navigation requires systematic approaches. Emotional decision-making destroys capital. Strategic frameworks preserve it. Understanding bull run crypto dynamics separates winners from losers.

Position building during accumulation phases provides optimal entries. Dollar-cost averaging reduces timing risk. Accumulating quality assets at cycle lows maximizes eventual returns. Patient capital captures full bull market gains when the next bull run crypto begins.

Portfolio allocation balances risk and reward. Bitcoin provides relative stability. Major altcoins like Ethereum offer enhanced upside. Selected smaller projects provide lottery tickets. Diversification across market caps spreads risk intelligently.

Entry timing uses technical and fundamental signals. Waiting for confirmation reduces false starts. Multiple indicator confluence increases probability. Strategic patience beats impulsive trading consistently.

Position sizing adapts to risk profiles. Conservative allocations favor Bitcoin and major altcoins. Aggressive approaches include more speculative positions. No single strategy suits all investors. Personal risk tolerance determines optimal allocation.

At , we understand that timing and execution are everything during crypto bull runs. As a leading crypto prop trading platform, we bring together capital, AI-powered analytics, and precision execution tools in one comprehensive solution. When you trade with a funded account from UpscaleTrade, you get the capital to maximize bull market opportunities, advanced tools to identify optimal entry and exit points, and transparent terms that align our success with yours. Our platform helps you implement the systematic strategies discussed here while managing risk effectively throughout the cycle.

Strategy Approaches Based on Risk Tolerance

| Risk Level | Bitcoin Allocation | Major Altcoins | Small Cap Altcoins | Strategy Focus | |------------|-------------------|----------------|-------------------|----------------| | Conservative | 70% | 25% | 5% | Capital preservation with steady growth | | Moderate | 50% | 35% | 15% | Balanced growth with managed risk | | Aggressive | 30% | 40% | 30% | Maximum growth potential |

Creating a Bull Market Exit Strategy

Exit strategies separate successful traders from the rest. Greed destroys more capital than fear. Predetermined targets enable disciplined execution.

Percentage-based profit taking provides systematic approaches. Sell 20% at 2x. Sell 20% more at 3x. Continue scaling systematically. This method captures gains while maintaining exposure.

Time-based exits consider cycle positioning. Historical patterns show 12-18 month bull markets. Approaching these timeframes suggests reducing exposure. Cycle awareness trumps price targeting alone.

Market sentiment indicators guide exit timing. Fear and Greed Index above 90 warns of tops. Extreme euphoria in social media signals danger. Smart money exits when retail rushes in.

Technical analysis identifies distribution phases. Volume characteristics change noticeably. Momentum indicators diverge bearishly. Support levels begin failing. These signals confirm cycle endings.

Current Analysis: Where Are We in the Crypto Next Bull Run Cycle?

Market analysis requires combining multiple frameworks. Current positioning determines optimal strategies. Understanding the cycle phase guides decision-making.

The April 2024 Bitcoin halving marked a crucial milestone. Historical patterns suggest bull markets accelerate 12-18 months post-halving. This framework places potential peak timing in late 2025 or early 2026.

Current Fear and Greed Index readings show moderate sentiment. Neither extreme fear nor extreme greed dominates. This neutral positioning suggests accumulation or early markup phase. Historical context supports this assessment.

Institutional adoption continues progressing. Bitcoin ETFs attracted billions in assets. Major financial institutions offer crypto services. Regulatory frameworks improve globally. These developments support a longer-term bullish thesis.

Technical analysis shows constructive patterns. Bitcoin consolidated after reaching new all-time highs. Altcoins demonstrate relative strength. Volume patterns suggest accumulation continues. Market structure supports bullish outlook.

Current positioning suggests an early-to-mid bull market phase. Significant upside potential remains. Corrections will occur inevitably. Long-term trajectory points upward. Strategic patience rewards prepared investors.

Common Mistakes to Avoid in a Bull Run in Stock Market and Crypto

Bull markets create both opportunity and danger. Common mistakes repeat across all cycles. Avoiding these errors preserves capital and maximizes returns.

FOMO (Fear of Missing Out) drives poor decisions. Chasing pumps near cycle peaks destroys capital. Buying after exponential moves guarantees losses. Emotional purchases rarely work. Discipline beats impulse consistently.

Overleveraging amplifies both gains and losses. Leverage works until it doesn't. One bad move liquidates entire positions. Bull markets create false confidence. Conservative leverage protects capital long-term.

