1. Paul Krugman highlights that Trump tariffs are in practice, lower than the official rates. Tariffs on paper are the average tariff rate one would predict if we apply the announced tariff rates to what we were importing before the tariffs. The tariff rate in practice is the actual amount collected in tariff revenue divided by the value of imports.

Imports from Canada are a case in point. Even under the Trump tariffs, most goods from Canada can enter duty-free if they’re “USMCA compliant” — that is, they qualified for zero tariffs under the free-trade agreement formerly known as NAFTA, rebranded but barely changed in practice during Trump’s first term. In 2024, only 38 percent of U.S. imports from Canada entered under the USMCA. That’s surprisingly low, but the main reason was probably paperwork: certifying that a good complies with the free trade rules requires a lot of documentation. For smaller exporters, in particular, that paperwork often wasn’t worth doing, because tariffs were low even for goods not certified as USMCA compliant. Now the tariffs are much higher, and there has been a rush to do the extra paperwork. In June 2025, 81 percent of imports from Canada entered duty free. Not incidentally, this points to a hidden cost of the tariffs: Companies are incurring significant administrative costs to deal with a vastly more complex tariff system.

2. Important point about Zohran Mamdani's victory in NYC.

More than 2mn New Yorkers cast ballots in the largest turnout in a mayoral race since 1969.

To put this in perspective, 1.1 million voters voted four years back!

The Times has a very good account of this remarkable victory.

A backbench assemblyman who had immigrated to New York City at age 7, he had almost no citywide profile. Even fellow socialists thought his views on policing and Israel would put a hard ceiling on his support... Mr. Mamdani’s political rise may be remembered for what came first: the buoyant, flamboyant, rule-breaking primary run that united a new coalition of Brooklyn gentrifiers and Queens cabbies around the city’s growing affordability crisis and the birth of a megawatt talent... The arc of his success is nothing short of staggering. At the start of the year, Mr. Mamdani was polling at 1 percent, tied, as he likes to say, with the candidate known as “someone else.” Few New Yorkers recognized his name, and his own political team put the odds of winning as low as 3 percent. Now, at age 34, he will be New York City’s youngest leader in more than a century, amid a pile of historic firsts: the first Muslim mayor, the first South Asian and arguably the most influential democratic socialist in the country.

