Real time market (RTM) volumes exceeded Day Ahead Market (DAM) volumes for the first time ever in Q1FY26 – a reversal, since DAM volumes have been much higher than RTM volume in the past. In June of Q1FY26, DAM prices fell from record peaks of around ₹6.95/unit in Q2FY24 to below ₹4/unit. Nine of the last 10 months have seen month-on-month declines in DAM prices. In the RTM market, prices dropped to nearly ₹0/unit between 7 am and 1 pm, and spiked to as high as ₹5/unit between 8 pm and midnight. This seems to be the norm during April-October. The diurnal variations are huge. On the same days, RTM units were sold at a few paisa/unit and also at above ₹5/unit... During sunlight hours, there are big surpluses. At night, shortfalls occur as solar no longer contributes and price surges. Peak RTM demand in summer typically occurs between 2000 and 2400 hours (8pm and midnight). Solar is off at that time. On most days in Q1FY26, night-time supply was 10 per cent below demand, with shortfalls reaching 90 per cent sometimes. Conversely, during peak solar hours (0700–1700 or 7 am–5 pm), supply was nearly three times the demand. RE capacity is scaling up at 25-30 Gw per year. There’s a case for a big push on the storage front, to ensure surplus solar units can be used at night.

2. Distribution of teachers between different school management.

3. India's cost advantage in medical procedures is clear.Chinese buyers propel Tokyo property prices beyond the reach of many Japanese. The government has been pushed to tighten the requirements for the “business manager” visas on which so many Chinese secure their residencies. Some predict a full nationalist backlash, pointing to the klaxons of xenophobia audible in July’s upper-house election campaigns… The number of foreign residents rose by an average of roughly 1,000 per day over the course of 2024, of which about 10 per cent were Chinese. By next year, according to some projections, the total Chinese population of Japan is likely to hit a million…

There has also been a surge of Chinese enquiries for places in Tokyo’s international schools, to as much as 60 per cent of the total in some cases… the Branz tower, a huge block of high-end flats overlooking Tokyo Bay, of which about 20 per cent are believed to have been sold to people with Chinese names, according to local estate agents. A listing for a three-bedroom flat in a nearby tower displayed in the window of a Chinese-owned estate agent in Roppongi, has an asking price of ¥350mn ($2.4mn). Other newly built developments nearby, including a vast complex built as the athletes’ village for the Tokyo 2020 Olympics, have similar ratios of Chinese buyers…

As the Chinese community in Bunkyo has expanded, the children have begun to group together and do not speak Japanese outside school. Within school, it is already becoming a distraction… The most tangible impact has been on property prices in Tokyo — one issue over which populist Japanese politicians have been able to stoke public anger. The prices of higher-end apartments in the capital, and the land in central wards on which low-rise houses can be built, has risen significantly since 2022.

Recent studies find that the left’s lack of concern over falling birth rates is likely to be pushing societies in a more conservative direction. Extending previous analysis of the interplay between political ideology and family formation, I find that the assumption that birth rates are falling across society in general is not really true. From the US to Europe and beyond, people who identify as conservative are having almost as many children as they were decades ago. The decline is overwhelmingly among those on the progressive left, in effect nudging each successive generation’s politics further to the right than they would otherwise have been. This may ultimately mean more curtailing of individual freedoms, not less. Of course, children do not inherit their parents’ politics wholesale, and each successive generation has historically tended to be more liberal than the last on social issues. But it is well established that children’s values are strongly shaped by those of their parents. A growing left-right birth rate gap will slow that liberalising conveyor belt, and could result in societies and politicians that are less liberal and less concerned with the environment than would otherwise be the case.

