Acest articol a fost publicat prima data în start-up.ro: https://start-up.ro/peisajul-fondurilor-vc-cu-finantare-publica-din-romania-perspectiva-la-final-de-q3-2025/ și a fost preluat cu acordul autorilor, dintre care fac parte și eu.

———–

Piața de capital de risc (VC) din România se confruntă cu o creștere fără precedent a finanțării publice, impulsionată în mare parte de inițiativele Uniunii Europene menite să sprijine ecosistemul național de startup-uri, în special în sectoarele tehnologice emergente și tehnologiile de tranziție digitală.

Deși persistă provocări, cum ar fi lipsa istorică de capital local și ratele scăzute de atragere de fonduri raportate la PIB comparativ cu alte țări din UE, aceste programe publice sunt pregătite să transforme semnificativ peisajul investițional.

Într-adevăr, companiile susținute de capitalul privat din România au demonstrat un impact notabil asupra economiei, cu o creștere netă de 7,1% a locurilor de muncă create în 2022 (față de 2,3% pentru economia generală) și o creștere de 5,2 miliarde de euro a cifrei de afaceri între 2019 și 2022.

Acest articol oferă o imagine de ansamblu cuprinzătoare a stării actuale a oportunităților de capital de risc cu finanțare publică din România la jumătatea anului 2025, detaliind programele cheie, progresele acestora și perspectivele viitoare.

Fondul de Fonduri de Redresare PNRR (REF): Principalul catalizator pentru creșterea pieței naționale a fondurilor VC

În centrul strategiei României pentru capitalul de risc public se află Fondul de Fonduri de Redresare (REF), un fond de fonduri substanțial de 400 de milioane de euro, alocat în cadrul Planului Național de Redresare și Reziliență (PNRR) și gestionat de Fondul European de Investiții (FEI).

Această inițiativă impune ca fondurile de capital de risc și private equity beneficiare să investească cel puțin o sumă echivalentă în România, asigurând un impact direct asupra economiei locale.

Stadiul Actual și Oportunități: La mijlocul anului 2025, 13 fonduri au obținut deja angajamente de la REF, totalizând 242,5 milioane de euro.

Acestea acoperă diverse etape, de la capital de risc în stadiu incipient la capital de creștere, cu nume notabile precum GapMinder Venture Partners II, Early Game Ventures II, Sparking Capital II, Morphosis Capital II și PCP SEE Fund II. În mod special, în iulie 2025, Sparking Capital II și PCP SEE Fund II au primit un total de 30 de milioane de euro de la REF pentru a investi în firme tehnologice emergente, respectiv în IMM-uri multisectoriale.

Guvernul anticipează susținerea a aproximativ 20 de fonduri până în 2026, ceea ce indică loc pentru încă aproximativ 7 fonduri. Aceasta lasă aproximativ 157,5 milioane de euro din bugetul REF încă disponibile pentru noi fonduri. Managerii de fonduri interesați să valorifice acest capital ar trebui să acționeze rapid, deoarece apelul pentru aplicații rămâne deschis până la 31 decembrie 2025. FEI evaluează propunerile în mod continuu, prioritizând echipele cu experiență solidă, strategii robuste și o capacitate dovedită de a atrage co-investiții private.

Angajamentele REF se situează de obicei între 15 și 30 de milioane de euro, servind adesea ca și capital de bază care poate acoperi o parte semnificativă din dimensiunea țintă a unui fond. Cu toate acestea, investitorii privați (LP = Limited Partners) sunt esențiali, majoritatea fondurilor susținute de REF fiind structurate pentru a include cel puțin 30% capital privat. Obiectivul REF este unul amplu, susținând startup-urile și IMM-urile de la etapele incipiente până la cele de creștere, incluzând chiar și proiecte de infrastructură în energia regenerabilă.

Instrumente Regionale de Capital de Risc: Impulsionarea Inovației Locale

Completând programul național PNRR/REF, Programele Operaționale Regionale ale României pentru perioada 2021-2027 instituie instrumente financiare pentru a stimula inovația la nivel local.

Trei regiuni au preluat inițiativa în lansarea de fonduri de risc selectate prin licitații competitive:

- Regiunea Vest (ADR Vest): Această regiune, care acoperă zone precum Timișoara și Arad, a fost deosebit de ambițioasă, lansând două fonduri distincte:

- Fondul de Accelerare („Instrument de Accelerare a Afacerilor”): Acesta marchează „primul accelerator regional de investiții” din România. Cu un capital total de 14 milioane de euro, din care 11,25 milioane de euro sunt destinate investițiilor directe în IMM-uri inovatoare din Regiunea Vest până în 2029. Fondul își propune să ofere finanțare pre-seed/seed (de obicei între 10.000 și 200.000 de euro pentru etapa de accelerare și între 200.000 și 1.000.000 de euro pentru etapa seed), alături de mentorat și acces la piață pentru companii inovatoare aflate în stadii foarte incipiente. ADR Vest are un obiectiv ambițios de a crește un „unicorn” regional până în 2029 prin acest efort. Pe 7 august 2025, ADR Vest a anuntat oficial consorțiul internațional Grow Wise Collective ca manager de fond. Acest consorțiu reunește Startup Wise Guys, Growceanu Angel Investment, Cowork Timișoara și Iceberg. După selectarea managerului și finalizarea aspectelor birocratice, pasul următor este lansarea programelor de pre-accelerare și accelerare pentru identificarea si sustinerea viitorilor inovatori.

- Fondul de Capital de Risc („Fond de Capital de Risc” – Vest): Acest fond va beneficia de un angajament public de 26 de milioane de euro, cerând managerului selectat să atragă cel puțin 9,6 milioane de euro în capital privat, creând astfel un fond de minimum 32 de milioane de euro dedicat IMM-urilor din Vestul României. Vizează companii în stadii post-seed/Seria A, investind între 0,5 și 4 milioane de euro per companie în peste 15 IMM-uri. Sectoarele eligibile se aliniază cu Strategia de Specializare Inteligentă a regiunii, incluzând în mod explicit agro-alimentar, producție durabilă, eficiență energetică, IT/auto, turism și științele sănătății/vieții. Licitația internațională pentru managerul acestui fond este în desfășurare, urmand ca managerul acestui fond sa fie selectat probabil pana la finalul anului.

- Regiunea Nord-Vest (ADR Nord-Vest): Acoperind județe active in ecosistemul de startup-uri precum Cluj și Oradea, această regiune a lansat un fond regional de capital de risc cu peste 23 de milioane de euro la dispoziția startup-urilor în stadii incipiente de creștere. Fondul își propune să finanțeze afaceri inovatoare care creează locuri de muncă bine plătite și produse globale din regiune. Procesul de achiziție pentru managerul de fond este în desfășurare, managerul urmând sa fie probabil contractat pana la finalul anului.

- Regiunea Centru (ADR Centru): La mijlocul anului 2025, această regiune (incluzând Brașov, Târgu Mureș și Sibiu) a lansat primul său fond de capital de risc pentru startup-uri inovatoare. Este un fond mai mic, cu 7,06 milioane de euro în finanțare publică și o cerință ca managerul să adauge cel puțin 10% capital privat, ceea ce implică un fond de minimum aproximativ 7,8–8 milioane de euro. Poziționat pentru investiții în etapa seed (100.000–200.000 de euro per startup), acest fond va sprijini aproximativ 40 de startup-uri inovatoare în domenii de specializare inteligentă, cum ar fi producția avansată, IT, sănătate și energie. Licitația internațională pentru managerul fondului Centru se află în desfășurare, urmand ca managerul sa fie selectat probabil pana în trimestrul 1 al anului 2026.

Deși celelalte regiuni ar putea urma și ele acest trend, nu au fost făcute (inca) anunțuri publice privind intenția de a lansa astfel de licitații și fondurile VC subsecvente.

Fondurile de Equity Dedicate Inovării (Programul POCIDIF), Cunoscut Oficial sub Numele „Innovation Romania”

Cea mai recenta oportunitate aparuta in piata este programul „Innovation Romania”, o inițiativă de aproximativ 100 milioane de euro în cadrul Programului Operațional „Creștere Inteligentă, Digitalizare și Instrumente Financiare” (POCIDIF). Guvernul României, prin Ministerul Investițiilor și Proiectelor Europene (MIPE), a semnat în decembrie 2024 un acord de finanțare cu FEI pentru a crea acest fond de holding (Fondul de Participare), care este gestionat de FEI, similar cu REF. O analiză ex-ante a relevat un deficit substanțial de 2 miliarde de euro în finanțarea VC pentru sectorul de inovare din România până în 2027, în special pentru finanțarea în stadii foarte incipiente și comercializarea cercetării.