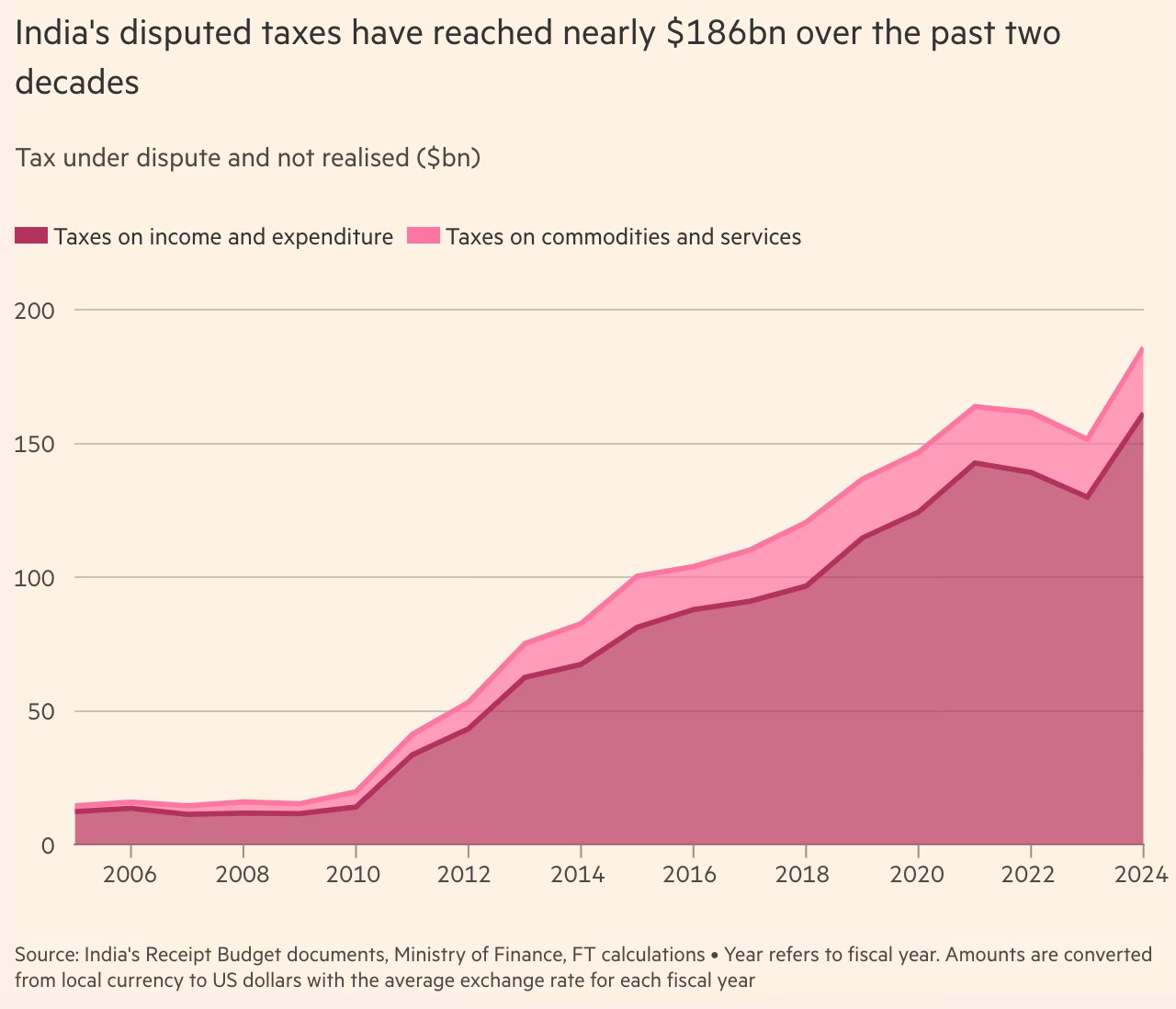

3. Nothing captures the essence of the first ten months of President Trump more than tariffs. The FT has a good graphic.

FamilyMart, 7-Eleven and Lawson all rely on a franchise business model to operate stores, taking a cut of sales or gross profit as a royalty in return for store owners using their brand, products and supply chains. In 7-Eleven’s case, typically between 40 per cent to 70 per cent of gross profit — sales minus cost of goods sold — is paid to the company. 7-Eleven Japan does not recognise the Convenience Store Union because franchisees are not its employees... store owners were under pressure because they were struggling to hire more staff. They had little leeway to raise wages unless the companies share more of the profits... Japan’s big three convenience store chains are trying to introduce technology such as self-service tills, artificial intelligence-assisted ordering systems and cleaning robots to reduce the volume of work. If those efforts fall short, the companies could be forced to introduce new franchise contract terms in order to account for higher wages, said analysts. Or, if new franchisees cannot be found, they will have to close stores.

6. Venture capital fund returns

For many years, long-run venture capital returns reported by Cambridge Associates reflected the huge profits from the dotcom boom of the late 1990s, a time when the average VC fund returned more than 20 per cent a year. Last year, though, those funds finally faded into history. Cambridge’s 25-year view now only catches funds raised — and invested — as the 90s boom turned into a bubble. These showed an annualised return of only 8 per cent. For every other period measured by Cambridge since then, VC returns fall below returns from investing in companies trading on Nasdaq. These are averages, and the profits in VC have always been heavily skewed to a handful of successful firms, making it essential to get exposure to the right funds.

And the top VCs benefit from a Mathew Effect,

Startups struggling for attention are drawn to the investors with the best track records: winning the right financial backers acts as a strong signal for young companies with little else to validate their claims of future greatness. That means the most successful VC firms usually get first option on the smartest founders and the best deals.

7. FT visual article on perhaps the grandest follies of our times, the Saudi Arabian futuristic city of Neom and its 170 km long 500 m tall mirror glass structure, The Line, conceived by Prince Mohammed Bin Salman.

