Nutra is one of the most popular verticals in affiliate marketing, dealing with promotion of nutraceuticals. There are many networks with such offers, and it’s easy to get confused when choosing among them. To make it easier for you, we have compiled our own rating of best nutra affiliate networks.

-

1

Offers: 18,000+

GEOs: 180 -

2

Offers: 5,500+

GEOs: any

CPA, CPL, COD, SOI, CPS, RevShare, PPI -

3

Offers: 1000+

GEOs: any

CPA -

4

Offers: 7300+

CPA, CPL, CPS, COD, SS

GEOs: any

In-house SmartLink available -

5

Offers: 700+

GEOs: any

CPA, FTD, RevShare, Hybrid, CPL, CPI, CPS, free trial -

6

Direct advertiser

Offers: 500+

CPA

GEOs: Tier-2

What Nutra Affiliate Marketing Is

Nutra affiliate marketing is performance marketing around health and wellness products where you get paid for a measurable action — most often a lead (COD form submit), a trial, or a purchase. In practice, “nutra” usually means direct-response offers that rely on fast trust-building: simple promise, localized landing, frictionless checkout, and a call center or payment flow that closes the order.

Nutra vs Health & Beauty: Do They Differ?

In affiliate marketing, “Nutra” is basically the performance/DR (direct-response) slice of Health & Beauty — supplements, wellness products, and “problem-solution” offers sold through aggressive funnels. Health & Beauty is the broader category that can include nutra plus cosmetics, skincare, grooming, devices, and brand-style e-commerce. In many CPA networks these labels overlap heavily and are often used interchangeably, but operationally “nutra” usually implies short funnels + hard KPIs (CPA/CPL/COD), stricter traffic rules, and more focus on approval rate/lead validation, while “Health & Beauty” may also include softer, brand/e-com offers with different conversion events and sometimes different allowed sources.

What Is a Nutra Affiliate?

A nutra affiliate is the traffic owner/media buyer who drives users to nutra offers and gets paid per approved action. Your job isn’t “to advertise vitamins” — it’s to generate compliant, trackable conversions at a cost below payout, while keeping approval rates stable (valid lead data, low duplicates, realistic funnels, no obvious fraud signals). Most nutra affiliates work with COD funnels, pre-landers, localized landing pages, and aggressive creative testing, because the economics depend on volume + conversion rate + lead quality.

What Is a Nutra Affiliate Network?

A nutra affiliate network is the middle layer between affiliates and advertisers/brands. The network provides the offer inventory (often across many GEOs), tracking (links, postbacks, subIDs), payout terms, and a manager who can approve traffic sources, raise caps, and share what’s working right now. For affiliates, the network reduces the “time to launch” because you don’t need to negotiate every offer directly, and you can switch GEOs/offers quickly if something gets saturated or restricted.

How Nutra Affiliate Marketing Works

Nutra, despite its high competitiveness, remains one of the best affiliate niches. And the workflow here is just like in any other niches, but the details decide whether you get paid. First, you pick an offer + GEO + allowed traffic source, then build a funnel: ad → pre-lander (optional) → landing page → conversion event. In COD, the conversion is usually a form submit; the advertiser validates it via call center and confirms delivery/payment. Your tracker records the click and sends the conversion via S2S postback (plus subID data so you can see which ad/creative/site placement produced it). After validation and the hold period, the network pays you on the agreed schedule — and your real KPI becomes approved rate, not just raw leads.

The main thing anyone entering nutra runs into is intense competition. The vertical has been established for a long time and is still considered one of the most popular among affiliates, on par with gambling.

Because of that, paid traffic is expensive. The situation is further complicated by restrictions from ad platforms, which dislike nutra and actively cut reach.

Your budget doesn’t go only to the campaigns themselves. You need to factor in costs for accounts that get banned regularly, continuous creative production, cloaking, anti-detect browsers, and other tools used to bypass anti-fraud.

Also, remember that most customers aren’t actively searching for these products. To get a workable CTR, you often have to use more aggressive approaches and carefully push on real audience pain points without crossing into outright deception.