Programul „Innovation Romania” este conceput pentru a capitaliza trei categorii distincte de fonduri de equity, fiecare abordând o lacună critică:

- Fonduri de Co-investiții (cu Business Angels): Aceste fonduri vor acționa ca LPs ancoră alături de investitori privați (business angels) în rundele pre-seed și seed. Acest model valorifică capitalul angel cu bani publici, crescând dimensiunile rundelor și împărțind riscul, făcându-l ideal pentru startup-urile tehnologice foarte timpurii, inclusiv healthtech.

- Fonduri de Accelerare: Asemănătoare acceleratoarelor de risc cu un fond atașat, acestea vor investi în companii în stadii foarte incipiente (proof-of-concept, start-up, seed) prin abordări programatice, cum ar fi cohortele. Ele vor oferi bilete inițiale mici, investiții de follow-on și sprijin esențial structurat de mentorat și consiliere.

- Fonduri de Transfer Tehnologic: Vizând în mod explicit comercializarea cercetării, aceste fonduri vor fi conectate la universități sau institute de cercetare, concentrându-se pe investiții în proiecte și spin-off-uri din R&D. Aceasta este o zonă crucială pentru domeniile de specializare inteligentă, abordând „deficitul de transfer tehnologic” al României. Această categorie reprezintă o oportunitate nouă și extrem de pertinentă, deoarece fondurile de capital de risc dedicate transferului tehnologic sunt practic inexistente în România.

Bugetul de aproximativ 100 milioane de euro este alocat flexibil între aceste trei tipuri de fonduri, în funcție de cerere și calitatea propunerilor. Selectarea administratorilor de fond de către FEI a fost anuntata oficial pe 11 septembrie, iar termenul pentru depunerea propunerilor este 15 noiembrie 2025. Pentru un manager de fond care își propune să strângă, de exemplu, 20 de milioane de euro pentru un accelerator sau 30 de milioane de euro pentru un fond de transfer tehnologic, acest program ar putea acoperi o parte semnificativă (50% sau mai mult, în funcție de teza de investiții), restul fiind obținut mobilizați de la investitori privați.

Concluzie: Un peisaj tot mai dinamic pentru Investitorii in startup-uri

La momentul septembrie 2025, peisajul capitalului de risc cu finanțare publică din România este mai dinamic ca niciodată. Deși o parte semnificativă din fondurile PNRR/REF a fost alocată, un capital substanțial rămâne disponibil până la sfârșitul anului 2025.

Fondurile regionale de capital de risc progresează si vor fi functionale in 2026, Aceste fonduri vor deveni în curând co-investitori activi în ecosistemele lor respective.

În paralel, noile VC_uri din programul Innovation Romania/POCIDIF reprezintă vor crea un nou layer finanțare VC specializată (accelerare, transfer tehnologic, etc). Apelul pentru managerii de fond fiind lansat in septembrie 2025, ne putem astepta ca aceste fonduri sa fie operationale la jumatatea lui 2026.

Pentru administratorii de fonduri care isi propun sa participe la astfel de apelurile de selectie, este necesar un echilibru intre experienta de investment in startup-uri si competentele necesare pentru a asigura un compliance solid cu cerintele specifice privind fondurile de capital de risc care utilizează bani publici pentru a investi în startup-uri. Principala reglementare care guvernează aceste fonduri este Regulamentul Comisiei (UE) nr. 651/2014, cu modificările ulterioare (GBER), în special articolele 21 și 22 referitoare la ajutorul pentru finanțare de risc. Aceste reglementări stabilesc condiții clare pentru modul de funcționare al fondurilor: co-investitorii privați trebuie să contribuie alături de fondurile publice, valoarea investițiilor este plafonată la nivel de companie și de fond, administratorii trebuie să fie stimulați să acționeze pe baze comerciale, iar toate operațiunile sunt supuse unor reguli stricte de raportare și transparență. Pe langa GBER, in functie de fiecare dintre cele 3 categorii de fonduri cu finantare publica de mai sus se aplica cerinte si reglementari suplimentare, precum ar fi cerintele de icnadrare in Strategiile de Specializare Inteligenta Regionale/Nationala, sau cerinte specifice privind raportarea. Odata depasite aceste provocari de compliance, noile fonduri vor putea stabili o bază solidă de capital din instrumentele UE și pot avea un impact semnificativ asupra ecosistemului tehnologic în plină dezvoltare din România.

O provocare importantă în ecosistem este creșterea numărului de fonduri de capital de risc (VC) în raport cu numărul limitat de manageri de fond experimentați. România se află practic la “a doua generație” de manageri de fonduri, ceea ce înseamnă un track record insuficient și constituie un dezavantaj semnificativ – marile fonduri evită țările unde managerii nu au istoric solid.

Pentru a acoperi acest deficit de expertiză locală, selecțiile de manageri de fond au atras tot mai mult echipe sau experți internaționali. Un exemplu elocvent este Fondul de Accelerare Vest, al cărui administrator desemnat este consorțiul internațional Grow Wise Collective, un parteneriat româno-estonian ce reunește expertiză europeană și cunoașterea pieței locale. Astfel de colaborări indică faptul că România începe să importe know-how din afara țării pentru a asigura gestionarea profesionistă a noilor fonduri de investiții.

O alta provocare, si oportunitate in acelasi timp, va fi numărul de fonduri ce vor exista la nivel de pre-seed – la început va crea o competiție aparentă, dar probabil manageri de fond vor ajunge sa colaboreze bine împreună pentru investiții si se vor crea pozitionari clare complementare intre ele. Pe masura ce aceste fonduri vor deveni mai cunoscute, numărul de startupuri va crește considerabil, mulți fondatori fiind atrasi de prezenta de capital investibil ce va fi disponibil.

Noile măsuri fiscale adoptate în 2025 generează, la rândul lor, provocări considerabile pentru investițiile în startup-uri. Cea mai controversată este creșterea accelerată a impozitului pe dividende – de la 5% în 2016 la 16% anul viitor – care va depăși chiar cota impozitului pe venit. O asemenea majorare reduce randamentul net al investițiilor și poate descuraja LP-ii (Limited Partners) și investitorii privați să finanțeze fonduri de venture capital orientate spre startup-uri. În plus, menținerea impozitului minim pe cifra de afaceri (IMCA) – inițial introdus temporar – este criticată de mediul de afaceri, care avertizează că această formă de taxare „descurajează investiţiile, erodează competitivitatea şi afectează atât investiţiile româneşti, cât şi pe cele străine”.

Astfel de poveri fiscale pot diminua profitabilitatea startup-urilor (printr-o povară fiscală mai mare asupra veniturilor și eventualelor exit-uri) și pot face investițiile în acestea mai puțin atractive. Totodată, lipsa de predictibilitate fiscală – cu schimbări adoptate adesea pe termen foarte scurt – transmite investitorilor semnale contradictorii și sporește percepția de risc asupra pieței. În loc să se concentreze pe creșterea afacerilor, fondatorii de startup-uri și managerii de fond sunt nevoiți să aloce resurse suplimentare pentru conformare fiscală, într-un mediu impredictibil care le poate afecta deciziile de investiție.

O alta posibila presiune pe termen lung va fi și felul cum se schimba peisajul de venture capital la nivel global, deja se observa transformari ale industriei de venture capital cu noi modele de investiții și cu siguranta aceste modele vor cascada și în estul Europei si nu ramane de vazut cum se vor adapta fondurile noi lansate în așa fel incat sa aibă acces la cei mai buni fondatori locali care sa creeze startupuri de succes.

]]>By tracking investments, trends, and emerging players, we provide a comprehensive overview of the key venture capital (VC) investments that shaped the Romanian startup landscape in 2024.

Through the Startup Ecosystem Radar, we gather and streamline key insights into a concise, easily digestible format, which we share as a free monthly newsletter with our partners and clients. Our aim is to offer valuable ecosystem insights that empower informed business decisions and foster connections with relevant stakeholders.

Stay updated with the latest developments – subscribe to our newsletter today!