Ignoring diversification concentrates risk dangerously. Single-asset concentration creates vulnerability. One project failing wipes out gains. Spreading risk across quality assets reduces exposure. Smart diversification balances concentration and protection.

Neglecting profit-taking leads to giving back gains. Paper profits disappear quickly. Systematic selling preserves real wealth. Greed convinces holders to wait for more. Markets punish this mindset eventually.

Following social media hype creates bagholders. Promoted coins dump after influencers sell. Due diligence beats tips consistently. Research-based decisions outperform hype-driven purchases. Think independently or pay the price.

Ignoring tax implications reduces net returns. Strategic selling considers tax efficiency. Timing transactions optimizes tax treatment. Professional advice saves money long-term. Planning ahead beats scrambling later.

Trading without stop-losses invites disaster. Unexpected crashes occur regularly. Protective orders limit downside. Small losses beat catastrophic ones. Risk management separates professionals from gamblers.

Looking Ahead: Predictions for the Next Crypto Bull Run

⚠️ Disclaimer: The following represents analytical frameworks based on historical patterns, not guarantees or financial advice. Market conditions change. External factors influence outcomes unpredictably. Use this information as one data point among many in your research.

Forward-looking analysis combines historical patterns with current developments. While nobody predicts perfectly, frameworks improve probability. This crypto bull run prediction synthesizes multiple data sources.

The April 2024 Bitcoin halving established primary timing catalyst. Historical patterns suggest peak timing in late 2025 through early 2026. This framework guides strategic positioning currently. Many crypto bull run prediction models point to similar timeframes.

Institutional adoption will accelerate throughout this cycle. More ETFs will launch globally. Major banks will expand crypto services. Regulatory clarity will improve. These developments support sustainable growth.

Bitcoin should lead initially as always. $100,000 marks psychological resistance. $150,000 becomes achievable during peak euphoria. Conservative estimates suggest 2-3x from current levels. Aggressive scenarios project higher.

Ethereum's ecosystem maturation drives strong performance. Scaling solutions improve dramatically. Real-world adoption increases. DeFi and NFTs continue evolving. ETH could reach the $8,000-$12,000 range.

The altcoin season will create spectacular opportunities. DeFi platforms with genuine utility will shine. Gaming and metaverse projects could explode. Infrastructure plays provide lower-risk exposure. Due diligence remains essential.

Macro factors influence crypto more than ever. Central bank policies affect risk appetite. Inflation concerns drive alternative assets. Geopolitical tensions highlight decentralization value. Broader context matters increasingly.

Technology improvements support long-term thesis. Layer-2 solutions address scalability. Interoperability improves. User experience gets better. Real-world utility increases. Fundamentals strengthen progressively.

Cycle characteristics may differ from the past. Institutional participation provides stability. Volatility might decrease somewhat. Bull market duration could extend. Previous patterns guide but don't guarantee. Flexibility beats rigid expectations.

FAQ

What is a crypto bull run?

A crypto bull run is a sustained period of rising cryptocurrency prices accompanied by widespread market optimism. These cycles typically last 12-18 months and feature significant capital inflows, increasing trading volume, and positive sentiment indicators. Bitcoin often gains over 1,000% during bull runs, while the entire market capitalization can grow 5-10x from bottom to peak.

When will the next crypto bull run begin?

The next crypto bull run likely began following Bitcoin's April 2024 halving. Historical patterns show bull markets accelerate 12-18 months after halving events. Current market structure, institutional adoption trends, and on-chain metrics suggest we're in early-to-mid bull market phase, with potential peak timing in late 2025 or early 2026.

How long do crypto bull runs typically last?

Crypto bull runs typically last between 12 and 18 months from the initial accumulation phase to the final distribution phase. However, the most explosive gains often occur in the final 6-8 months. The 2013, 2017, and 2021 cycles all followed similar timeframes, though exact durations varied. Understanding cycle timing helps optimize entry and exit strategies.

What are the signs of a crypto bull run?

Key signs include Bitcoin halving events, Fear and Greed Index readings consistently above 70, golden crosses on major moving averages, increasing trading volume, institutional adoption announcements, and strong on-chain metrics showing accumulation. Technical patterns like higher lows, breakouts from consolidation, and bullish divergences also signal emerging bull markets.

How does the Bitcoin halving cycle affect crypto bull runs?

