Many people assume that a balanced-budget requirement is the best fiscal policy. But that’s not the case.

There’s overwhelming evidence (even from surprising sources) that spending caps are the ideal fiscal rule.

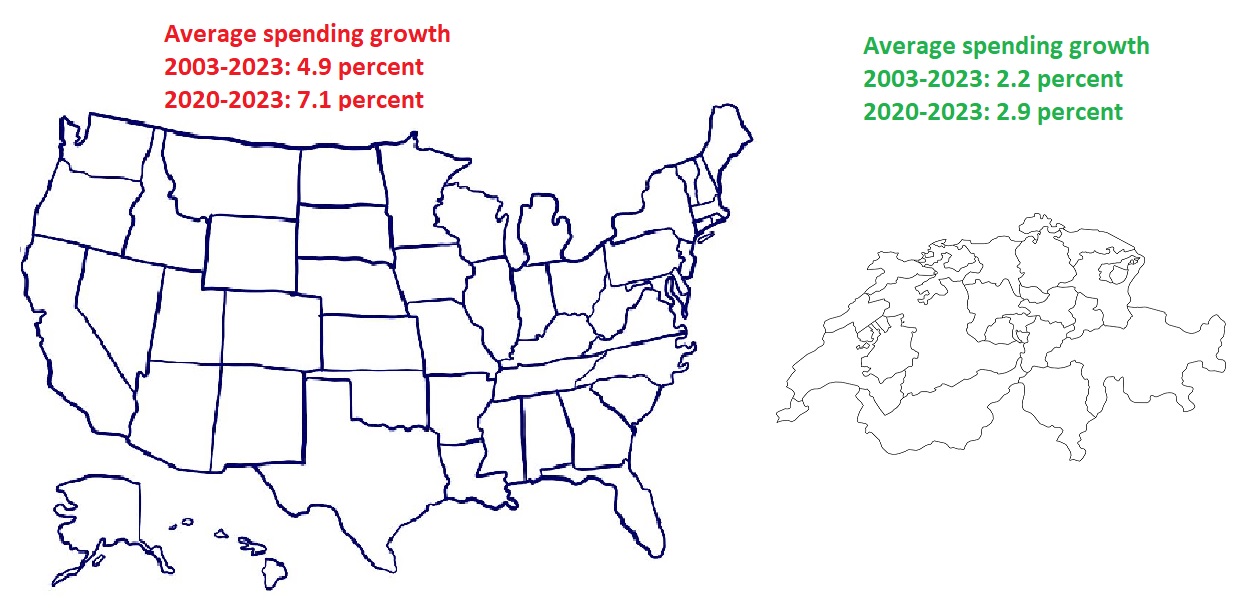

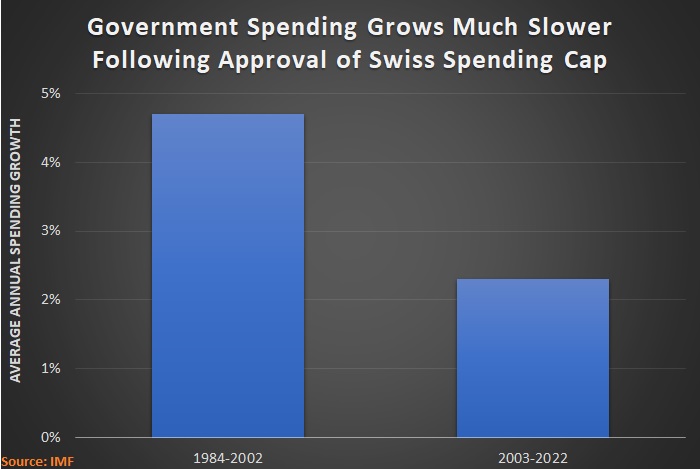

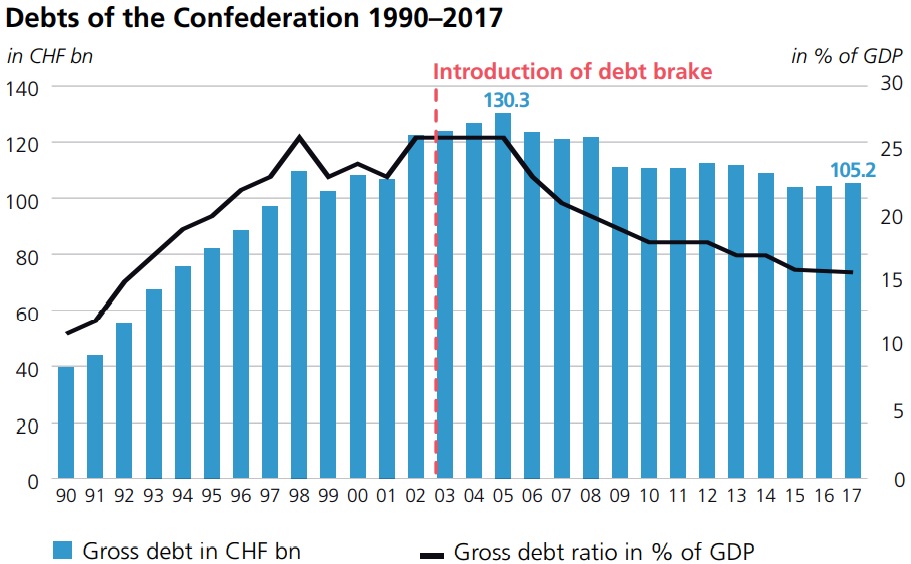

This is why I tell international audiences to copy Switzerland, where a spending cap has produced superb results.

