Trading

Crypto trading for your clients

Embed institutional-grade trading, custody, staking, and financing via our APIs.

Trading Solutions

Execution and liquidity

Multi-venue liquidity access

Access spot liquidity across top exchanges and venues through a single connection. Smart routing to compare venues, improve all-in pricing, and reduce market impact.

Advanced algorithmic execution

TWAP, VWAP, iceberg orders, and more for automated, precision trading.

Streaming quotes or RFQ

Request firm, all-inclusive pricing from leading liquidity providers, or streaming quotes in real time for continuous price discovery.

High-touch OTC desk

Work directly with our institutional OTC trading team for large, discreet block trades.

Custody and collateral

Secure, institutional-grade custody

Safeguard assets in segregated, offline storage wallets within a Qualified Custodian.

Fast 24/7 access

Most transfers process within 15 minutes, and nearly all are processed within 2 hours.

Broad asset coverage

Access 420+ digital assets from a single custody platform, reducing the need to manage multiple providers.

Financing

Trade finance

Bridge between traditional and digital asset markets with financing that lets you trade without full pre-funding, then settle post-trade on agreed terms.

Agency lending for yield

Earn income on your digital assets through an agency lending program managed by Coinbase’s agency lending team. No need to build your own lending desk. Eligible customers* can lend into a program that spans 85+ crypto assets, with margin calls and collateral management handled by Coinbase.

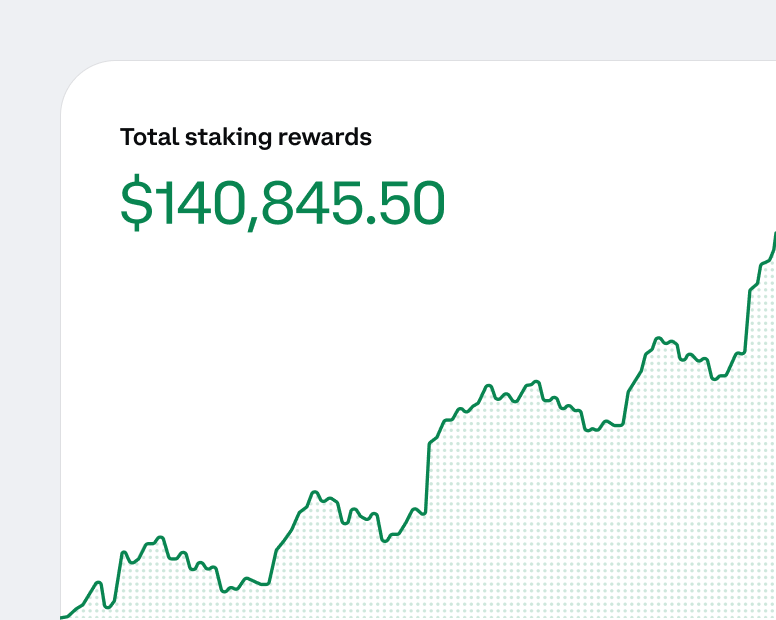

Staking

Staking from custody

Offer staking on over a dozen assets from the same custody environment, so assets do not need to be moved to less secure venues.

Rewards with institutional controls

Allow customers to generate rewards on strategic holdings while maintaining institutional policies and oversight.

Trading tools for onchain builders

High performance onchain swaps

Execute token-to-token swaps on Ethereum and Base with sub-500ms latency, aggregator-powered routing across major DEX liquidity, and with the ability to add slippage and gas optimization.

Built for Bots, Agents, and DeFi Apps

Power agentic systems, DeFi vaults, and trading bots using CDP wallets or your own wallet setup. The API supports both EOAs and Smart Accounts, offers optional gas sponsorship, and returns full swap metadata for compliance and backtesting.

Why Coinbase?

Turnkey trading stack

Launch institutional-grade trading through a single integration. The Trading bundle gives you multi-venue execution, custody, integrated financing and risk tooling out of the box, so teams can focus on strategy instead of complex infrastructure.

Scale your product

Start with spot markets and scale into additional tradable assets such as futures and perpetuals as your business and regulatory posture evolves.

Built on institutional experience

The trading API and workflows are informed by years of serving hedge funds, asset managers, and other large institutions. Benefit from reliability, controls, and market structure refined in demanding institutional environments.

Built by Coinbase

Coinbase sets the industry benchmark for safeguarding digital assets, with battle-tested key management systems, 24/7 threat monitoring, and dedicated security teams.

The future of markets is onchain

$236B

in institutional trading volume in Q3’25

$135M

in institutional transaction revenue in Q3’25

$840B

of notional derivatives trading volume (Deribit and Coinbase collectively)

Disclaimer: This material is the property of Coinbase, Inc., its parent, and its affiliates and is for informational purposes. This material is not accounting, investment, legal, or tax advice. No representation or warranty is made, expressed or implied, with respect to the future performance of any digital asset, financial instrument or other market or economic measure. Please note that all investments involve risk, including risk of loss, and thus may not be suitable for everyone. Recipients should consult their advisors before making any investment decision. Trading venues not connected to Coinbase Prime may offer better pricing. Coinbase, Inc. is licensed to engage in virtual currency business activity by the New York State Department of Financial Services and is not registered or licensed in any capacity with the U.S. Securities and Exchange Commission or the U.S. Commodity Futures Trading Commission. Not all products and features are available in all jurisdictions.

View our licensing information here.

Coinbase Custody Trust Company, LLC is chartered as a limited purpose trust company by the New York State Department of Financial Services to engage in virtual currency business.

Copyright 2025 | Coinbase, Inc.

* Agency lending is offered to eligible U.S. customers who meet the definition of ‘qualified purchaser’ as an unregistered offering under Regulation D.