Bitcoin halving events occur every four years and reduce new Bitcoin issuance by 50%. This programmed supply shock creates fundamental catalysts for bull runs. Historical data shows all three major crypto bull runs (2013, 2017, 2021) occurred 12-18 months after halving events. The April 2024 halving positioned the market for the next bull cycle.

Conclusion

Crypto bull runs create extraordinary wealth-building opportunities. Understanding cycle phases, recognizing signals, and implementing systematic strategies maximize returns while managing risk. The next bull run offers similar potential to previous cycles, but only prepared investors capture full gains.

Smart Money Concept: How to Trade Like Institutional Investors in 2025

Smart Money Concept: How to Trade Like Institutional Investors in 2025

Smart Money Concept (SMC) represents a fundamental shift in how retail traders approach financial markets. Unlike traditional technical analysis that relies on lagging indicators like moving averages or RSI, SMC trading focuses on reading institutional order flow and understanding how large market participants manipulate price before executing their positions. This methodology teaches traders to identify the footprints that banks, hedge funds, and institutional investors leave in the market through order blocks, liquidity grabs, and fair value gaps.

The core principle behind smart money concept trading centers on a simple reality: institutional investors move markets, while retail traders react to those movements. By learning to recognize where institutions are likely to enter and exit positions, traders gain a significant edge over those using conventional technical analysis. The learning curve for mastering SMC typically spans six to twelve months of dedicated practice, but the methodology proves effective across multiple timeframes from M15 charts up to daily analysis. Success rates with proper risk management consistently fall within the 60-75% range, making SMC one of the most reliable trading frameworks when applied systematically.

Modern trading platforms have made implementing smart money concept strategies more accessible than ever. Traders can now analyze institutional behavior patterns, identify key liquidity zones, and execute precision entries based on order flow analysis. The methodology works equally well across forex pairs, cryptocurrency markets, and traditional stock indices, though each market presents unique characteristics in how institutions operate.