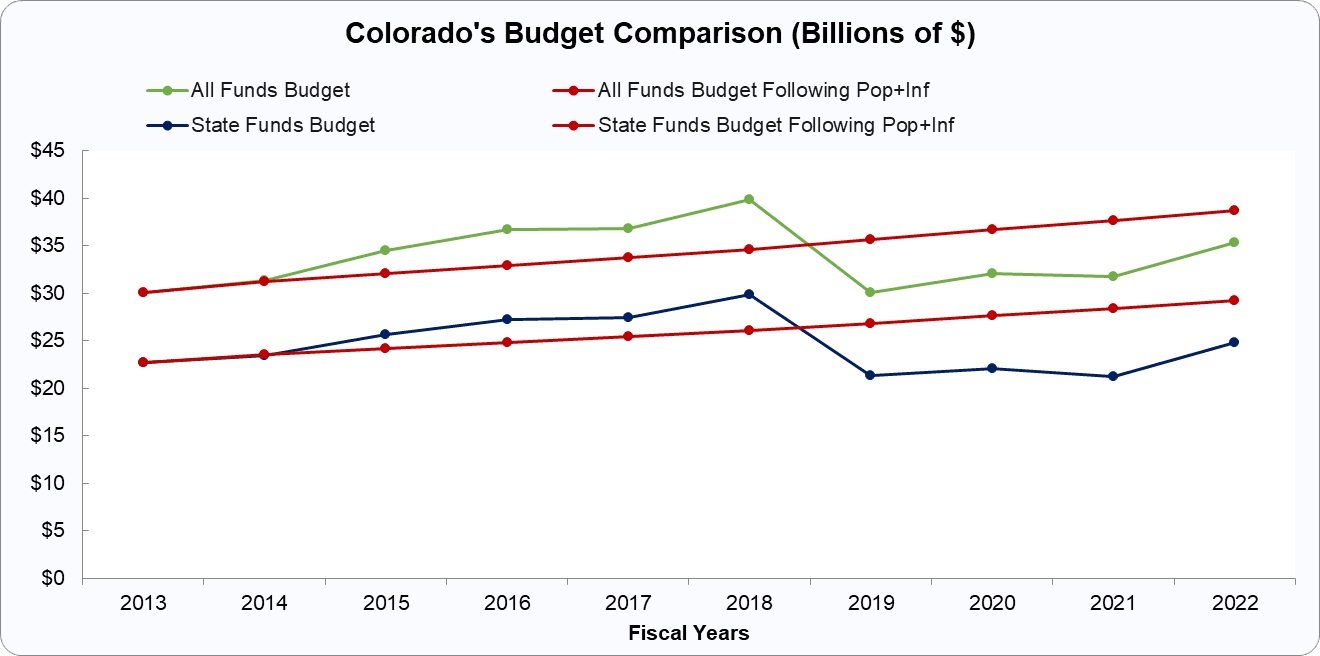

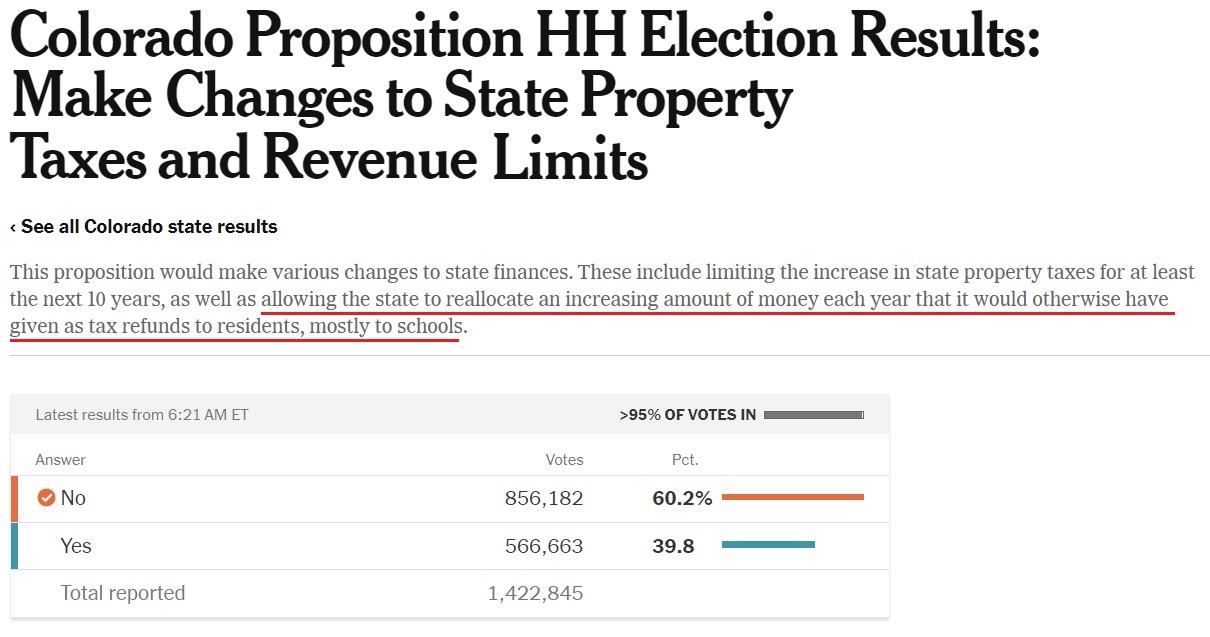

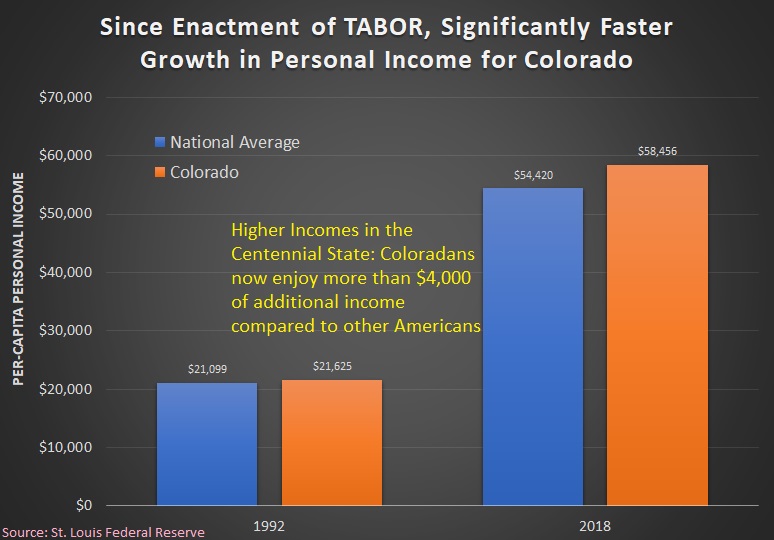

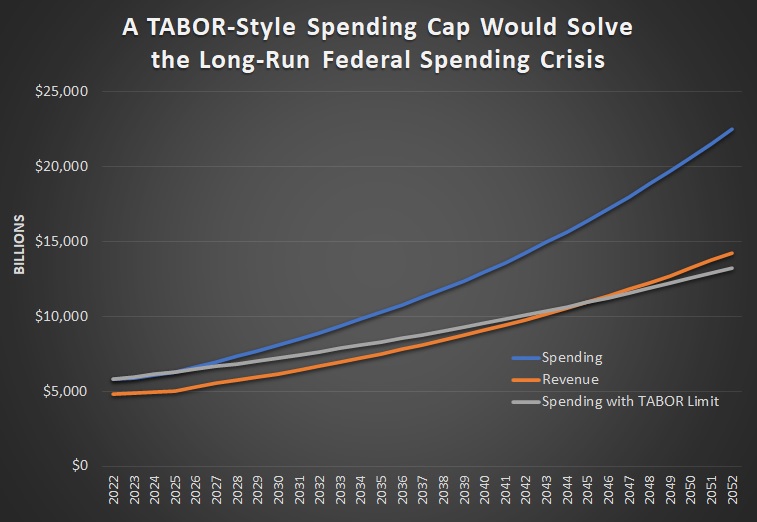

And for American audiences, I tell them to copy Colorado’s Taxpayer Bill of Rights (TABOR), a provision in the state constitution to prevents government spending from growing faster than population plus inflation.