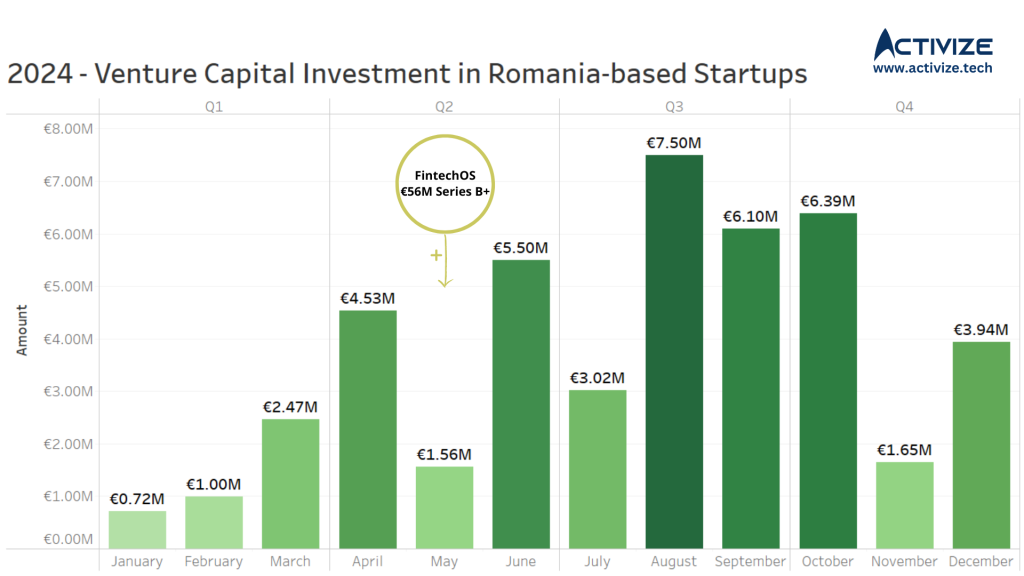

In this article, we have gathered information about VC investments based on media announcements and the dates of public deal disclosures. Throughout 2024, we tracked 48 investment rounds in Romanian startups and 9 in foreign startups with at least one Romanian founder residing abroad.

The total investment for this period amounted to approximately €100.4 million across 48 rounds in domestic startups. Meanwhile, foreign startups with Romanian founders secured around €9.8 billion across 10 investment rounds, with one round remaining undisclosed in terms of transaction value.

It is important to note that the above analysis is significantly influenced by FintechOS‘s notable $60M (~€56M) Series B+ investment. To offer more accurate predictions and conclusions, we have chosen to treat this as a distinct entity. Additionally, in the following chart, we have separately accounted for this investment round to provide a clearer view of the monthly distribution of the invested capital.

Examining the quarterly breakdown of investment figures for 2024, the second and third quarters accounted for over 63% of the total investment, with Q3 alone representing a significant 37.44%. This suggests that the largest investments in Romanian startups occurred during the summer and early autumn months. The surge in investments is likely attributed to concentrated funding rounds, increased investor activity as in the first part of the year 2 funds were launched.

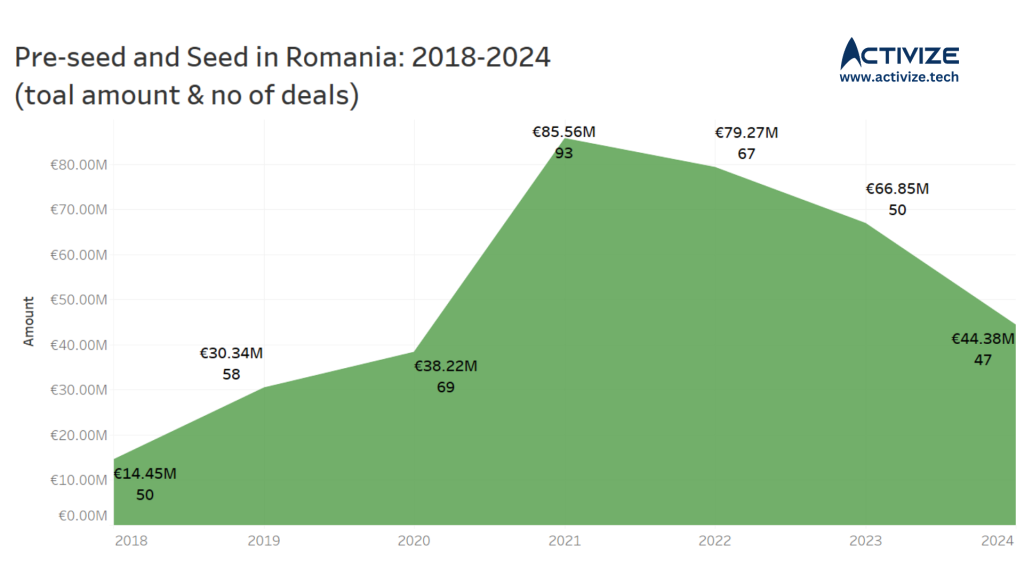

Note: The graphic above is focused on pre-seed and seed in Romanian startups from angel networks and venture capital funds and doesn’t include the following rounds of investments: FintechOS’s $60M series B round from 2021, DRUID’s $16M series A round from 2022, FlowX.AI’s $35M series A round from 2023, DRUID’s $30M series B round from 2023 and FintechOS’s $60M series B+ round from 2024.

Starting in 2018, Romania’s startup ecosystem experienced a steady upward trend in investments for four years, with both the investment amounts and the number of deals gradually increasing. 2021 marked a milestone, with nearly 100 deals totaling €85.56M. However, after this peak, we saw a decrease in total venture capital investments caused by a mix of factors.

In 2023, the total amount invested in Romanian startups decreased by approximately 16% compared to 2022. When compared to the record funding of 2021, the decline was even more notable, around 22%. In 2024, the total investment in Romanian startups reached €44.38M, showing some recovery compared to the previous years.

While the decrease in investment figures could initially be seen as a downturn, it can also be viewed as a correction, bringing the funding levels back to a more sustainable and normal rate. This signals cautious optimism for the future, with new funds launching and a more stable investment environment anticipated in the coming years.

Regarding the distribution of the investments received by the Romanian startups in 2024, we can group them by the following way:

- €938.5K in 11 rounds up to €200K (probably others investments were made at this stage, but these were not announced publicly)

- €7.56M in 18 rounds €200K to €1M

- €22.38M in 15 rounds €1M to €3M

- €13.5M in 4 round higher than €3M

- FintechOS’s $60M (~€56M) round

Here are some notable investment deals from the second half of 2024:

- FintechOS, a leading end-to-end financial product management platform from Romania, announced the successful completion of a $60M Series B+ investment round led by Molten Ventures, Cipio Partners, BlackRock and others (link).

- Catalyst Romania has announced a €2M investment in ADAPTA Robotics, a Romanian robotics development company (link).

- Pago, a payment service that simplifies invoice management and recurring payments, has successfully raised €2.3M through SeedBlink, and with the contribution of Mozaik Investments (link).

- The Romanian healthtech startup dotLumen has announced a €5M financing round, €1M through SeedBlink, and with the European Innovation Council and the Venture to Future Fund contributing an additional €4M (link).

- Romanian edtech startup Youni Choice has secured $1M in financing from the Czech investment fund Soulmates Ventures, with participation from the venture capital fund Early Game Ventures (link).

If you’re curious about the most significant deals from the first half of 2024, you can find them in our six-month overview here.

In order to have access to the full list of investments as they appear, subscribe to Startup Ecosystem Radar.

Funding for foreign startups with Romanian founders

Startups with at least one Romanian co-founder raised a total of €9.8 billion across 10 deals, and one additional deal remaining undisclosed in 2024. This underscores the strong presence of Romanian entrepreneurs in the global startup ecosystem, successfully securing significant funding beyond the local market.

One of the biggest investments were the following:

- Databricks, Romanian cofounded data and AI company, has announced its Series J funding led by Thrive Capital. The company has raised €9.68 billion ($10 billion) (link).

- The London-based Romanian robotics and data intelligence company Dexory has successfully closed a €77.4 ($80M) Series B funding round, led by DTCP (link).

- NY-based startup with Romanian roots, Ezra has received €19.6M ($21M) in an investment round led by Healthier Capital. The investment will be used for the improvement of its AI-powered full-body scans solution (link).