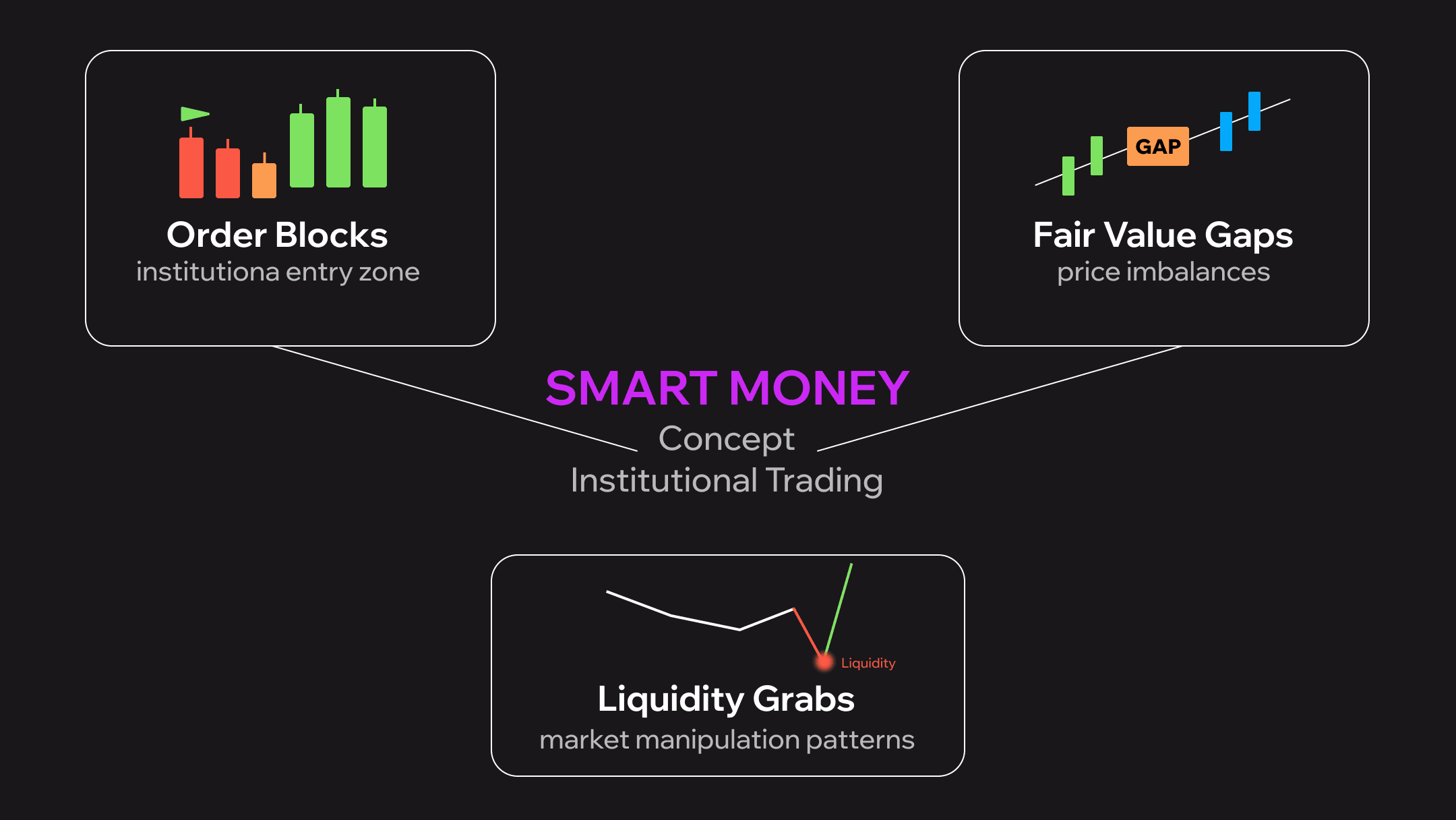

Core Smart Money Concept Components

Understanding the fundamental building blocks of smart money concept creates the foundation for successful institutional-style trading. These components work together to reveal where large market participants have placed their orders and how they intend to move price.

Order Blocks - Institutional Entry Zones

Order blocks represent the last opposing candle before a significant price move and identify areas where institutional orders were placed. When banks and hedge funds enter large positions, they cannot simply execute market orders without causing massive slippage. Instead, they accumulate positions over time, creating distinctive price patterns that SMC traders learn to recognize.

Bullish order blocks form when a down candle is followed by a strong upward move, indicating institutions finished selling and began aggressive buying. Bearish order blocks appear when an up candle precedes a sharp decline, showing where institutions completed their buying before initiating short positions. The key to identifying valid order blocks lies in the impulsive move away from the zone. Institutional orders create explosive price action because of the sheer volume being executed.

Smart money concept order blocks function differently from traditional support and resistance. Rather than zones where price repeatedly bounces, order blocks represent unfilled institutional orders waiting to be matched. When price returns to these zones, institutions add to their positions, creating strong reactions. Traders using platforms with advanced charting capabilities can mark these zones precisely and set alerts for when price approaches, allowing for systematic entry strategies based on institutional behavior rather than lagging technical indicators.

Fair Value Gaps and Market Structure

Fair value gaps emerge when price moves so rapidly that it leaves inefficiencies in the market structure. These gaps appear as spaces on the chart where no trading occurred at certain price levels, creating imbalances that the market typically seeks to fill. In smart money concept methodology, fair value gaps represent areas where institutional orders overwhelmed available liquidity, causing price to jump without normal auction process.

Market structure analysis within SMC focuses on identifying higher highs, higher lows, lower highs, and lower lows to determine trend direction and strength. Break of structure (BOS) occurs when price definitively breaks through a previous high or low, confirming trend continuation. Change of character (ChoCH) happens when price breaks counter to the established trend, signaling potential reversals. These structural breaks often coincide with fair value gaps, as institutions execute large enough orders to both break structure and create price inefficiencies simultaneously.

Understanding how fair value gaps interact with market structure provides traders with high-probability zones for entries. When price pulls back to fill a gap within a bullish market structure, it creates optimal long entry opportunities. Conversely, rallies into bearish fair value gaps during downtrends offer ideal short positions. The combination of structural analysis and gap identification separates smart money concept from basic price action trading.

Liquidity Grabs - Reading Institutional Manipulation

Liquidity grabs represent one of the most powerful concepts in smart money trading methodology. Institutions need substantial liquidity to fill their large orders, and that liquidity sits just beyond obvious support and resistance levels where retail traders place their stop losses. Before making major moves, smart money will often push price beyond these levels to trigger retail stops, creating the liquidity pool they need for their actual positions.

Classic liquidity grab patterns include stop hunts below recent lows in uptrends and raids above recent highs in downtrends. These moves appear designed to shake out retail traders before price reverses sharply in the intended direction. Confirmation signals include rapid reversals on high volume, engulfing candles that reclaim the broken level, and immediate movement back into the prior range. Traders who recognize these patterns avoid getting stopped out and can even enter positions in the direction of the true institutional move.