Payment Models in Nutra Affiliate Marketing

In nutra, the “payment model” is simply the rule for what gets counted as a conversion and when it becomes payable. Two offers can both say “$25 CPA,” but one pays on raw form submits and the other pays only after a call center confirms the order or after delivery. That difference decides your real ROI because it changes approval rate, hold time, and how much gets scrubbed.

COD (Cash on Delivery) is the classic nutra model in many Tier-2/3 markets. The user submits a form, a call center confirms the order, and the product is delivered and paid on delivery. Affiliates are usually paid for an approved/confirmed order, and sometimes only after delivery. The key metric is approval rate: duplicates, unreachable phones, wrong GEO details, and call center delays will kill profitability even if CTR and raw leads look fine.

Trial / “free + shipping” / low-ticket trial funnels take a small payment upfront and may rebill later (continuity). You’re paid on the paid event (trial purchase) or on a qualified billing step. These offers can work well in card-heavy GEOs, but they come with heavier compliance pressure and higher sensitivity to refunds and chargebacks, which affects holds and long-term stability.

Straight sale (CPS or purchase CPA) is a one-time checkout purchase where you get a percent of sale or a fixed payout on purchase. This model tends to reward trust and intent: it often performs best with warmer traffic (SEO/content/influencers, brand-like funnels) and can be harder to scale on cold paid traffic unless the landing, pricing, and proof are very strong. Refund windows and holds are usually the big operational variable.

CPL lead-gen (SOI/DOI) pays for a lead submit, sometimes requiring a second confirmation step like email/SMS (DOI). It’s a common way to test angles quickly, but it’s also where scrubs happen a lot: duplicates, fake data, low-quality leads, and incentive-like behavior get declined. DOI generally improves quality but reduces volume, so you’re always balancing speed of testing vs approval stability.

Hybrid and RevShare models combine a fixed payout with backend revenue share, or rely mainly on revenue share over time (more common when there’s continuity/upsell economics). They can be very profitable if the advertiser has strong retention and clean reporting, but you’re more dependent on attribution accuracy, retention policies, and the advertiser’s accounting.

Top Nutra Affiliate Networks

Nutra affiliate networks differ less by “brand” and more by mechanics: what Health & Beauty inventory you can access, which traffic types are realistically approved per offer, how tracking is set up, and how payment terms fit your cash-flow.

ClickDealer

ClickDealer is a performance marketing company / CPA network that’s been on the market since 2012 and positions itself as an “online marketing agency specializing in CPA campaigns,” operating across 40 verticals with its own in-house platform. They list Nutra as one of their main verticals, and they run campaigns under strict offer-level promotion rules.

Features:

- Vertical fit: runs Nutra among its main verticals (as Health & Beauty).

- Traffic rules: core accepted sources include display, native, search, social, email; pop/redirect and incent are only allowed on selected offers.

- Default payout terms: Monthly NET15, with a $500+ minimum per billing period.

- Faster payouts (if approved): expedited options like Weekly NET5 (or more frequent in some cases) for trusted partners.

- SmartLink terms: Monthly NET15 with $100+ minimum; can be switched to $500+ weekly after traffic quality approval.

- Payment methods: Wire Transfer, Crypto, PayPal, Tipalti, eCheck, Payoneer.

- Tracking ops: supports global or per-campaign/event postbacks, plus postback testing (so you can validate setup without a real transaction).

- Clean link setup: lets you use custom domains in tracking links.

- API access: API for offer feed, generating tracking links, setting pixels/postbacks, and pulling reports.

MyLead

MyLead is a global affiliate network connecting 6,000+ affiliate programs and campaigns across 251 GEOs. Their nutra affiliate offers catalog (including a dedicated Supplements category) plus Smartlinks for broad testing and S2S postback support for clean tracking/optimization.

Features:

- Nutra catalog you can filter fast: The Supplements category has offer filters for GEO (200+), device type, and allowed traffic type (incl. whether incent is allowed).

- Smartlinks for broad testing: Smartlink product + a documented way to pass your tracker clickId token into the smartlink for attribution.

- S2S postback support: they publish a tracker setup guide explaining server-to-server postback flow (network ↔ tracker ↔ traffic source).

- Clear withdrawal rails: PayPal, Skrill, Revolut, BTC, USDT, Capitalist, YooMoney, bank transfer.