- Berlin-based startup Root Global (co-founded by Eric Oancea), a digital platform for reducing carbon emissions in the food industry, has secured €8M in a seed funding round led by Christoph Janz at Point Nine (link).

In order to have access in real time to this kind of information, join Startup Ecosystem Radar.

Closing

Looking to 2025, the venture capital landscape may face challenges due to macroeconomic instability, fiscal reforms, and political uncertainties. With several European economies also navigating tough times, it’s expected to be a difficult year for businesses. However, crisis periods often create opportunities for startups, and 2025 still remains a promising year for investments.

]]>As part of Startup Ecosystem Radar, we curate and condense this valuable information into a digestible format and offer it as a free monthly newsletter to our partners and clients. Our goal is to provide insights about the ecosystem, empowering informed business decisions and facilitating connections with relevant stakeholders. Don’t miss out on the latest updates – subscribe to our newsletter today!

Based on public announcements, in the first half of 2024, we tracked 23 investment rounds in Romanian startups and 7 in foreign startups with at least one Romanian founder residing abroad.

The investment amount for this period reached approximately €71.7M across 23 rounds in domestic startups, while foreign startups with Romanian founders secured ~€28.74M across 6 investment rounds, and one round undisclosed in terms of transaction value.

It is important to note that the above analysis is highly impacted by FintechOS‘s significant $60M (~€56M) Series B+ investment. To provide more realistic predictions and conclusions, we have decided to address it as a distinct entity. Furthermore, in the following chart, we have separately included this investment round to better observe the monthly distribution of the invested capital.

Based on Crunchbase’s data, globally, the first quarter of 2024 experienced a notable decline in startup funding, reaching the second-lowest point since 2018. Although there was a slight 6% increase compared to the previous quarter, funding saw a significant 20% drop from the same period last year.

This pattern is also present here, at the local level. As depicted in the chart above, the first quarter for Romanian startups fell significantly short of the success seen in the same period last year (you can check out our article on analyzing the first half of 2023).

In comparison to the €38.1M (29 investment rounds) invested in Romanian startups during the first quarter of 2023 (excluding FlowX.AI’s $35M Series A investment round), this year experienced a substantial 60.1% decrease, with startups attracting just €15.72M (excluding FintechOS’s Series B+ investment) distributed across 22 investment rounds.

This trend underscores a more cautious stance among investors, who are now leaning slightly more towards safer perceived investments (especially from angel investors) or supporting existing investments with follow-ons with aim to protect their own portfolio (in case of some venture capital funds).

“There is a noticeable trend from especially the seed & series A VCs to not take the same amount of risk as before, but follow on and protect their own portfolio, as well as choose their bets wiser based on profitability, sustainability, break-even point and last consolidation of the current business model and client base. In our case at Startup Wise Guys and being the most active in the pre-seed stage, we choose to invest and accelerate and then follow on in the most resilient startups. Hence, 39% of our portfolio companies that we invested over 9 years ago are active while the overall market benchmarks point towards only 10% of the companies to be alive after 10 years. This above-average survival rate is evidence that accelerator-backed companies know how to overcome tough times if monitored closely and followed on at the right time.“

Razvan Suta, CEE Business Development Lead @Startup Wise Guys

While not breaking record levels, it’s important to recognize the significant growth in the European (and also Romanian) startup funding landscape in the past 10 years. Based on Vestbee’s funding report, from 2014 to 2021, Europe’s venture capital ecosystem showed steady expansion, with funding levels more than doubling in 2021 alone. However, following a surge in 2021 and 2022, European VC investment reverted to pre-2021 levels, signaling a market cooling off due to a combination of factors.

“While the investment volume has slightly increased compared to the same period last year, we at TechAngels see fewer Romanian start-ups to choose from at the top of the funnel. As such, half of the 43 start-ups we have seen in pitching sessions in H1-2024 are foreign – albeit 6 have Romanian co-founders established abroad. FilmChain is one example of a foreign start-up founded by 2 Romanian entrepreneurs in the diaspora, who managed to attract funds from local business angels. We remain optimistic about the second half of the year: Q4 is typically when the investment activity picks up speed. We expect some companies in our angel’s portfolios to raise subsequent rounds – either Seed or Series A.”

Marius Istrate, Chairman of the Board @TechAngels Romania.

Regarding the distribution of the investments received by the Romanian startups, we can group them by the following way:

- €829.5K in 9 rounds up to €200K (probably others investments were made at this stage, but these were not announced publicly)

- €2.57M in 7 rounds €200K to €1M

- €6.82M in 5 rounds €1M to €3M

- €5.5M in 1 round higher than €3M

- FintechOS’s $60M (~€56M) round

“This year at Fortech Investments, we have shifted our focus from investing in very early startups even without revenue to more mature start-ups, and we realized that deal flow for late seed in Romania was really limited, pushing us to make more investments in start-ups from abroad that we might have intended to. It seems there is a sense of disappointment in the Romanian start-up scene, with fewer entrepreneurial initiatives compared to previous years. This can be attributed to the limited funding options available last year, as most VCs were raising funds in Romania. However, we are optimistic that this trend may change in 2025, as there are new initiatives emerging to create more funding opportunities.”

Irina Mișca, Investment Manager @Fortech Investments

Some of the highest and most important deals so far in 2024 were the following:

- FintechOS, a leading end-to-end financial product management platform from Romania, announced the successful completion of a $60M Series B+ investment round led by Molten Ventures, Cipio Partners, BlackRock and others (link).

- Genezio, a startup launched in 2023 to create tools to help developers automate app creation, raised a €1.87M ($2M) pre-seed round led by Gapminder Ventures. The investment was made together with Underline Ventures and a group of angel investors (link).

- Cluj-based startup Nordensa, which wants to democratize investing in football players, has received an pre-seed investment round worth €1.65M from a number of angel investors (independent and members of Transylvania Angels Network and Growceanu) (link).

- TOKERO, a cryptocurrency exchange, has announced the successful closing of its first private funding round of €1.3M ($1.4M) for the development of their own utility token, the TOKERO LevelUP Token (link).

- ELEC, the Romanian electric ride sharing platform, has attracted investment funds of over €1M to become an electromobility ecosystem (link).

We have to point out that beside these mentioned, there are a few other solid rounds which were not disclosed yet, included in the metrics above, but not named publicly.

In order to have access to the full list of investments as they appear, subscribe to Startup Ecosystem Radar.

Ranking in Eastern Europe

In the macro picture of the past years, in terms of rounds and volume, Invest Europe says that Romania is statistically in the mid-area within the Eastern European rankings, situated better than countries like Bulgaria or Slovakia, but behind others like Slovenia, Poland or Estonia.

While compared based on percent of GDP, private equity investments represent less than 0.03% of countries GDP, which ranks Romania, among the last ones in Europe.

Funding for foreign startups with Romanian founders

Regarding the funding raised by startups which have at least one Romanian co-founder, this totals ~28.74M in 6 deals. This represents nearly a halving compared to the same period in 2023, which totaled around €58.1M.

The biggest investments were the following:

- NY-based startup with Romanian roots, Ezra has received €19.6M ($21M) in an investment round led by Healthier Capital. The investment will be used for the improvement of its AI-powered full-body scans solution (link).

- Deltia.AI, a Berlin based startup that develops artificial intelligence technologies for factories, completed a €4.5M seed funding round led by Cavalry Ventures (link).

- FilmChain, the startup in the international film industry, founded by two Romanians, has completed an investment of €2.8M led by Holt InterXion, with the support of Roca X, DeBa Ventures, TechAngels Romania and HearstLab (link).

In order to have access in real time to this kind of information, join Startup Ecosystem Radar.

Closing

These statistics offer a snapshot of the first half of the year, with potential for further fluctuations throughout the full year compared to previous periods.

Despite ongoing challenges, optimism for the future remains strong, underscoring the need to stay alert and responsive to the evolving dynamics of the CEE region in the upcoming quarters.

Also check this other article that might be of interest, but focused on the Startup Programs and Events in Romania: A Comprehensive Overview (January-June 2024).

Look forward to our comprehensive year-end review of venture capital funding in Romanian startups for 2024. Stay updated on further insights and developments in the startup ecosystem by subscribing to our newsletters below!

]]>As we recently said farewell to 2023, it’s time for us to make a recap of what happened last year in the Romanian startup ecosystem in terms of venture capital investments. In this overview, we’ll present significant insights and highlights, offering a comparative analysis of the capital inflows against previous years.