I’ve written several articles about TABOR restraining the growth of government in the Rocky Mountain State. The net effect has been very positive for Colorado households.

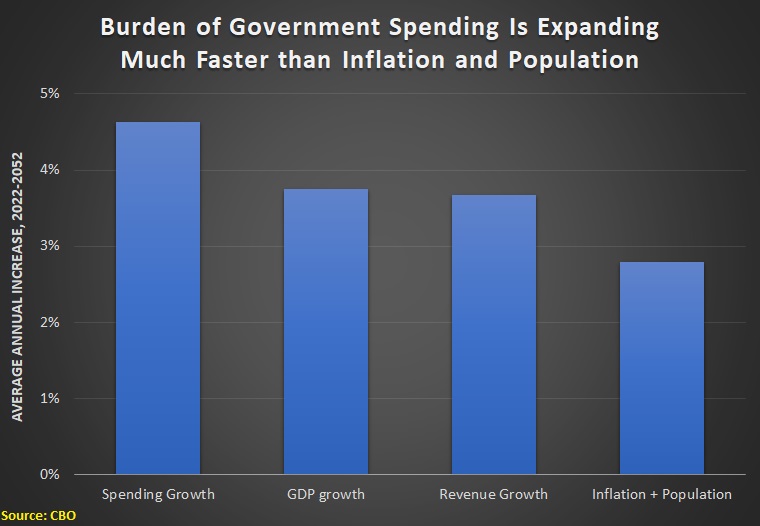

Unfortunately, the vast majority of states have been increasing spending faster than inflation plus population.

