Banks

Crypto infrastructure for the world's top banks

Integrate once, build across your business - all the tools banks need to build secure and regulated offerings for retail, private banking, and institutional clients.

Solutions for Banks

Use cases

Retail

Wealth

Capital Markets

Investment Management

Investment Banking

Infrastructure and Compliance

Why Coinbase?

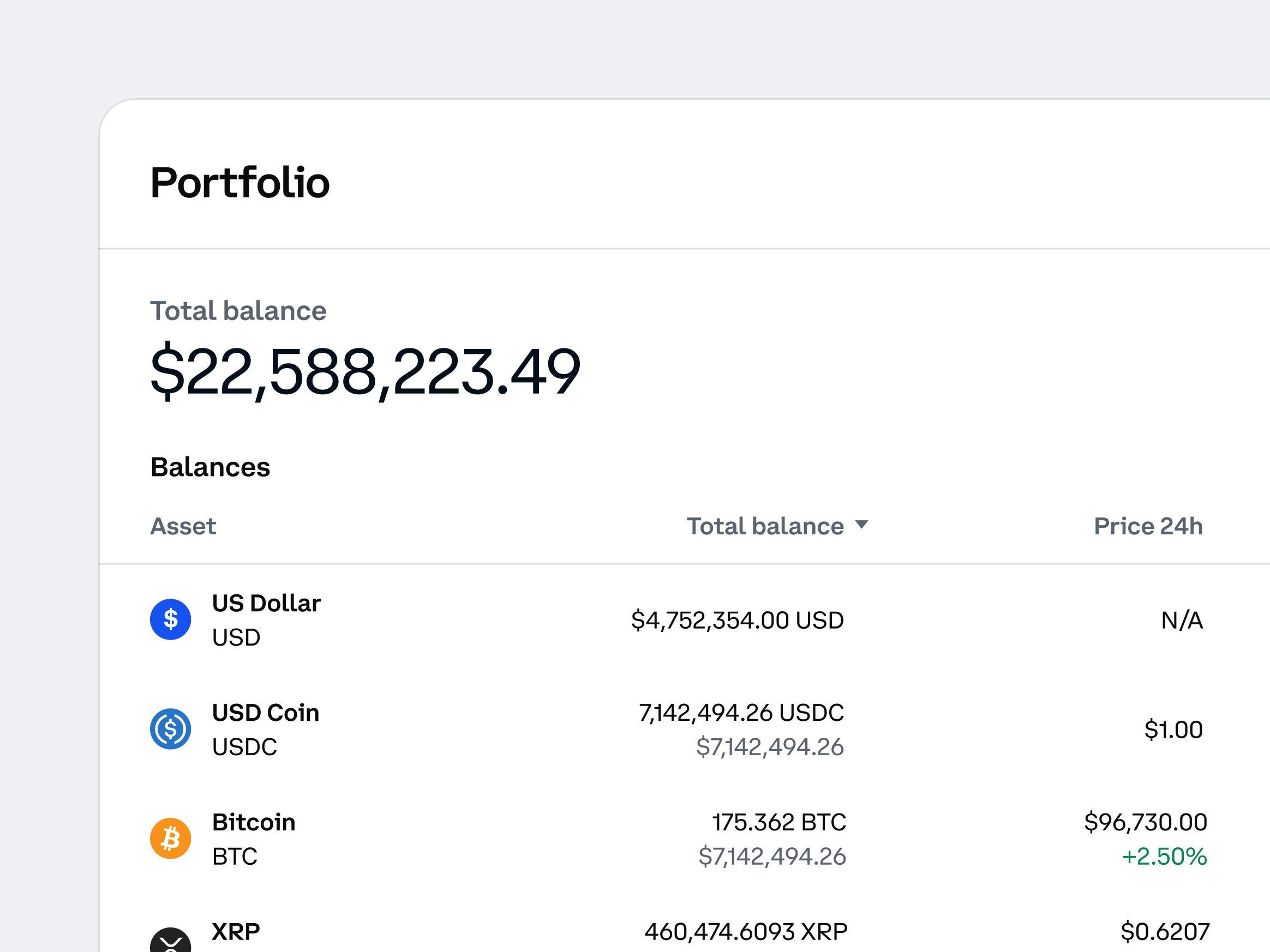

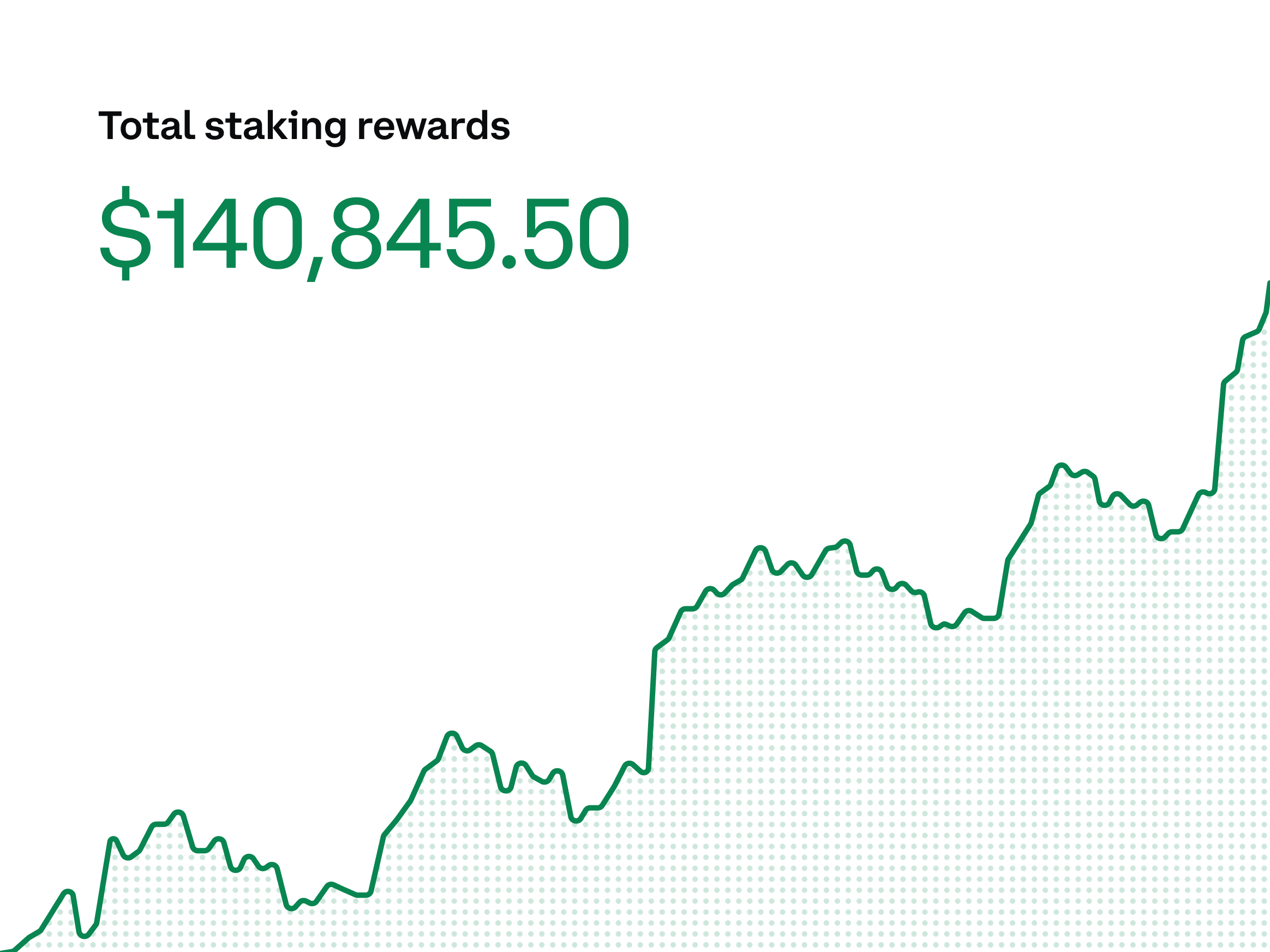

The product depth to build crypto products for all of your customers

Through our deep suite of product and feature building blocks, you can start building with Coinbase and continue to expand across your business. From an initial retail brokerage build, to expansion into wealth management, to infrastructure and compliance.

Institutional experience

We’ve forged partnerships with some of the leading financial institutions and asset managers in the world, and understand institutional-scale partnership. We have the team, product depth, and resources to help leading firms succeed as they build in crypto.

Global compliance

As a public company, our financials are reported quarterly, and independently audited annually. While headquartered in the US, we implement a rigorous global compliance framework and continue to seek approval from international regulatory bodies to support product expansion.

Accelerated time to market

Developing crypto infrastructure is complex and expensive. By leveraging Coinbase’s proven systems, our partners can build best-in-class solutions with minimal lift. We keep partners ahead of the curve as the industry develops and understand crypto to the core.

No representation or warranty is made, express or implied, with respect to the future performance of any digital asset, financial instrument or other market or economic measure. Recipients should consult their advisors before making any investment decision. Coinbase, Inc. is not registered or licensed in any capacity with the U.S. Securities and Exchange Commission or the U.S. Commodity Futures Trading Commission. Not all products and features are available in all jurisdictions.