Additionally, we’ll spotlight some of the most noteworthy funding rounds, providing a comprehensive recap of the important moments that defined the landscape of venture capital investments in the Romanian startup scene throughout the past year.

This article is based on our scouting and mapping processes, through which we gather various news, updates, events, opportunities and many other topics of interest related to the startup ecosystem. As part of Startup Ecosystem Radar, we curate and condense this valuable information into a digestible format and offer it as a free monthly newsletter. If you would like to get these reports, subscribe by using the form at the end of this article.

If you are interested in finding out more about the state of Romanian startup investments, you can explore the 2022 edition here and also we have made a wrap-up in which we discuss the first half of 2023 from startup investments perspective.

What has happened at the European level?

To understand the local startup scene, it’s important to also reflect on the existing macro-level trends across Europe.

Each year, the venture capital firm Atomico publishes a report called The State of European Tech, which includes a comprehensive analysis of investment trends. In the 2023 edition, the report reveals a notable shift in the European tech landscape, projecting a significant decrease in total capital invested in tech startups to $45 billion – down by 55% from 2021, when the investment volume exceeded $100 billion for the first time.

This shift was caused by a multitude of factors, such as inflation, higher interest rates, economic uncertainty, and geopolitical events. All of these continue to impact VC funding for startups in Europe. According to Atomico, the continent was on track to raise only $45 billion in 2023, roughly half of the $82 billion invested in 2022.

Funding for Romania-based startups during 2023

Monitoring the public announcements, we found out that during 2023 there were 54 investment rounds made in Romanian startups (2 of these were undisclosed).

The amount invested in startups reached approximately ~€66.85M across 50 rounds.

It’s important to note that the figures do not include DRUID’s ~€27.4M ($30M) round and FlowX.AI’s ~€32M ($35M) round. The decision to exclude these amounts is driven by the desire to present a more realistic situation of the general funding trends in Romania, as these particular investment sums are considered outliers within the context of the overall local funding landscape and their investors are from outside Romania.

Taking this into consideration, the following chart illustrates the quarterly comparison of venture capital investments in Romanian startups for the years 2022 and 2023. We have also highlighted the largest investment rounds undertaken in each of these years for a clearer observation of the quarterly distribution of the invested capital.

Examining the quarterly breakdown of investment figures for 2023, we see a slightly distinct pattern as in 2022. The first and fourth quarters stood out with €27.4M and €25.6M, while the third quarter, recording €3.04M, marked a notable dip, indicating the calmer period of summer and delayed investment process.

Starting from 2018, for 4 years there was a continuous upward trend, with investment amounts steadily increasing each year and the number of deals gradually rising. In 2021, Romanian startups experienced a milestone year: nearly 100 deals were made, totaling €85.56M. But after this successful year, unforeseen events unfolded, influencing the funding environment for startups. The evolving global landscape introduced challenges and shifts, which contributed to a general decrease in the total amount invested by venture capitals, a trend that started from the year 2022 onward.

In 2023, the total amount invested in Romanian startups showed a decrease of nearly ~16% compared to the preceding year, 2022. Furthermore, when contrasted with the robust funding of 2021, there was a more substantial decline of approximately ~22%.

The above chart highlights an existing situation on the size of the rounds in 2023. Specifically, the most popular deal types are situated between €200K and €1 million, indicating a strong emphasis on small-sized funding rounds, where angel investors networks are active (to name a few, Techangels, Growceanu, Transylvania Angels Network, Bravva and WIT Angels Club).

It is important to consider that in 2023 we had few funds which invested very little or at all as they were at the end of the active investing period and their focus was on raising the next funds, which will probably be launched in 2024 – this leading to a growth again in funding rounds.

While T.A.N. members invested more in 2023 than in 2022 it was still a year filled with trepidation. This was due to investors being wary of the known macroeconomic issues and problems (inflation, interest rates rising, wars, etc.), as well as the microeconomic circumstances for their families and firms. Expecting 2024 to be a similar year, or even more worrying, due to the ongoing and unresolved global uncertainties.

Emmett King, co-founder of Transylvania Angels Network

Considering the deal size, we have the following:

- €1.37M in 13 rounds up to €200K

- €13.47M in 23 rounds €200K to €1M

- €18.31M in 10 rounds €1M to €3M

- €33.7M in 4 rounds higher than €3M

- FlowX.AI’s ~€32M ($35M) round

- DRUID’s ~€27.4M ($30M) round

- 2 undisclosed rounds

Overall, for us 2023 was a low point in terms of investor interest in the early stage asset class. Similar or better deals than those on the table a year prior were left untouched by angels who preferred to pay attention elsewhere in their portfolio. Future moonicorns will probably come from all areas of the tech sector, with AI technology continuing to have an increasingly important role to play in everything that is being created

Ciprian Man, co-founder of Growceanu

Some of the highest and most important deals from the second half of 2023 were the following:

- Romanian AI startup Druid announced it has raised $30M in a series B round of funding led by TQ Ventures (link).

- Bobnet, a startup that develops hardware and software solutions for the automation of the retail industry, has obtained financing of €15M from the American investment fund NCH Capital (link).

- Bright Spaces,a startup for the real estate industry, has launched a fundraising campaign on SeedBlink, to reach its goal of ~€2M in a new round. €1.85M have already been raised from VC funds that have supported the startup in the past, but also from new partners (link).

- Nooka Space has secured a €2M investment round to support the ongoing global expansion (link).

If you are curious which were the most important deals from the first half of 2023, you can read them in our 6 month overview, here.

From an investment perspective, 2023 was peculiar, especially compared to the past 2-3 years. Due diligence became more rigorous and that made for less opportunities. But the ones that we had were definitely more qualitative and it seems that founders did listen to the advice that everyone was giving at the beginning of last year – “traction and sustainability over growth”. This leads me to think that 2024 will become more balanced – the start-ups are more mature and investors will have to deploy, given their activity in the past two years.”

Valentin Filip, managing partner at Fortech Investments

Funding for foreign startups with Romanian founders

Regarding the funding raised by startups which have at least one Romanian co-founder, this totals ~$706.07M in 14 deals and 1 undisclosed one, seeing a growth of approximately 35.2% compared to 2022 when the sum was ~$521.96M in 13 deals.

The biggest investment rounds were the following:

- Databricks, an AI and data analytics startup with two Romanian founders in its team (Ion Stoica & Matei Zaharia), raised a series I investment worth over $500M led by T. Rowe Price (link).

- Tractable, a London-based AI startup that uses computer vision to assess the condition of cars and homes, has announced a $65M series E investment led by SoftBank Vision Fund 2. The company is cofounded by the Romanian Răzvan Ranca (link).

- MaintainX, a startup founded by the Romanian Chris Țurlică, received a $50M series C investment for the product that offers software for industrial maintenance (link).

Closing and predictions for 2024

Keeping an eye on the venture capital ecosystem, we’re not surprised by these results.

The past year (2023) stood at the intersection of two forces: contraction in funding due to macroeconomic changes (leading to investors being more selective or focusing on supporting existing portfolio companies) and decreases in funding due to “gap year” for some funds that closed their active investing period.

For 2024, we expect the launch of a few new funds, either as the second fund in greater size and new funds based on angel investors activity. This is on the plus side.

On the other side, the macro-economy will continue its downtrend which will not be encouraging for private investments (angel investors will continue to be cautious and play safer, while venture funds will be focused in selection on scalability potential of the startups).

We see startups that are willing to be paying more attention to innovation public grants to focus their early-stage product funding.

The number of programs for startups will continue to rise (new ones being launched) as these programs are contributing a lot to investment-readiness and connections with investors.

While, the European funds (mostly from central Europe), will continue to be active in the Romanian ecosystem, not as first investors, but in co-investing roles together with local funds.

]]>As part of Startup Ecosystem Radar, we curate and condense this valuable information into a digestible format and offer it as a free monthly newsletter to our partners and clients. Our goal is to provide insights about the ecosystem, empowering informed business decisions and facilitating connections with relevant stakeholders. Don’t miss out on the latest updates – subscribe to our newsletter today!

The first 6 months review can be found here and now we will present the second part of 2023.

Highlights of Events & Programs in the Romanian Startup Ecosystem (2023)

1. ABC Incubator has launched the ABC Accelerator, a new initiative designed to support startups in taking their businesses to the next level (link).