- Minimum withdrawal: €100 (you withdraw “on request” once you pass the minimum).

- Processing window (cash-flow planning): payout deadline is up to 14 working days, and it can be extended if traffic verification is needed.

- Express withdrawals: within 48 business hours with a 7% fee (fee not charged if the 48h promise isn’t met).

- Incent traffic is strictly offer-rule-based: it’s only allowed when a specific program’s promotion rules permit it.

LuxeProfit

LuxeProfit is a multi-vertical CPA network that launched in 2019 and later moved from private access to a more public setup. It’s positioned around Nutra + iGaming (also Crypto/Adult), runs on the Affise platform, and is typically used by affiliates who want a wide offer pool plus standard CPA-network tooling (postbacks/pixels/smartlink-style routing) for fast testing across GEOs.

Features:

- Verticals: Nutra / iGaming (also Crypto, Adult).

- Offer volume: ~1,500+ offers.

- Payout models: CPA, CPL, plus RevShare (from 50%).

- Allowed traffic types they explicitly work with: ASO, Facebook Ads, Google Ads, Push, TikTok, UAC.

- Tracking platform: Affise.

- Postback + pixel setup: supports adding postbacks (incl. global postback) and pixels in the UI.

- SmartLink option: SmartLink is available for routing across GEOs/offers when you want broader testing.

- Payments: weekly payouts, $100 minimum; methods like USDT, Capitalist, Bitcoin.

iMonetizeIt

iMonetizeIt is a CPA network with a strong SmartLink focus, accepting worldwide traffic across multiple sources. They have 100+ nutra affiliate offers, being a standalone direction inside the platform.

Features:

- Nutra vertical: 100+ offers; categories include hypertension, joints, diabetes, weight loss, male potency, prostatitis.

- Traffic sources: app, social, search, native, banner, email, push.

- Payout methods: Bank transfer, PayPal, Paxum, WebMoney, Capitalist, BTC, QIWI, USDT (TRC20/ERC20).

- Minimum payout depends on method: $80 (Paxum/WebMoney/Capitalist/QIWI), $200 (BTC), $500 (USDT), $1000 (wire).

- S2S tracking primitives: supports Click ID for S2S postback + Token1/Token2 parameters (pass campaign/creative/source IDs for optimization).

- Postback setup options: global postback or per-campaign postback (campaign postback overrides global).

- API: API integration + documented endpoint reference and API key access in profile.

- Extra tools: guide for setting up postback via Telegram bot (useful if you want alerts/automation around conversions).

Yellana

Yellana is a multi-vertical CPA network created by the RichAds team, best known for iGaming-heavy inventory but positioned as “all GEO / all sources” with 700+ direct offers and in-house products. For nutra, they’re relevant when you want a network that can run Nutra/Health alongside other verticals and you care more about ops (weekly payouts + flexible tracking) than a pure nutra-only catalog.

Features:

- Offer base: 700+ direct offers (multi-vertical).

- Payout cadence + minimum: weekly payouts from $100.

- Payment models: CPA, FTD, RevShare, Hybrid, CPL, CPI, CPS, Free Trial.

- Traffic policy: “all traffic sources” accepted (fraud excluded, of course).

- Tracking: multi-postback support (multi-event / multiple postback setup).

- Optimization tool: traffic back (route/return traffic for further monetization/rotation).

- Nutra relevance: mentioned among the niches they work with.

