Dear Shareholders of Lunit,

I am writing to you today with a deep sense of responsibility and respect, in appreciation for your interest and support in Lunit. Today, on January 30, 2026, we have announced our decision to pursue a public capital raise, targeting approximately 250 billion KRW. I would like to take this opportunity to speak to you directly and explain the rationale behind this decision, the context in which it was made, and how we believe it serves the interests of our shareholders.

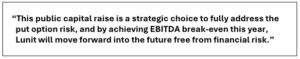

I understand and am fully aware that the announcement of another capital raise may be met with concern. In fact, during our last Annual Shareholder Meeting held in March 2025, we had announced that Lunit would stay away from another public capital raise at least in the short-term. However, we would not be taking this step unless we firmly believed it is the right decision to maximize shareholder value, even if it may feel like a step back in the near term. Our conviction is that this decision positions Lunit to take several decisive steps forward.

Fully Addressing Put Option Risk Will Maximize Shareholder Value

One of the key factors influencing our judgment is the persistent pressure on our share price over recent months. As many of you are aware, the financial risk related to potential put option exercises by convertible bond holders, who have invested in Lunit on May 2024 to consummate our acquisition of Volpara, has weighed heavily on market sentiment. After careful consideration, we concluded that addressing this issue comprehensively — rather than incrementally or reactively — is the most responsible course of action at this point in time. Removing this uncertainty allows the market to better reflect Lunit’s fundamentals and long-term potential, and we believe this clarity is essential to restoring shareholder value. This is why we have decided to pursue a large capital raise through public offering rather than pursue a smaller capital raise through a PIPE.

I believe it is important to reflect on why we raised capital previously and what it has enabled us to achieve. The convertible bond issuance was undertaken primarily to support our acquisition of Volpara, a decision driven by our conviction that success in the United States — the world’s largest and most influential healthcare market — is essential to Lunit’s long-term success. Since completing the acquisition, we have successfully established a strong operational and commercial footprint in the U.S. market, significantly expanding our customer base, strengthening relationships with leading healthcare providers, and embedding Lunit more deeply into clinical workflows. To our knowledge, there has been no clear precedent of a Korean medical device company achieving meaningful success in the U.S. healthcare market, and while we remain humble about the work ahead, we believe the progress made through Volpara meaningfully validates our strategic direction.

Commitment for EBITDA Break-even in 2026

At the same time, we fully recognize the importance of demonstrating a clear and credible path to profitability. This has been a central focus of our execution since last year. In mid-2025, we made the difficult but necessary decision to downsize our organization, a move that will result in approximately a 20% reduction in operating expenditures this year compared to last year. Coupled with our expectation of approximately 40-50% revenue growth, we believe Lunit is well positioned to reach EBITDA break-even within this year. This marks a meaningful inflection point for our business and reflects the discipline we have imposed across the organization.

Regarding the revenue growth expectations for this year, we are very confident we will be able to continue to demonstrate strong commercial growth this year driven by (1) exponential growth in Lunit INSIGHT revenue in Americas as synergies between Lunit and Volpara (Lunit International) will start to materialize this year, and (2) continued exponential growth in Lunit SCOPE revenue through continued expansion in our meaningful work with global pharmaceutical companies like AstraZeneca and Daiichi Sankyo, industry validation additionally demonstrated through our recent partnerships with leading laboratory companies including LabCorp, IQVIA, CellCarta, and more to come.

Our Future Is Bright

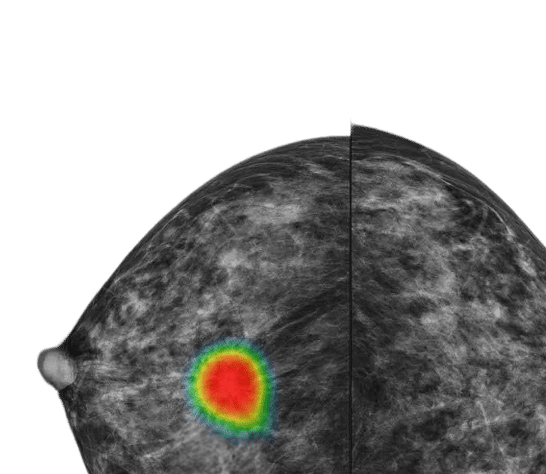

Looking beyond the near term, our confidence in Lunit’s future remains strong. The role of AI in healthcare is no longer speculative — it is becoming essential. From early detection to treatment decision support, AI will fundamentally reshape how cancer is screened, diagnosed, and treated worldwide. Lunit has spent years building deep clinical expertise, validated technology, and trusted global partnerships, and established itself as one of the global leaders in healthcare AI. Moreover, with an industry leading customer base of over 10,000 hospitals throughout the world using our AI products in clinical practice, coupled with a true global operation covering not only Asia but the US, and EMEA, we believe we are uniquely positioned to lead in this transformation.

I believe Lunit stands out in its high standards and goals. We have remained committed to being at the cutting-edge in AI. In particular, Lunit winning the recent government award to build a first-in-class multimodal biomedical foundation model not only validates this conviction, but underscores the confidence that both the government and the people of South Korea place in Lunit to lead such an essential national initiative. Such technology will serve as a cornerstone in transforming healthcare worldwide, bringing meaningful automation and insights to clinical practice. As these capabilities take shape, Lunit will be at the forefront of a global transformation in healthcare. This moment marks the beginning of a new chapter for the company—one in which we introduce products and services that not only reshape clinical workflows but also influence the very way medicine is delivered around the world.

Concluding Remarks

This capital raise is intended to ensure that Lunit has the financial strength and strategic flexibility to fully realize that opportunity — to invest where returns are highest, to move decisively in a rapidly evolving market, and ultimately to create enduring value for our shareholders. Importantly, based on our current business trajectory and our expectation of reaching profitability, we view this raise as one designed to strengthen our balance sheet through this critical phase of growth, and we do not anticipate the need for additional capital raising under normal operating conditions. While we will always remain prudent and flexible in managing the company for the long term, our clear objective is for this to be the final capital raise required to support Lunit’s path to sustainable profitability.

I understand that trust must be earned through results, not words. My commitment to you is that we will continue to operate with discipline, transparency, and a relentless focus on both short-term and long-term value creation. I am grateful for your continued support and patience.

Thank you for your trust.

Sincerely,

Brandon Suh

Chief Executive Officer

Lunit