Smart Money Concept Trading Strategy Framework

Implementing smart money concept trading requires a systematic framework that combines all core components into a coherent strategy. The process begins with multi-timeframe analysis, typically starting on daily or four-hour charts to identify overall market structure and trend direction. Traders mark key order blocks, fair value gaps, and liquidity zones on higher timeframes before drilling down to lower timeframes for precise entries.

Entry rules within the SMC trading framework demand confluence between multiple factors. An ideal entry occurs when price reaches a higher timeframe order block within market structure, creating a fair value gap on the entry timeframe, after sweeping liquidity from obvious levels. This confluence significantly increases probability compared to single-factor entries. Traders wait for confirmation through candlestick patterns, typically seeking engulfing candles or strong closes back into the order block zone before executing positions.

Exit criteria focus on logical profit targets rather than arbitrary risk-reward ratios. The first target typically sits at the next opposing order block or fair value gap, while final targets aim for major liquidity pools beyond obvious highs or lows. Stop losses are placed beyond the order block being traded, accounting for potential liquidity grabs that might occur before the main move. This approach aligns exits with where institutions are likely to take profits rather than using round numbers or fixed percentages that lack market structure context.

Position sizing in smart money concept trading follows institutional risk management principles. Rather than risking fixed percentages on every trade, SMC practitioners scale position sizes based on confluence factors and setup quality. High-confluence setups with multiple confirming factors warrant larger positions, while lower-probability trades receive reduced capital allocation. This variable position sizing approach mirrors how institutional traders allocate capital across opportunities with varying conviction levels.