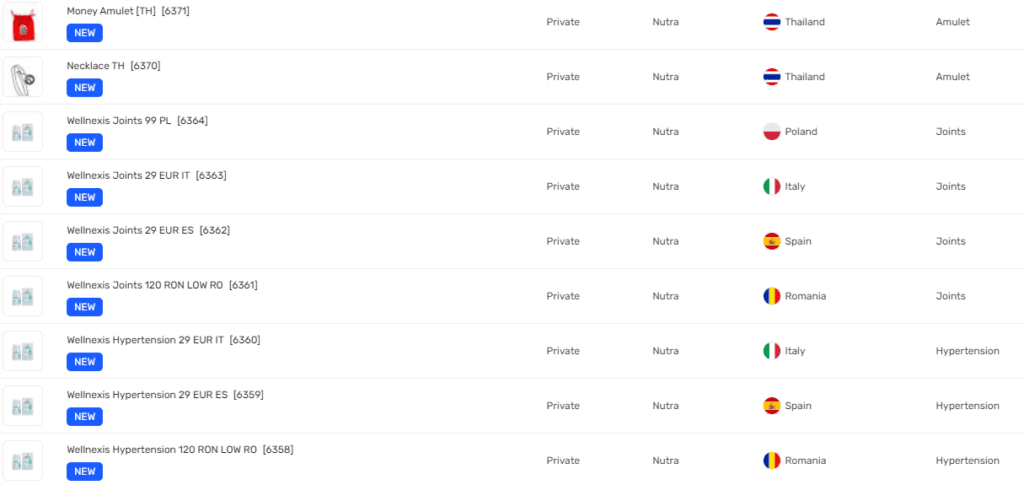

LemonAD

LemonAD is a CPA network that also operates as a direct advertiser with almost 10 years on the market, and it pushes nutra through its own infrastructure (in-house offers + localized promo/landing assets). They have a Health & Beauty inventory across a broad GEO set, plus ready-made adapted ad creatives aimed at faster launches in non-English markets.

Features:

- Direct nutra advertiser + network: combines affiliate network + direct advertiser model (in-house nutra).

- Own offer base: 500+ in-house nutra affiliate offers.

- GEO coverage: 90+ GEOs.

- Localized promo assets: ad creatives/promos are translated and culturally adapted.

- Payment systems: USDT, Wire (USD/RUB), Capitalist, WebMoney, card (RUB), plus several region-specific rails (Adeerpay, MyBroCard, cash options).

- Alternative payout option: TON introduced.

Quick Comparison

For better understanding, you can analyze these best health & beauty affiliate networks in this table:

| Network | Traffic rules | Tracking & integrations | Payout terms | Payment methods |

|---|---|---|---|---|

| ClickDealer | Display / Native / Search / Social / Email; Pop/Redirect + Incent only on selected offers | Global/per-campaign/event postbacks + testing; custom domains; API (offer feed, links, pixels/postbacks, reports) | Default NET15 monthly, $500+ min; SmartLink NET15, $100+ min; faster (e.g., Weekly NET5) if approved | Wire, PayPal, Crypto, Tipalti, eCheck, Payoneer |

| MyLead | Offer-level rules; incent only if explicitly allowed | S2S postback support + tracker setup guidance; Smartlink supports clickId pass-through | Withdraw on request; min €100 (higher for PayPal/crypto); processing up to 14 working days; express 48h with 7% fee | PayPal, Skrill, Revolut, BTC, USDT, Capitalist, YooMoney, bank transfer |

| LuxeProfit | Explicitly works with ASO, FB/Google Ads, Push, TikTok, UAC | Affise; postbacks (incl. global) + pixels; SmartLink option | Weekly, $100 min; hold noted as 7 days | USDT, Capitalist, Bitcoin |

| iMonetizeIt | App, Social, Search, Native, Banner, Email, Push | ClickID + Token params; global/per-campaign postback; API; Telegram postback bot | Minimums by method: $80 (Paxum/WebMoney/Capitalist/QIWI), $200 (BTC), $500 (USDT), $1000 (wire) | Wire, PayPal, Paxum, WebMoney, Capitalist, BTC, QIWI, USDT (TRC20/ERC20) |

| Yellana | all traffic sources (fraud excluded) | Multi-postback; “traffic back” routing tool | Weekly from $100 | bank/e-wallets |

| LemonAD | Not clearly standardized | Global postback + API | “On request” / request-day payouts claimed | USDT, Wire (USD/RUB), Capitalist, WebMoney, card (RUB), regional methods, TON |

How We Picked the Best Nutra Affiliate Networks

We built this top-list around operational criteria that affect ROI and scaling, not brand hype. Each network was evaluated on (1) offer depth and how easy it is to find/filter offers by GEO and rules, (2) traffic-source clarity (what’s actually allowed per offer, and how strict enforcement is), (3) tracking tooling you need to scale safely (S2S postback, subID support, multi-event tracking, API/custom domains), (4) payout terms that don’t kill cash-flow (cadence, minimums, holds, payment rails like USDT/wire/e-wallets), and (5) launch support that matters in nutra (localization assets, smartlink/testing options, and a realistic path to faster payouts once traffic quality is proven).

