I. The Magnificent Seven lose their cohesion

Analysts are beginning to divide the Magnificent 7 into smaller subgroups. They talk about the “Fab 4” or “Mag5” – that is, the 4 or 5 companies from the group that continue to drive the market upwards, while the rest have become a burden. Only Alphabet and Nvidia outperformed the S&P 500 in 2025. The gap between Mag7 share prices in the second half of 2025 was enormous.

Competition in the field of AI has become a wedge that divides the group. Amazon, Alphabet, Microsoft and Meta are spending hundreds of billions on AI infrastructure and data centres. Nvidia dominates the market for the chips needed to power these models. Apple and Tesla are lagging behind. Apple has been criticised for lower costs and slower AI development, while Tesla has suffered from slowing electric car sales. Nevertheless, the “magnificent seven” still have a huge impact on the market, accounting for about 36% of the S&P 500’s capitalisation.

Source: MSN

II. Withdrawal from defensive sectors

The defensive sectors of the US economy are currently the most undervalued relative to high-tech companies in history. Defensive sectors include companies whose services are in demand regardless of the state of the economy or consumer sentiment: healthcare, consumer staples, utilities, including electricity, water and gas companies, and the telecommunications industry. We observed similarly low valuations for defensive companies before the dot-com bubble burst in 2000. Investors were so obsessed with the internet craze that they forgot about the major sectors. The same is true today, with the difference that the above-mentioned glorious companies are benefiting from it.

III. Can precious metals continue to shine?

In 2025, the price of gold rose by 64% in dollar terms. Over the past 5 years, this growth has been 152%, and the price of gold is currently at its ATH (all-time high). Does gold have a chance for further growth? Let’s take the ratio of US stocks to gold. Every time gold reached its 1929 peak of 1.54 gold, it provided a solid foundation for growth in the gold market.

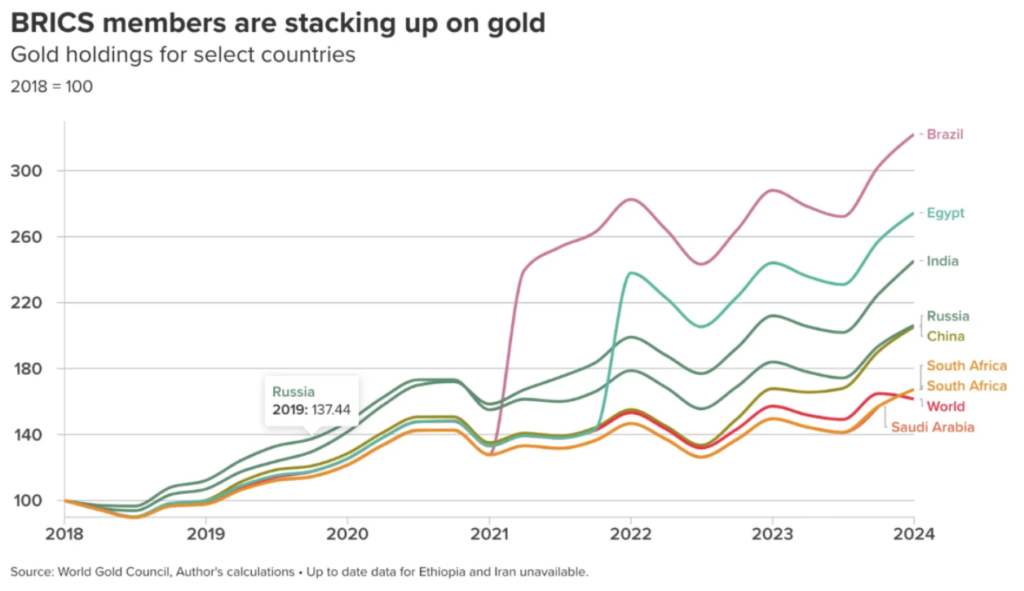

Factors that point to a further rise in GOLD prices include geopolitical tensions, interest rate cuts by central banks, mistrust of the bond market and the weakness of the US dollar. Another such factor is high demand from central banks. In 2025, after a hiatus of almost 30 years, central banks hold more gold than US bonds. However, we must remember the dangers. These include a possible recovery of the dollar, the return of investors (at least temporarily) to the bond market, and young investors choosing Bitcoin over gold. It should also be noted that gold has grown by an average of 11% per year since 2000.