2. StepFWD selected 20 early stage technology startups to enter their 7-month accelerator program (link) and had the demo day on December 12th.

3. The Institute of Excellence in Entrepreneurship (IdEA) successfully hosted the 9th edition of the Commons Accel startup accelerator. At the end of the program, 12 startups have pitched their ideas in front of investors (link). Moreover, idEA, together with Shopoteque, have launched ShopStart Accel, an accelerator for businesses that want to launch an online shop (link).

4. Rubik Hub has completed the fifth edition of the Rubik Garage accelerator where 24 startups took part (link). Also, Rubik Hub, in partnership with Fortech Investments, Google for Startups, WIT Angels Club, and AmCham Romania, has introduced the “Rubik Garage – Scale to USA” acceleration program, tailored for entrepreneurs aiming to grow in the US market (link).

5. Social Innovation Solutions organized the final of the sixth edition of the Future Makers incubator (link).

6. LevelUP Health & Life Sciences Accelerator program by INNO, a department of the North-West Regional Development Agency, has organized the first edition of the accelerator for health and life sciences startups in Romania and held its Demo Day event on 18th of September (link).

7. Startups and scaleups participating in the InnovX-BCR accelerator had the Demo Day and the best ones were awarded. Caut Curier won first place in the Startups category (link).

8. Orange Romania has welcomed six new startups into its Orange Fab acceleration program, chosen in response to the 5G project call earlier this year (link).

9. Startarium PitchDay‘s fifth edition has been organized under a new identity: “Romanians are entrepreneurs.” This competition, initiated by Impact Hub Bucharest and ING Bank and supported by Pluxee, showcased the entrepreneurial spirit of Romanians (link).

10. Impact Hub Bucharest’s Black Sea ClimAccelerator, dedicated to green businesses in Romania had the Demo Day in December. Additionally, the winners of the fourth edition of the Innovators for Children program (link) and the Empowering Women in Agrifood program were announced during the Pitch Days.

11. Activize and Impact Hub Bucharest has launched 2 ecosystem reports this autumn:

- Romanian Agrifood Overview Report – 3rd Edition (supported by EIT Food and Microsoft for Startups Founders Hub)

- Romanian Green Startups Overview Report – 3rd Edition (together with Spherik Accelerator & supported by EIT Climate-KIC and in partnership with Raiffeisen Bank and OMV Petrom)

12. Bright Labs Incubator by Make IT in Oradea organized its Demo Day and unveiled the winner of this cohort: ROCCO, an innovative platform that transforms your smartphone into a restaurant ordering kiosk (link).

13. BANAT Demo Day, a bi-annual regional event organized by ROTSA, took place in October. Ten tech project founders had the chance to present their ideas and products to investors (link).

14. The Romanian Farmers’ Club launched the third series of the “Entrepreneur in Agriculture 4.0” management training program. It aims to increase the performance and competitiveness of Romanian farmers by transforming their own business into a sustainable business model (link).

15. Techcelerator has organized the fourth edition of Investors’ Day – the accelerator’s flagship event, where 8 startups pitched their ideas (link).

16. Launch, the community that supports Romanian founders of early stage startups, has organized the second edition of Launch Health Tech, bringing together the most active players in the health technology ecosystem (link).

17. Activize and FreshBlood, together with Transilvania University of Brașov, have organized Green Tech Hackathon focused on innovative ideas for student-led teams.

18. SynergistEIC, a program by Spherik Accelerator and its partners, has closed the call for the first edition and selected 15 greentech startups to embark on a journey of innovation, sustainability, and impact.

19. EIT Manufacturing RIS Hub Romania managed by Iceberg has organized the Revive & Reinvent Manufacturing pre-acceleration program (link).

20. Fix Cluj, an incubator program aimed at young people between the ages of 16 and 26 who are from Cluj-Napoca, announced the winners its latest edition at the closing gala (link).

Conferences & tech events

1. In September, the second edition of the consolid8 Festival was held in Brasov.

2. Future Banking organized in October a new edition of the Future Banking Summit, the event devoted to the financial and banking industry in Romania (link).

3. SeedBlink introduced Open Day Bucharest, a series of events providing entrepreneurs with the opportunity to have one-on-one meetings with the company’s investment team to explore financing and equity management (link).

4. In the beginning of October, the Urban Mobility Innovation Day event brought together forward-thinking startups, fostering collaboration and innovation in the face of urban mobility challenges (link).

5. How to Web, Eastern Europe’s leading startup & innovation conference has been organized in October.

6. Edtech Romania has held its inaugural meetup, as a How To Web satellite event. This event provided a platform for edtech enthusiasts to connect, share their thoughts, gain insights and discover collaboration opportunities (link).

7. The fourth edition of Prow – a conference dedicated to tech and digital products, was organized in October.

8. Codecamp has organized two technology dedicated festivals, one in Iași (October) and the other one in Cluj-Napoca (November).

9. The 11th edition of ITDays, a regional conference in Cluj-Napoca, Romania has been organized in November.

10. The second edition of ROStartup Conference was organized in November (link).

11. In November, FreshBlood and Activize organized 2 events in Bucharest: Hubvantage Innovation Forum and Morning HealthTalks event.

12. Start-up.ro have launched the documentary “Roaring Tigers of Europe” about the evolution of the Romanian startup ecosystem – a journey of challenges and growth (link).

13. Oradea City Hall inaugurated on December 12th, the Business Incubator, named “Cresc Oradea Mare“, welcoming up to 50 startups and offering support services for the ones incubated (link).

Closing

As the year comes to an end, we take note of a robust list, showing the flourishing state of the Romanian startup ecosystem. The collaborative efforts demonstrated through diverse programs and events have not just spurred innovation but have also set the stage for a bright future. With gratitude for the achievements of this year, we bid it farewell, eagerly anticipating the opportunities and advancements the next year will bring.

]]>As part of Startup Ecosystem Radar, we curate and condense this valuable information into a digestible format and offer it as a free monthly newsletter to our partners and clients. Our goal is to provide insights about the ecosystem, empowering informed business decisions and facilitating connections with relevant stakeholders. Don’t miss out on the latest updates – subscribe to our newsletter today!

Based on public announcements, during the first half of 2023, we managed to track 31 investment rounds in Romanian startups and 6 in foreign startups that have at least one Romanian founder (residing abroad).

The investment amount for this period reached approximately €69.2M across 30 rounds (and one round undisclosed) in domestic startups, while foreign startups with Romanian founders secured ~$58.1M (~€51.7M) across 6 investment rounds.

It is important to note that the above analysis is highly impacted by FlowX.AI‘s significant ~€32M ($35M) Series A investment. In order to be able to make more realistic conclusions, we decided to show it separately together with the others two big rounds (Digitail and Veridion) as most of the capital in these 3 rounds was not originating from Romania. Also to mention that Kubeark’s $2.8M round was entirely foreign funded.

Furthermore, in the following chart, we have mentioned separately the biggest investment rounds made this year in order to better observe the monthly distribution of the invested capital

Over the past two years, the startup ecosystem in Romania went through some notable developments in terms of the investment activity. Analyzing the first half of 2022 (you can check out our article from last year regarding this topic) and 2023 reveals a few trends related to startup investments.

In the initial six months of 2022, €64.5M was invested in Romanian startups across 36 investment rounds.

However, the first half of 2023 witnessed a ~42% decrease in the total investment volume. Romanian startups managed to raise €37.1M distributed across 29 investment rounds (we didn’t count FlowX.AI’s ~€32M Series A investment round). This indicates that the level of interest from investors is still there, albeit slightly reduced compared to the previous year.

The data can show us an important shift in the investment landscape, with investors adopting a more selective approach. The overall investment amount experienced a significant decline, there is an amount of local capital flowing into good startups.

Regarding distribution of the investments received by the Romanian startups, we can group them by the following way:

- €725K in 6 rounds up to €200K (probably others investments were made at this stage, but these were not announced publicly)

- €6.17M in 11 rounds €200K to €1M

- €15.7M in 10 rounds €1M to €3M

- €15.5M in 2 rounds higher than €3M (Digitail and Veridion)

- FlowX.AI’s ~€32M ($35M) round

Some of the highest and most important deals were the following:

- The Romanian IT startup FlowX.AI obtained a venture capital financing of ~€32M ($35M), in an investment round led by the London fund Dawn Capital (link).