How Affiliates Benefit from Nutra Networks

Affiliates benefit from nutra networks when the network improves three things you can measure: approval rate (how many conversions actually get paid), time-to-scale (how fast you can launch and iterate), and cash-flow (how quickly you get money back to reinvest). Everything else is secondary.

Faster Access to Proven Offers + Bundles

A good health & beauty affiliate network saves you weeks of negotiation and dead-end testing by giving you ready, working offer/GEO combinations. Offers that already have a known funnel type (COD vs trial vs straight sale), known allowed sources, and realistic caps.

How this benefits you as an affiliate:

- You can pivot fast when a GEO burns out or AR drops: swap to a similar offer in the same GEO, or move the same angle to a neighboring GEO without rebuilding the whole setup.

- You can test multiple variants of the same product angle (different landers/prices/call-center flows) and keep your traffic source constant, which makes optimization cleaner.

- You reduce “black box time” because managers can point you to current bundles (offer + lander + allowed sources) instead of you guessing.

Pre-Landers/Creatives + Compliance-Ready Assets

Nutra is one of the few verticals where creatives don’t just affect CTR — they affect whether you get paid at all. Networks that are strong in nutra usually provide assets that are aligned with advertiser rules and local behavior.

How this benefits you as an affiliate:

- You launch faster using ready landers/prelanders (advertorials, quiz pages, story-style prelanders) that match the traffic source (native vs social vs push).

- You reduce rejects by using approved claim levels (soft vs aggressive copy) and correct disclaimers, instead of getting stuck in moderation loops.

- You improve lead quality (especially COD) because good assets collect call-center-friendly data: correct phone formats, coherent intent, realistic user flow — which improves your approval rate.

Better Economics: Payouts, Caps, Payment Terms

Networks sit between you and advertisers and can unlock terms you usually can’t get alone — but only if they’re operationally connected.

How this benefits you as an affiliate:

- You get higher caps and more stable volume when your traffic proves clean, so you can scale without constantly hitting limits.

- You can move to faster payout schedules (weekly/Net-X upgrades) once you demonstrate quality — which directly increases how much you can reinvest.

- You get more predictable validation: clearer reject reasons, faster feedback loops, and escalation when something breaks (call-center issues, sudden AR drops, landing outages), so you stop bleeding spend in silence.

How to Choose a Nutra Affiliate Network

Picking a nutra network is mostly an operational decision: can you track cleanly, get paid on time, run your traffic source without surprises, and scale offers without getting trapped by caps or validation issues. Use the checklist below as a practical filter.

| Checklist item | What “good” looks like | Red flags |

|---|---|---|

| S2S postback support | You can set global + per-offer/campaign postbacks, pass a click ID, and verify with postback testing | “Pixel only”, no clear click ID flow, conversions don’t match your tracker |

| SubIDs / tokens | Multiple parameters (campaign/creative/placement) are supported and shown in reports | Only 1 subID, or subIDs exist but aren’t visible in reporting |

| Multi-event tracking | Supports stages like lead → approved → delivered / rebill, not just a single “conversion” | Everything is counted as one event, you can’t see what becomes payable |

| Reporting quality | Fast updates, consistent attribution, export/API access, clear breakdown by subIDs | Reports lag badly, numbers “jump,” no exports, no transparency |

| Offer-level traffic rules | Every offer states allowed sources and restrictions (brand bidding, claims, placements, incent, pop) | Rules are vague (“ask manager”), restrictions appear only after you launch |

| Your traffic source is explicitly supported | Network has proven workflows for your source (native/social/search/email/push/ASO) | “We accept all traffic” but rejects your source in practice |

| GEO depth (not “worldwide”) | Multiple active nutra offers per target GEO + ability to switch fast | One-off offers, no alternatives when a GEO burns |

| Clear conversion definition | It’s clear whether payout is for lead submit vs confirmed vs delivered, especially for COD | “CPA” with no definition; approvals depend on “internal checks” |