The budget for The Line was $1.6tn, Neom executives were told in late 2021. But an updated internal estimate the following spring put the cost at around $4.5tn, according to a person familiar with the estimates. That is roughly the size of Germany’s annual economic output. Teams then began tackling the unprecedented design and engineering challenges raised: imagining what life would be like inside a 500 metre-high, 170km-long wall; sourcing the steel and cement that would consume much of global supply; and making water circulate in a manmade deepwater port with no current... Its staggering requirements for materials were enough to overwhelm both the capacity of its local infrastructure, and its pricing power... to make the concrete for the first 20 modules, the contractors would need a supply of cement every year that would be greater than France’s annual output. Each 800-metre module required, by design, about 3.5mn tonnes of structural steel, 5.5mn cubic metres of concrete and 3.5mn tonnes of reinforcement steel — the narrow steel bars twisted into cage forms to strengthen the reinforced concrete. “We were going to take something like 60 per cent of the global production of green steel [per year], which causes the price to go up,” said a senior design manager.

8. Ed Luce writes that peak Trump is over. He writes that the Democratic Party election victories owed significantly to their focus on rising prices, and that the deal with China postponing tariffs for one year may have won Trump some reprieve on the inflation front.

Trump now has a strong incentive to declare similar wins on other trade wars. In that regard, Tuesday night was also a good one for Brazil, India, Canada and other targets of Trump’s ire. By a quirk of timing, the US Supreme Court on Wednesday held hearings on the legality of his tariff war. Was it coincidence that conservative justices sounded unusually bold in querying that? They too might possibly help Trump by striking the tariffs down.

9. John Burn-Murdoch points out that culture conflicts (and not economic differences) have been the drivers of political polarisation in the US.

In their pioneering paper The Business of the Culture War, published earlier this month, MIT and Harvard economists Shakked Noy and Aakaash Rao use second-by-second TV viewing data to show how the commercial incentives of cable news channels helped to sow discord not only among their viewers but across America more broadly.

Their key insights are that content relating to crime, immigration, race, gender and criticism of elites reliably increases viewing figures (while economics and healthcare cause people to switch away). This means there is a resulting shift in coverage towards more culture war issues and fewer socio-economic stories, which leads voters to rate these issues as more important. Politicians then respond by campaigning more on cultural hot button topics. All told, they estimate that the emergence and growth of cable news can account for fully one-third of the increase in US cultural conflict since 2000.

It has exactly one active office. In New Delhi... CCI has no presence in Bengaluru, one small outpost in Navi Mumbai, and a “touch-and-go” office in Kolkata that lawyers say is barely functional. Markets regulator Sebi, by comparison, has 22 offices. The aviation regulator, DGCA, has around 20. When it conducts raids, it flies 25–30 officers to Mumbai. Every investigation means teams of lawyers and informants shuttling to Delhi for two years. “In India, such a large country, there is only one big agency for 28 states,” said Kumar. “Look at the US. There are competition agencies in all the states.” The costs add up. Filing a case itself can set a company back Rs 50,000 to Rs 6 lakh. Add multiple Delhi trips—three or four by the informant, three by lawyers, over a 2–2.5-year period—and justice becomes a luxury good... The Commission is still operating with roughly the same headcount it had in 2009. The Director-General’s office, sanctioned for around 20 officers, has seven. The merger-control team has six. Case disposals that once took three months now take six to eight—on a good day.

Simon Evenett, professor of geopolitics and strategy at IMD business school in Lausanne, Switzerland, said the clauses were so broad that they handed the US unilateral powers to terminate the agreements, giving Washington fresh leverage across the region. The agreement with Malaysia also includes a provision requiring it to align with US sanctions and other economic restrictions. “Ultimately, poison pill provisions transform trade agreements from purely commercial instruments into tools for managing partner countries’ broader foreign economic policy orientation,” Evenett wrote in a paper this week. Although there is a partial legal precedent for poison pills in the 2020 US-Mexico-Canada Agreement, Evenett said the USMCA clause had legally defined triggers, in contrast to the broad conditions in the Malaysia and Cambodia pacts.

12. The rise and rise of US Government debt.