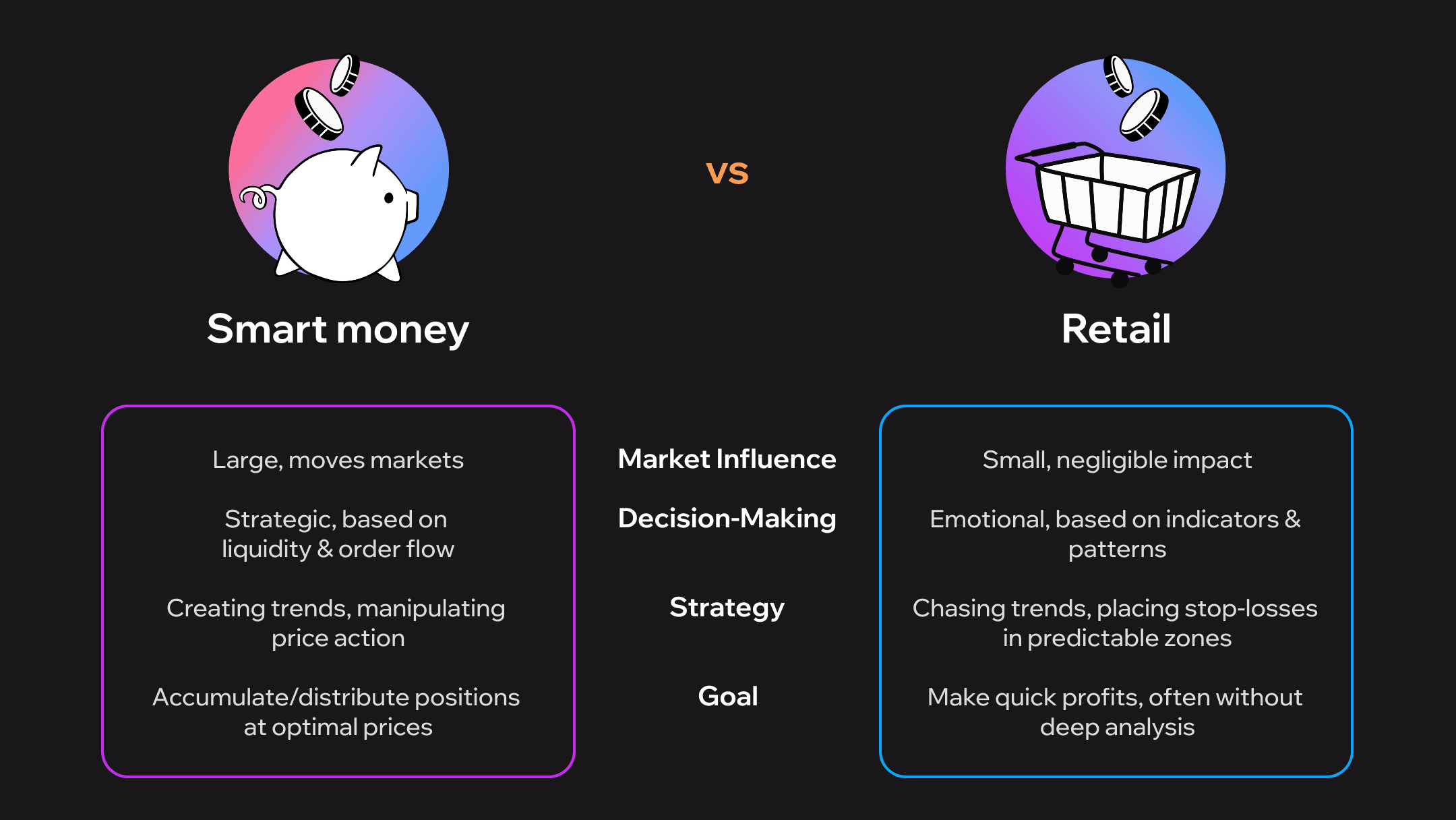

SMC vs Traditional Trading Methods

The distinction between smart money concept and traditional technical analysis extends far beyond simple terminology differences. Traditional trading relies heavily on lagging indicators that calculate values from past price data. Moving averages, MACD, RSI, and similar tools all react to price movements that already occurred, creating inherent delays in signal generation. By the time these indicators trigger entries, institutions have often already positioned themselves and begun taking profits.

The distinction between smart money concept and traditional technical analysis extends far beyond simple terminology differences. Traditional trading relies heavily on lagging indicators that calculate values from past price data. Moving averages, MACD, RSI, and similar tools all react to price movements that already occurred, creating inherent delays in signal generation. By the time these indicators trigger entries, institutions have often already positioned themselves and begun taking profits.

Smart money concept trading operates proactively rather than reactively. By identifying where institutions must go to find liquidity and fill orders, SMC traders position themselves ahead of major moves rather than chasing momentum after it develops. This fundamental difference in approach explains why SMC practitioners often enter positions that appear counterintuitive to traditional technical traders. When conventional analysis shows oversold conditions suggesting bounces, SMC traders recognize liquidity grabs preparing for further declines.

Supply and demand trading represents the closest traditional methodology to smart money concept, as both focus on identifying zones where significant orders exist. However, supply and demand typically treats these zones as static areas where price repeatedly reacts, while SMC recognizes the dynamic nature of institutional order flow. Order blocks represent unfilled orders that institutions actively manage, adjusting positions as market conditions evolve. This nuanced understanding allows SMC traders to distinguish between zones that will hold and those likely to break as institutional sentiment shifts.

The effectiveness gap between methodologies becomes evident in ranging markets where traditional technical analysis struggles. Indicators generate conflicting signals in consolidation, while smart money concept clearly identifies the liquidity zones institutions are targeting and the order blocks they're building positions from. This advantage proves particularly valuable for traders seeking consistency across varying market conditions.

Market-Specific Applications

Smart Money Concept in Forex Trading

Foreign exchange markets provide ideal conditions for smart money concept application due to the massive institutional participation required for currency transactions. Central banks, commercial banks, and multinational corporations constantly execute large currency orders, creating clear order blocks and liquidity patterns. Major pairs like EURUSD, GBPUSD, and USDJPY display particularly clean SMC setups because of the concentrated institutional flow and high liquidity that prevents excessive manipulation.

The forex market's 24-hour nature allows traders to identify institutional order flow across different trading sessions. London and New York sessions typically show the most significant smart money activity, with clear liquidity grabs occurring during session opens as institutions position for the day ahead. Currency pairs often respect order blocks for extended periods because institutional forex positions remain active for days or weeks, creating reliable zones for multiple entry opportunities. Traders implementing smart money concept forex strategies focus on higher timeframe structure while using M15 or M30 charts for entries, aligning with the methodical pace at which institutions build currency positions.

Day Trading with Smart Money Concept

Applying smart money concept to day trading requires adjustments in timeframe focus while maintaining the same core principles of reading institutional behavior. Day traders typically work with M5 to M15 charts for entries while referencing H1 and H4 for structure and order block identification. The faster timeframes demand quicker decision-making, but the advantage comes from catching institutional moves within a single session rather than holding positions overnight.