- Digitail, a veterinary platform founded by Romanians, announced the closure of a $11M (~€10M) Series A funding round led by Atomico, joined by previous investors byFounders, Gradient, and Partech (link).

- Veridion has secured a $6M (~€5.5M) investment to expand its sales and marketing intelligence platform in the US market. The funding round was led by LAUNCHub Ventures, OTB Ventures, Underline Ventures, joined by previous investors Gapminder and Day One Capital, and will be used to accelerate Veridion’s growth in the US, as well as to further develop its product (link).

- Kubeark, a hyper-scaling platform, has attracted $2.8M (~€2.6M) in funding in a pre-seed round. The investment round was led by Credo Ventures, with participation from Seedcamp, LAUNCHub Ventures, 500 Emerging Europe and others (link).

- Catalyst Romania Fund II, a leading venture capital fund in Southeast Europe, has invested €2M to support the scaling efforts of the ESX platform (link).

In order to have access to the full list of investments as they appear, subscribe to Startup Ecosystem Radar.

Funding for foreign startups with Romanian founders

Regarding the funding raised by startups which have at least one Romanian co-founder, this totals ~$58.1M in 6 deals. This amount has notably decreased compared to the same period in 2022, this being ~€500.3M.

The biggest investments were the following:

- Hackajob, the London-based startup co-founded by Romanian Răzvan Creangă, received a $25M Series B investment to grow the platform that helps find technical employees (link).

- Dexory, formerly known as BotsAndUS, a startup founded by three Romanians in the UK, has successfully secured a $19M investment in a Series A funding round led by Atomico (link).

- Finverity, a trade and supply chain startup co-founded by Alex Fenechiu in the UK, has announced a $5M investment round from venture capital funds Outward VC, Acrobator Ventures, s16vc, B&Y Venture Partners and other private investors (link).

In order to have access in real time to this kind of information, join Startup Ecosystem Radar.

Closing

It is worth noting that these statistics provide just a snapshot of the first half of the year. The full-year picture may reveal further fluctuations and trends that could unveil some facts regarding startup venture capital funding in Romania.

As the startup ecosystem continues to evolve and respond to various economic and market factors, it will be interesting to track future investment patterns and see how the growth and innovation of Romanian startups will be influenced.

See you at the end of 2023, when we will be back with a comprehensive overview of venture capital funding in Romanian startups for the entire year. Until then, stay tuned for further insights and developments regarding the startup ecosystem by subscribing to our newsletters down below!

]]>As part of Startup Ecosystem Radar, we curate and condense this valuable information into a digestible format and offer it as a free monthly newsletter to our partners and clients. Our goal is to provide insights about the ecosystem, empowering informed business decisions and facilitating connections with relevant stakeholders. Don’t miss out on the latest updates – subscribe to our newsletter today!

Highlights of Events & Programs in the Romanian Startup Ecosystem (2023)

1. FreshBlood together with Activize and powered by Microsoft for Startups, EIT Health, Fortech Investments, Fortech Products and Wolfpack Digital, have created the second edition of the Romanian HealthTech Startups Overview Report, an overview of the healthtech ecosystem and the most active healthtech startups.

2. Spherik Accelerator and its partners have launched SynergistEIC, a 6-month acceleration program for greentech startups, with grants of €50K for the selected 15 startups. The program will have the next call in March 2023.

3. Innovation Labs organized its 11th edition of the national workshops and mentoring program for young tech entrepreneurs, being the main university based tech startup accelerator program in Romania (link).

4. Make IT in Oradea has launched the third edition of Bright Labs Incubator, a program designed to help first-time ambitious tech entrepreneurs from SEE take their bright ideas to market in six months (link). Also, starting with this edition, the program is supported by the Estonian investment fund Startup Wise Guys through access to international mentors, partnerships for international expansion and funding opportunities (link).

5. InnovX-BCR accelerator opened registrations for the Startups group, dedicated to technology entrepreneurs with businesses over €50K as yearly revenue. (link).

6. Fifteen startups have been accepted into the Advancing AI 3 accelerator, a Techcelerator and Google for Startups initiative supporting AI-focused startups in Central and Eastern Europe. The program offers mentorship, networking, and funding opportunities to accelerate their growth (link). Furthermore, they have partnered up with ROTSA and Startup Reaktor to support EIT Digital Venture, a new opportunity for early-stage tech startups from the Baltics, Eastern Europe and Southern Europe (link).

7. Startup Reaktor, the first incubation platform in Romania that automatically leads validated startups to private funding, partnered with Rōnin to get incubated startups financed (link).

8. Orange Fab Romania added four new startups to its program, providing mentorship, resources, and access to Orange’s network and customers (link). Also, they launched a call for 5G projects, inviting startups and developers to collaborate on commercial solutions utilizing 5G technology and network (link).

9. F&B Business Accelerator has launched a new edition of its accelerator program for startups in the hospitality and retail industry. This year’s program includes a specialized fund for HORECA and retail, which will provide startups with additional funding and access to industry experts (link).

10. The second edition of FIX Cluj, an incubator program aimed at young people between the ages of 16 and 26 who are from Cluj-Napoca, has been launched. The program provides grants of up to €50K, as well as personalized mentorship and support to help young people develop and test innovative ideas (link).

11. EIT Urban Mobility consortium, formed by Iceberg, Spherik Accelerator and FZMAUR, launched a new edition of its Startup Support Programme, which offers mentorship and practical experience in areas such as product management, go-to-market strategy, sales, financial forecasting, pitching, and investment strategy (link).

12. Rubik Hub has launched new editions for Rubik Garage, an equity-free accelerator for MVP-stage & early-stage startups from the CEE Region (link) and RubikEDU, a program that aims to support early-stage startup founders in developing and validating their business ideas, and it offers access to various resources, such as mentorship, training sessions, networking opportunities, and co-working spaces (link).

13. INNO, the department responsible for innovation and investment attraction of the Northwest Regional Development Agency, has launched the first accelerator in Romania dedicated exclusively to startups in the fields of health and life sciences, LevelUP Health & Life Sciences Accelerator (link).

14. The Institute of Excellence in Entrepreneurship (IdEA), the developer of numerous entrepreneurial education and training projects, launched cohort #8 for its most famous program, Commons Accel (link).

15. Empowering Women in Agrifood, an accelerator program by Impact Hub Bucharest, launched its third edition, aimed at early-stage women entrepreneurs in the agribusiness sector (link).

16. The 6th edition of digital incubator Future Makers has been launched, for startups in health, wellbeing, and innovation sectors (link).

17. Women in Tech Romania and the Bravva Angels community organized the HackHER hackathon, aimed especially at teams with women and focused on gender equality in the technology field (link).

18. Launch, the community that supports Romanian founders of early stage startups, has organized the first edition of Launch Health Tech, bringing together the most active players in the health technology ecosystem (link). Moreover, throughout this period, they have organized several community events, workshops and campus days.

19. How to Web has launched Spotlight 2023, the competition dedicated to early-stage tech startups from Central and Eastern Europe. The conference event will take place in Bucharest, during October 4-5 (link).

20. Early-stage startups had the chance to register for Upcelerator, an online accelerator program in Eastern Europe. In the program, participants received support from over 40 experienced mentors, a clear structure and action plan, as well as mentoring hours and more. (link).

Conferences & tech events

1. Startup Weekend Bucharest and Startup Weekend Oradea brought together in March those interested in startups with co-founders, mentors and experts (link).

2. Startup Moldova Summit 2023 brought together investors and entrepreneurs from the Republic of Moldova and other countries. The summit aimed to showcase the Moldovan startup ecosystem and to connect local startups with potential investors and partners (link).

3. The sixth edition of the Future Healthcare conference has been organized by Wall-street.ro and it focused on the role of innovation in transforming the healthcare system (link).

4. Codecamp, the longest-running IT conference in Romania, took place in Bucharest, attended by the tech speakers of the moment, who addressed topics of interest to the IT industry (link).

5. Bucharest Tech Week 2023 took place in May and it focused on the role of digitalization in driving efficiency across various industries (link).

6. start-up.ro has organized the Smart Future event, which was a map of innovation initiatives and a guide for how technology changes Romania in the next year (link).

7. Techsylvania, the annual technology conference and innovation festival held in Cluj-Napoca, took place in June.

8. Unchain Fintech Festival, conference related to fintech & blockchain organized in Oradea, took place at the end of June.