| Approval rate transparency | You get decline reasons (duplicates, unreachable, wrong GEO, fake data) and a way to improve AR | High scrub with no reasons; “quality issues” without specifics |

| Caps and scaling path | Caps are stated; there’s a clear process to raise them based on performance | Hard caps with no escalation; sudden cap drops without notice |

| Payout cadence | Weekly/biweekly/net terms are clear; there’s a path to faster payouts after proving quality | “On request” with no SLA; payout dates shift; inconsistent schedules |

| Minimum payout | Minimum matches your cash-flow (e.g., $100–$500 range depending on model/rail) | High minimums that trap balance; different minimums not disclosed upfront |

| Hold period / validation | Holds match the model (COD validation, refunds); rules are written and stable | Holds extend “because reasons”; retroactive changes |

| Payment rails you can actually use | Realistic options: USDT, wire, major e-wallets; predictable fees | Only one inconvenient method; hidden fees; “ask support” for basic payout info |

| KYC timing | KYC is clear (at signup vs before first payout) | Surprise KYC right before payout / after you’ve scaled |

| Manager effectiveness | Manager provides working bundles (offer + lander + allowed sources), cap upgrades, fast answers | Generic replies, slow approvals, no actionable guidance |

| Compliance stance (nutra-specific) | Clear policy on claims, creatives, prelanders; quick feedback to avoid bans | “Do whatever” attitude that gets you banned or scrubbed later |

| Advertiser relationship | They can escalate issues (call center downtime, approval drops, broken landing/payment flow) | They can’t influence anything; you’re stuck guessing |

| Exit / pivot ability | Easy to swap offers/GEOs; no lock-in; tracking remains stable | You’re locked to one offer/flow; link/attribution breaks when you pivot |