Which helps to explain with Sam Aaron of the South Carolina Policy Council has a column in National Review that urges the rest of the country to enact spending caps.

Here are some excerpts.

For years, the federal government’s unprecedented pandemic spending spree masked structural problems in state budgets. …states are about to feel the weight of federal withdrawal. To prepare, state governments must get serious about their own spending… The solution is simple: States across the country must adopt responsible spending frameworks that restrain year-over-year growth…

This is not a red-state or a blue-state issue. …Politicians from both parties tend to spend nearly all the revenue they have available each year, and, without codified limits in place, states will continue ratcheting up spending until fiscal disaster strikes. That is why states should adopt a..responsible spending limit. The limit is calculated by indexing the previous year’s general fund and multiplying it by population growth plus inflation, ensuring that spending does not grow faster than taxpayers’ ability to afford it. …Spending limits also have broad bipartisan appeal among the voters. In South Carolina, 77 percent of Republicans and 56 percent of Democrats said that they would support a spending cap tied to population growth and inflation.

The article specifically cites polling data in South Carolina because Mr. Aaron’s group is pushing for TABOR-style reforms in the Palmetto State.

This is a great idea, one that I’ve also been pushing.

The South Carolina Policy Council just released a report, co-authored by Aaron and Vance Ginn, that looks at the benefits of state spending restraint.