Intraday smart money concept patterns often revolve around liquidity grabs at the beginning of major sessions. The Asian session low frequently gets swept during London open as institutions collect stops before pushing price higher, creating classic SMC entry setups. Similarly, New York open commonly sees raids of European session highs or lows before the true directional move emerges. Day traders who understand these patterns position themselves to capitalize on the reversals that follow liquidity collection.

The compressed timeframes in day trading amplify the importance of execution precision. Entries must occur at the exact edge of order blocks rather than anywhere within the zone, and stops need tight placement to maintain favorable risk-reward on shorter-term moves. Modern trading platforms with one-click execution and precise order placement capabilities become essential tools for implementing SMC day trading strategies effectively. Traders can practice these faster-paced setups through demo accounts before committing capital to live markets where execution speed directly impacts profitability.

Risk Management for SMC Trading

Institutional-style risk management separates consistently profitable smart money concept traders from those who struggle despite understanding the technical concepts. Unlike retail risk management that focuses primarily on percentage-based stop losses, SMC risk management considers market structure context and institutional behavior patterns when determining position parameters.

Institutional-style risk management separates consistently profitable smart money concept traders from those who struggle despite understanding the technical concepts. Unlike retail risk management that focuses primarily on percentage-based stop losses, SMC risk management considers market structure context and institutional behavior patterns when determining position parameters.

Stop loss placement in smart money trading always accounts for potential liquidity grabs beyond the order block being traded. Rather than placing stops at obvious levels like just below order block lows, institutional-minded traders add buffer room for wicks that might sweep stops before reversing. This approach accepts slightly wider stops in exchange for avoiding premature exits on positions that ultimately work. The trade-off makes sense because SMC entries occur at structural levels where directional conviction runs high, justifying the additional risk to avoid manipulation-induced stop outs.

Position sizing methodology within smart money concept adjusts based on setup confluence and conviction level. When multiple factors align including higher timeframe order blocks, fair value gaps, market structure confirmation, and liquidity grab evidence, traders can comfortably increase position sizes because probability dramatically improves with confluence. Conversely, trades based on single factors receive minimum position sizing. This variable approach ensures capital allocation matches opportunity quality rather than treating every setup identically.

The risk-reward framework in SMC trading differs fundamentally from traditional fixed-ratio approaches. Rather than targeting arbitrary 2:1 or 3:1 ratios, institutional-style traders identify logical profit targets based on market structure. The first target typically sits at the next opposing order block or major fair value gap, while final targets aim for liquidity pools beyond obvious structural levels. This structure-based targeting often yields reward-to-risk ratios exceeding 5:1 or even 10:1 on well-executed trades, though the focus remains on structural logic rather than ratio achievement.

Advanced SMC Psychology and Implementation

Mastering the smart money concept extends beyond technical pattern recognition into understanding the psychological dynamics between institutional and retail participants. Institutions deliberately engineer price action to trigger emotional responses in retail traders, creating the liquidity and positioning they need for their actual trades. Recognizing this manipulation while avoiding emotional reactions separates successful SMC implementation from theoretical knowledge.

Breaker blocks represent an advanced SMC concept where previously bullish order blocks fail and become bearish zones, or vice versa. This occurs when institutional sentiment shifts significantly enough that former support becomes resistance. Traders who adapt to these breaker patterns avoid fighting against repositioned institutional flow. The psychology behind breaker blocks centers on recognizing when market narrative changes demand strategic flexibility rather than stubbornly holding bias.

Mitigation blocks function similarly to order blocks but represent areas where institutions need to mitigate existing positions before establishing new directional trades. These zones often appear as minor pullbacks within strong trends where smart money takes partial profits or adjusts positions before the next leg. Understanding mitigation versus primary order blocks prevents confusion about which zones will hold for major reversals versus brief pauses in existing trends.

Implementation framework for systematic smart money concept practice begins with paper trading or demo account work until pattern recognition becomes second nature. Traders should mark order blocks, fair value gaps, and liquidity zones in real-time daily, then review how price interacted with those levels after the fact. This deliberate practice builds the pattern recognition neural pathways required for live trading success. Progressing to live markets should start with minimum position sizes, gradually scaling up as consistency develops over months rather than rushing into full-size positions immediately.

Conclusion - Your SMC Action Plan

Smart money concept provides retail traders with a framework for understanding and trading alongside institutional participants rather than being their counterparty. The methodology's effectiveness stems from its foundation in market mechanics and order flow reality rather than mathematical indicators divorced from actual buying and selling pressure.