2025 was also a phenomenal year for silver. The metal rose 146% in dollar terms. This growth had a solid foundation, as it was driven by demand for silver in the economy and the limited availability of the metal. Another important factor was that the US classified the metal as strategic and China (the world leader in silver processing) restricted its exports. Is silver expensive now? At over $90 per ounce, silver is at an all-time high. However, compared to M2 (a measure of money in circulation that takes into account funds in current and savings accounts), this value is well below its historical peak. If the price of silver had reached a level similar to that of 2011, given the growth in M2, the price would be $97. But if it were the same as in the 1980s, an ounce of silver would cost approximately $531!

Silver therefore has potential for further growth. This may be driven by increased demand from industry, the aforementioned export controls from China, or the fact that the silver market is relatively small and demand for silver is high. Since 2000, silver has grown by an average of 10.4%. The 146% growth projected for 2025 is a significant deviation from the norm. It is also worth noting that the gold-silver ratio, i.e. the ratio of how many ounces of silver we can buy for one ounce of gold, is currently at a low level of 50. This indicates that silver has become significantly more expensive compared to gold over the last 30 years. Speculators, industrial lobbies and politicians, who would benefit from a fall in the price of silver, could have a negative impact on the price of the metal.

IV. Refinanzierung von US-Schulden

The high price of precious metals is mainly due to capital migration from bonds. The US debt will have to be repaid in 2026. This problem will be solved through refinancing, i.e. issuing new bonds (taking on new debt) to repay bonds that are approaching maturity. The last two times we saw a similar situation – during the GFC, the global financial crisis, and the “Covid recession” – interest rates were at 0%. Currently, interest rates are at 3.75%. The higher the interest rates, the higher the borrowing costs and the burden on the government, which is already enormous. In the current fiscal year 2026 (since October 2025), the government spent $179 billion in just two months to service its debt. This is the second largest expenditure after social spending.

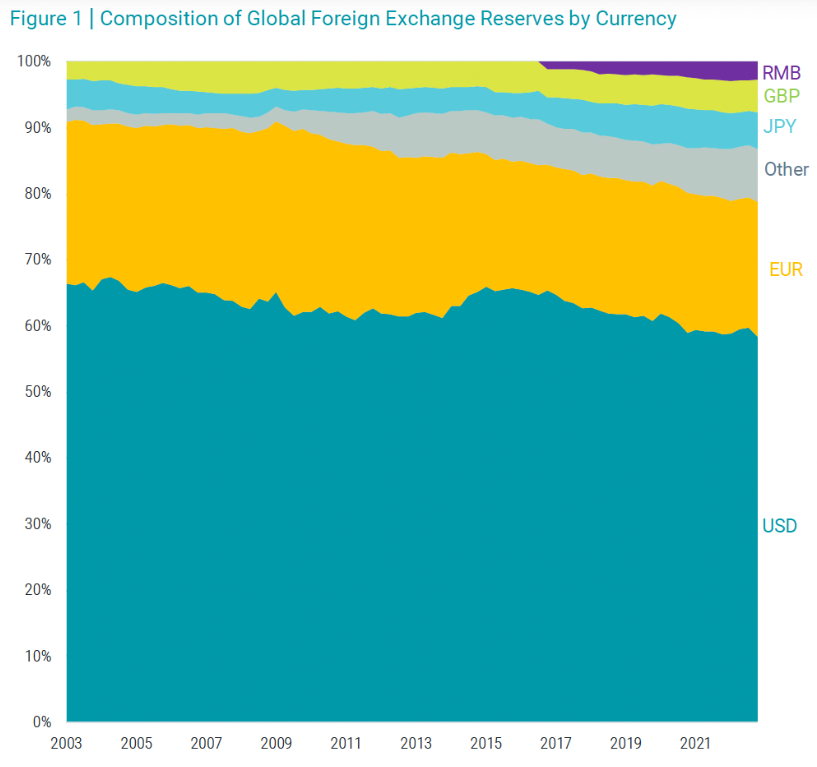

V. Die Globalisierung des Renminbis

The dollar’s share of global reserves (black line) is falling in favour of gold. The decline in confidence in the US financial system will not go unnoticed by its biggest competitor, China. Beijing is expanding its financial payments network and developing an alternative to the US-led Swift system. The Middle Kingdom is lending more and more money to developing countries and encouraging international companies to issue bonds denominated in Chinese currency. About half of cross-border transactions in China are currently denominated in its own currency, compared with almost zero yuan share in such transactions 15 years ago. As a former member of the Chinese central bank said, the government wants the yuan “to be seen as a strong currency that is used more globally”. The yuan currently accounts for 8.5% of global foreign exchange transactions. That is a small amount compared to the dollar, which accounts for 89% of this category. However, the message is clear: China will fight to strengthen the role of its currency in international trade. This is another area in which Beijing is challenging the United States.