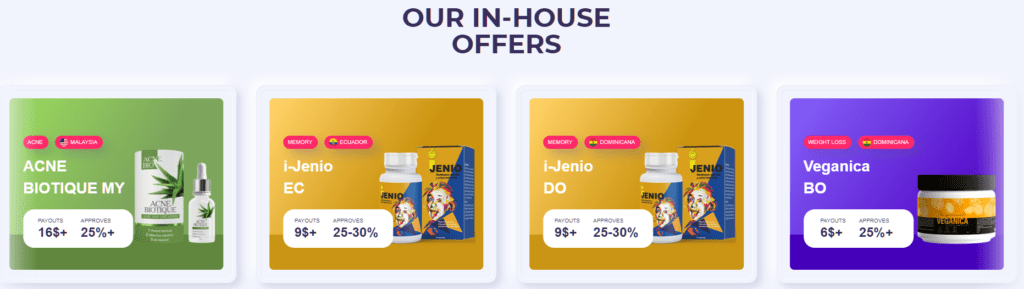

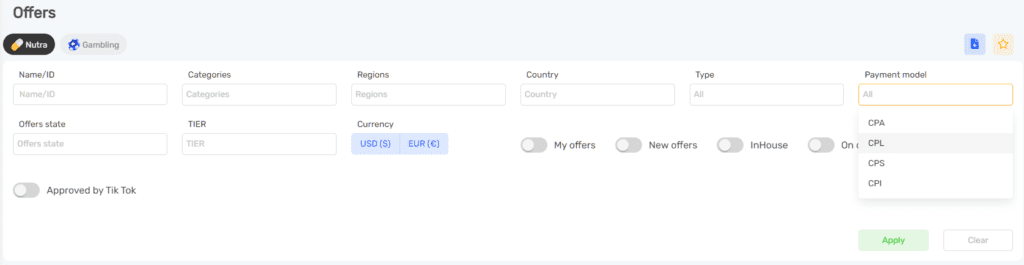

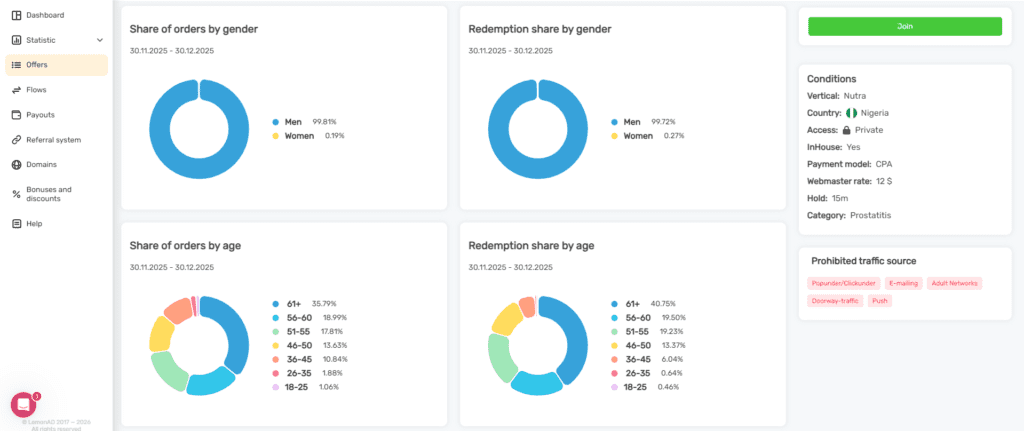

Overall, a good network is always interested in you having more conversions — so they do a lot to help. For example, this is an offer tab in a network, where the latter presents data on customers for the product:

Biggest Nutra Affiliate Offer Categories and Where They Work

Nutra “categories” are really demand clusters: people search (or click) when they have a specific problem, a specific fear, or a specific vanity goal. What converts isn’t the product name — it’s the angle + funnel type (COD vs trial vs purchase) matched to the GEO and traffic temperature.

Categories of Nutra Affiliate Offers

Weight loss & metabolism is evergreen because the intent is constant and creatives are easy to refresh (new “method,” new “routine,” new “story”). It works across many GEOs, but the funnel has to match trust: aggressive DR can work in COD-heavy markets, while Tier-1 typically needs cleaner compliance and stronger proof layers.

Joint/back pain & mobility converts well because it targets older audiences with persistent pain and high willingness to try “relief” solutions. It’s one of the most stable COD categories in many Tier-2/3 GEOs (Sri Lanka, for instance), and it also works in content funnels where you can build credibility (symptoms, causes, routines, comparisons).

Men’s health (potency/libido/prostate) is a classic high-EPC category, but it’s also high-risk for moderation, claims, and aggressive creatives. Performance depends heavily on platform rules and the level of explicitness allowed; it often does better in native/push/email than on strict social placements unless the creative is softened.

Skin care & beauty is broad: anti-aging, acne, pigmentation, hair growth. It performs well when the creative is visual and the landing is localized. It’s often easier to run as e-commerce (purchase CPS/CPA) than “hard nutra” claims, especially on Tier-1 sources with strict ad review.

Cardio / blood pressure / “clean vessels” style offers are common in many markets, but they’re sensitive to medical claims and require careful wording. They tend to be strongest in GEOs where DR advertorial formats are common, and weaker on platforms that aggressively police health claims.

Diabetes / blood sugar support exists as a category, but it’s also one of the most compliance-sensitive. It can convert in older demo GEOs, yet it’s frequently restricted by platforms and advertisers; you need conservative creatives, disclaimers, and often warmer traffic.

Amulets are a “pseudo-nutra” category that often appears in nutra catalogs because it runs on the same direct-response mechanics: short funnels, story-style prelanders, and usually COD fulfillment in lower-regulation GEOs. They sell through superstition/“instant fix” framing (luck, protection, “energy,” sometimes male-power angles), but they’re higher-risk operationally: many networks restrict them, creatives are easy to flag as misleading, and scrub/returns can be higher than classic supplements—so they’re mostly a Tier-3, push/native/communities play with stricter wording and offer-level rules.

Vision/hearing (vision support, hearing “restoration” style) is another older-demo cluster that can work in COD markets, but it’s similarly sensitive to claims. Success usually comes from softer promises and symptom-relief framing rather than “cure” framing.

Best-Matching Platforms per Offer Type

COD-heavy categories (joint pain, cardio, “symptom relief,” older-demo supplements) usually match best with native and push because you can run high-volume DR angles and iterate quickly on headlines and prelanders. They also work with Telegram/community traffic in certain GEOs when you can drop a warm explanation + social proof and drive to a localized landing.