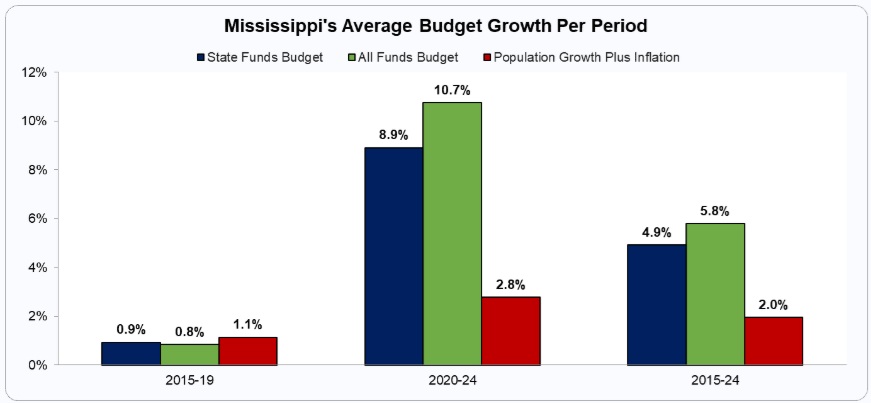

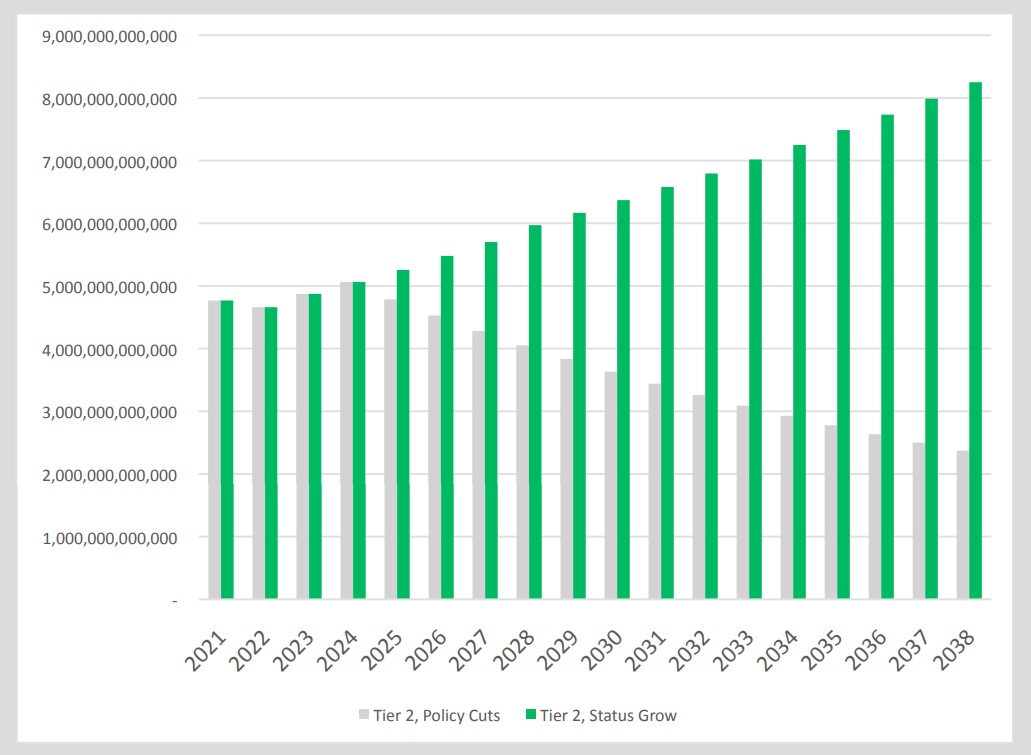

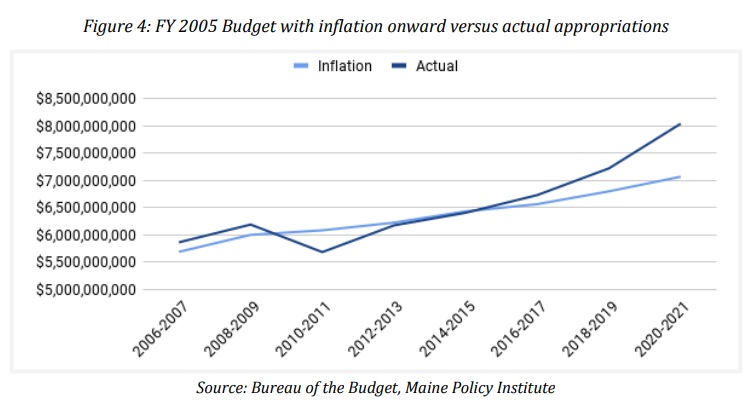

Here’s a chart that summarizes the problem. Spending growth hasn’t utterly reckless, but the state budget has been growing faster than inflation plus population. And that unfortunate trend adds up to a lot of money over time.

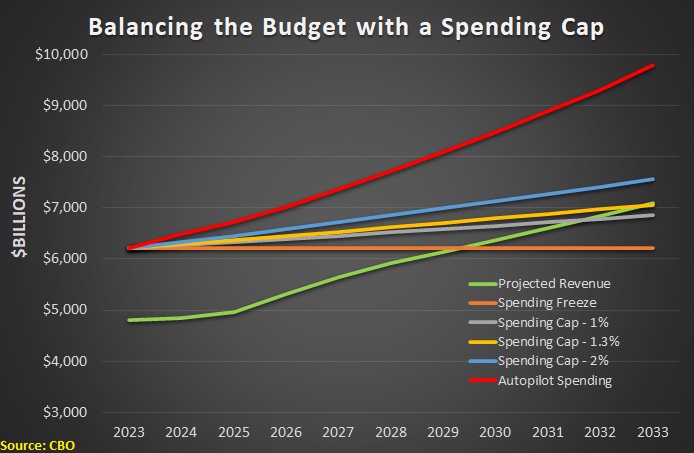

The solution is clear.

South Carolina enters Fiscal Year 2027 with…growing fiscal risk. …Over the past decade, recurring spending has outpaced population growth plus inflation. The Americans for Tax Reform’s Sustainable Budget Project estimates that in 2024, South Carolina’s state-fund expenditures exceeded population growth plus inflation by $6.8 billion and all-fund spending by $9.9 billion—nearly $36 billion in cumulative overspending since 2015.