Closing

Even after a careful selection, we can see that the list is quite long, there has been a lot going on in the Romanian startup ecosystem in terms of programs and events. As we move forward to the second part of 2023, there are still numerous exciting opportunities and initiatives awaiting eager participants.

To always be up to date with the vast array of resources, insights, and updates available, we invite you to check out our other informative products and subscribe to our newsletters down below!

]]>Their insights and experiences shed light on the challenges and opportunities faced by healthtech startups in Romania.

We are grateful for their cooperation in sharing their vision with us!

Special thanks to VoxiKids, Eduson, The Care Hub, Docviser, Cardiomedive, Zitamine, Dahna, Digital Clinics, Sano-Meter, InnoVR Solutions, .lumen, Bright Living, Doctor 31, GenetX, NutriCare.Life, Telios Care & WakeZ.

Rising Interest of Romanian Investors in Healthtech Startups

The Romanian investment landscape has been seeing a rise in interest towards healthtech startups, especially in recent years. With the help of technological advancements, the healthcare sector has been able to offer new solutions to diagnose, treat, and prevent diseases.

As Romania’s startup ecosystem continues to grow, investors are increasingly interested in backing innovative healthtech companies that can tackle healthcare challenges. The COVID-19 pandemic has accelerated this trend, resulting in a surge in demand for healthcare technology solutions.

From my experience there is a growing interest in healthtech startups among Romanian investors. Healthtech has become an increasingly important sector in recent years, as advancements in technology have enabled new ways to diagnose, treat, and prevent diseases. Romania has a growing startup ecosystem, and investors are increasingly interested in backing innovative healthtech companies that can offer new solutions to healthcare challenges.

AnaMaria Onică – Co-founder & CEO Voxi

While interest in the space is high, there is a general perception among investors that the amount of money needed for a startup is too high, and the return on investment is expected to be short, usually lasting only one to two years. In healthcare, certification can last up to 18 months, which adds to the perceived risk. Despite this perception, a few interested investors have been successfully attracted to invest in medical startups, as they understand both the pros and cons of investing in such companies.

However, investors are more inclined to invest in startups that already have paying clients or can prove some type of traction. Although some investors may not consider healthtech as the best option to generate revenue due to the certification process, others are passionate about healthcare and see health tech products as being on a favorable trend.

The growing interest in healthtech among Romanian investors is a positive sign that the potential impact of healthtech on society is being recognized.

said Edi Butaru – Co-founder of InnoVR Solutions

The startup founders are excited about the opportunities that lie ahead and are confident that investors and entrepreneurs alike will continue to recognize the need for improvement in the healthcare industry, including the mental health sector.

The Role of Technology Startups in Overcoming Healthcare Challenges in Romania: Collaboration and Openness towards Innovation

The healthcare system in Romania is in need of significant improvements, and technology and innovation have been recognized as a potential solution to many of its challenges. While some medical professionals are eager to explore new solutions and partnerships with startups, others remain reticent and resistant to change. The fear of the unknown and lack of understanding about technology and its potential impact on patient care and outcomes are contributing factors to this resistance.

I have big hopes that things will improve over time and these people will realize that technology must be to their advantage and not seen as a threat.

Alexandru Lazăr – CEO of Docviser

There is a growing number of startups in Romania focused on developing digital solutions to improve the healthcare system, but adoption of innovation in healthcare is slowed down by various factors, including regulation, funding, and mistrust in new technologies. Despite this, there is a positive trend in the interest and openness towards startups among medical professionals, particularly in the private sector. Many hospitals are beginning to accept and embrace the role of startups in providing technological solutions to existing healthcare challenges, and doctors are increasingly looking to become entrepreneurs or collaborate with startups to improve the healthcare experience.

It is important for medical professionals to recognize that technology can be an ally in improving patient outcomes and reducing costs. Collaboration between startups and healthcare providers is crucial in developing solutions that are reliable, tested, and certified to meet the demands of the healthcare industry.

While change is a process, the growing interest and openness towards startups in the healthcare system in Romania offer hope for a brighter future, declared Mirela Meită, founder of Digital Clinics.

Overcoming Obstacles: Improving the Healthtech Ecosystem for Startup Founders

The healthtech industry is rapidly growing, with startups continuously developing innovative solutions to address healthcare challenges. However, the ecosystem still faces several obstacles that impede the growth of healthtech startups. To address these challenges, several changes can be made to improve the ecosystem and make life easier for startup founders.

One of the biggest challenges that healthtech startups face is securing adequate funding to support research, development, and commercialization of their products or services. In order to tackle these difficulties, there should be an increase in funding opportunities, such as grants, venture capital, and government support.

Many things need to change in the Romanian health tech ecosystem, but if we’re only referring to the start-up community, we would like to see more events gathering startup founders where we can share our experience, more funds/investors focused on this field, and also more support even from the government (maybe in the form of grants) to encourage innovation in this field.

Alexandra Stroe – Co-founder of Zitamine

Besides funding, streamlining regulations and creating a more transparent and predictable regulatory environment could help startups move more quickly and efficiently through the approval process. Collaboration and partnerships between healthtech startups, healthcare providers, and other stakeholders could also lead to more effective solutions that meet the needs of patients and healthcare providers.

Education and awareness is another aspect that needs to be addressed, said Daniela Tatu Chitoiu from Dahna. Increasing education and awareness around healthtech and its potential benefits could help generate more interest and investment in the sector. This could include initiatives to educate medical professionals and patients about new technologies and encourage adoption of innovative solutions that can improve healthcare outcomes. Moreover, digital literacy among doctors and hospital management should be emphasized to adopt technology and be more efficient in healthcare delivery.

In conclusion, the healthtech ecosystem requires several changes to support startup founders in bringing innovative solutions to healthcare challenges. The changes include increased funding, streamlined regulations, collaboration and partnerships, education and awareness, and digital literacy. These changes would make the journey of launching a healthtech startup less intimidating and make the life of a founder much easier.

The Future of Healthtech in Romania: Personalization, Innovation, and Access

The field of healthtech in Romania is rapidly evolving, with numerous developments expected in the next decade. As technology continues to advance, we can expect to see an increase in the adoption of digital health solutions, including wearables, telemedicine, and remote monitoring. These solutions could help improve access to healthcare services and reduce costs, particularly in underserved areas.

In addition, telemedicine and virtual care could also help improve access to healthcare services for children in rural or underserved areas, where in-person consultations may be difficult to arrange. This could be especially important for children with complex medical needs.

Personalized education and therapy programs, tailored to a child’s specific condition, level of functioning, and learning style, can be used to address the unique needs and challenges of children with special needs. Healthtech has the potential to significantly improve the lives of children with developmental differences by providing innovative solutions that are tailored to their unique needs and challenges.

As technology continues to advance, the focus in the healthtech sector will shift towards personalization and offering customized, automated solutions to solve individual problems. The use of wearables that track different health-related data points, as well as the ability to order at-home blood test kits, will become more widespread and easy-to-use. Emerging technologies such as artificial intelligence, blockchain, and the Internet of Things (IoT) will also contribute to the development of more advanced digital solutions and increase data interoperability in the digital healthcare sector in Romania.

Virtual reality could also play a significant role in the future of healthcare, particularly in the field of psychotherapy. The use of virtual reality simulations for exposure therapy, virtual reality assisted mindfulness practices, and even the exploration of different aspects of the patient’s inner world, could greatly benefit patients suffering from PTSD, anxiety disorders, depression, and personality disorders.

Overall, the potential for innovation in the healthtech sector in Romania is vast, and with the right investment and development, could significantly improve access to healthcare services for those in need.

Everything depends on the mentality of those who are part of it (part of the ecosystem).

Constantin Lucian Nutu – Founder of Doctor 31

The integration of technology and healthcare can help provide tailored solutions for patients with unique needs and challenges, ultimately leading to better outcomes and improved quality of life.

Don’t miss out on the latest insights and trends in the Romanian healthtech industry. Check out the Romanian Healthtech Overview Report now and discover the innovative solutions that are transforming healthcare in Romania.

And if you want to get in your inbox various opportunities for startups (funding, acceleration programs, competitions, conferences, pitching opportunities), join the Startups League newsletter: https://activize.tech/startups-league

]]> Photo credit:

Photo credit: