1. How is global trade changing due to Trump tariffs?

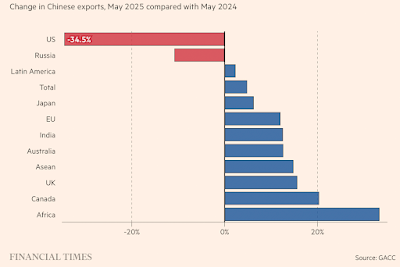

US tariff revenue surged almost fourfold from a year earlier to a record $24.2bn in May, while imports from China fell 43 per cent from the same month in 2024... China's exports are up 4.8% on last year despite a sharp drop in trade with the US.

The value of Chinese exports to the US dropped 43 per cent year on year in May, according to figures published by the US census bureau — equivalent to $15bn-worth of goods. But the country’s overall exports rose 4.8 per cent in the same period, official Chinese data showed, as the shortfall in trade with the US was offset by a 15 per cent increase in shipping to the Association of Southeast Asian Nations trade bloc and a 12 per cent rise to the EU...

Separate research by Capital Economics estimated that $3.4bn of Chinese exports were rerouted through Vietnam in May, a rise of 30 per cent compared with the same month last year. Indirect trade through Indonesia also increased markedly, with an estimated $0.8bn rerouted in May 2025, 25 per cent higher than May 2024. Exports of electronic components such as printed circuits, parts of telephone sets and flat panel display modules to Vietnam were up 54 per cent, or $2.6bn, in May 2025 compared with a year earlier, Chinese data shows... Indian exports to the US jumped 17 per cent in May compared with a year earlier, while imports from China and Hong Kong rose 22.4 per cent according to Ajay Srivastava, founder of the Global Trade Research Initiative, a research group.

Despite the carve-outs and climbdowns, the US’s overall average effective tariff rate now stands at 15.8 per cent, according to calculations by the Yale Budget Lab — the highest rate since 1936 and an increase of more than 13 percentage points since Trump returned to office in January.

The most tangible consequence of the Trump tariffs so far is not supply chain reordering, but the sudden dearth of dealmaking, according to Persson of EY. A survey of dealmakers by PwC in May found that 30 per cent were either pausing or revising deals because of the uncertainty caused by tariffs. Among those pushed back amid the uncertainty included bids for Boeing’s navigation unit and an expected £4bn sale by buyout group Apax of insurance group PIB. The sudden slowdown flew in the face of investor expectations that Trump’s return to the White House would trigger a wave of M&A activity on the back of a deregulatory splurge, according to Josh Smigel, partner in PwC’s deals practice. As a result, Smigel calculates, private equity firms are holding about $1tn worth of assets that — absent the Trump uncertainty — could have been redeployed back into the market if planned exits had not stalled.

3. Has Israel won the battle, but only to lose the war?

Mr. Netanyahu’s relentless and unapologetic military response to the Oct. 7, 2023, Hamas-led attack that killed 1,200 people and took 250 people hostage has cemented the view of Israel as a pariah, its leadership accused of genocide and war crimes, and disdained by some world leaders. In opinion polls globally, most people have a negative view of Israel. In Gaza, the war against Hamas has taken a devastating toll, killing tens of thousands of people and leaving more than a million homeless and hungry. Much of the enclave has been reduced to rubble. Poverty and hopelessness are rampant... Israel’s actions have shattered a rock-solid, bipartisan consensus in the United States for defending Israel. Now, support for the country has become a fiercely contentious issue in Congress, the subject of angry debates and protests on college campuses and fuel for a surge in antisemitic incidents in the United States and around the world... Israel has created a new wave of global opinion critical of its goals and methods. And many Israelis now feel threatened while abroad, even as they are more secure at home...

In a Pew Research survey of 24 countries around the world published last month, negative opinions about Israel have surged. In 20 countries, more than half of the people said they had an unfavorable view of Israel. In eight countries — Australia, Greece, Indonesia, Japan, the Netherlands, Spain, Sweden and Turkey — more than 75 percent held that view... Just 46 percent of Americans in the latest Gallup survey expressed support for Israel, the lowest number since the company began asking the question a quarter-century ago. A third of the respondents in the United States said they sympathized with the plight of the Palestinians, up from just 13 percent in 2003... Inside Israel, the decision to prioritize military victories over the return of the hostages has deeply wounded many people. And the violence has strained the good will of the country’s allies and neighbors.

4. Thrive Capital, founded by Josh Kushner, the brother of Jared Kushner is charting a new model of VC investing.

The approach Kushner has developed since launching Thrive 14 years ago: get close to founders, remain loyal through crises and concentrate funds in a small number of companies. Betting a billion dollars or more on a behemoth inverts the classic venture model: firms typically write dozens of small cheques in young start-ups; most fail, but the flops are more than offset by a few spectacular successes... venture capital has mutated from a cottage industry into an institutionalised asset class... The shift has left VCs with a choice: remain faithful to early-stage investing and hope for outsize returns, or scale up funds to meet increasingly massive private companies. Thrive is attempting to manage both, writing cheques for multibillion-dollar start-ups its team believe can still multiply 10 or 100-fold in value... Most VCs split funds between dozens of start-ups, but the vast majority of a Thrive fund will go to just 10-15. The firm has put 10 per cent or more of earlier funds to work in single companies, including workplace messaging app Slack, GitHub, Instagram and Stripe. Thrive first invested in Stripe, then valued at $3bn, in 2014, and has increased its stake multiple times, including investing close to $2bn last year... the firm has quietly shown intense fealty to founders during moments of crisis, such as during the boardroom coup that briefly ousted OpenAI’s Altman last year. Kushner was instrumental in returning Altman to the company after less than a week...

Thrive’s rivals, including more established West Coast firms, dismiss the approach as closer to asset management. “We invest in companies, they trade in stocks. It’s like an ETF [exchange traded fund] for venture,” says a partner at one Silicon Valley firm. “But private companies are not stocks. You can’t get out when they start going down.” Speaking privately to the FT, some institutional investors question whether Thrive’s massive bets can ever deliver “venture-style returns”. Others say it is too soon to judge a group whose biggest investments have not yet cashed out. Thrive’s biggest portfolio companies, including OpenAI and payments start-up Stripe, have racked up massive paper gains. But until they go public or are acquired, profits won’t be returned to institutional investors in Thrive’s funds... The payout for Thrive and its backers would be enormous should Stripe, OpenAI, or defence tech company Anduril go public... Thrive has raised a total of $12.3bn, and now has almost $25bn under management, making it one of the largest VCs in the country.

Interesting that Mukesh Ambani has a 3.3% stake in Thrive capital as part of a consortium of investors!

5. This is a very good graphic that shows how VCs are experiencing a squeeze in their cash flows.

The private equity giant Blackstone spent $10 billion in 2021 to acquire QTS, and has been pouring billions more into the company to help it expand its data centers... This largely unglamorous industry is critical for A.I. leaders to get right. QTS leases its facilities to companies like Amazon and Meta and supplies the electricity and water needed to power and cool their computers... Blackstone calls data centers one of its “highest conviction investments.” Blackstone is already one of the world’s largest owners of office buildings, warehouses and science labs, but it has sunk more money into data centers and related infrastructure than into almost any other sector in the firm’s 40-year history. All told, Blackstone has put more than $100 billion into buying and lending to data centers, as well investing in construction firms, natural gas power plants and the machinery needed to build them... (it) says it still sees strong demand from tech companies, which are willing to sign what they describe as airtight leases for 15 to 20 years to rent out data center space...Blackstone is not alone. Data centers are drawing a crowd on Wall Street — investment giants like KKR, BlackRock and Blue Owl have collectively plowed hundreds of billions into the industry. As investment firms announce larger and larger deals, one Wall Street executive says he jokes about “Braggawatt” deals, as data centers are typically measured by the wattage they use. The spending frenzy has created concerns about whether too many data centers are being built... The complexity and cost of running A.I.-focused data centers stem from the vast amounts of power they guzzle, which can be about 10 to 20 times as much per server or rack as general cloud computing. There is also the need to keep the centers operational 99.999 percent of the day, or the “five nines” in industry parlance. That equates to about five minutes of downtime all year for maintenance or to switch out servers.

7. China's dominance of clean energy technologies

China has also begun to dominate nuclear power, a highly technical field once indisputably led by the United States. China not only has 31 reactors under construction, nearly as many as the rest of the world combined, but has announced advances in next-generation nuclear technologies and also in fusion, the long-promised source of all-but-limitless clean energy that has bedeviled science for years.

Americans created the first practical silicon photovoltaic cells in the 1950s and the first rechargeable lithium-metal batteries in the 1970s. The world’s first wind farm was built in New Hampshire nearly 50 years ago. Jimmy Carter installed solar panels on the White House in 1979... In 2008 the United States produced nearly half of the world’s polysilicon, a crucial material for solar panels. Today, China produces more than 90 percent.

This is a good description of China's manufacturing prowess.

Last June, the Urumqi solar farm, the largest in the world, came online in the Xinjiang Autonomous Region in China. It is capable of generating more power than some small countries need to run their entire economies. It’s hardly an anomaly. The other 10 largest solar facilities in the world are also in China, and even bigger ones are planned. The Chinese automaker BYD is currently building not one but two electric vehicle factories that will each produce twice as many cars as the largest car factory in the world, a Volkswagen plant in Germany.

Finally, a graphic that captures China's clean energy investments globally.

Chinese firms are building wind turbines in Brazil and electric vehicles in Indonesia. In northern Kenya, Chinese developers have erected Africa’s biggest wind farm. And across the continent, in countries rich with minerals needed for clean energy technologies, such as Zambia, Chinese financing for all sorts of projects has left some governments deeply in debt to Chinese banks. Since 2023, Chinese companies have announced $168 billion in foreign investments in clean energy manufacturing, generation and transmission, according to Climate Energy Finance, a research group.

8. Tim Harford points to a new paper by David Autor and Neil Thompson who use an "expertise" framework to explain the impact of automation and AI on jobs. Autor and Thompson pose a question

Would we expect accounting clerks and inventory clerks to be similarly affected by automation? There are several well-established approaches to analysing this question, and all of them suggest that the answer is “yes”. Back in the day, both types of clerk spent a lot of time performing routine intellectual tasks such as spotting discrepancies, compiling inventories or tables of data, and doing simple arithmetic on a large scale. All of these tasks were the kind of things that computers could do, and as computers became cheap enough they took over. Given the same tasks faced the same sort of automation, it seems logical that both jobs would change in similar ways.But that is not what happened. In particular, say Autor and Thompson, wages for accounting clerks rose, while wages for inventory clerks fell. This is because most jobs are not random collections of unrelated tasks. They are bundles of tasks that are most efficiently done by the same person for a variety of unmysterious reasons. Remove some tasks from the bundle and the rest of the job changes. Inventory clerks lost the bit of the job requiring most education and training (the arithmetic) and became more like shelf-stackers. Accounting clerks also lost the arithmetic, but what remained required judgment, analysis and sophisticated problem solving. Although the same kind of tasks had been automated away, the effect was to make inventory clerking a job requiring less training and less expertise, while accounting clerks needed to be more expert than before.The natural worry for anyone hoping to have a job in five years’ time is what AI might do to that job. And while there are few certainties, Autor and Thompson’s framework does suggest a clarifying question: does AI look like it is going to do the most highly skilled part of your job or the low-skill rump that you’ve not been able to get rid of? The answer to that question may help to predict whether your job is about to get more fun or more annoying — and whether your salary is likely to rise, or fall as your expert work is devalued like the expert work of the Luddites.

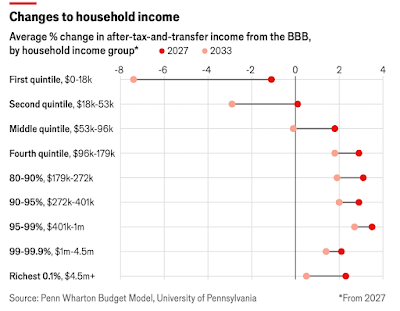

9. Two graphics that capture the essence and outcome of One Big Beautiful Bill (OBBA). One, stripped off all its hype, OBBA is a giant tax cut bill.

And its biggest beneficiaries will be the richest.Analysis by scholars at the University of Pennsylvania suggests that Americans earning under $18,000 would lose $165 in 2027, or 1.1% of their income. By 2033 their annual losses would rise to $1,300 on average—about 7.4% for the group. The richest 0.1%, earning over $4.45m, would gain more than $300,000 in 2027, a 2.3% increase. Much of this comes indirectly, via changes to corporate taxes, which are usually assumed to benefit wealthier households who own stocks... Analysis of the House version by scholars at the University of Pennsylvania suggests that Americans earning less than $16,999 would lose about $820 a year—a 5.7% reduction in median income for that group. The richest 0.1%, earning more than $4.3m, would gain $390,000, a 2.8% increase.

Yimin is one of the five largest open-cast coal mines in China. During peak season, it used to require about 300 trucks, operated by around 1,200 drivers working shifts around the clock, to transport coal to processing sites, and soil, sand and rocks to dumping grounds. But managers said the mine faced a shortage of drivers. Dangerous driving conditions led to high attrition rates, compounded by declining interest among younger generations in pursuing this profession. “Truck drivers face exhausting workloads that often lead to health issues,” said Yimin mine director Shu Yinqiu. The solution came earlier this year with a fleet of 100 photovoltaic-battery-powered, self-driving trucks. They represent the world’s largest deployment of autonomous electric mining trucks, highlighting China’s resolve to upgrade its traditional industries with advanced technologies, as the nation grapples with a shrinking labour force and an ageing population...

Key partners in the project include Huawei Technologies, Xuzhou Construction Machinery Group, State Grid and the Beijing University of Science and Technology. Now, instead of a thousand-man crew, just 24 people, divided into four teams, are needed to operate the 100 new trucks. Staff monitor and control the vehicles from the comfort of a remote control room, where live-feed videos and real-time traffic information are displayed on multiple screens... As of September, the China National Coal Association (CNCA) estimated there were over 1,500 automated mining trucks in China. It predicted that number would triple to 5,000 by the end of this year and exceed 10,000 by 2026... A fleet of 100 unmanned trucks could save coal mine operators 40 million yuan (US$5.6 million) in driver salaries annually, according to CNCA estimates.

11. Major announcement for the establishment of a PCB and Copper Clad Laminate (CCL) manufacturing facility by Syrma SGS Technology at Naidupeta in Andhra Pradesh with an investment of about Rs 1800 Cr and in partnership with South Korean company Shinhyup Electronics Ltd. The project is expected to be commissioned by 2026-27 and can avail incentives under the GoI's Electronics Component Manufacturing Scheme (ECMS). In 2024, the GoI had imposed a 30% anti-dumping duty (ADD) on bare PCBs to boost domestic production. The Indian PCB market was valued at $6.2 bn in 2024 and is estimated to grow by a CAGR of 16.4% from 2025-33.

12. Spain wants to avoid the costs of being part of NATO, while wanting to access its benefits. It was the only standout against accepting the goal of 5% of GDP defence spending target by NATO members at the recent NATO summit. At the same time, as FT reports, one of its defence firms, Indra, which is 28% owned by the Spanish Government, is benefiting from NATO defence spending.

In April, the group was given a role in 12 European Defence Fund research and development projects and made the leader of one involving radars. Its executives were in Ukraine last month pitching their wares... In the air, Indra is Spain’s lead participant in Europe’s flagship fighter jet project, the Future Combat Air System, a sometimes prickly partnership with Airbus, which represents Germany, and France’s Dassault Aviation.

13. India's derivatives market, and how Jane Street abused it before SEBI cracked down.

In December 2020 — when Jane Street first set up its Mumbai arm — the monthly turnover of futures and options markets on the National Stock Exchange had reached nearly $300bn, from just $134.7bn four years earlier, and by December 2024 stood at $512.7bn. This became a fertile terrain for Jane Street. Between January 2023 and March 2025 the firm netted an overall profit in India of about $4.3bn, Sebi said in its order on Thursday.

Once seen as embarrassing parsimony, buying knock-offs has become a fashion statement of its own. Egged on by hashtags, TikTok videos and media articles, customers are leaning into the fun of finding cheaper but still good alternatives, turning the search for dupes into a public treasure hunt. Nearly half of US consumers surveyed by analytics firm First Insight said they had tried a product specifically because it was a “dupe”, and 70 per cent of shoppers who make more than $150,000 said they were more likely to try a dupe than other private label goods...

The warehouse store’s $20 sweatshirt mimics the ornamental stitching and pouch pockets of Lululemon’s Scuba offering, which sells for six times the price. And Costco’s dupe of the Design jacket mimics an unusual line of curved stitching across the back. Lululemon contends in its lawsuit that those specific details violate the “trade dress” patents that it has registered over the past two years, as well as a trademark on the colour description “tidewater teal” that it applied for one day before filing its claim that Costco had “unlawfully traded upon Plaintiffs’ reputation, goodwill and sweat equity”.

Interestingly, US laws allow considerable flexibility in the interpretation of design patents.

US rules protect makers from infringement claims if the similarities are based on function rather than distinctive design. The warehouse group could also try to turn the dupe craze to its advantage by arguing that consumers are unlikely to be misled into believing that they are buying a Lululemon original. Costco’s products are clearly marked with either the Kirkland brand or the manufacturer’s name. Despite the publicity, most patent attorneys expect the dispute to settle, as Deckers’ first Uggs lawsuit did last year. Each side has too much to lose from a trial. Costco could be on the hook for gigantic monetary damages, while “if Lululemon were to lose, it would be open season” for other duplicates, says Josh Gerben, a DC trademark attorney.

Shishu Mapan, an artificial intelligence (AI) tool trained on over 30,000 infants, built by scientists at the Wadhwani Institute for AI, a non-profit that develops AI-based solutions for social impact. Using a short, arc-shaped video while the newborn is undressed and laid on a cloth sheet, the app estimates the infant’s weight and growth metrics, which eliminates the need for scales or guesswork... AI-powered tools like Wadhwani AI’s app could become frontline essentials, capable of transforming child health outcomes where the system often falls short. It also eases the burden on frontline health workers, who often struggle to keep up with high demand in rural areas... AI-powered tools like Wadhwani AI’s app could become frontline essentials, capable of transforming child health outcomes where the system often falls short. It also eases the burden on frontline health workers, who often struggle to keep up with high demand in rural areas... AI-powered tools like Wadhwani AI’s app could become frontline essentials, capable of transforming child health outcomes where the system often falls short. It also eases the burden on frontline health workers, who often struggle to keep up with high demand in rural areas.

17. Interesting that even as the overwhelming majority of the world has no confidence in Donald Trump, India stands alongside Israel in having the highest confidence!

18. Patent cliffs facing pharma companies.

Keytruda... cancer medicine is one of the world’s best sellers, earning Merck $29.5bn in sales last year... In 2028 Keytruda’s patent ends... Drugs worth about $180bn of revenue a year are going off patent in 2027 and 2028, according to research firm Evaluate Pharma, representing almost 12 per cent of the global market. Bristol Myers Squibb and Pfizer are also facing 2028 patent expirations for top-selling drugs.

While all innovations can be patented, the pharma industry suffers from patent cliffs in ways that others such as the tech industry do not. This is mainly because the key active ingredient in a drug is covered by one main patent, which is hard to invent around, and chemical formulas are relatively easy to copy. Sampat of Johns Hopkins says the median number of patents per drug is around three to five, not the hundreds or thousands that cover, for instance, an iPhone. “So any given patent expiring doesn’t matter all that much for something like the iPhone, as it would for a drug,” he says. Also unlike the iPhone, few patients are loyal to their brands and healthcare systems are eager to cut costs by moving to generic versions quickly after they are released. Many countries have laws allowing pharmacists to automatically swap out branded prescriptions with generics.

19. The problem with the rail ticket subsidy of Indian Railways

This monopoly network transports 13 million people every day and its non-premium services are heavily subsidised. According to the railway minister, the cost of travel per km by train is ₹1.38 but passengers pay only 73 paise, a subsidy of 47 per cent. Though the government dishes out large sums for passenger subsidies, part of the gap is supposed to be covered by freight services and premium air conditioned passenger services. The problem with this cross-subsidy policy is that railway freight services have been steadily losing share to road transport over the decades and its profits are not enough to cover the losses from passenger services. As for AC services, some of which make money in some years, they account for a minuscule 5 per cent of overall passengers. The proliferation of low-cost airlines and growing air connectivity — ironically, this, too, is government policy — is likely to diminish demand for this segment, despite the investment in semi high-speed premium Vande Bharat service.

20. The NPAs on bank loans to MSMEs are at historic lows.

Gross NPAs in the system have touched a new low of 2.3 per cent of loans, with a sharp drop in NPAs in MSMEs. Gross NPAs in MSMEs declined from 6.8 per cent in 2022-23 to 4.5 per cent in 2023-24 and further to 3.6 per cent in 2024-25. NPAs in the MSME sector have historically been of the order of 9 per cent or more... bankers have found innovative ways, such as the Trade Receivables Discounting System (TReDS), to finance MSMEs... The TReDS book was about ₹2.7 trillion, or 10 per cent of the MSME book, in 2023-24. It cannot explain the current NPA level of 3.6 per cent on the entire MSME exposure. The NPA level in the Emergency Credit Line Guarantee Scheme (ECLGS) is 5.6 per cent. Recall that the ECLGS was introduced during the pandemic in May 2020 in order to facilitate additional lending to MSMEs and prevent a secular collapse in the sector on account of a crisis of liquidity. The eligibility conditions were pretty stringent. Only MSMEs that were solvent prior to the onset of pandemic were meant to qualify. The loans granted under ECLGS in the period 2021-23 amounted to ₹3.68 trillion or 12 per cent of loans outstanding to MSMEs in 2024-25. If gross NPAs on the ECLGS loans were 5.6 per cent and NPAs on total MSME loans are 3.6 per cent, that makes the performance on the remaining 88 per cent of MSME loans truly impressive.

21. Finally, a graphic below on the spectacular reduction in the price of green energy sources since 2010.