About Poach

## About Poach

Poach is a cutting-edge dealflow intelligence platform designed for venture capitalists and early-stage investors who want to move faster and smarter. In the hyper-competitive world of venture capital, the first investor to spot a promising founder often wins the deal. Poach solves this by providing a high-quality, predictive signal that sits perfectly between a warm introduction and cold inbound outreach. The platform automates the tracking of top-tier VCs on social media, specifically Twitter, to identify the founders they are following—a key early indicator of interest. It then enriches this data by matching Twitter profiles to LinkedIn, applying AI-powered labeling to categorize individuals (e.g., founder, engineer, funded), and delivers raw, filterable data directly to your inbox daily. This process allows investors to identify and engage with high-potential founders, often months before they officially begin a fundraising round, fundamentally expanding and de-risking their dealflow sourcing strategy.

## Features of Poach

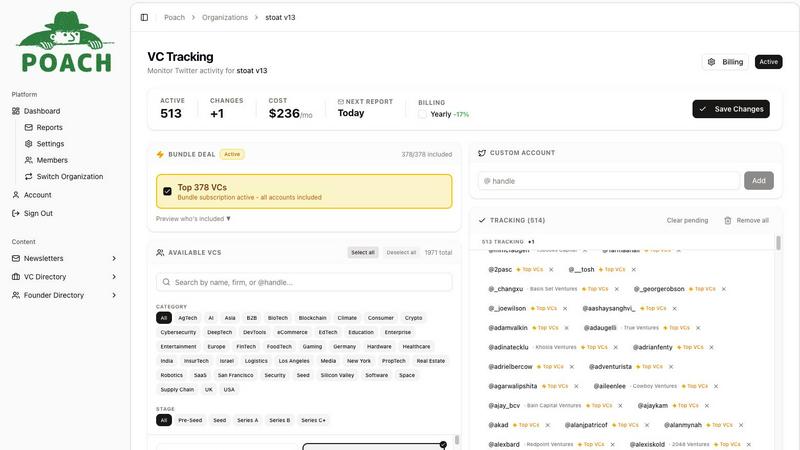

### VC Social Tracking

Poach's core engine continuously monitors the Twitter follows of a curated list of top-tier venture capitalists. Since VCs often follow founders they are scouting or have early conversations with, this activity serves as a powerful, non-public signal of emerging talent and upcoming deals. This automated surveillance provides investors with a real-time feed of who is catching the attention of their most insightful peers, turning social data into a strategic asset.

### LinkedIn Enrichment & Identity Resolution

Raw Twitter data alone lacks context. Poach employs proprietary identity resolution technology to accurately match Twitter handles with corresponding LinkedIn profiles. This critical step enriches each lead with professional depth, pulling in detailed work history, educational background, and career trajectory to build a comprehensive picture of each individual beyond their social media presence.

### AI-Powered Profiling & Labeling

Using advanced AI, Poach analyzes the combined Twitter and LinkedIn data to automatically label each person with specific, actionable tags. These labels include "founder," "funded," "engineering," "product," "research," and "investor." This automated categorization allows users to instantly filter thousands of profiles to find exactly the type of talent they are looking for, such as unfunded technical founders or researchers transitioning to entrepreneurship.

### Raw Data Delivery & Daily Digest

Poach delivers intelligence in the most flexible format possible. Subscribers receive a daily email digest with executive summaries of new leads and, most importantly, a full CSV export attached. This raw data dump includes all enriched fields and AI labels, enabling investors to import leads directly into their CRM, build custom filters, and conduct their own analysis, ensuring the platform integrates seamlessly into existing workflows.

## Use Cases of Poach

### Proactive Founder Sourcing for Seed-Stage VCs

Early-stage venture firms can use Poach to systematically identify technical founders working on stealth projects before they have a pitch deck. By filtering the AI-labeled data for "founder" and excluding the "funded" tag, investors can build a pipeline of truly early-stage opportunities, allowing for relationship-building months ahead of a formal fundraise and significantly increasing their chances of leading a round.

### Market Mapping for Investment Thesis Development

Investment teams can leverage Poach to validate and explore new thematic theses. By tracking which founders in specific sectors (like AI for science or blockchain) are being followed by respected investors, firms can map emerging ecosystems, identify key players and trends, and gain conviction on where to focus their investment strategy based on real-time signals from the market.

### Talent Scouting for Portfolio Companies

Beyond dealflow, venture capital firms can use Poach as a powerful talent scouting tool for their existing portfolio companies. By filtering for specific roles like "engineering" or "product" among individuals recognized by top VCs, they can source high-potential candidates who are already vetted by the market, helping their startups build world-class teams faster.

### Competitive Intelligence and Benchmarking

Investors can gain valuable competitive intelligence by observing which VCs are following which founders. This allows firms to understand the sourcing strategies and focus areas of their competitors, benchmark their own dealflow velocity, and identify which investors are seeing the same signals, providing context for potential co-investment opportunities or competitive dynamics.

## Frequently Asked Questions

### How accurate is Poach's data and AI labeling?

Poach's accuracy is built on a multi-layered process. The proprietary identity resolution between Twitter and LinkedIn ensures profiles are matched correctly. The AI labeling is trained on vast datasets of professional bios and career histories to reliably distinguish between roles like founder, engineer, and investor. The platform is trusted by top VC firms for its high signal-to-noise ratio and proven track record of identifying founders who go on to raise significant rounds.

### What is the typical "lead time" or advantage Poach provides?

The advantage varies but is typically substantial. As evidenced by Poach's proven signal cases, the platform can identify founders 7 to 10 months before they publicly announce a fundraise. This lead time comes from detecting the very early scouting and relationship-building phase when VCs first discover and follow promising individuals on social media, long before any official fundraising process begins.

### Can I filter the data for my specific investment criteria?

Absolutely. This is a core strength of Poach. The daily CSV export includes all raw data and AI-generated labels. You can filter this dataset using any spreadsheet or CRM tool based on labels (e.g., "founder" AND NOT "funded"), location, keywords in bios, or the specific VC who followed them. This allows you to tailor the feed precisely to your firm's stage, sector, and geography focus.

### How does Poach differ from other startup databases or news aggregators?

Poach is fundamentally different because it is predictive, not reactive. Traditional databases list companies that are already actively fundraising or in the news. Poach detects the earliest signal—VC social interest—which often occurs when a founder is still in stealth mode or just starting to build. It provides a forward-looking pipeline, whereas other tools report on events that have already happened.

Poach is a cutting-edge dealflow intelligence platform designed for venture capitalists and early-stage investors who want to move faster and smarter. In the hyper-competitive world of venture capital, the first investor to spot a promising founder often wins the deal. Poach solves this by providing a high-quality, predictive signal that sits perfectly between a warm introduction and cold inbound outreach. The platform automates the tracking of top-tier VCs on social media, specifically Twitter, to identify the founders they are following—a key early indicator of interest. It then enriches this data by matching Twitter profiles to LinkedIn, applying AI-powered labeling to categorize individuals (e.g., founder, engineer, funded), and delivers raw, filterable data directly to your inbox daily. This process allows investors to identify and engage with high-potential founders, often months before they officially begin a fundraising round, fundamentally expanding and de-risking their dealflow sourcing strategy.

## Features of Poach

### VC Social Tracking

Poach's core engine continuously monitors the Twitter follows of a curated list of top-tier venture capitalists. Since VCs often follow founders they are scouting or have early conversations with, this activity serves as a powerful, non-public signal of emerging talent and upcoming deals. This automated surveillance provides investors with a real-time feed of who is catching the attention of their most insightful peers, turning social data into a strategic asset.

### LinkedIn Enrichment & Identity Resolution

Raw Twitter data alone lacks context. Poach employs proprietary identity resolution technology to accurately match Twitter handles with corresponding LinkedIn profiles. This critical step enriches each lead with professional depth, pulling in detailed work history, educational background, and career trajectory to build a comprehensive picture of each individual beyond their social media presence.

### AI-Powered Profiling & Labeling

Using advanced AI, Poach analyzes the combined Twitter and LinkedIn data to automatically label each person with specific, actionable tags. These labels include "founder," "funded," "engineering," "product," "research," and "investor." This automated categorization allows users to instantly filter thousands of profiles to find exactly the type of talent they are looking for, such as unfunded technical founders or researchers transitioning to entrepreneurship.

### Raw Data Delivery & Daily Digest

Poach delivers intelligence in the most flexible format possible. Subscribers receive a daily email digest with executive summaries of new leads and, most importantly, a full CSV export attached. This raw data dump includes all enriched fields and AI labels, enabling investors to import leads directly into their CRM, build custom filters, and conduct their own analysis, ensuring the platform integrates seamlessly into existing workflows.

## Use Cases of Poach

### Proactive Founder Sourcing for Seed-Stage VCs

Early-stage venture firms can use Poach to systematically identify technical founders working on stealth projects before they have a pitch deck. By filtering the AI-labeled data for "founder" and excluding the "funded" tag, investors can build a pipeline of truly early-stage opportunities, allowing for relationship-building months ahead of a formal fundraise and significantly increasing their chances of leading a round.

### Market Mapping for Investment Thesis Development

Investment teams can leverage Poach to validate and explore new thematic theses. By tracking which founders in specific sectors (like AI for science or blockchain) are being followed by respected investors, firms can map emerging ecosystems, identify key players and trends, and gain conviction on where to focus their investment strategy based on real-time signals from the market.

### Talent Scouting for Portfolio Companies

Beyond dealflow, venture capital firms can use Poach as a powerful talent scouting tool for their existing portfolio companies. By filtering for specific roles like "engineering" or "product" among individuals recognized by top VCs, they can source high-potential candidates who are already vetted by the market, helping their startups build world-class teams faster.

### Competitive Intelligence and Benchmarking

Investors can gain valuable competitive intelligence by observing which VCs are following which founders. This allows firms to understand the sourcing strategies and focus areas of their competitors, benchmark their own dealflow velocity, and identify which investors are seeing the same signals, providing context for potential co-investment opportunities or competitive dynamics.

## Frequently Asked Questions

### How accurate is Poach's data and AI labeling?

Poach's accuracy is built on a multi-layered process. The proprietary identity resolution between Twitter and LinkedIn ensures profiles are matched correctly. The AI labeling is trained on vast datasets of professional bios and career histories to reliably distinguish between roles like founder, engineer, and investor. The platform is trusted by top VC firms for its high signal-to-noise ratio and proven track record of identifying founders who go on to raise significant rounds.

### What is the typical "lead time" or advantage Poach provides?

The advantage varies but is typically substantial. As evidenced by Poach's proven signal cases, the platform can identify founders 7 to 10 months before they publicly announce a fundraise. This lead time comes from detecting the very early scouting and relationship-building phase when VCs first discover and follow promising individuals on social media, long before any official fundraising process begins.

### Can I filter the data for my specific investment criteria?

Absolutely. This is a core strength of Poach. The daily CSV export includes all raw data and AI-generated labels. You can filter this dataset using any spreadsheet or CRM tool based on labels (e.g., "founder" AND NOT "funded"), location, keywords in bios, or the specific VC who followed them. This allows you to tailor the feed precisely to your firm's stage, sector, and geography focus.

### How does Poach differ from other startup databases or news aggregators?

Poach is fundamentally different because it is predictive, not reactive. Traditional databases list companies that are already actively fundraising or in the news. Poach detects the earliest signal—VC social interest—which often occurs when a founder is still in stealth mode or just starting to build. It provides a forward-looking pipeline, whereas other tools report on events that have already happened.

You may also like:

Beeslee AI Receptionist

Beeslee is your AI receptionist that answers calls and books appointments 24/7 so you never miss a lead.

Golden Digital's Free D2C Marketing Tools

Free AI tools to scale your D2C brand with data-driven profit and growth insights.

Fere AI

Fere AI deploys autonomous agents to research and execute crypto trades 24/7.