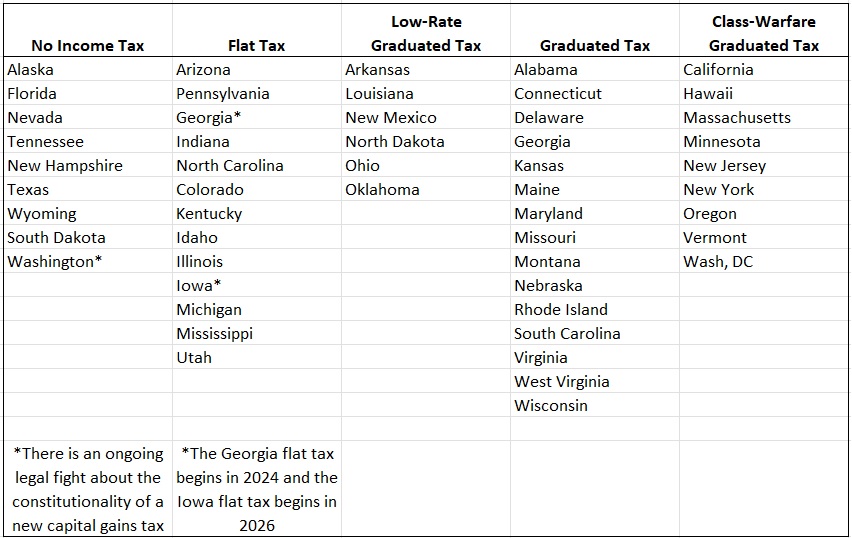

…Voters are ready for disciplined, transparent budgeting that prioritizes people over programs. The South Carolina Responsible Budget answers that call. It establishes a clear rule—government spending shall not grow faster than the average taxpayer’s capacity to fund it… By adopting this approach, South Carolina can transform record surpluses into a disciplined mechanism for long-term prosperity—eliminating the personal income tax within a decade. …dedicating 30 percent of surpluses could eliminate the personal income tax by FY 2032 and the corporate income tax by FY 2033. …Adopting this approach…would likely improve the Tax Foundation’s ranking of state tax competitiveness from 33rd to the top 15, aligning it with regional leaders like Florida and Tennessee while preserving fiscal stability.

Eliminating state income taxes would be a major achievement.

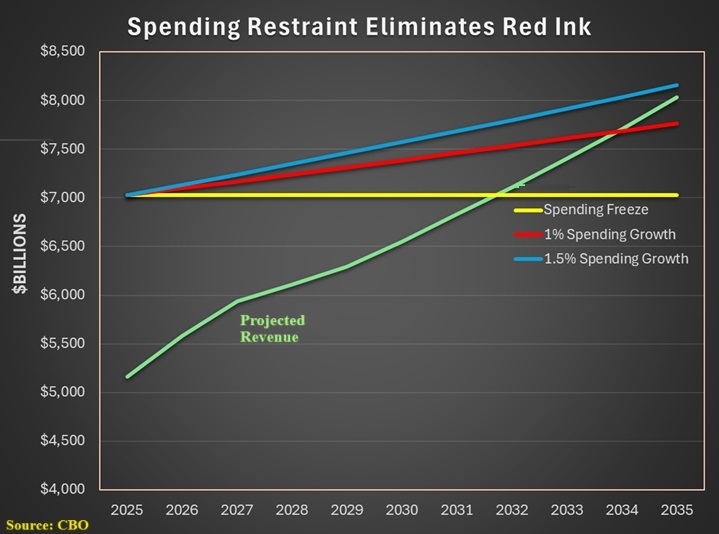

And Chart 3 shows it can happen relatively quickly with modest spending restraint.

Amen. South Carolina (and other states) can get rid of state income taxes. But it requires long-run spending restraint.