Your path forward starts with education and practice. Begin by studying price charts through the SMC lens, identifying order blocks, fair value gaps, and liquidity grabs on instruments you plan to trade. Mark these levels in advance and observe how price reacts when reaching them. This observational practice builds intuition faster than theoretical study alone. Consider structured learning through quality educational resources or mentorship programs that provide feedback on your analysis, accelerating the pattern recognition development process.

Implementation should progress methodically from paper trading through small live positions to full-size trading only after demonstrating consistent profitability. The journey from learning smart money concept to mastering its application typically requires six to twelve months of dedicated effort, but the resulting edge in understanding market mechanics provides lasting competitive advantages. Trading platforms with advanced charting, precise execution capabilities, and comprehensive order management tools support this implementation journey by allowing you to focus on analysis and decision-making rather than fighting technology limitations.

Trading like institutional investors in 2025 means mastering Smart Money Concepts — understanding order blocks, liquidity zones, and institutional footprints on the chart. With , traders can apply these methodologies using AI-powered analytics and real-time order flow data, scaling their strategies with company capital and transparent profit-sharing. This integration allows retail traders to align with institutional moves, execute with precision, and maximize returns in volatile markets.

FAQ

How do I identify valid order blocks in smart money concept trading?

Valid order blocks show specific characteristics including an impulsive move away from the zone, clean candle structure without excessive wicks, and positioning within broader market structure context. The candle preceding the impulse should have clear rejection from one direction followed by explosive movement opposite. Higher timeframe order blocks carry more significance than lower timeframe ones, and blocks forming after liquidity grabs prove more reliable than random swing points. Confluence with fair value gaps or major structural levels strengthens order block validity considerably.

What's the typical success rate with SMC trading strategies?

Smart money concept trading achieves win rates between 60-75% when implemented with proper risk management and selective trade filtering. Success rates improve significantly when traders demand confluence between multiple factors rather than taking every potential setup. The methodology's strength lies not just in win rate but in favorable risk-reward profiles, as structure-based targeting often yields ratios exceeding 3:1 or 5:1. Consistency develops over time as pattern recognition improves through deliberate practice and market observation.

Can I use smart money concept with small trading accounts?

SMC works effectively with accounts of any size because the methodology focuses on percentage-based risk management rather than absolute position sizes. Small accounts benefit particularly from SMC's high-probability setups and favorable risk-reward profiles, allowing capital growth through consistent execution. The key lies in accepting position sizes appropriate to account balance rather than over-leveraging to achieve arbitrary profit targets. Starting with micro lots or cent accounts while learning prevents significant capital loss during the skill development phase.

How does smart money concept differ from supply and demand trading?

While both methodologies identify zones where significant orders exist, smart money concept recognizes the dynamic nature of institutional order flow versus static supply-demand zones. SMC incorporates liquidity grabs, fair value gaps, and changing market structure into analysis, while traditional supply-demand focuses primarily on reaction zones. Smart money traders understand that institutions actively manage positions and create manipulation patterns before major moves, adding layers of analysis beyond basic zone identification.

What technical indicators complement smart money concept analysis?

Smart money concept functions as a complete standalone methodology requiring no indicators, as it focuses on pure price action and order flow. Some traders incorporate volume analysis or VWAP to confirm institutional participation levels, but lagging indicators like moving averages or oscillators typically conflict with SMC principles. The methodology's strength lies in reading price structure directly rather than filtering it through mathematical transformations that introduce lag and reduce clarity.

Is smart money concept suitable for complete trading beginners?

SMC presents a steeper initial learning curve than basic technical analysis because it requires understanding market mechanics and institutional behavior rather than simply following indicator signals. However, beginners who commit to proper education often develop better trading foundations through SMC than those starting with indicator-dependent approaches. The six to twelve month mastery timeline assumes consistent study and practice, making structured learning programs valuable for accelerating the education process and avoiding common misconceptions that delay progress.

Where can I find quality smart money concept learning resources?

Quality SMC education comes from sources emphasizing practical application over theoretical discussion. Look for programs providing chart examples, trade breakdowns, and feedback on student analysis rather than vague conceptual explanations. Many successful SMC traders share educational content through various platforms, though distinguishing between quality instruction and superficial coverage requires careful evaluation. Consider starting with free resources to grasp core concepts before investing in comprehensive courses or mentorship that provide structured learning paths and personalized guidance for skill development.