In a 2023 report, Mr. de Boer and a colleague estimated that Delta’s SkyMiles program was the world’s most valuable loyalty plan, worth about $28 billion. Investors value Delta itself at around $40 billion, based on its stock price. The loyalty program at American is worth about $24 billion, while United’s is worth $22 billion, according to the report. At Southwest Airlines, which started as a low-fare airline but has become one of the country’s biggest carriers, the loyalty program is worth around $9 billion.The airlines share little publicly about their loyalty programs, but American and Delta each received about $7 billion from frequent-flier programs last year and United about $6 billion, according to an analysis of financial filings by Jay Sorensen, who runs IdeaWorksCompany, a consulting firm that works for airlines and other aviation businesses. Those programs are supported in part by the millions of people who use airline credit cards and then earn airline points for spending. The banks that issue those cards buy those points from the airlines in bulk, typically spending many billions of dollars every year... Banks recoup that money by charging interest and fees to card users and from fees paid by retailers, restaurants and other merchants every time customers pay with credit cards. For the banks, airline cards bring in many customers who fly and spend a lot.Last year, consumers spent about $186 billion on Delta-branded credit cards, according to an analysis of securities filings of American Express, the airline’s credit card partner. That was about 12 percent of global spending on cards issued by the bank. Delta said in a financial filing that cash sales of loyalty points to American Express were $7.4 billion in 2024, an 8 percent increase from the year before.Many travelers love the cards and loyalty programs. By earning status, they can board planes early, enter airport lounges and enjoy other perks. Racking up points for dream vacations or seat upgrades is a powerful motivator, too. Those benefits create what Dwight James, Delta’s senior vice president of loyalty, calls “an emotional bias” toward the airline... Loyalty programs have become so valuable that during the pandemic, American, United and Delta each used their programs as collateral to borrow billions of dollars. The companies were struggling because they had to ground many planes and others flew largely empty.

10. New York City is a big outlier among US cities, thanks to its intra-city mass transit and high FAR.

A lot of FDI that flowed into India from roughly the middle of the last decade, peaking in 2020-21, were in the form of private equity (PE) and venture capital (VC) investments – in diverse sectors, from retail, e-commerce and financial services to green energy, healthcare and real estate. Those who put in this money are now cashing out by selling the shares they had originally bought, either to other firms engaged in the same business or via initial public offerings by the investee companies. Such exits by investors seeking to monetise their profitable “mature positions” were valued at $24 billion in 2022, $29 billion in 2023 and $33 billion in 2024, according to Bain & Company. The American management consulting firm reckons about 59% of PC/VC exits in 2024 to have been through public markets that were, in turn, enabled by the rich stock valuations in India.

12. Labour-intensive exports made up 35% of India's exports to the US in FY25, down from 50% in FY19. However, the share of the US in each of them have risen in the period.

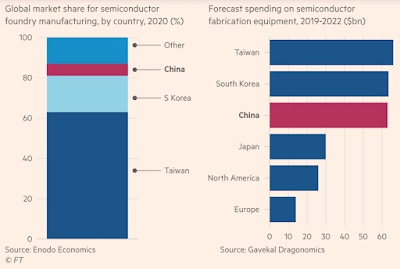

Textlies and food processing, in particular, are major employers.And also forms a major share of manufacturing wages.Its economy, while slowing, is still nearly 30 percent larger than America’s when one accounts for purchasing power. China has twice the manufacturing capacity, producing vastly more cars, ships, steel and solar panels than the United States and more than 70 percent of the world’s batteries, electric vehicles and critical minerals. In science and technology, China produces more active patents and top-cited publications than the United States. And militarily, it has the world’s largest naval fleet, a shipbuilding capacity estimated to be more than 230 times as great as America’s and is fast establishing itself as a leader in hypersonic weapons, drones and quantum communications.

The balance changes when compared with allies.

Together with economies such as Europe, Japan, South Korea, Australia, India, Canada, Mexico, Taiwan and others, there is no competition. This coalition would be more than twice China’s G.D.P. when adjusted for purchasing power, more than double its military spending, the top trading partner of most countries in the world, and would represent half of global manufacturing to China’s one-third. It would possess deeper talent pools, create more patents and top-cited research, and wield a degree of market power that could deter Chinese coercion. Allied scale would win the future.