High-moderation categories (men’s health, diabetes, blood pressure, anything “medical”) often perform better on platforms where you can control the message and reduce ad-review friction: SEO/content sites, email, and native advertorials with careful compliance. If you rely on social, you typically need “soft” creatives and a clean funnel, otherwise you’ll burn accounts and creatives faster than you can scale.

Beauty/skin/hair is flexible: it can run direct response on native/push with visual angles, but it also benefits from content-driven platforms (SEO, social content, influencer-style pages) because trust and demonstration matter. When it’s closer to cosmetics/e-com, purchase funnels and retargeting tend to outperform pure “hard nutra” landers.

Weight loss sits in the middle: it can scale as DR in many GEOs, but it also works extremely well with content funnels (meal plans, routines, “my results” stories) because the audience is broad and platform restrictions vary. The best operators treat it as a testing engine: DR to find angles fast, content to stabilize and reduce moderation risk.

You can find more about offers and how to work with them in our case studies compilation.

Best Platforms to Promote Nutra Affiliate Offers

Where you run nutra matters more than the offer. Different platforms = different moderation pressure, intent level, and tracking stability.

Owned Platforms (SEO, Email, Content, Funnels)

Owned channels are the most stable for nutra because you control the pre-sell and can warm users before the offer. SEO/content works especially well for problem-driven categories (joint pain, skin, “support” health angles). Email can scale, but list quality decides everything. Your own funnels (prelanders/landers) let you test hooks and form steps without waiting on networks.

Social Media Platforms

Social works when you use softer angles and “native-looking” formats (UGC, storytelling, routine/lifestyle). Hard DR claims burn fast because of strict moderation and account risk. You win on social by building trust quickly, then sending users into a clean funnel.

Paid Promotions (Native, Push, PPC/Ad Networks)

Paid is fastest for scaling, but only if the channel fits the funnel. Native is the classic nutra workhorse (advertorials + testing angles). Push gives volume but volatile quality, so approval rate can crash. PPC/search is viable when you stay compliant and often works better with content-style funnels than direct landers.

But all this won’t matter if you use wrong ad creatives. More on how to create landing pages, promo materials, and ad creatives for nutra is here.

FAQ

In many Tier-2/3 GEOs, COD dominates because users are more willing to order without paying online, and advertisers close via call centers. In card-heavy GEOs, you’ll more often see trial / low-ticket front-end or purchase CPA/CPS. The “best” model is the one that matches your traffic and cash-flow: COD can scale volume, but approval rate and validation speed decide profitability.

It depends on the advertiser. Some pay on confirmed orders (after call center verification), others only on delivered/paid orders. If the network can’t clearly state which event is payable and what the validation window is, that offer is risky for budgeting.

Most declines come from duplicates, unreachable or fake phone numbers, wrong GEO data, incent-style behavior, or low-intent traffic that never confirms with the call center. You reduce rejects by using correct phone formats, filtering placements, matching the funnel to the source (no “cold push → long form”), and tracking by subIDs so you can cut the bad segments fast.

At minimum: S2S postback, multiple subIDs, and stable reporting. If you run COD, the best setup is multi-event tracking (lead → approved → delivered) so you can optimize on what actually becomes payable. An API/export is a big plus once you have volume.

Holds exist because advertisers validate: COD needs confirmation/delivery checks, and card funnels have refunds/chargebacks. Holds are longer when traffic is new, when the offer has high return risk, or when quality signals look suspicious. The practical question is whether the network can explain the hold logic and whether you can earn faster terms after proving stable quality.

Many networks will request KYC either before your first payout or when you request higher limits/faster terms. The important part is timing: if KYC is sprung at the last minute, it can freeze cash-flow. Treat “when is KYC required” as a required pre-launch check.

Commonly accepted sources include native, push, search/PPC, social, email, and sometimes ASO—but nutra is almost always offer-rule-based, not “network-wide.” Pop/redirect and incentivized traffic are often restricted to specific campaigns only. Always read the offer’s traffic rules before you launch.

SmartLink is useful for quick testing when you want to validate a traffic source/GEO without manually wiring multiple offers. Direct offers win when you need control: specific lander/prelander, strict compliance, stable payout event, and clean optimization. Many affiliates use SmartLink to scout and then switch winners to direct campaigns.